Allowance For Doubtful Accounts In Balance Sheet - The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s. Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services “on credit” and. Explore the components, estimation methods, and financial impact of the allowance for doubtful accounts in this comprehensive guide. What is allowance for doubtful accounts?

Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services “on credit” and. What is allowance for doubtful accounts? Explore the components, estimation methods, and financial impact of the allowance for doubtful accounts in this comprehensive guide. The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s.

Explore the components, estimation methods, and financial impact of the allowance for doubtful accounts in this comprehensive guide. What is allowance for doubtful accounts? The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s. Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services “on credit” and.

Chapter 8

Explore the components, estimation methods, and financial impact of the allowance for doubtful accounts in this comprehensive guide. The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s. Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services “on credit” and. What is allowance.

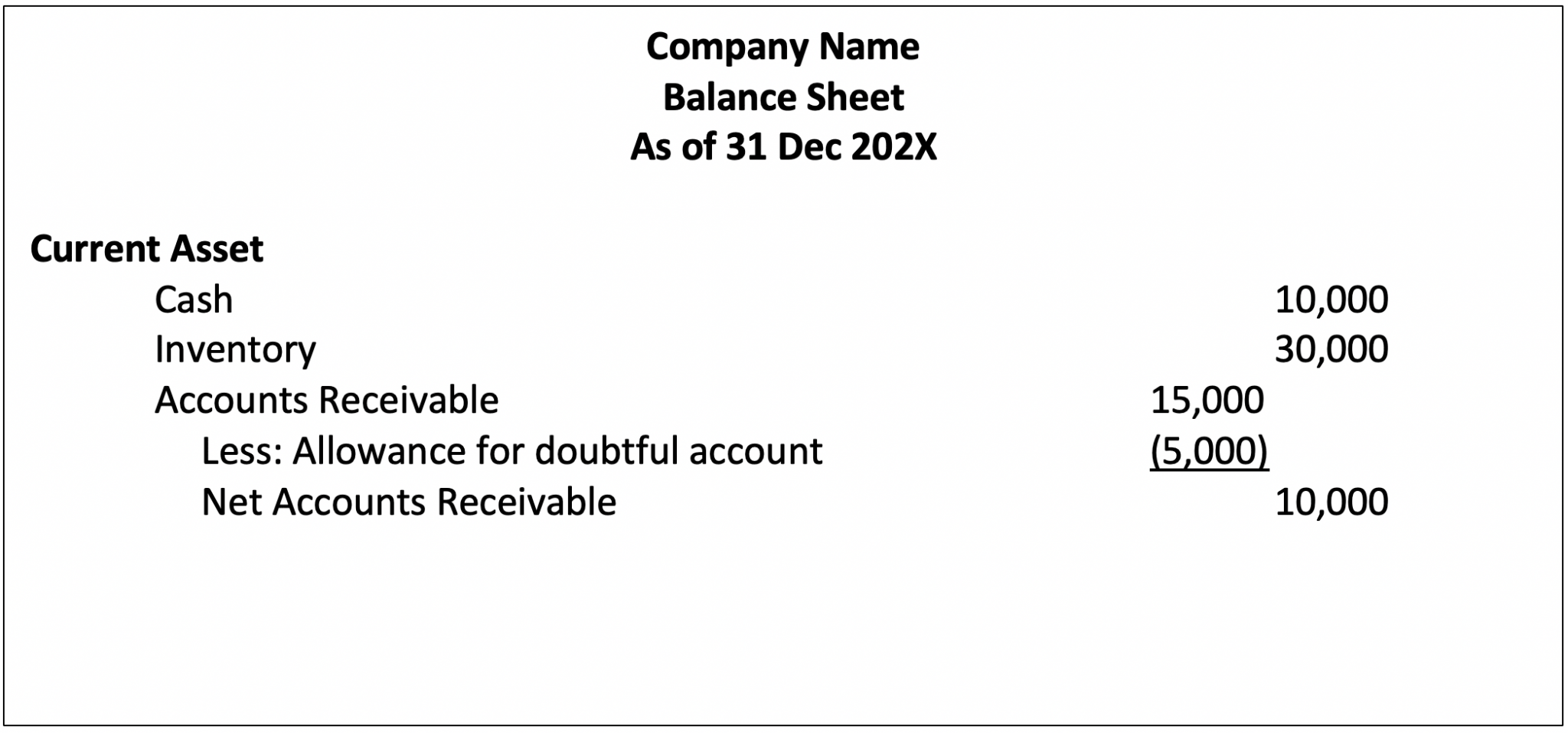

Classified Balance Sheet Allowance For Doubtful Accounts

Explore the components, estimation methods, and financial impact of the allowance for doubtful accounts in this comprehensive guide. The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s. Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services “on credit” and. What is allowance.

