Balance Sheet Adjustments - Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company. Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and depreciation on fixed assets; Accounting for items mentioned in the trial balance will be. Explain adjustment entries relating to above. The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control. A reasonable way to begin the process is by reviewing the amount. Before we start seeing all the adjustments one by one, some matters must be considered at the time of adjustment:

The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control. Explain adjustment entries relating to above. A reasonable way to begin the process is by reviewing the amount. Before we start seeing all the adjustments one by one, some matters must be considered at the time of adjustment: Accounting for items mentioned in the trial balance will be. Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company. Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and depreciation on fixed assets;

The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control. Explain adjustment entries relating to above. Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and depreciation on fixed assets; Before we start seeing all the adjustments one by one, some matters must be considered at the time of adjustment: Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company. Accounting for items mentioned in the trial balance will be. A reasonable way to begin the process is by reviewing the amount.

What is the Adjusted Trial Balance and How is it Created? YouTube

Accounting for items mentioned in the trial balance will be. The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control. Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and.

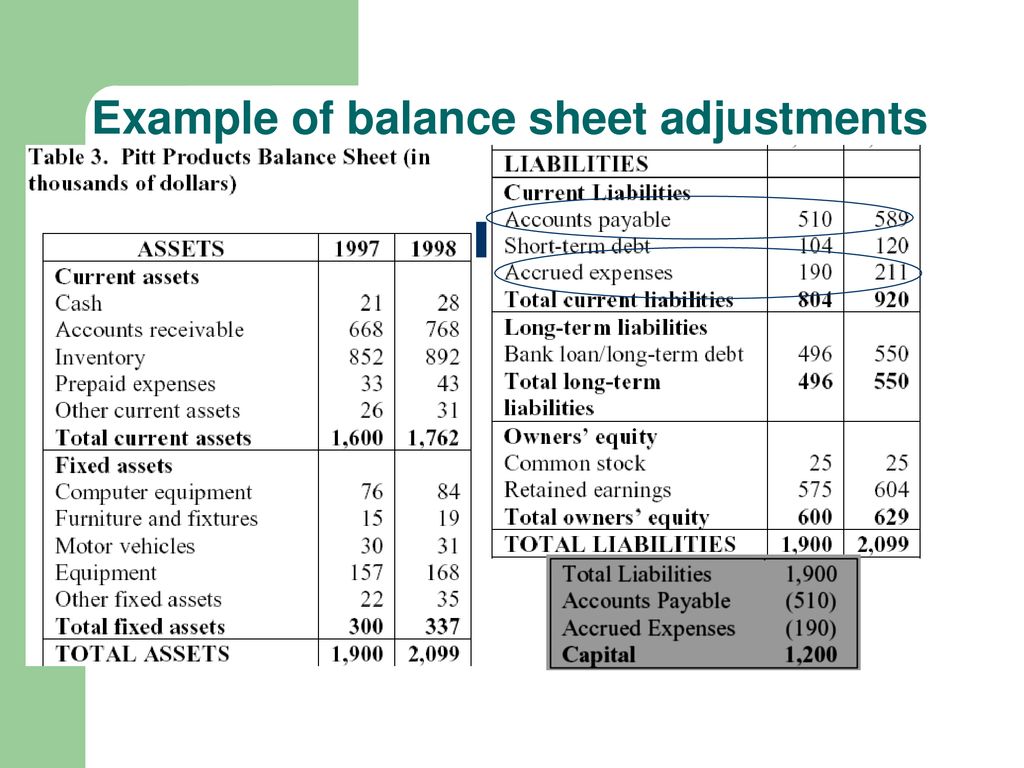

Economic Value Added Small Manufacturer Example from Roztocki et al

Before we start seeing all the adjustments one by one, some matters must be considered at the time of adjustment: The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control. Balance sheet adjustments refer to the process of changing entries on a.

