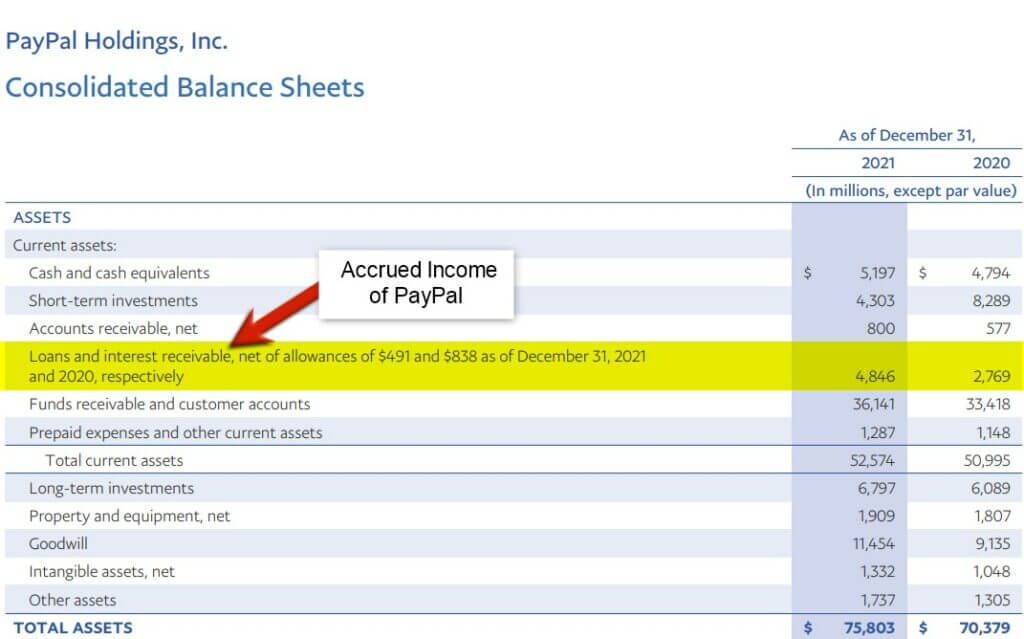

Accrued Revenues Would Appear On The Balance Sheet As - Accrued revenue is a crucial concept in accounting that refers to the recognition of revenue before it is actually. Accrued revenue appears as a current asset on the balance sheet. This is because it represents money the. These are initially recorded as assets on the balance sheet and gradually expensed over the periods to which they relate. Accrued revenue is income earned by providing goods or services, but the payment hasn’t been received yet. The unbilled revenue account should appear in the current assets portion of the balance sheet. Accrued revenue is reported as a current asset on the balance sheet, even though cash has not been received. Impact on the balance sheet. Thus, the offsets to accruals in.

Accrued revenue appears as a current asset on the balance sheet. The unbilled revenue account should appear in the current assets portion of the balance sheet. These are initially recorded as assets on the balance sheet and gradually expensed over the periods to which they relate. Impact on the balance sheet. Accrued revenue is reported as a current asset on the balance sheet, even though cash has not been received. Accrued revenue is a crucial concept in accounting that refers to the recognition of revenue before it is actually. Accrued revenue is income earned by providing goods or services, but the payment hasn’t been received yet. This is because it represents money the. Thus, the offsets to accruals in.

Impact on the balance sheet. This is because it represents money the. Accrued revenue is income earned by providing goods or services, but the payment hasn’t been received yet. Accrued revenue is a crucial concept in accounting that refers to the recognition of revenue before it is actually. Thus, the offsets to accruals in. Accrued revenue appears as a current asset on the balance sheet. Accrued revenue is reported as a current asset on the balance sheet, even though cash has not been received. The unbilled revenue account should appear in the current assets portion of the balance sheet. These are initially recorded as assets on the balance sheet and gradually expensed over the periods to which they relate.