Classified Balance Sheet Allowance For Doubtful Accounts

The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s. What is allowance for doubtful accounts? Explore the components, estimation methods, and financial impact of the allowance for doubtful accounts in this comprehensive guide. Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services.

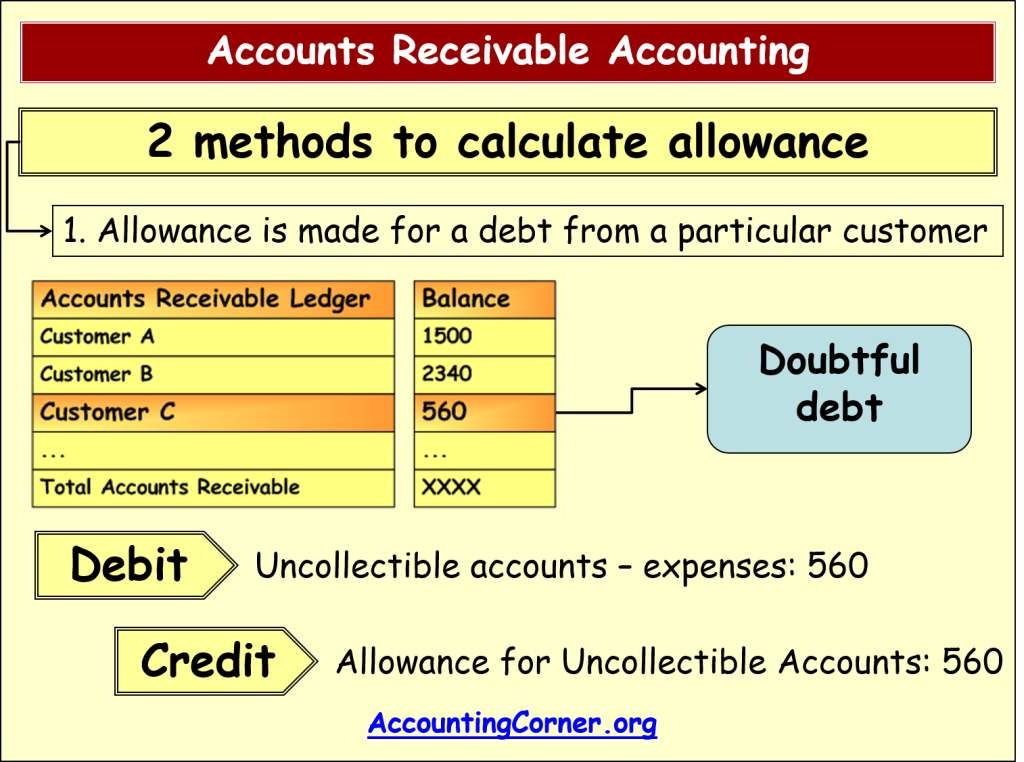

Allowance for Doubtful Accounts Accounting Corner

Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services “on credit” and. What is allowance for doubtful accounts? The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s. Explore the components, estimation methods, and financial impact of the allowance for doubtful accounts in.

Accounts Receivable Journal Entry Example Accountinguide

Explore the components, estimation methods, and financial impact of the allowance for doubtful accounts in this comprehensive guide. What is allowance for doubtful accounts? The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s. Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services.

Classified Balance Sheet Allowance For Doubtful Accounts

What is allowance for doubtful accounts? Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services “on credit” and. The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s. Explore the components, estimation methods, and financial impact of the allowance for doubtful accounts in.

