I Recently Bought Propertyfor $1 How Much Expenses Is That - We ended up selling this property. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. “in total, our investment was $75,500. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. For example, on a $400,000 home, closing costs. The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. Additional minor updates and repairs cost about $3,000. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially.

We ended up selling this property. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. Additional minor updates and repairs cost about $3,000. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. “in total, our investment was $75,500. Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. For example, on a $400,000 home, closing costs.

As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. For example, on a $400,000 home, closing costs. We ended up selling this property. Additional minor updates and repairs cost about $3,000. The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. “in total, our investment was $75,500. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially.

How Much Does It Cost To Buy A House Scotland at Katherine James blog

We ended up selling this property. “in total, our investment was $75,500. The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. Additional minor updates and repairs cost.

[Solved] Last year, Eleanor and Felix Knight bought a home with a

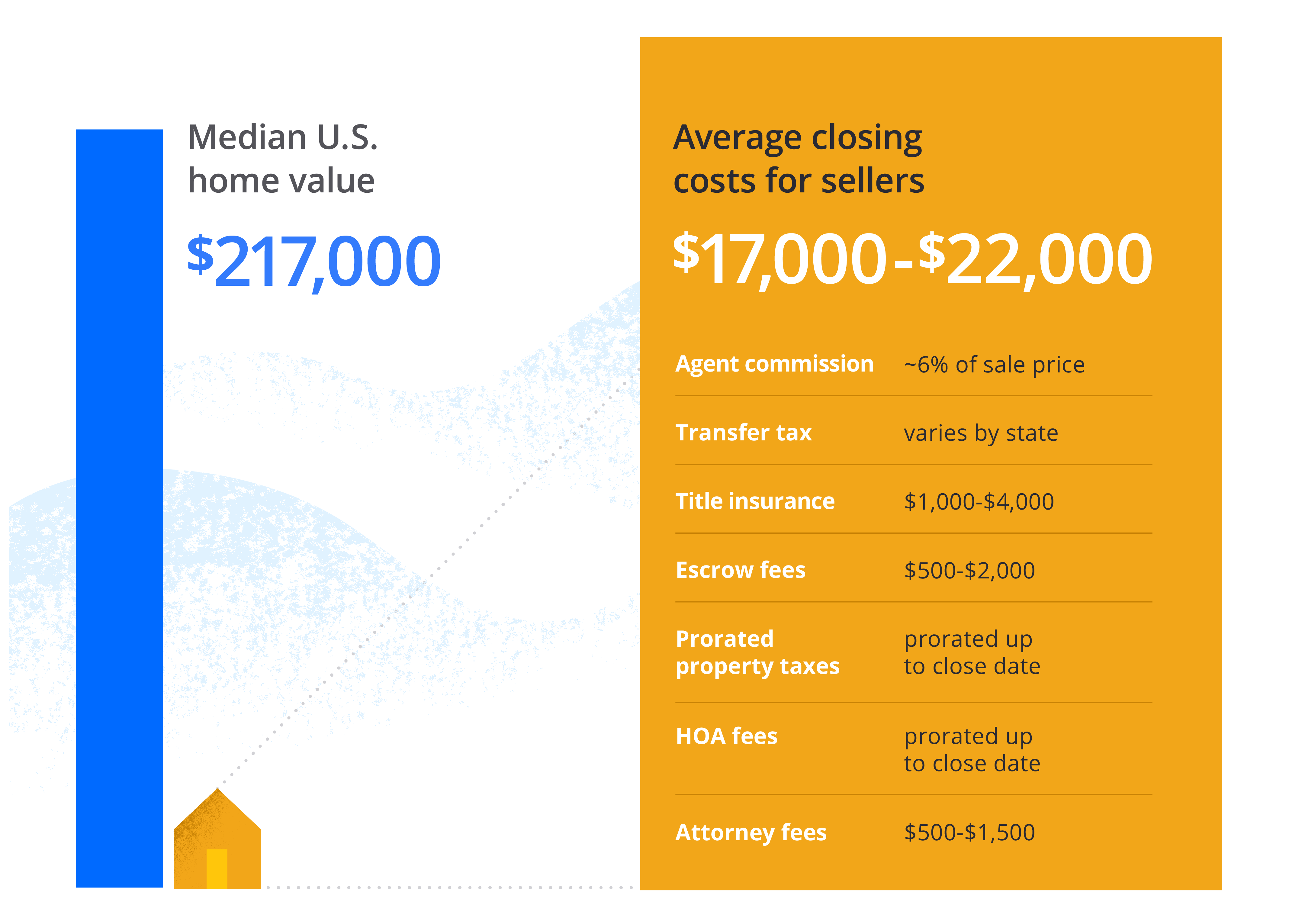

Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. For example, on a $400,000 home, closing costs. Closing costs typically range.

How to Easily Track Your Rental Property Expenses

Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. Additional minor updates and repairs cost about $3,000. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. For example, on a $400,000 home, closing costs. Janelle buys her home for $60,000.

How Much Money do you Need to Buy a Rental Property?

For example, on a $400,000 home, closing costs. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. Additional minor updates and repairs cost about $3,000. We ended up selling this property.

Post by Andy Buchanan Commonstock How Much Real Estate Could you

Additional minor updates and repairs cost about $3,000. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and.

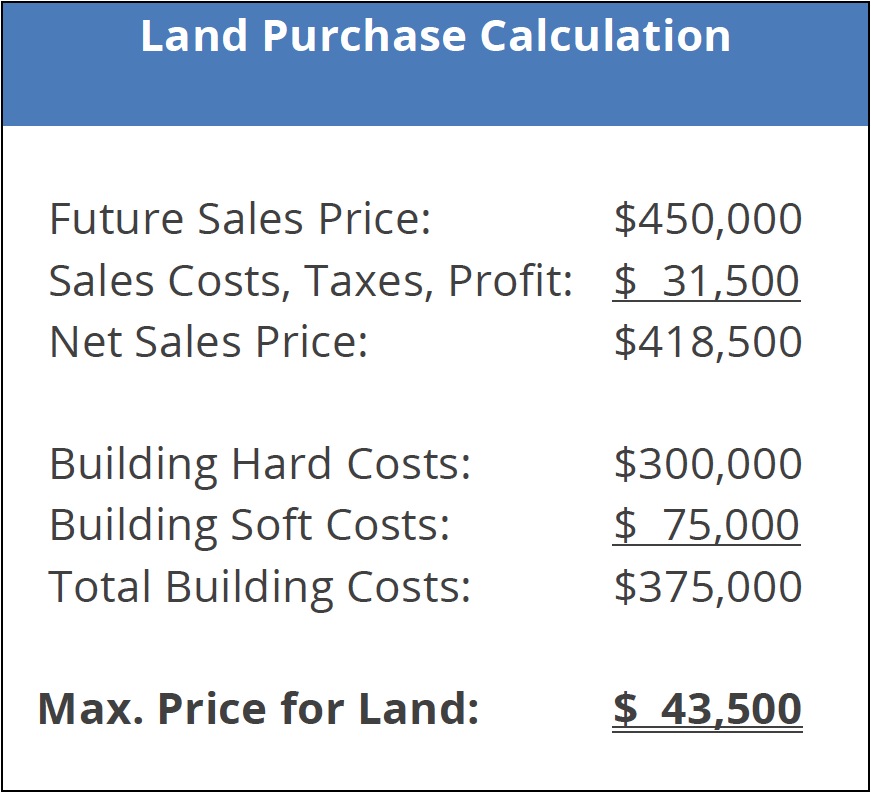

How much does it cost to build a house after buying land kobo building

The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. We ended up selling this property. “in total, our investment was $75,500. The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. Closing costs vary depending on the location, property price, and loan.

