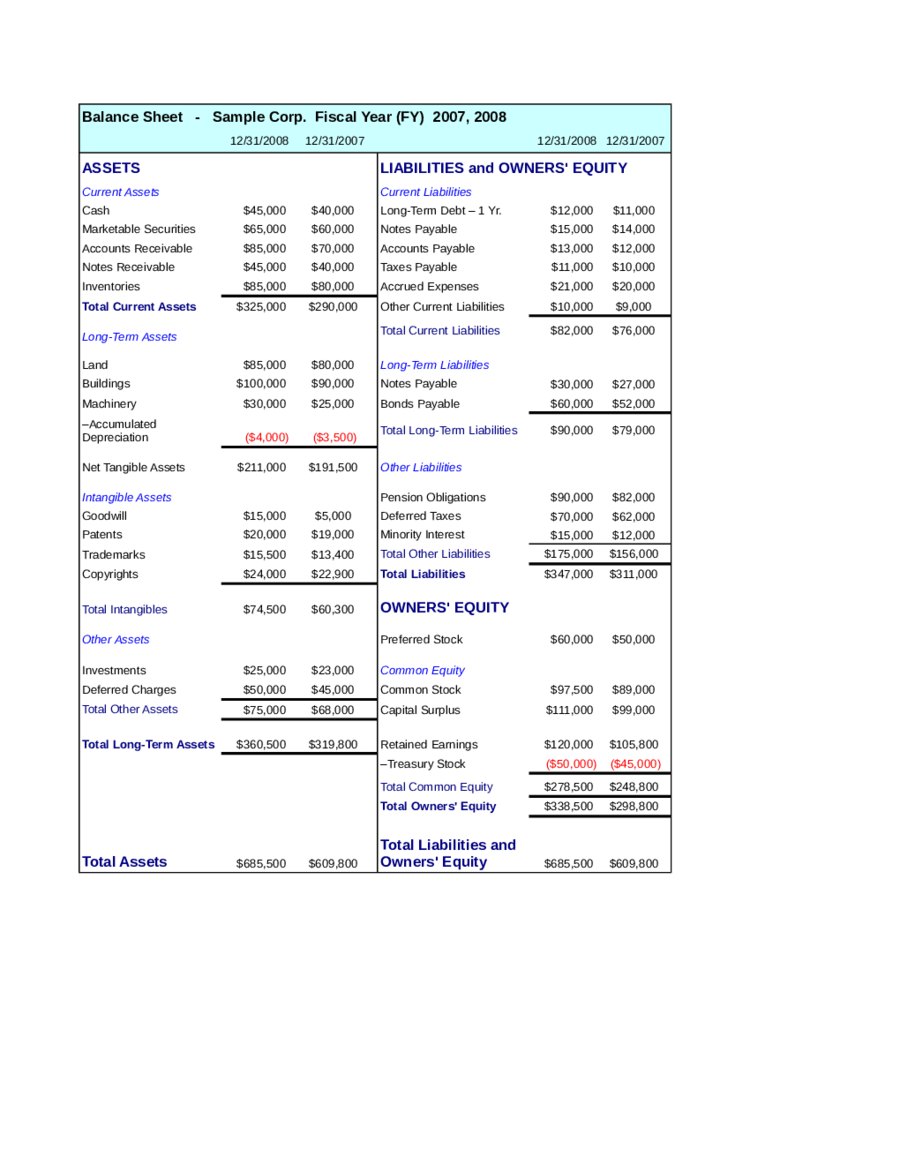

Balance Sheet 2024 - Since the 2024 business year, receivables for income taxes, which were previously included in other receivables and miscellaneous assets, have been reported. In terms of our report. Finance income and expenses/net gains and losses from financial instruments. Standalone statement of profit and lossfor the year ended 31st march, 2024 the accompanying notes 1 to 31 are an integral part of the standalone financial statements.