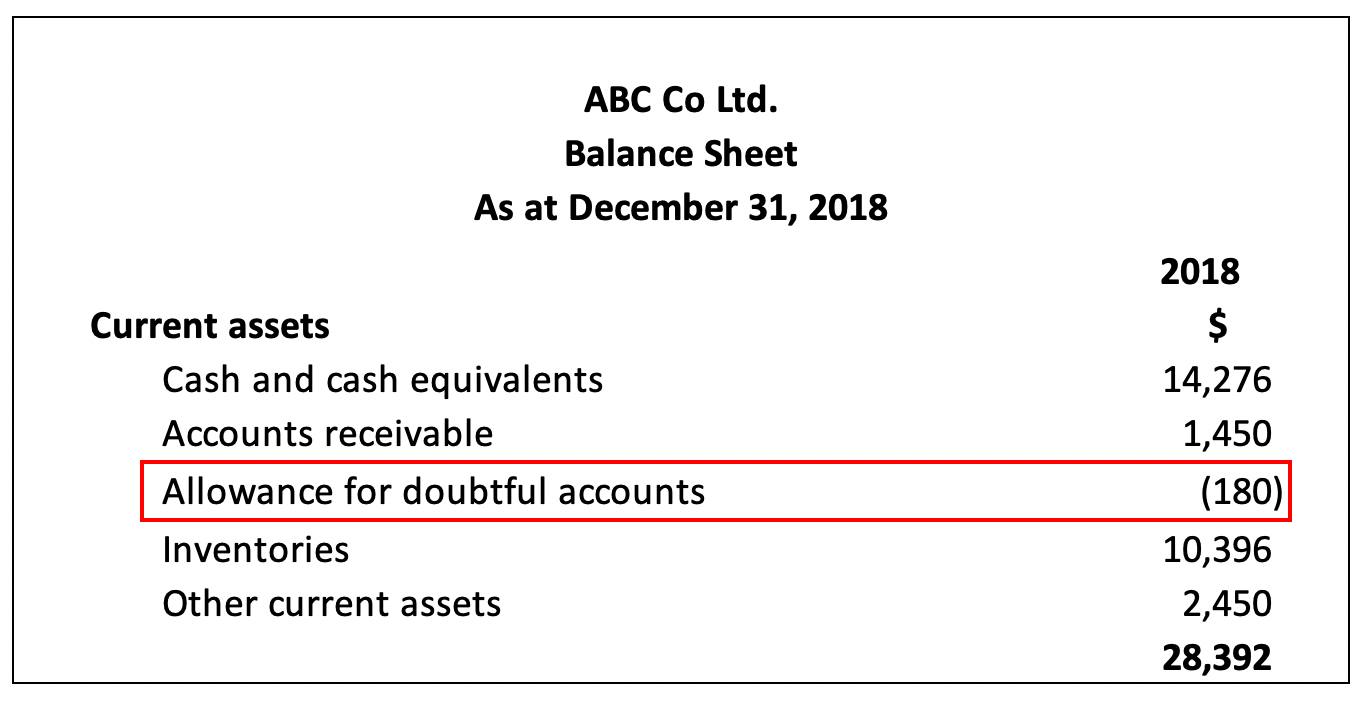

Allowance for Doubtful Debts Balance Sheet SidneyoiRivers

The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s. What is allowance for doubtful accounts? Explore the components, estimation methods, and financial impact of the allowance for doubtful accounts in this comprehensive guide. Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services.

