B Recently Died And Was Insured With A Life Insurance - In this scenario, the insurer is faced with the issue of b having understated his age when applying for the life insurance policy. The consideration clause in a life insurance policy indicates that a policyowner's consideration consists of a completed application and. During the claims process, the family of the deceased or a. In this situation, it is important to look at the impact of the misrepresentation about b's age on the life insurance policy claims. Learn how life insurance policies are managed if the owner passes away before the insured, including ownership transfer,. In this case, b had a life insurance policy for over five years. Study with quizlet and memorize flashcards containing terms like b recently died and was insured with a life insurance policy for over five.

The consideration clause in a life insurance policy indicates that a policyowner's consideration consists of a completed application and. In this situation, it is important to look at the impact of the misrepresentation about b's age on the life insurance policy claims. During the claims process, the family of the deceased or a. In this case, b had a life insurance policy for over five years. In this scenario, the insurer is faced with the issue of b having understated his age when applying for the life insurance policy. Learn how life insurance policies are managed if the owner passes away before the insured, including ownership transfer,. Study with quizlet and memorize flashcards containing terms like b recently died and was insured with a life insurance policy for over five.

Learn how life insurance policies are managed if the owner passes away before the insured, including ownership transfer,. In this situation, it is important to look at the impact of the misrepresentation about b's age on the life insurance policy claims. The consideration clause in a life insurance policy indicates that a policyowner's consideration consists of a completed application and. In this case, b had a life insurance policy for over five years. During the claims process, the family of the deceased or a. In this scenario, the insurer is faced with the issue of b having understated his age when applying for the life insurance policy. Study with quizlet and memorize flashcards containing terms like b recently died and was insured with a life insurance policy for over five.

