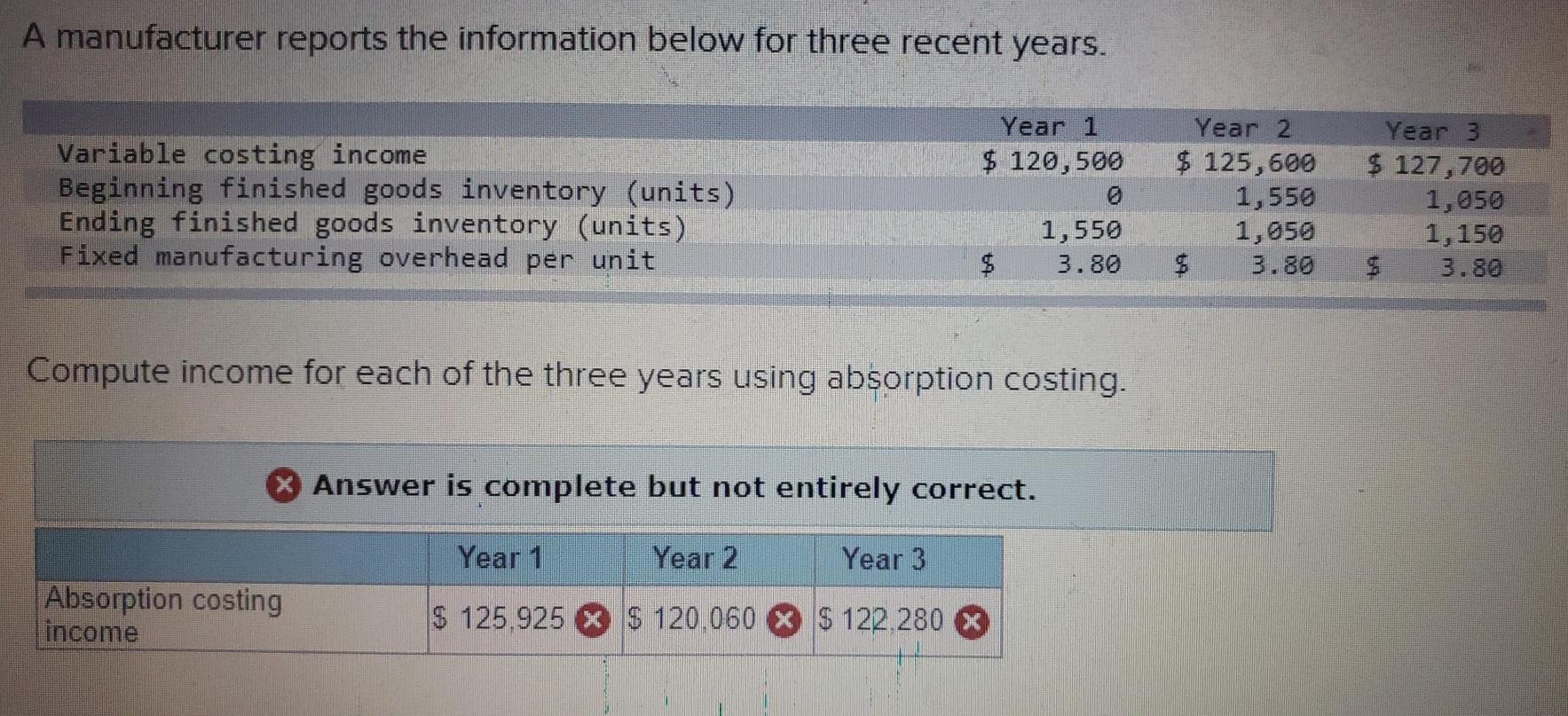

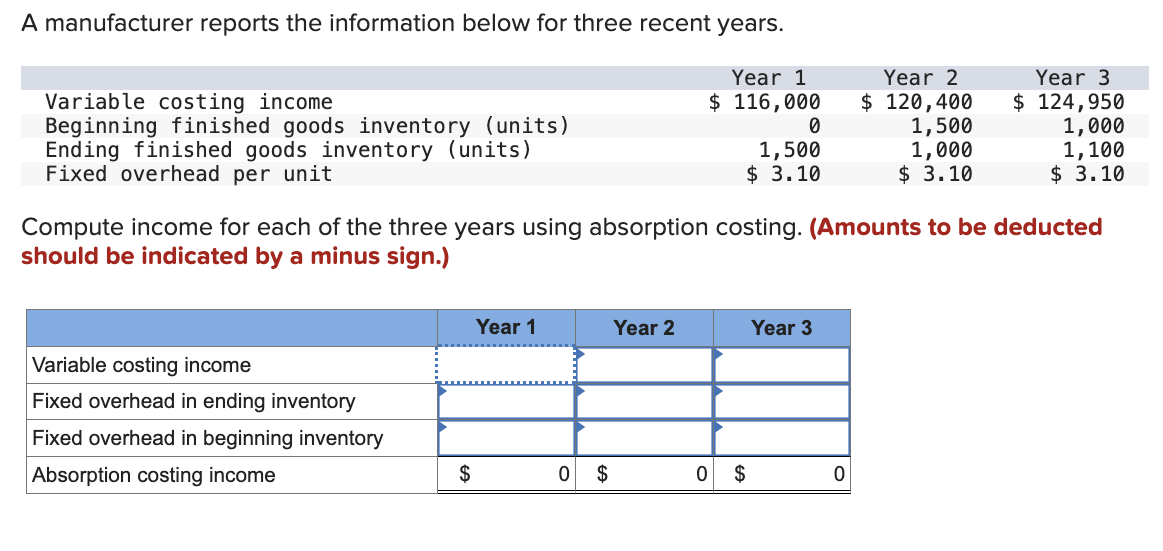

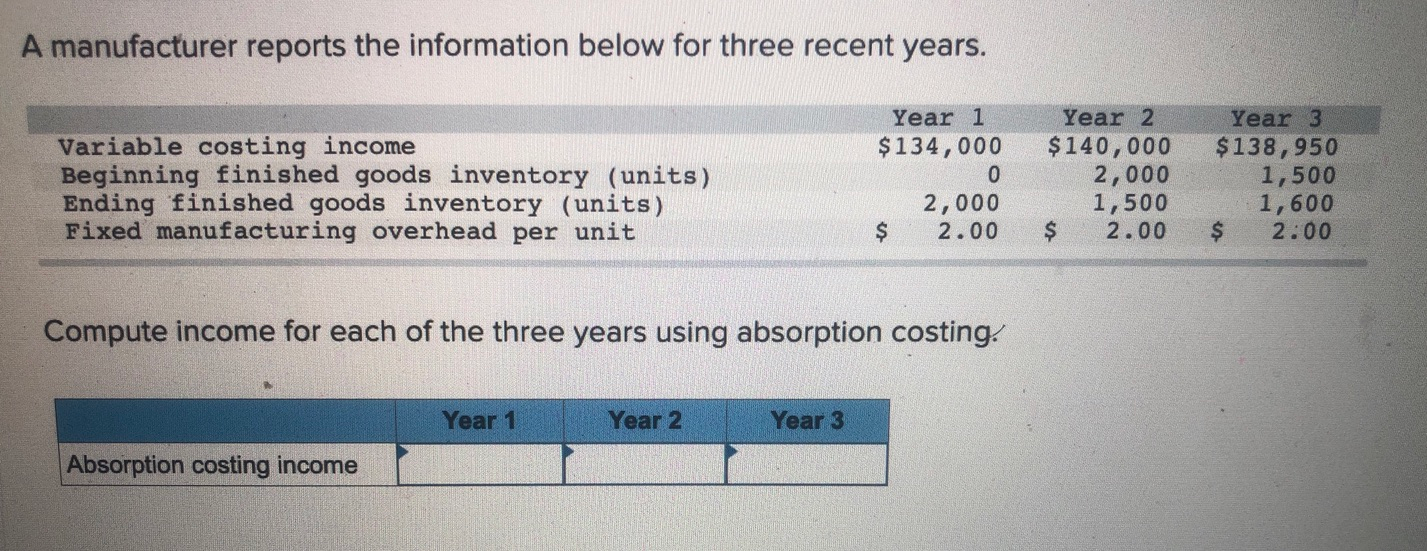

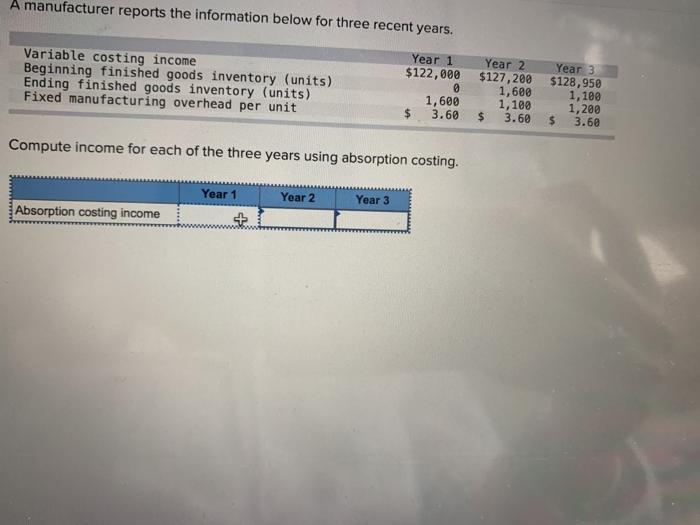

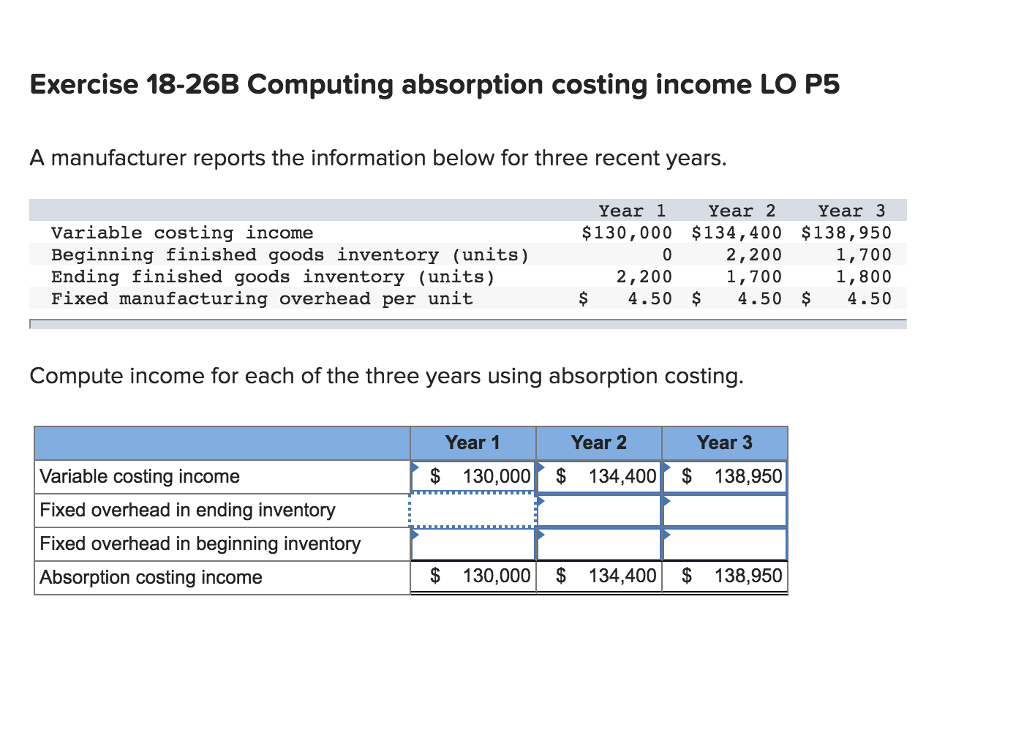

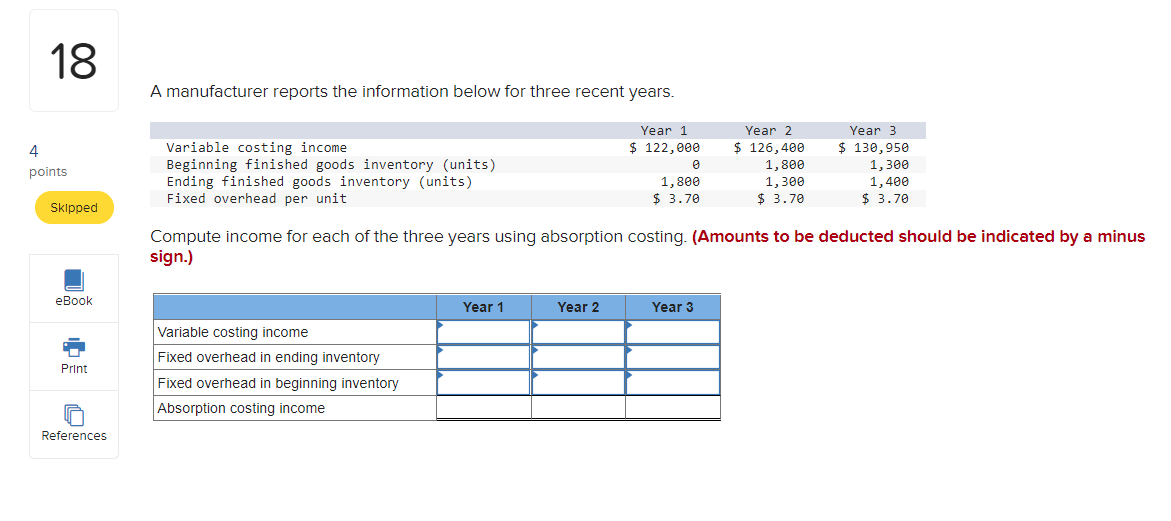

A Manufacturer Reports The Information Below For Three Recent Years - Solution for a manufacturer reports the information below for three recent years. Sirhuds inc., a maker of smartwatches, reports the information below on. First, we need to compute for the fixed overhead of each inventory balance for each year. Year 3 $123,950 year 1 year 2 variable costing income. Absorption costing income for year 1 year 2 and year 3 To find the total fixed manufacturing overhead for each year, we multiply this by the number