In terms of our report. Finance income and expenses/net gains and losses from financial instruments. Since the 2024 business year, receivables for income taxes, which were previously included in other receivables and miscellaneous assets, have been reported. Standalone statement of profit and lossfor the year ended 31st march, 2024 the accompanying notes 1 to 31 are an integral part of the standalone financial statements.

Standalone statement of profit and lossfor the year ended 31st march, 2024 the accompanying notes 1 to 31 are an integral part of the standalone financial statements. Finance income and expenses/net gains and losses from financial instruments. Since the 2024 business year, receivables for income taxes, which were previously included in other receivables and miscellaneous assets, have been reported. In terms of our report.

Flexible Spending Account 2024 Carryover Balance Sheet Tiffi Gertrude

Since the 2024 business year, receivables for income taxes, which were previously included in other receivables and miscellaneous assets, have been reported. In terms of our report. Finance income and expenses/net gains and losses from financial instruments. Standalone statement of profit and lossfor the year ended 31st march, 2024 the accompanying notes 1 to 31 are an integral part of.

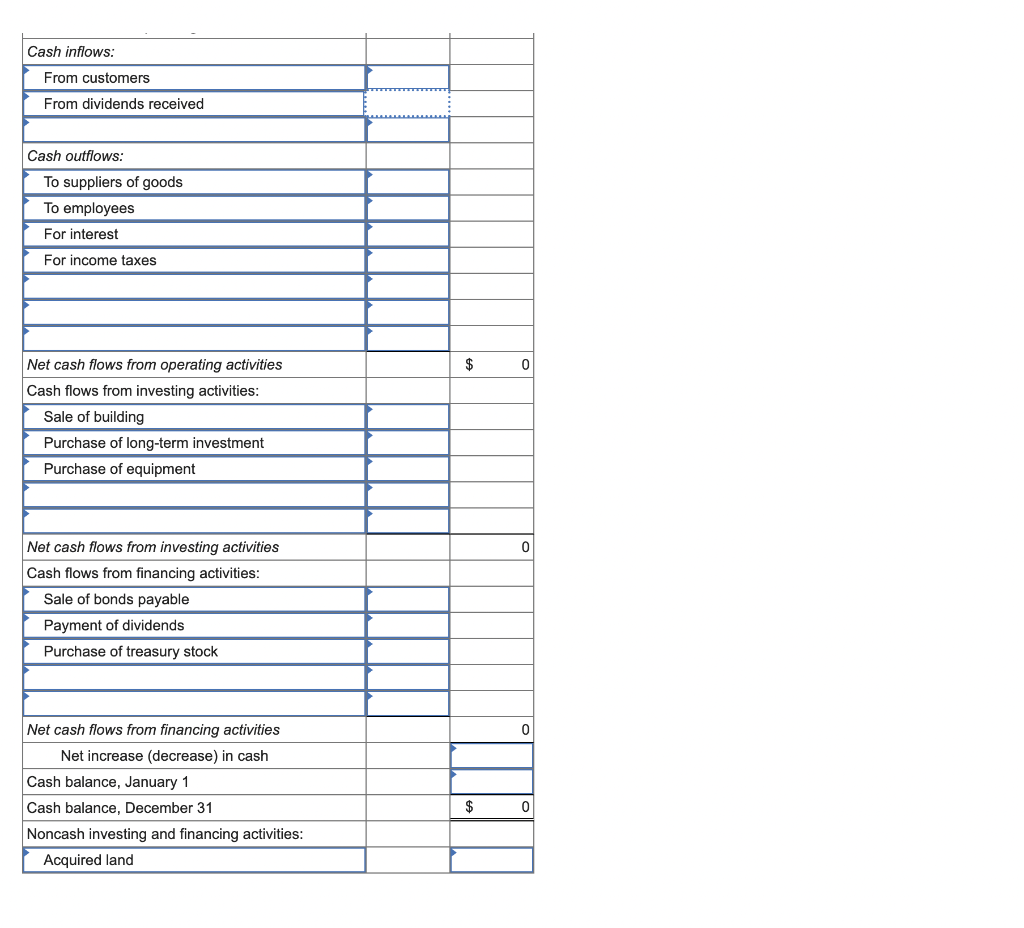

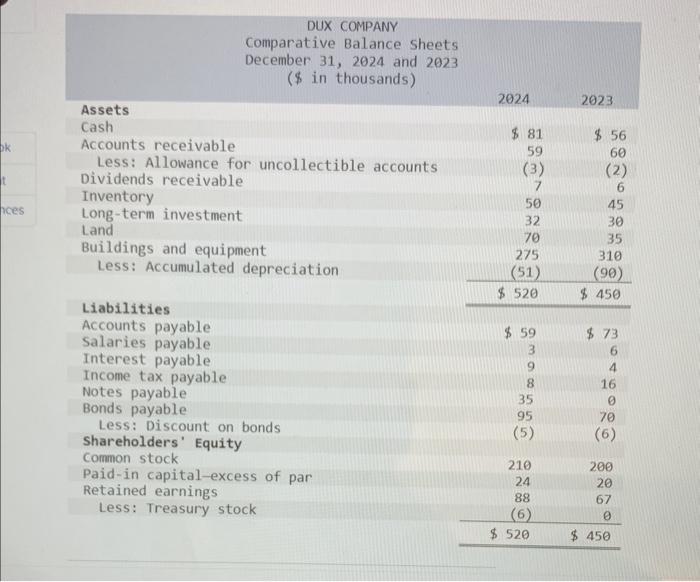

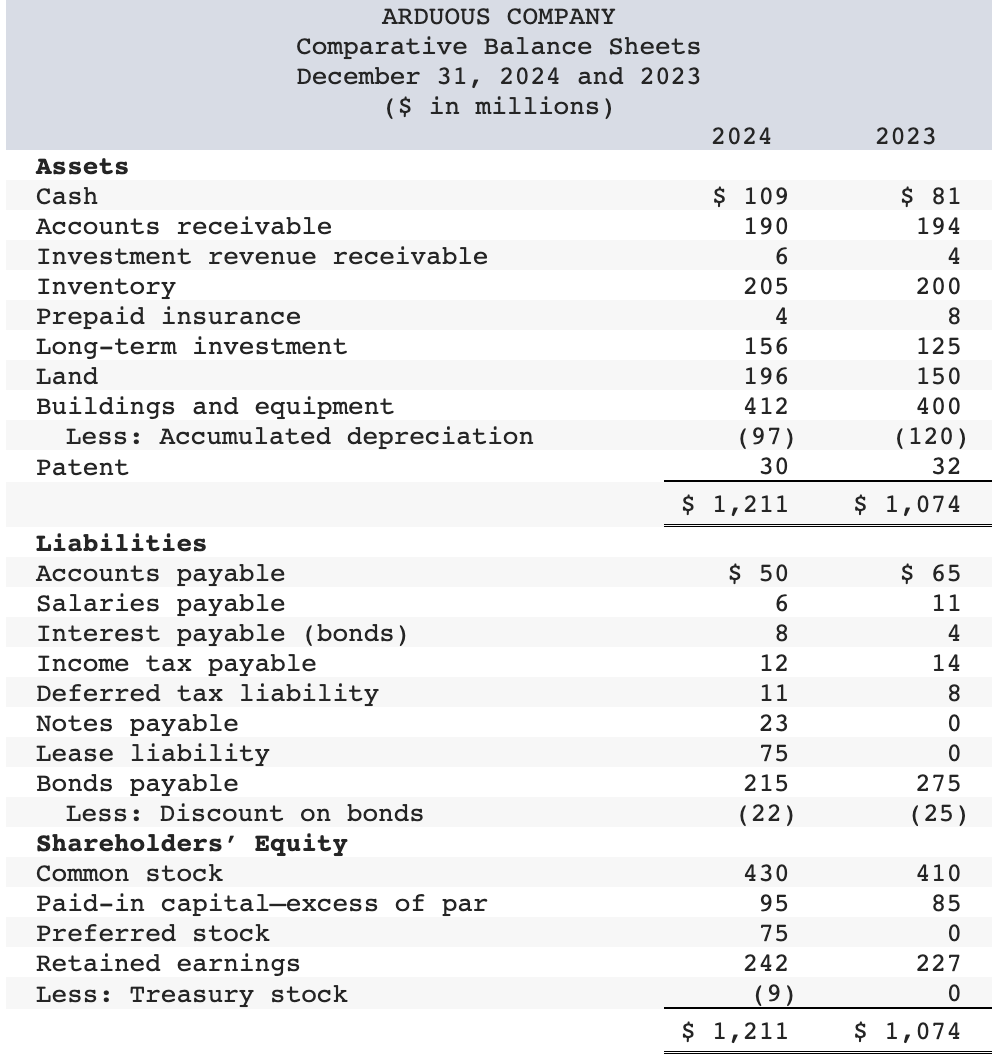

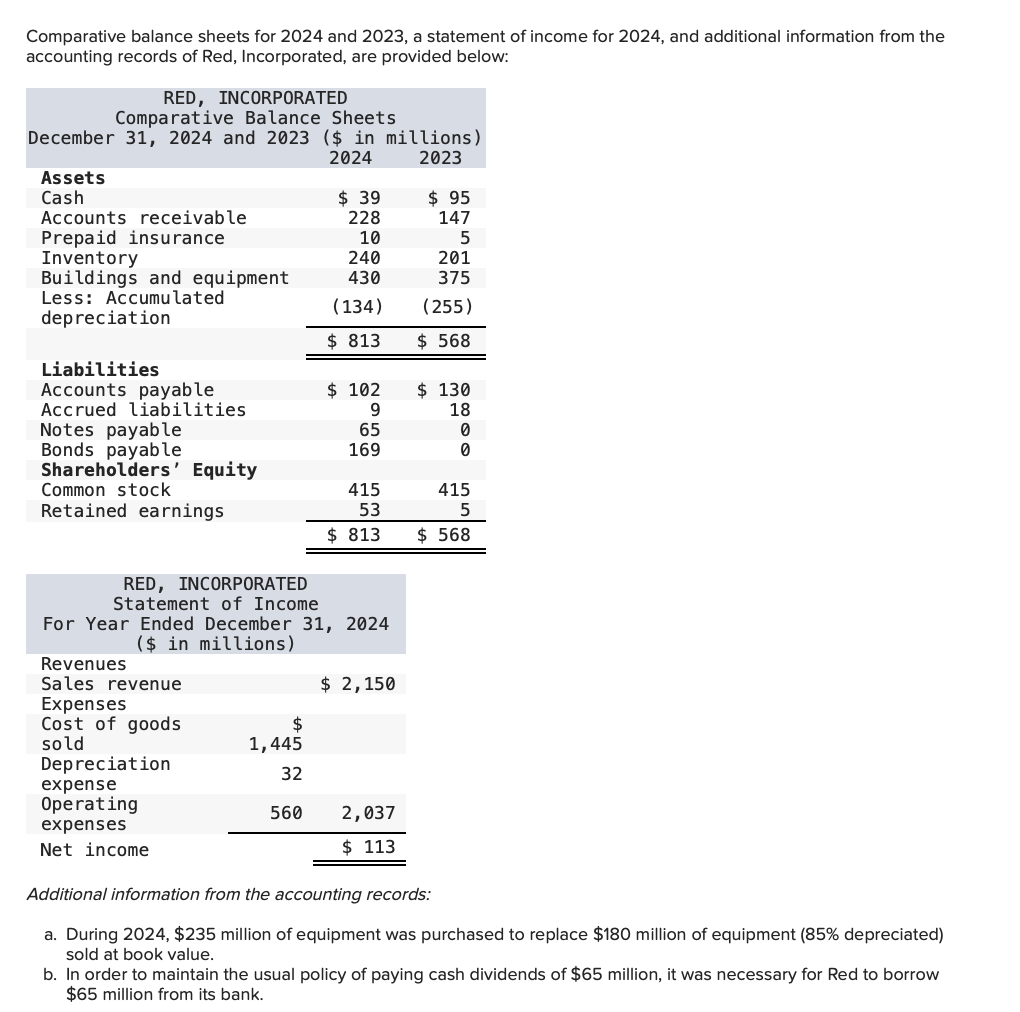

Solved The comparative balance sheets for 2024 and 2023 and

Finance income and expenses/net gains and losses from financial instruments. Standalone statement of profit and lossfor the year ended 31st march, 2024 the accompanying notes 1 to 31 are an integral part of the standalone financial statements. Since the 2024 business year, receivables for income taxes, which were previously included in other receivables and miscellaneous assets, have been reported. In.

Solved The comparative balance sheets for 2024 and 2023 and

Finance income and expenses/net gains and losses from financial instruments. In terms of our report. Since the 2024 business year, receivables for income taxes, which were previously included in other receivables and miscellaneous assets, have been reported. Standalone statement of profit and lossfor the year ended 31st march, 2024 the accompanying notes 1 to 31 are an integral part of.