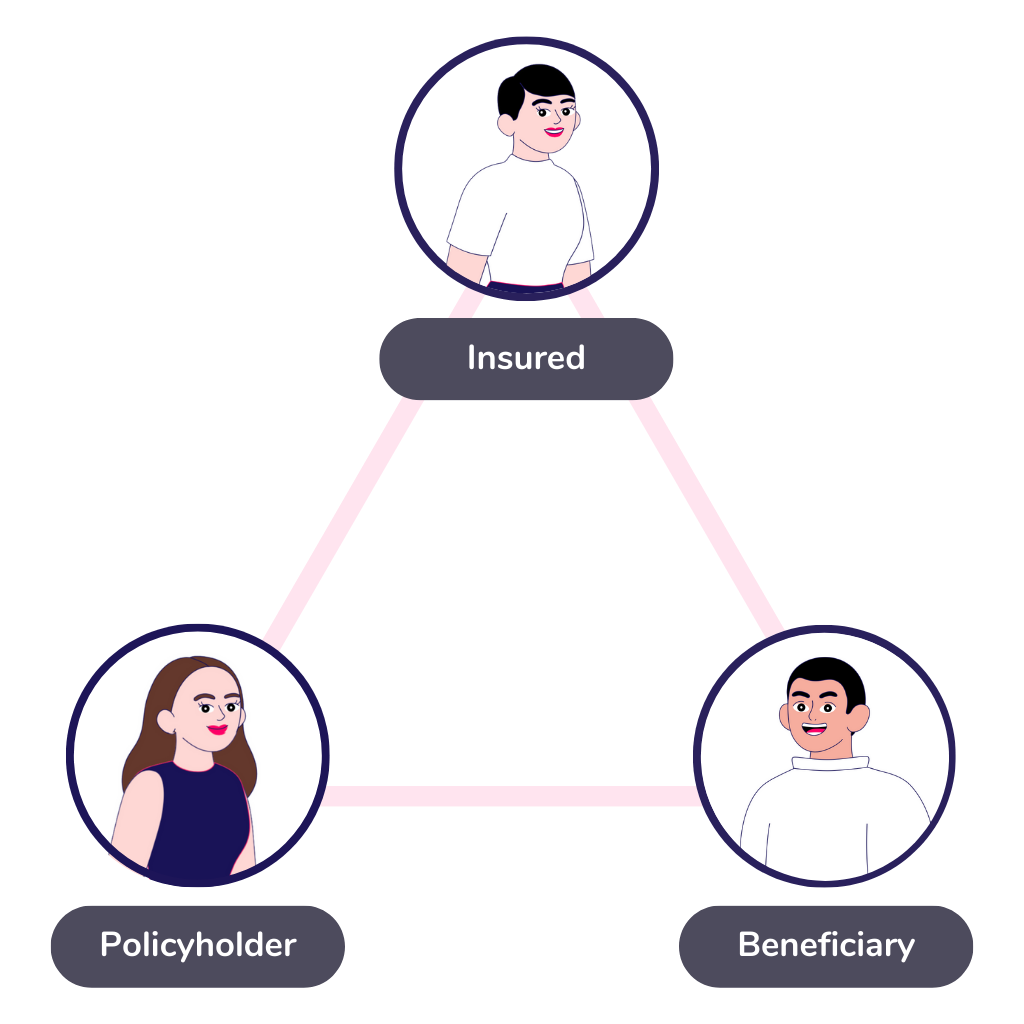

Beneficiary of Life Insurance Bowtie

In this situation, it is important to look at the impact of the misrepresentation about b's age on the life insurance policy claims. In this case, b had a life insurance policy for over five years. In this scenario, the insurer is faced with the issue of b having understated his age when applying for the life insurance policy. During.

How To Use Life Insurance While You're Alive YouTube

In this scenario, the insurer is faced with the issue of b having understated his age when applying for the life insurance policy. In this situation, it is important to look at the impact of the misrepresentation about b's age on the life insurance policy claims. In this case, b had a life insurance policy for over five years. Study.

Accidental Death Benefit and Dismemberment Ad&d Insurance. Stock Image

In this case, b had a life insurance policy for over five years. The consideration clause in a life insurance policy indicates that a policyowner's consideration consists of a completed application and. In this situation, it is important to look at the impact of the misrepresentation about b's age on the life insurance policy claims. Study with quizlet and memorize.

How Can Whole Life Insurance Premiums Remain Level? Bank On Yourself

Study with quizlet and memorize flashcards containing terms like b recently died and was insured with a life insurance policy for over five. Learn how life insurance policies are managed if the owner passes away before the insured, including ownership transfer,. In this scenario, the insurer is faced with the issue of b having understated his age when applying for.