of units in ending inventory for that. Using absorption costing, the incomes for year 1, year 2, and year 3 are $122,160, $118,600, and $124,390 respectively. A manufacturer reports the information below for three recent. Compute income for each of the three years using absorption costing. Compute income for each of the three years using absorption costing.

Compute income for each of the three years using absorption costing. Compute income for each of the three years using absorption costing. Multiply each year's beginning and ending. Absorption costing income for year 1 year 2 and year 3 Sirhuds inc., a maker of smartwatches, reports the information below on. First, let's calculate the cost of goods sold (cogs) for each year. Compute income for each of the three years using absorption costing. To find the total fixed manufacturing overhead for each year, we multiply this by the number of units in ending inventory for that. Using absorption costing, the incomes for year 1, year 2, and year 3 are $122,160, $118,600, and $124,390 respectively. A manufacturer reports the information below for three recent.

To find the total fixed manufacturing overhead for each year, we multiply this by the number of units in ending inventory for that. Year 3 $123,950 year 1 year 2 variable costing income. Sirhuds inc., a maker of smartwatches, reports the information below on. Multiply each year's beginning and ending. Compute income for each of the three years using absorption costing. First, we need to compute for the fixed overhead of each inventory balance for each year. Using absorption costing, the incomes for year 1, year 2, and year 3 are $122,160, $118,600, and $124,390 respectively. Absorption costing income for year 1 year 2 and year 3 First, let's calculate the cost of goods sold (cogs) for each year. Compute income for each of the three years using absorption costing.

Solved A manufacturer reports the information below for

Compute income for each of the three years using absorption costing. To find the total fixed manufacturing overhead for each year, we multiply this by the number of units in ending inventory for that. Multiply each year's beginning and ending. First, we need to compute for the fixed overhead of each inventory balance for each year. Compute income for each.

