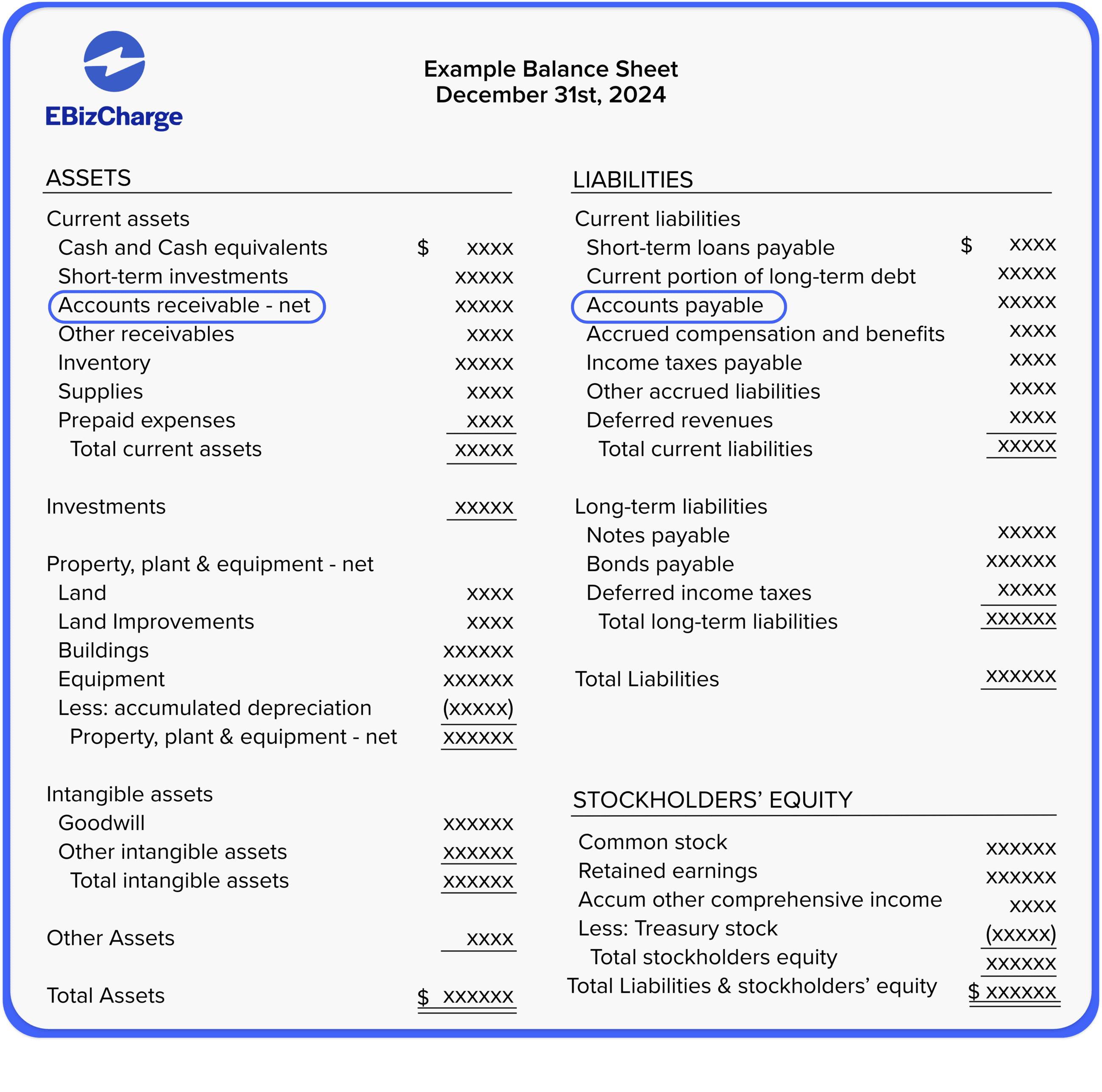

Accounts Receivable Are Valued And Reported On The Balance Sheet - Receivables are current assets (if collectible within 12 months) and are reported on the balance sheet at their net realizable value. Accounts receivable are valued and reported on the balance sheet at (blank) realizable value. Understand the placement and impact of accounts receivable on the balance sheet, including valuation, liquidity effects, and.