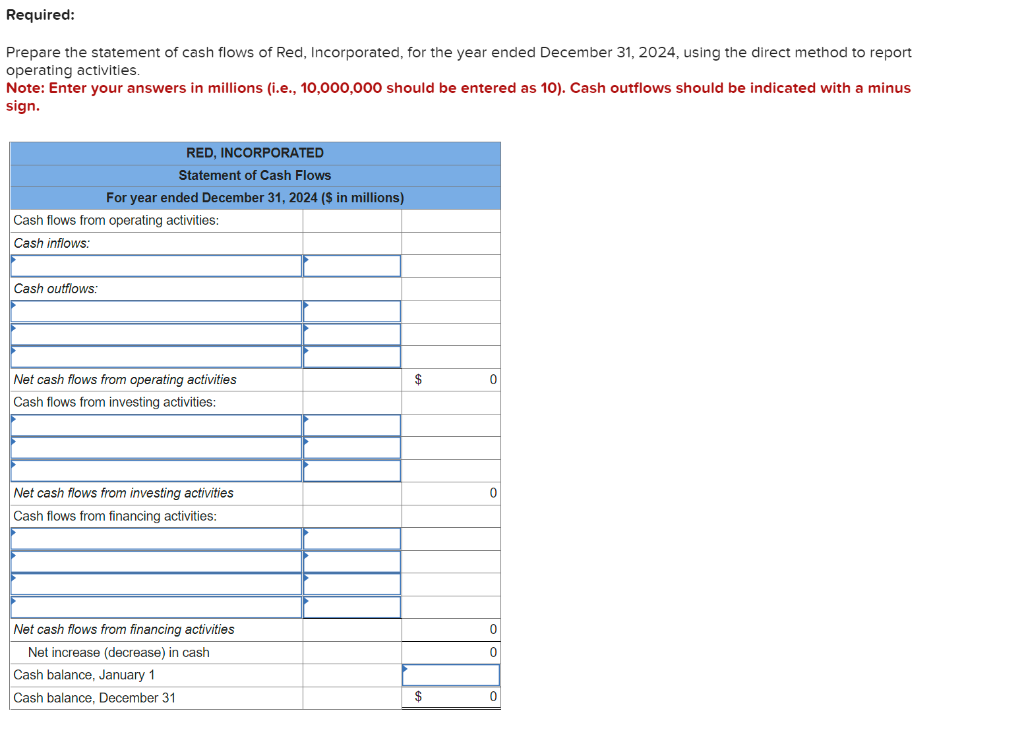

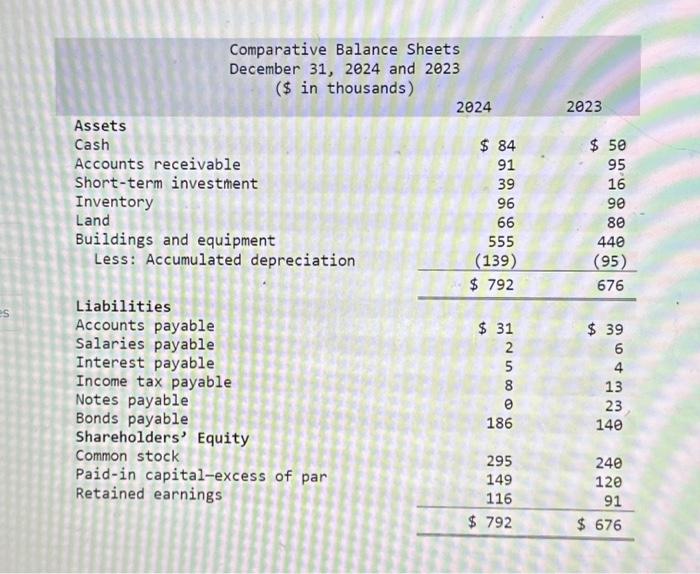

Solved Comparative balance sheets for 2024 and 2023 , a

Standalone statement of profit and lossfor the year ended 31st march, 2024 the accompanying notes 1 to 31 are an integral part of the standalone financial statements. Since the 2024 business year, receivables for income taxes, which were previously included in other receivables and miscellaneous assets, have been reported. In terms of our report. Finance income and expenses/net gains and.

Solved The comparative balance sheets for 2024 and 2023 and

Standalone statement of profit and lossfor the year ended 31st march, 2024 the accompanying notes 1 to 31 are an integral part of the standalone financial statements. Since the 2024 business year, receivables for income taxes, which were previously included in other receivables and miscellaneous assets, have been reported. Finance income and expenses/net gains and losses from financial instruments. In.

. The comparative balance sheets for 2024 and 2023 and the... Course Hero

Standalone statement of profit and lossfor the year ended 31st march, 2024 the accompanying notes 1 to 31 are an integral part of the standalone financial statements. Since the 2024 business year, receivables for income taxes, which were previously included in other receivables and miscellaneous assets, have been reported. Finance income and expenses/net gains and losses from financial instruments. In.

2024 Accounting Matti Shelley

In terms of our report. Standalone statement of profit and lossfor the year ended 31st march, 2024 the accompanying notes 1 to 31 are an integral part of the standalone financial statements. Finance income and expenses/net gains and losses from financial instruments. Since the 2024 business year, receivables for income taxes, which were previously included in other receivables and miscellaneous.