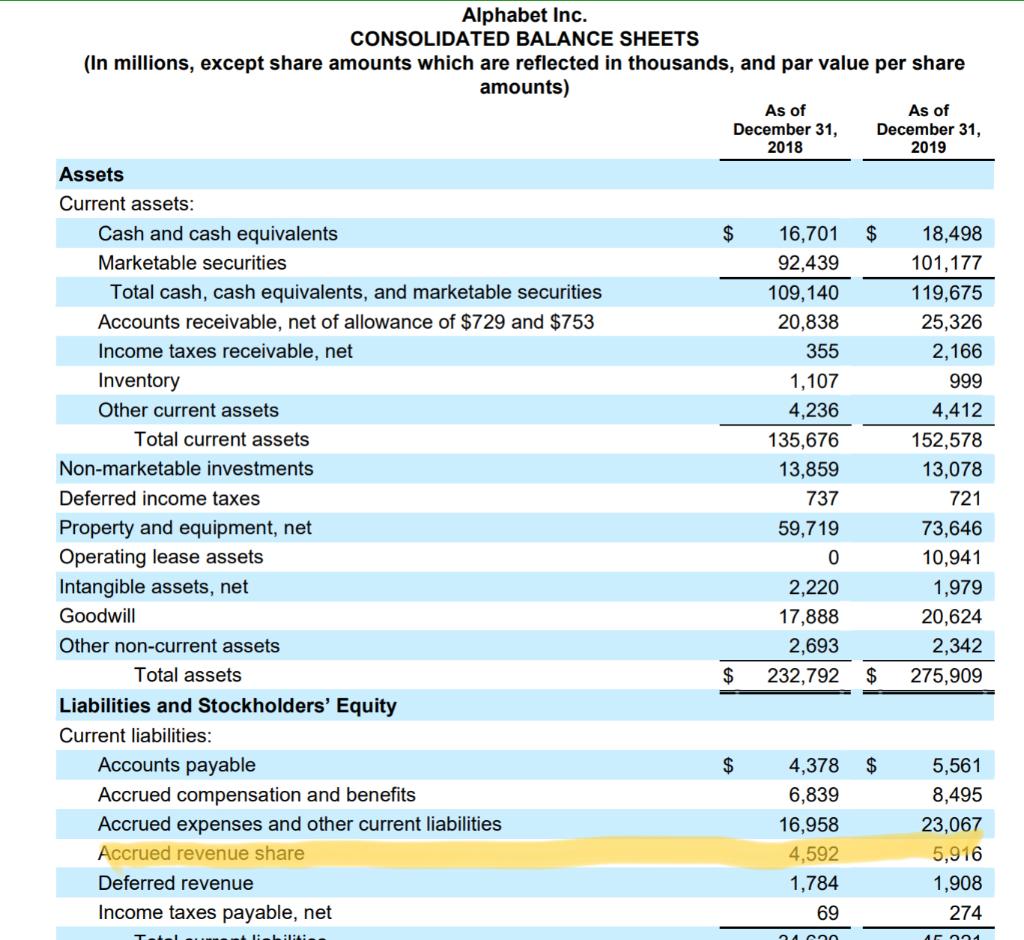

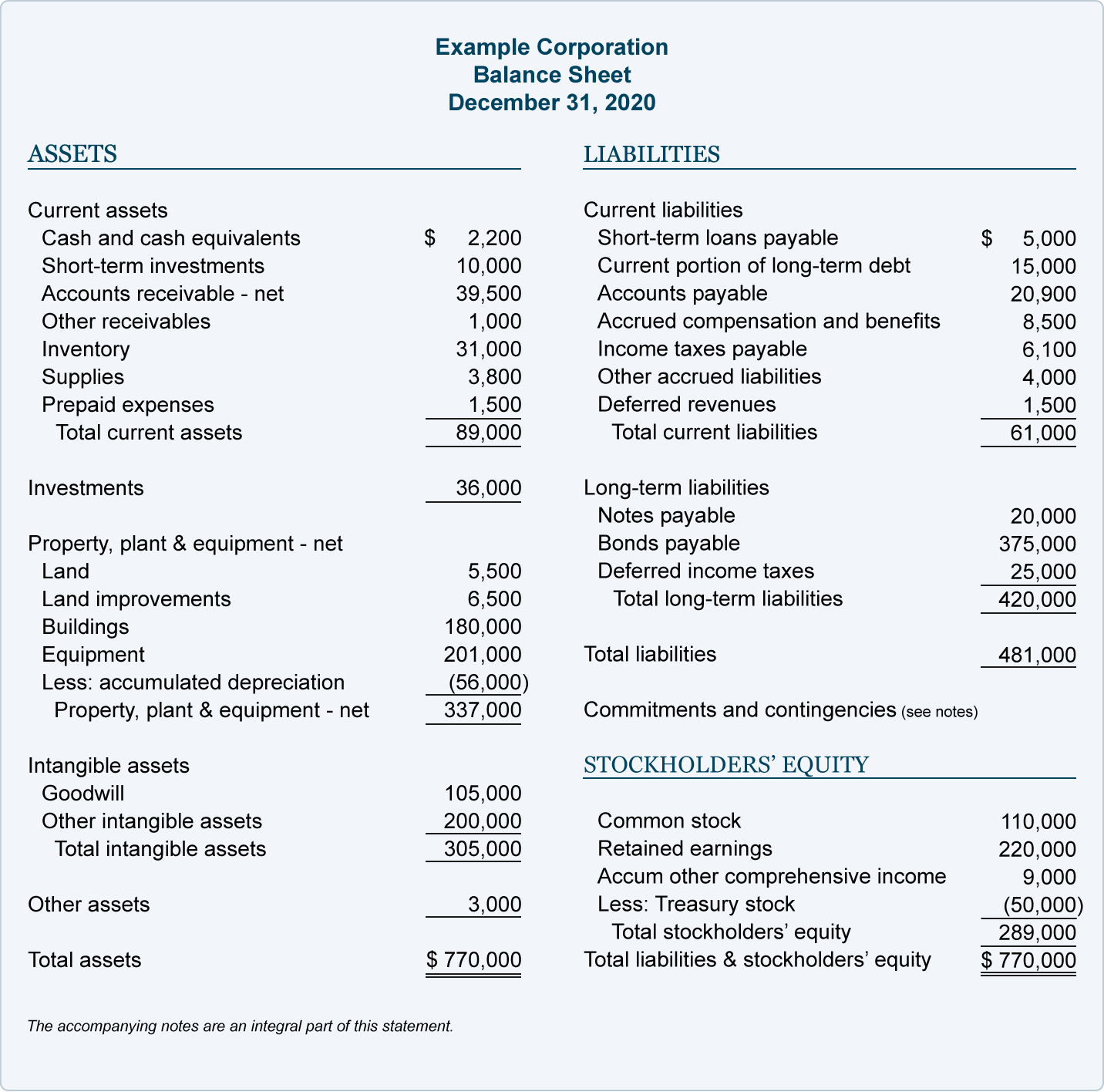

Solved Accrued revenue is an asset. But, on the balance

Accrued revenue appears as a current asset on the balance sheet. Accrued revenue is a crucial concept in accounting that refers to the recognition of revenue before it is actually. The unbilled revenue account should appear in the current assets portion of the balance sheet. Accrued revenue is reported as a current asset on the balance sheet, even though cash.