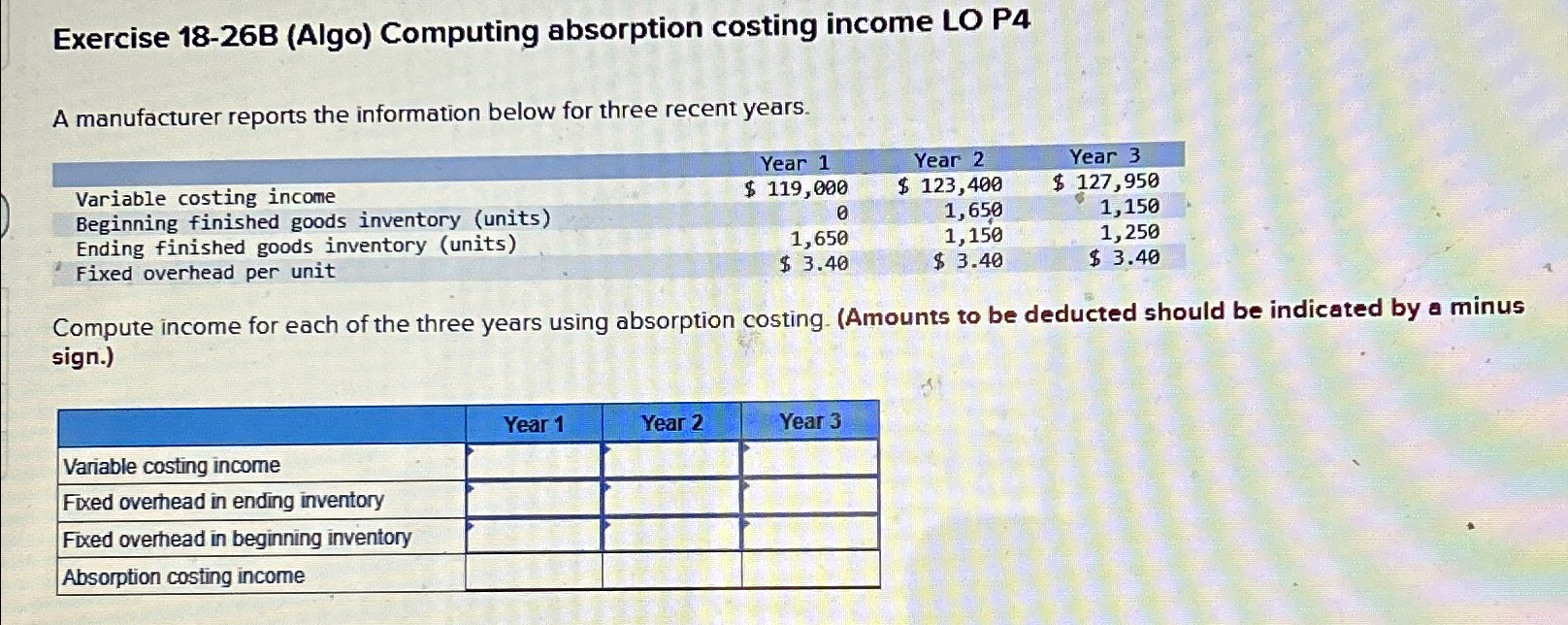

Solved Exercise 1826B (Algo) absorption costing

Compute income for each of the three years using absorption costing. Sirhuds inc., a maker of smartwatches, reports the information below on. Using absorption costing, the incomes for year 1, year 2, and year 3 are $122,160, $118,600, and $124,390 respectively. Solution for a manufacturer reports the information below for three recent years. A manufacturer reports the information below for.

Solved A manufacturer reports the information below for

Year 3 $123,950 year 1 year 2 variable costing income. Using absorption costing, the incomes for year 1, year 2, and year 3 are $122,160, $118,600, and $124,390 respectively. Compute income for each of the three years using absorption costing. First, we need to compute for the fixed overhead of each inventory balance for each year. Compute income for each.

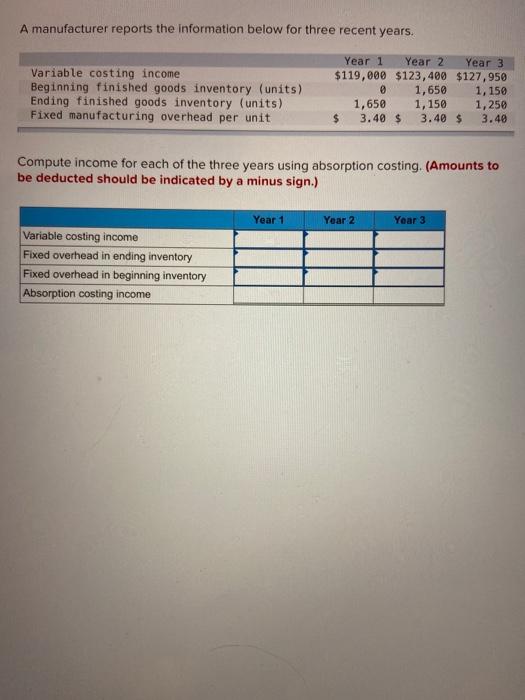

Solved A manufacturer reports the information below for

Sirhuds inc., a maker of smartwatches, reports the information below on. First, we need to compute for the fixed overhead of each inventory balance for each year. Compute income for each of the three years using absorption costing. Compute income for each of the three years using absorption costing. Compute income for each of the three years using absorption costing.