Accounts receivable are valued and reported on the balance sheet at (blank) realizable value. Understand the placement and impact of accounts receivable on the balance sheet, including valuation, liquidity effects, and. Receivables are current assets (if collectible within 12 months) and are reported on the balance sheet at their net realizable value.

Receivables are current assets (if collectible within 12 months) and are reported on the balance sheet at their net realizable value. Accounts receivable are valued and reported on the balance sheet at (blank) realizable value. Understand the placement and impact of accounts receivable on the balance sheet, including valuation, liquidity effects, and.

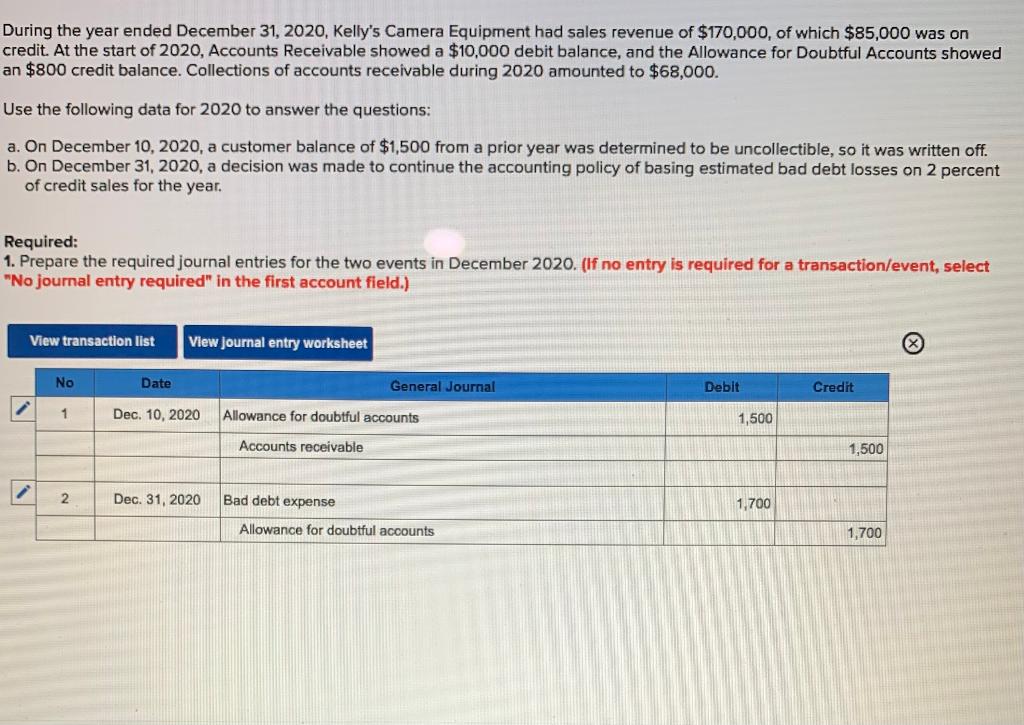

Solved 2. Show how the amounts related to Accounts

Understand the placement and impact of accounts receivable on the balance sheet, including valuation, liquidity effects, and. Receivables are current assets (if collectible within 12 months) and are reported on the balance sheet at their net realizable value. Accounts receivable are valued and reported on the balance sheet at (blank) realizable value.