Sale Of Balance 2024 Pdf Caye Maxine

Since the 2024 business year, receivables for income taxes, which were previously included in other receivables and miscellaneous assets, have been reported. In terms of our report. Standalone statement of profit and lossfor the year ended 31st march, 2024 the accompanying notes 1 to 31 are an integral part of the standalone financial statements. Finance income and expenses/net gains and.

Solved The comparative balance sheets for 2024 and 2023 and

In terms of our report. Since the 2024 business year, receivables for income taxes, which were previously included in other receivables and miscellaneous assets, have been reported. Standalone statement of profit and lossfor the year ended 31st march, 2024 the accompanying notes 1 to 31 are an integral part of the standalone financial statements. Finance income and expenses/net gains and.

Solved Comparative balance sheets for 2024 and 2023 , a

In terms of our report. Finance income and expenses/net gains and losses from financial instruments. Standalone statement of profit and lossfor the year ended 31st march, 2024 the accompanying notes 1 to 31 are an integral part of the standalone financial statements. Since the 2024 business year, receivables for income taxes, which were previously included in other receivables and miscellaneous.

Standalone Statement Of Profit And Lossfor The Year Ended 31St March, 2024 The Accompanying Notes 1 To 31 Are An Integral Part Of The Standalone Financial Statements.

In terms of our report. Since the 2024 business year, receivables for income taxes, which were previously included in other receivables and miscellaneous assets, have been reported. Finance income and expenses/net gains and losses from financial instruments.

:max_bytes(150000):strip_icc()/Clipboard01-c7616f51a8aa4207b2ca85aa29748e4c.jpg)