How Much Does it Cost to Sell a House? Zillow

The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%..

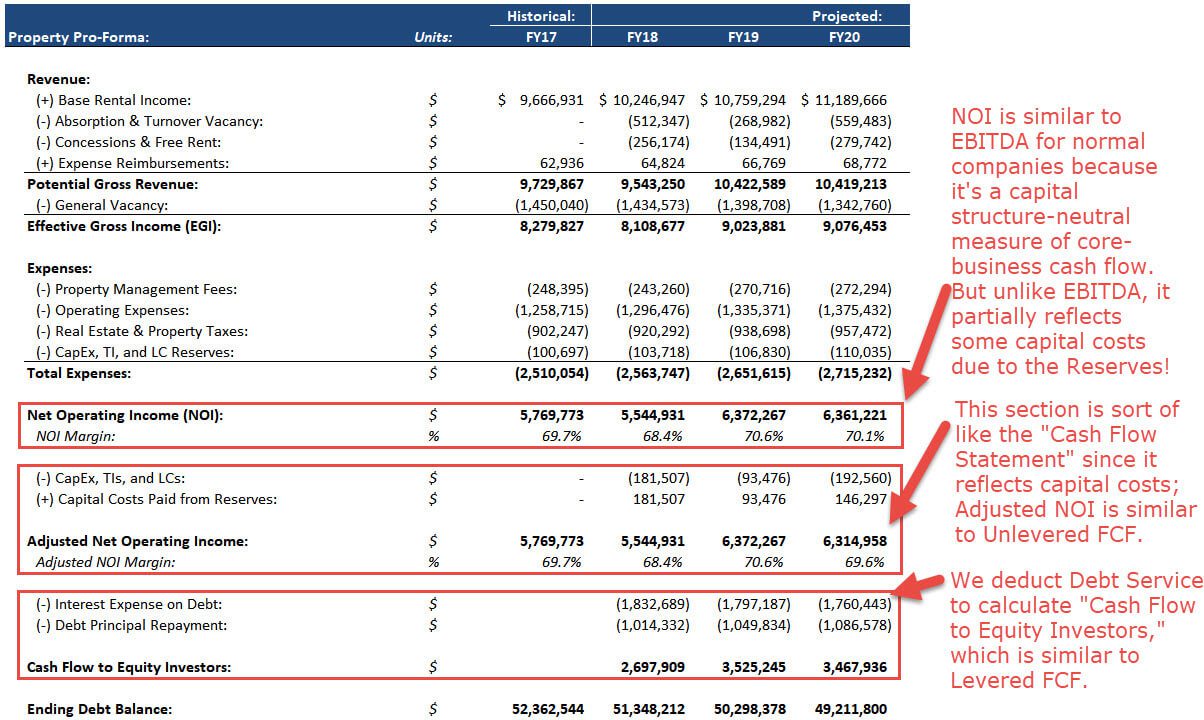

Real Estate ProForma Calculations, Examples, and Scenarios (Video)

Additional minor updates and repairs cost about $3,000. For example, on a $400,000 home, closing costs. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. The answer could make a big difference in how much you save—and it largely depends on your specific expenses,.

How Much Money Do You Need To Buy A House? Bankrate

Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between.