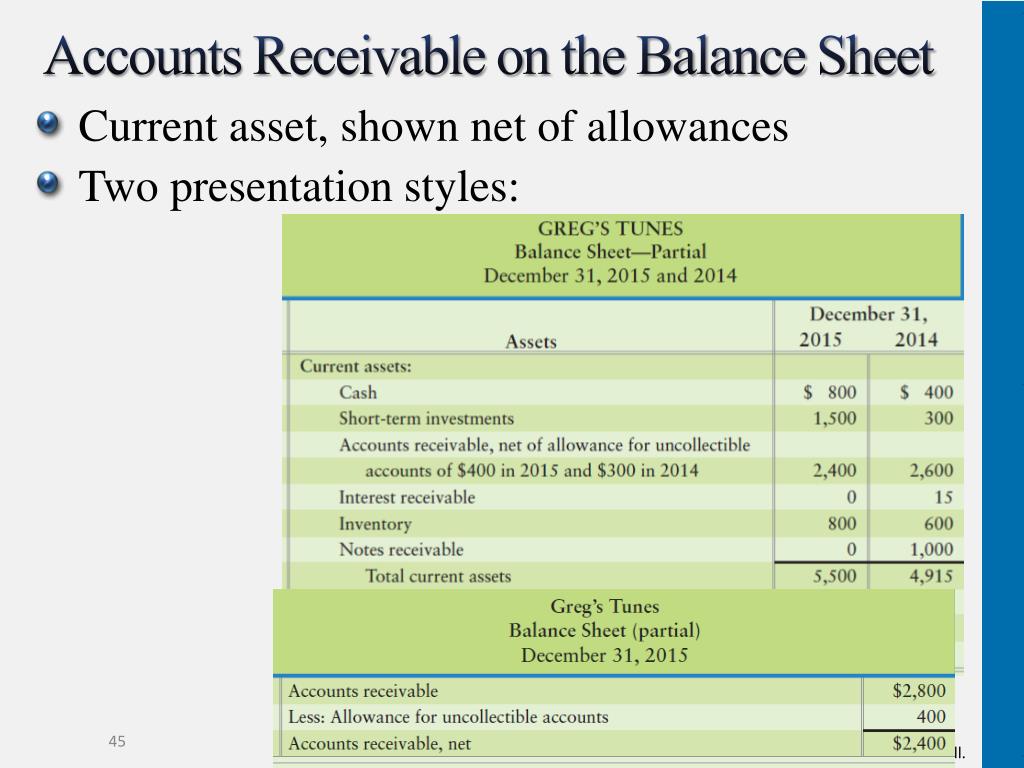

Accounts Receivable on the Balance Sheet Accounting Education

Accounts receivable are valued and reported on the balance sheet at (blank) realizable value. Understand the placement and impact of accounts receivable on the balance sheet, including valuation, liquidity effects, and. Receivables are current assets (if collectible within 12 months) and are reported on the balance sheet at their net realizable value.

Performing balance sheet and cash flow planning in Financials

Understand the placement and impact of accounts receivable on the balance sheet, including valuation, liquidity effects, and. Accounts receivable are valued and reported on the balance sheet at (blank) realizable value. Receivables are current assets (if collectible within 12 months) and are reported on the balance sheet at their net realizable value.

Accounts Receivable on the Balance Sheet

Accounts receivable are valued and reported on the balance sheet at (blank) realizable value. Receivables are current assets (if collectible within 12 months) and are reported on the balance sheet at their net realizable value. Understand the placement and impact of accounts receivable on the balance sheet, including valuation, liquidity effects, and.

PPT Receivables PowerPoint Presentation, free download ID1657894

Understand the placement and impact of accounts receivable on the balance sheet, including valuation, liquidity effects, and. Receivables are current assets (if collectible within 12 months) and are reported on the balance sheet at their net realizable value. Accounts receivable are valued and reported on the balance sheet at (blank) realizable value.

