Aca Cheat Sheet - This section uses two sets of codes released by the irs to help employers have. It is used to report the employee’s enrollment only. We created this cheat sheet to help you address employee questions and understand your filing. As part of the aca, the irs created two sets of. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. Lowest hourly rate this year was $10/hour.

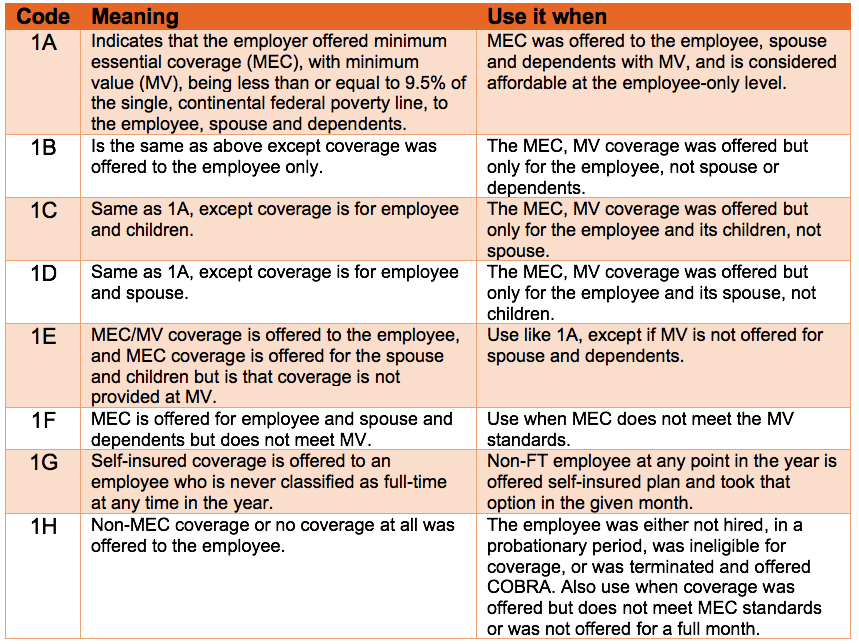

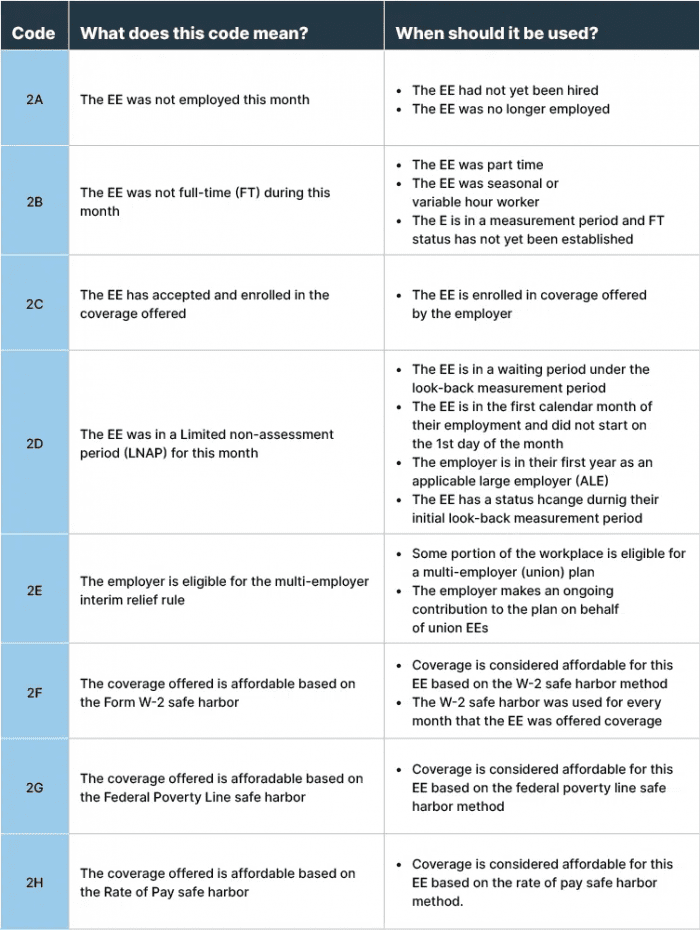

This section uses two sets of codes released by the irs to help employers have. It is used to report the employee’s enrollment only. We created this cheat sheet to help you address employee questions and understand your filing. As part of the aca, the irs created two sets of. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. Lowest hourly rate this year was $10/hour.