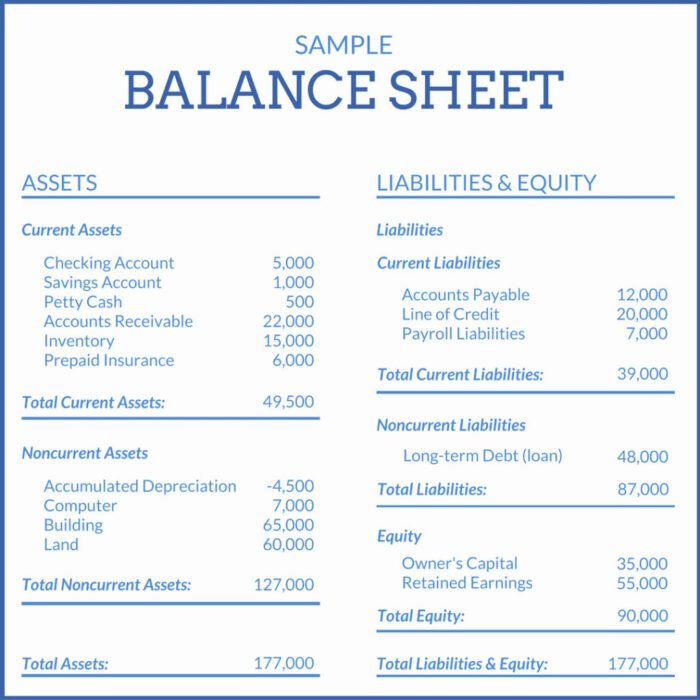

Balance Sheet Format, Example & Free Template Basic Accounting Help

This is because it represents money the. Accrued revenue appears as a current asset on the balance sheet. Accrued revenue is a crucial concept in accounting that refers to the recognition of revenue before it is actually. These are initially recorded as assets on the balance sheet and gradually expensed over the periods to which they relate. The unbilled revenue.