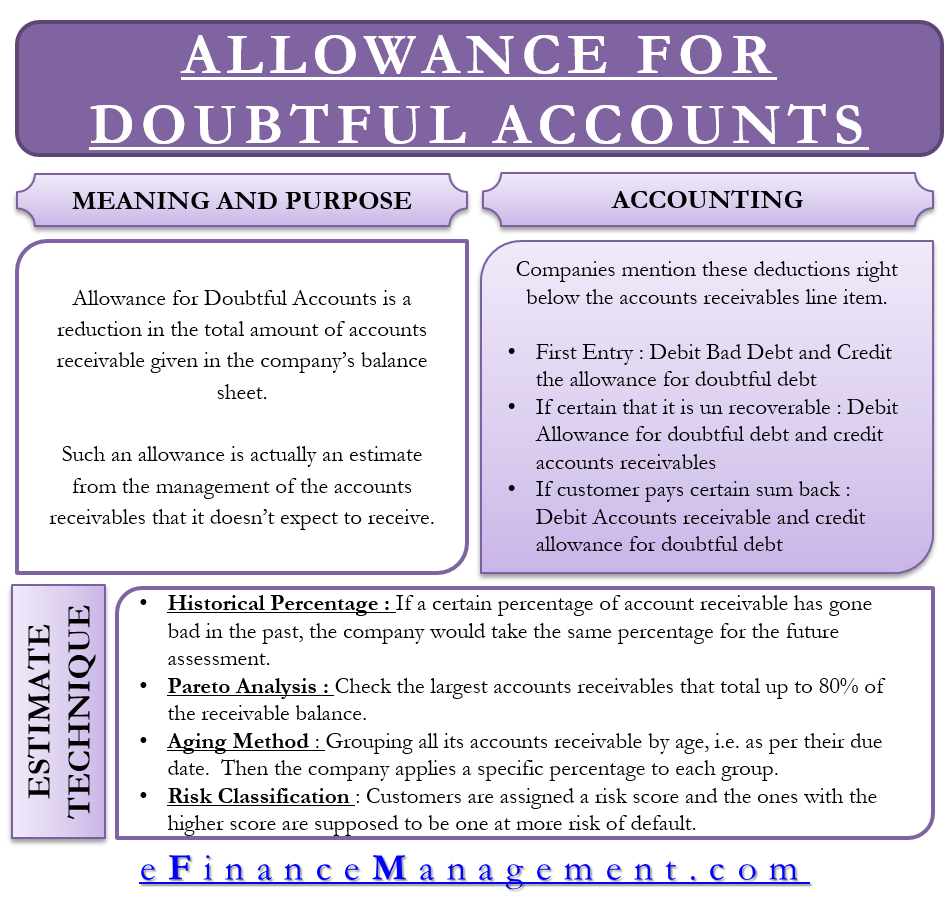

Allowance for Doubtful Accounts Meaning, Accounting, Methods And More

Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services “on credit” and. What is allowance for doubtful accounts? The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s. Explore the components, estimation methods, and financial impact of the allowance for doubtful accounts in.

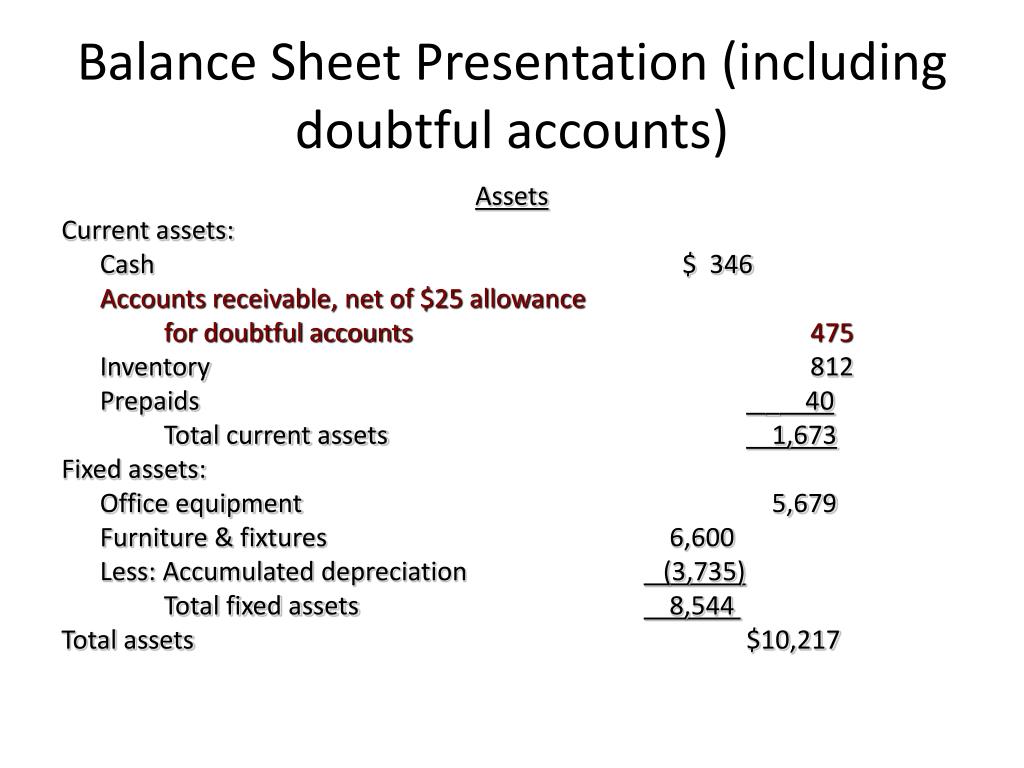

PPT Chapter 8 PowerPoint Presentation, free download ID6814346

The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s. What is allowance for doubtful accounts? Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services “on credit” and. Explore the components, estimation methods, and financial impact of the allowance for doubtful accounts in.

Bad Debt Expense and Allowance for Doubtful Account Accountinguide

Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services “on credit” and. What is allowance for doubtful accounts? Explore the components, estimation methods, and financial impact of the allowance for doubtful accounts in this comprehensive guide. The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing.

The Allowance For Doubtful Accounts Is A Reduction Of The Total Amount Of Accounts Receivable Appearing On A Company’s.

What is allowance for doubtful accounts? Explore the components, estimation methods, and financial impact of the allowance for doubtful accounts in this comprehensive guide. Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services “on credit” and.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)