Solved A manufacturer reports the information below for

Sirhuds inc., a maker of smartwatches, reports the information below on. Absorption costing income for year 1 year 2 and year 3 Year 3 $123,950 year 1 year 2 variable costing income. First, let's calculate the cost of goods sold (cogs) for each year. Compute income for each of the three years using absorption costing.

Solved A manufacturer reports the information below for

Multiply each year's beginning and ending. Sirhuds inc., a maker of smartwatches, reports the information below on. Solution for a manufacturer reports the information below for three recent years. Year 3 $123,950 year 1 year 2 variable costing income. A manufacturer reports the information below for three recent.

Solved A manufacturer reports the information below for

Sirhuds inc., a maker of smartwatches, reports the information below on. Using absorption costing, the incomes for year 1, year 2, and year 3 are $122,160, $118,600, and $124,390 respectively. First, let's calculate the cost of goods sold (cogs) for each year. Absorption costing income for year 1 year 2 and year 3 First, we need to compute for the.

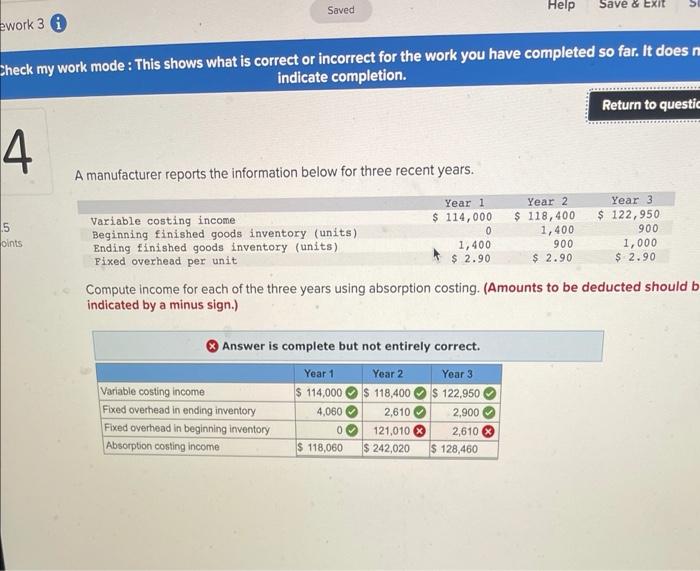

Solved Exercise 1826B Computing absorption costing

Absorption costing income for year 1 year 2 and year 3 To find the total fixed manufacturing overhead for each year, we multiply this by the number of units in ending inventory for that. A manufacturer reports the information below for three recent. First, we need to compute for the fixed overhead of each inventory balance for each year. Compute.

(Solved) A Manufacturer Reports The Information Below For Three

To find the total fixed manufacturing overhead for each year, we multiply this by the number of units in ending inventory for that. Compute income for each of the three years using absorption costing. A manufacturer reports the information below for three recent. Year 3 $123,950 year 1 year 2 variable costing income. Compute income for each of the three.

Solved 18 A manufacturer reports the information below for

First, let's calculate the cost of goods sold (cogs) for each year. A manufacturer reports the information below for three recent. Multiply each year's beginning and ending. Sirhuds inc., a maker of smartwatches, reports the information below on. Compute income for each of the three years using absorption costing.

Compute Income For Each Of The Three Years Using Absorption Costing.

Compute income for each of the three years using absorption costing. First, let's calculate the cost of goods sold (cogs) for each year. First, we need to compute for the fixed overhead of each inventory balance for each year. Year 3 $123,950 year 1 year 2 variable costing income.

Sirhuds Inc., A Maker Of Smartwatches, Reports The Information Below On.

Compute income for each of the three years using absorption costing. Using absorption costing, the incomes for year 1, year 2, and year 3 are $122,160, $118,600, and $124,390 respectively. A manufacturer reports the information below for three recent. Solution for a manufacturer reports the information below for three recent years.

Absorption Costing Income For Year 1 Year 2 And Year 3

Multiply each year's beginning and ending. To find the total fixed manufacturing overhead for each year, we multiply this by the number of units in ending inventory for that.