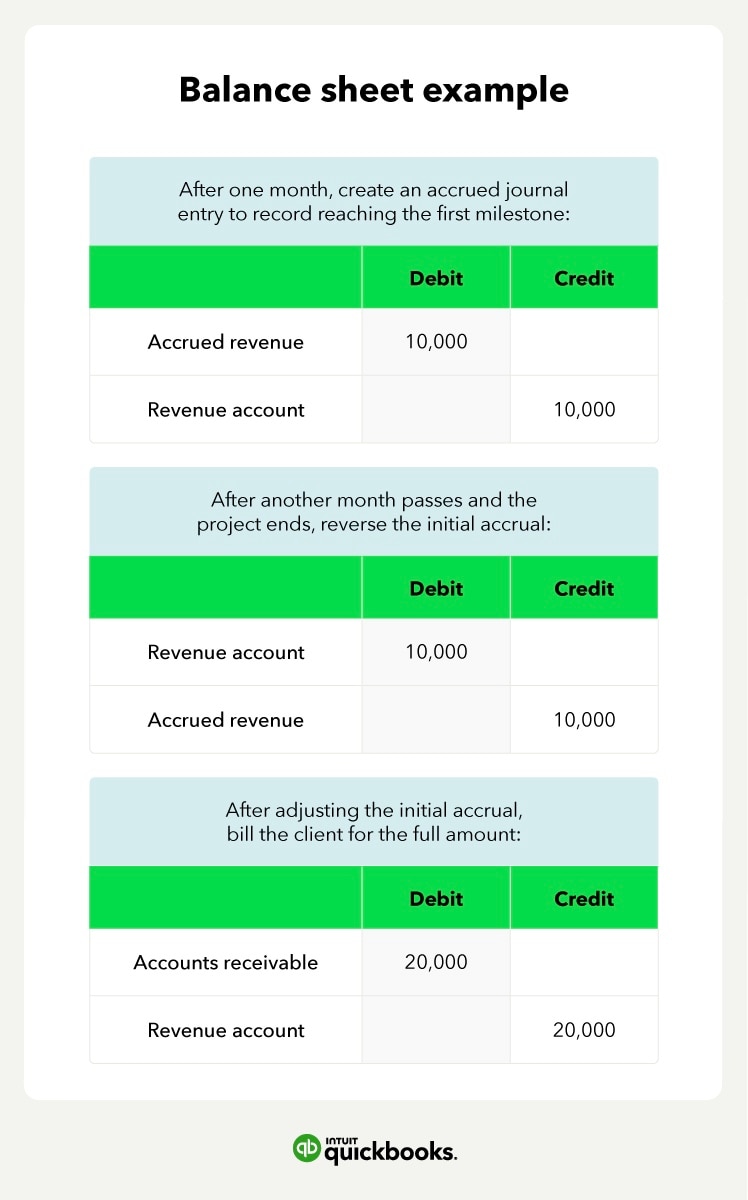

Accrued revenue how to record it in 2023 QuickBooks

This is because it represents money the. Thus, the offsets to accruals in. Accrued revenue is a crucial concept in accounting that refers to the recognition of revenue before it is actually. The unbilled revenue account should appear in the current assets portion of the balance sheet. Impact on the balance sheet.