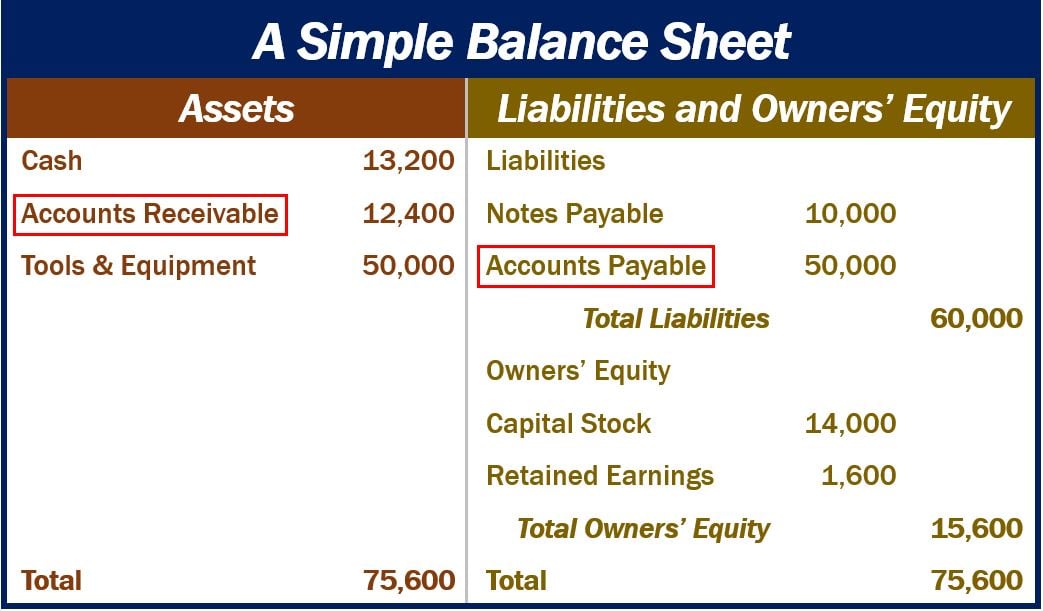

What is accounts receivable? Definition and examples

Accounts receivable are valued and reported on the balance sheet at (blank) realizable value. Receivables are current assets (if collectible within 12 months) and are reported on the balance sheet at their net realizable value. Understand the placement and impact of accounts receivable on the balance sheet, including valuation, liquidity effects, and.

Balance Sheet Explanation, Components, and Examples (2022)

Receivables are current assets (if collectible within 12 months) and are reported on the balance sheet at their net realizable value. Accounts receivable are valued and reported on the balance sheet at (blank) realizable value. Understand the placement and impact of accounts receivable on the balance sheet, including valuation, liquidity effects, and.

What are Accounts Receivable and Accounts Payable?

Receivables are current assets (if collectible within 12 months) and are reported on the balance sheet at their net realizable value. Accounts receivable are valued and reported on the balance sheet at (blank) realizable value. Understand the placement and impact of accounts receivable on the balance sheet, including valuation, liquidity effects, and.

Accounts Receivable Balance Listing

Understand the placement and impact of accounts receivable on the balance sheet, including valuation, liquidity effects, and. Accounts receivable are valued and reported on the balance sheet at (blank) realizable value. Receivables are current assets (if collectible within 12 months) and are reported on the balance sheet at their net realizable value.

How to Find Accounts Receivable on Balance Sheet

Accounts receivable are valued and reported on the balance sheet at (blank) realizable value. Understand the placement and impact of accounts receivable on the balance sheet, including valuation, liquidity effects, and. Receivables are current assets (if collectible within 12 months) and are reported on the balance sheet at their net realizable value.

Accounts Receivable Are Valued And Reported On The Balance Sheet At (Blank) Realizable Value.

Receivables are current assets (if collectible within 12 months) and are reported on the balance sheet at their net realizable value. Understand the placement and impact of accounts receivable on the balance sheet, including valuation, liquidity effects, and.

/accounts-receivables-on-the-balance-sheet-357263-final-911167a5515b4facb2d39d25e4e5bf3d.jpg)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)