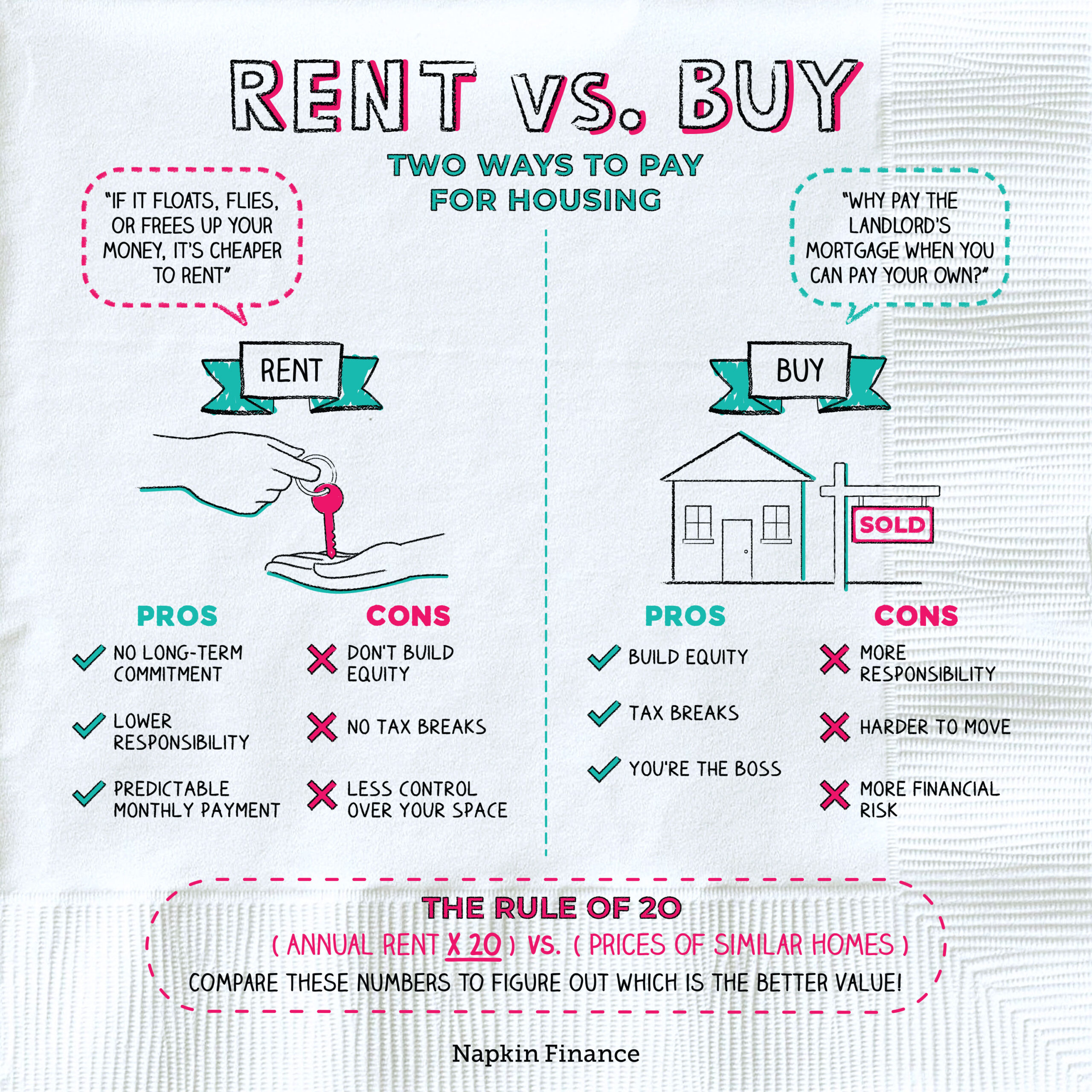

Should I Buy a House Rent vs. Buy Real Estate Buying vs Renting

The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. “in total, our investment was $75,500. Additional minor updates and repairs cost about $3,000. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. As a supplemental fee to the realty transfer tax paid by a property's seller,.

The Answer Could Make A Big Difference In How Much You Save—And It Largely Depends On Your Specific Expenses, Especially.

We ended up selling this property. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. “in total, our investment was $75,500.

Janelle Buys Her Home For $60,000 Cash And Assumes A Mortgage Of $240,000 On It.

Additional minor updates and repairs cost about $3,000. Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. For example, on a $400,000 home, closing costs. The original owner sells their $200,000 home for $1 and no longer uses or occupies the property.