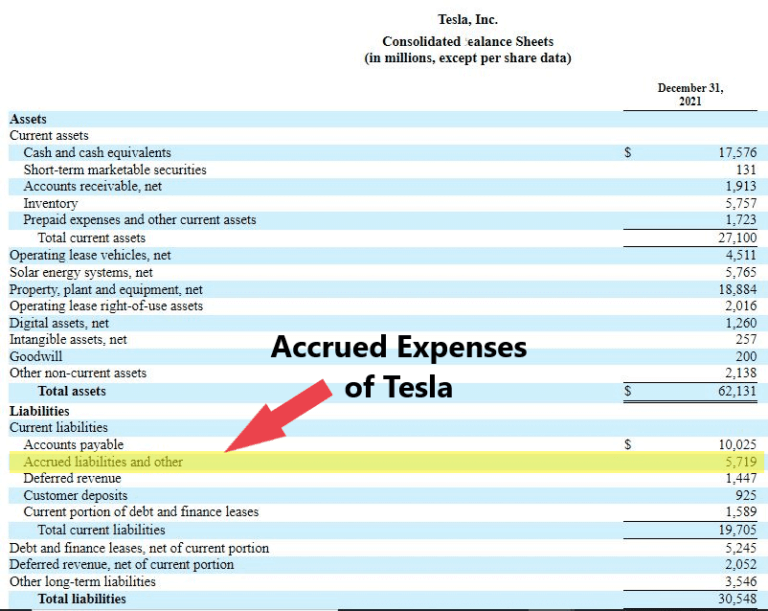

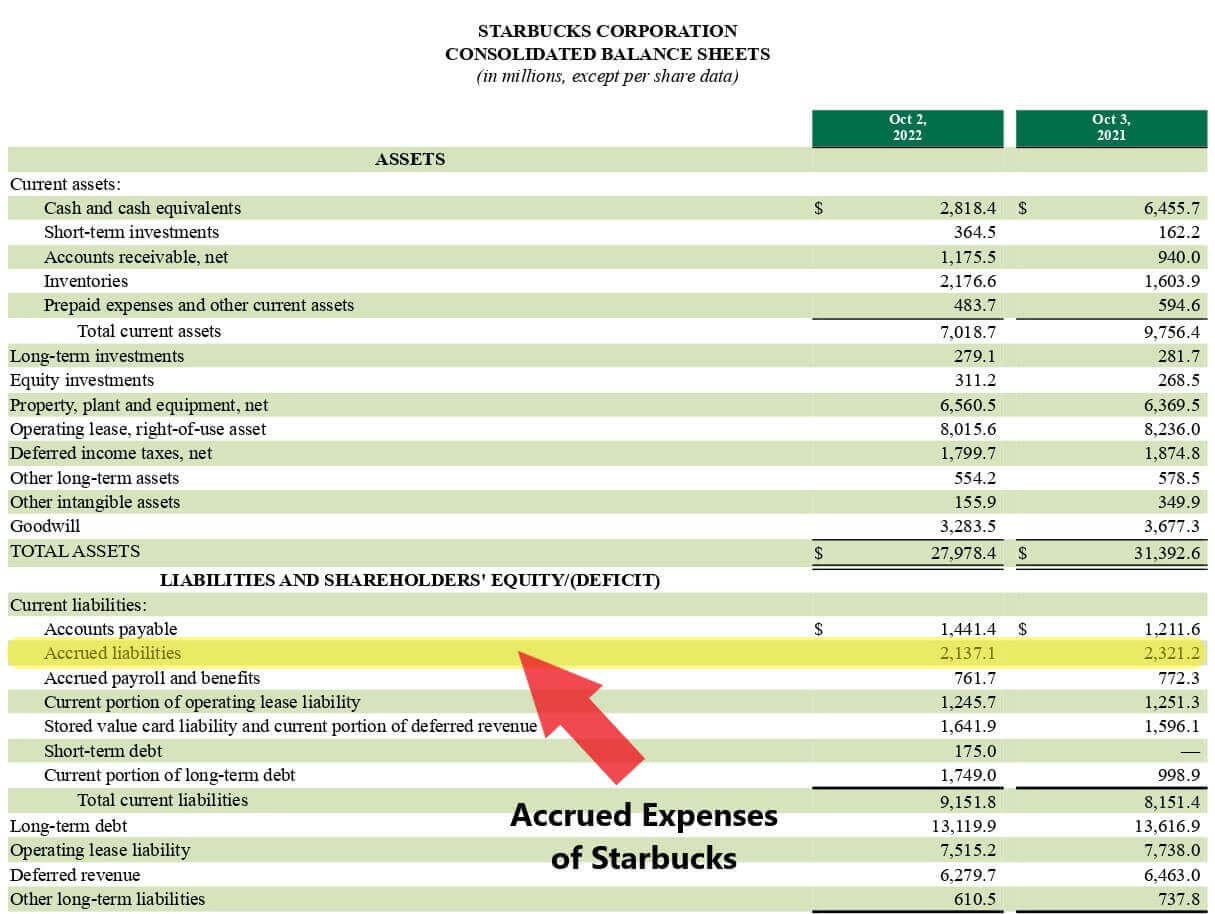

Accrued Expense Examples of Accrued Expenses

Impact on the balance sheet. Accrued revenue is a crucial concept in accounting that refers to the recognition of revenue before it is actually. The unbilled revenue account should appear in the current assets portion of the balance sheet. Accrued revenue is income earned by providing goods or services, but the payment hasn’t been received yet. This is because it.