Lowest hourly rate this year was $10/hour. This section uses two sets of codes released by the irs to help employers have. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. We created this cheat sheet to help you address employee questions and understand your filing. As part of the aca, the irs created two sets of. It is used to report the employee’s enrollment only.

The Affordable Care Act ACA Code Cheat Sheet You Need Aca Staff Health Form

$10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. We created this cheat sheet to help you address employee questions and understand your filing. This section uses two sets of codes released by the irs to help employers have. It is used to report the employee’s enrollment only. As part.

ACA Codes A 1095 Cheat Sheet You're Gonna Love! Thread HCM

This section uses two sets of codes released by the irs to help employers have. It is used to report the employee’s enrollment only. As part of the aca, the irs created two sets of. Lowest hourly rate this year was $10/hour. We created this cheat sheet to help you address employee questions and understand your filing.

ACA Code Cheatsheet

We created this cheat sheet to help you address employee questions and understand your filing. This section uses two sets of codes released by the irs to help employers have. As part of the aca, the irs created two sets of. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130..

ACA Code Cheatsheet

Lowest hourly rate this year was $10/hour. As part of the aca, the irs created two sets of. This section uses two sets of codes released by the irs to help employers have. We created this cheat sheet to help you address employee questions and understand your filing. $10/hour x 130 hours per month (aca full time) x 2023 safe.

ACA Codes a 1095Cheat Sheet You're Gonna love

$10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. This section uses two sets of codes released by the irs to help employers have. As part of the aca, the irs created two sets of. Lowest hourly rate this year was $10/hour. It is used to report the employee’s enrollment.

The Affordable Care Act (ACA) Code Cheat Sheet You Need Advantage

It is used to report the employee’s enrollment only. This section uses two sets of codes released by the irs to help employers have. Lowest hourly rate this year was $10/hour. As part of the aca, the irs created two sets of. We created this cheat sheet to help you address employee questions and understand your filing.

ACA Code Cheatsheet

We created this cheat sheet to help you address employee questions and understand your filing. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. It is used to report the employee’s enrollment only. Lowest hourly rate this year was $10/hour. As part of the aca, the irs created two sets.

ACA Code Cheatsheet

Lowest hourly rate this year was $10/hour. This section uses two sets of codes released by the irs to help employers have. As part of the aca, the irs created two sets of. It is used to report the employee’s enrollment only. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x.

Affordable Care Act (ACA) Reporting Cheat Sheet Reporting Made Easy

We created this cheat sheet to help you address employee questions and understand your filing. It is used to report the employee’s enrollment only. Lowest hourly rate this year was $10/hour. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. This section uses two sets of codes released by the.

Affordable Care Act (ACA) Reporting Cheat Sheet Reporting Made Easy

Lowest hourly rate this year was $10/hour. This section uses two sets of codes released by the irs to help employers have. We created this cheat sheet to help you address employee questions and understand your filing. As part of the aca, the irs created two sets of. It is used to report the employee’s enrollment only.

As Part Of The Aca, The Irs Created Two Sets Of.

Lowest hourly rate this year was $10/hour. $10/hour x 130 hours per month (aca full time) x 2023 safe harbor rate (9.12%) = $10/hour x 130. We created this cheat sheet to help you address employee questions and understand your filing. This section uses two sets of codes released by the irs to help employers have.