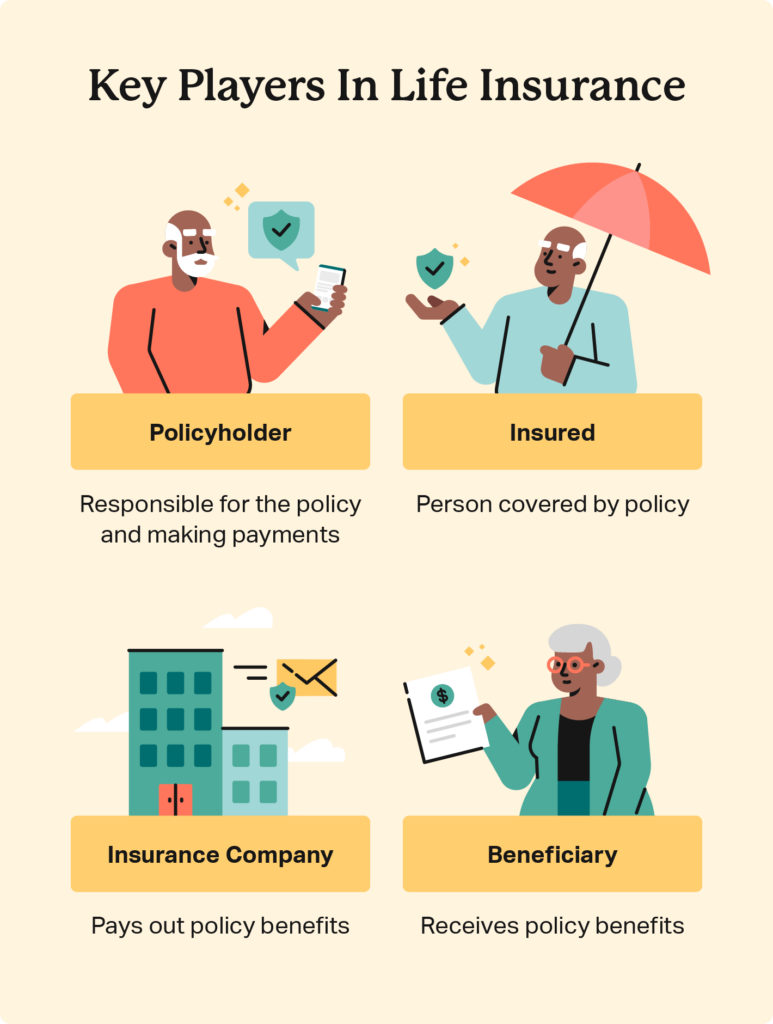

What Is Life Insurance and What Does It Cover?

During the claims process, the family of the deceased or a. In this case, b had a life insurance policy for over five years. The consideration clause in a life insurance policy indicates that a policyowner's consideration consists of a completed application and. In this situation, it is important to look at the impact of the misrepresentation about b's age.

Insurance Terms Beneficiary & Premium Boston Mutual Life Insurance

The consideration clause in a life insurance policy indicates that a policyowner's consideration consists of a completed application and. In this scenario, the insurer is faced with the issue of b having understated his age when applying for the life insurance policy. In this case, b had a life insurance policy for over five years. In this situation, it is.

Life Insurance Tutorial Sophia Learning

The consideration clause in a life insurance policy indicates that a policyowner's consideration consists of a completed application and. Learn how life insurance policies are managed if the owner passes away before the insured, including ownership transfer,. Study with quizlet and memorize flashcards containing terms like b recently died and was insured with a life insurance policy for over five..

Who Gets Life Insurance If Beneficiary is Dead?

In this scenario, the insurer is faced with the issue of b having understated his age when applying for the life insurance policy. In this case, b had a life insurance policy for over five years. The consideration clause in a life insurance policy indicates that a policyowner's consideration consists of a completed application and. Study with quizlet and memorize.

Life Insurance Meaning, Elements, and Types of Life Insurance Policies

The consideration clause in a life insurance policy indicates that a policyowner's consideration consists of a completed application and. Learn how life insurance policies are managed if the owner passes away before the insured, including ownership transfer,. In this case, b had a life insurance policy for over five years. Study with quizlet and memorize flashcards containing terms like b.

Writing Note Showing Life Insurance. Business Photo Showcasing Pays Out

The consideration clause in a life insurance policy indicates that a policyowner's consideration consists of a completed application and. Learn how life insurance policies are managed if the owner passes away before the insured, including ownership transfer,. In this situation, it is important to look at the impact of the misrepresentation about b's age on the life insurance policy claims..

In This Case, B Had A Life Insurance Policy For Over Five Years.

During the claims process, the family of the deceased or a. Study with quizlet and memorize flashcards containing terms like b recently died and was insured with a life insurance policy for over five. Learn how life insurance policies are managed if the owner passes away before the insured, including ownership transfer,. The consideration clause in a life insurance policy indicates that a policyowner's consideration consists of a completed application and.

In This Scenario, The Insurer Is Faced With The Issue Of B Having Understated His Age When Applying For The Life Insurance Policy.

In this situation, it is important to look at the impact of the misrepresentation about b's age on the life insurance policy claims.