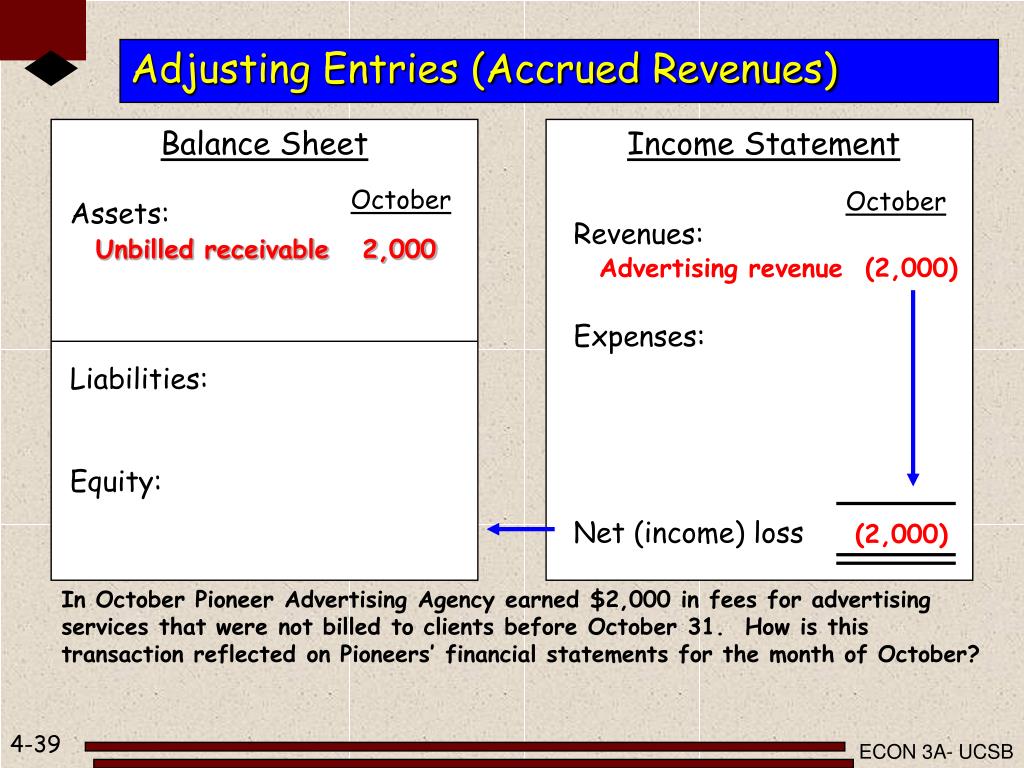

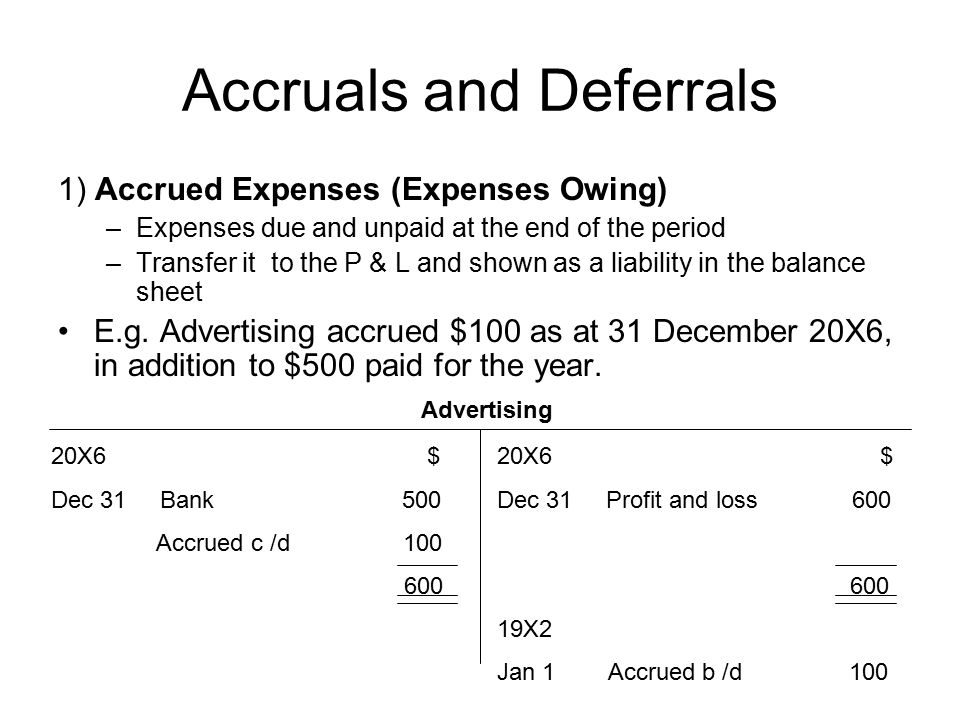

PPT Measurement and Accrual Accounting PowerPoint Presentation

Accrued revenue is income earned by providing goods or services, but the payment hasn’t been received yet. Accrued revenue appears as a current asset on the balance sheet. Accrued revenue is a crucial concept in accounting that refers to the recognition of revenue before it is actually. Accrued revenue is reported as a current asset on the balance sheet, even.

The accrual basis of accounting Business Accounting

Impact on the balance sheet. These are initially recorded as assets on the balance sheet and gradually expensed over the periods to which they relate. Accrued revenue is income earned by providing goods or services, but the payment hasn’t been received yet. Accrued revenue is reported as a current asset on the balance sheet, even though cash has not been.

How to read and understand financial statements

This is because it represents money the. Accrued revenue is income earned by providing goods or services, but the payment hasn’t been received yet. Impact on the balance sheet. The unbilled revenue account should appear in the current assets portion of the balance sheet. Accrued revenue appears as a current asset on the balance sheet.

How to Understand Your Balance Sheet A Beginner's Guide 2025

This is because it represents money the. Accrued revenue appears as a current asset on the balance sheet. Accrued revenue is income earned by providing goods or services, but the payment hasn’t been received yet. These are initially recorded as assets on the balance sheet and gradually expensed over the periods to which they relate. Impact on the balance sheet.

Accrued Expense Examples of Accrued Expenses

Accrued revenue is income earned by providing goods or services, but the payment hasn’t been received yet. Accrued revenue appears as a current asset on the balance sheet. Accrued revenue is a crucial concept in accounting that refers to the recognition of revenue before it is actually. Thus, the offsets to accruals in. These are initially recorded as assets on.

What is Accrued Journal Entry, Examples, How it Works?

Impact on the balance sheet. Accrued revenue is reported as a current asset on the balance sheet, even though cash has not been received. Accrued revenue appears as a current asset on the balance sheet. The unbilled revenue account should appear in the current assets portion of the balance sheet. These are initially recorded as assets on the balance sheet.

Accrued Revenue Is A Crucial Concept In Accounting That Refers To The Recognition Of Revenue Before It Is Actually.

Accrued revenue is income earned by providing goods or services, but the payment hasn’t been received yet. These are initially recorded as assets on the balance sheet and gradually expensed over the periods to which they relate. Impact on the balance sheet. This is because it represents money the.

Accrued Revenue Appears As A Current Asset On The Balance Sheet.

Thus, the offsets to accruals in. Accrued revenue is reported as a current asset on the balance sheet, even though cash has not been received. The unbilled revenue account should appear in the current assets portion of the balance sheet.