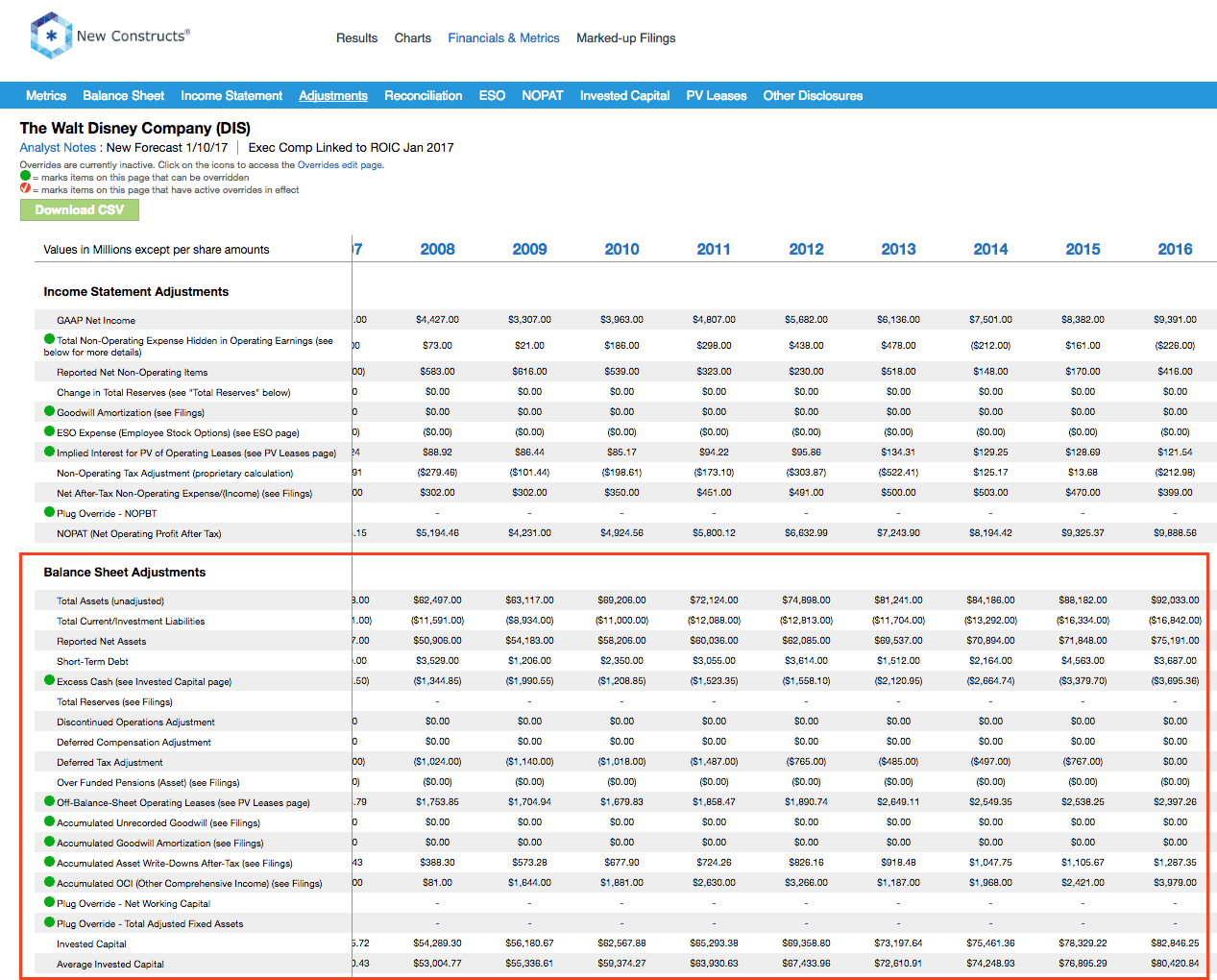

Profit Growth Consistent At Disney

Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company. Explain adjustment entries relating to above. Accounting for items mentioned in the trial balance will be. Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and depreciation on.

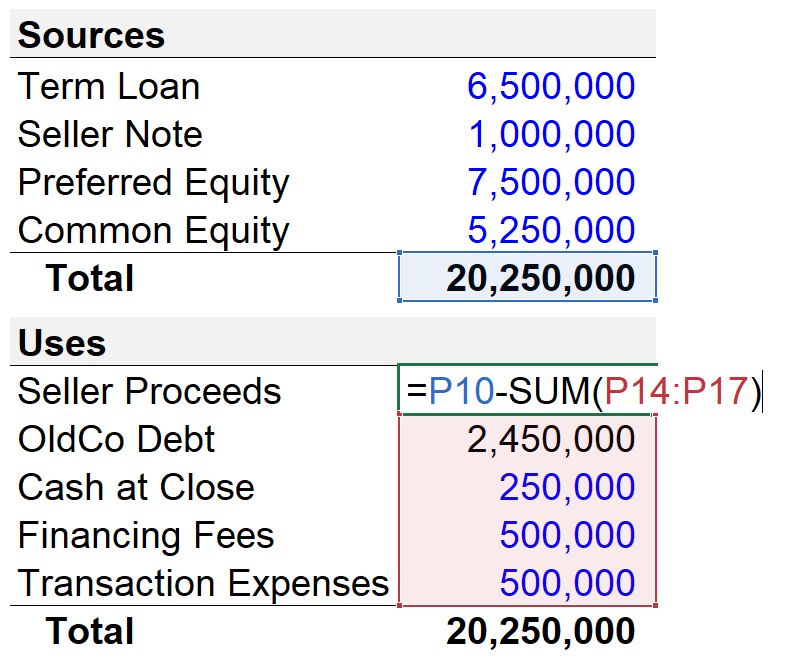

LBO Pro Forma Balance Sheet Adjustments A Simple Model

Accounting for items mentioned in the trial balance will be. Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company. The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that.

LBO Pro Forma Balance Sheet Adjustments A Simple Model

A reasonable way to begin the process is by reviewing the amount. Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company. Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and depreciation on fixed assets; The purpose.

BALANCE SHEET ADJUSTMENTS GRADE 11 ACCOUNTING MODULE 6

The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control. Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and depreciation on fixed assets; Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to.

LBO Pro Forma Balance Sheet Adjustments A Simple Model

A reasonable way to begin the process is by reviewing the amount. Explain adjustment entries relating to above. Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and depreciation on fixed assets; Before we start seeing all the adjustments one by one, some matters must be considered at the time of adjustment: Balance sheet adjustments refer to the.

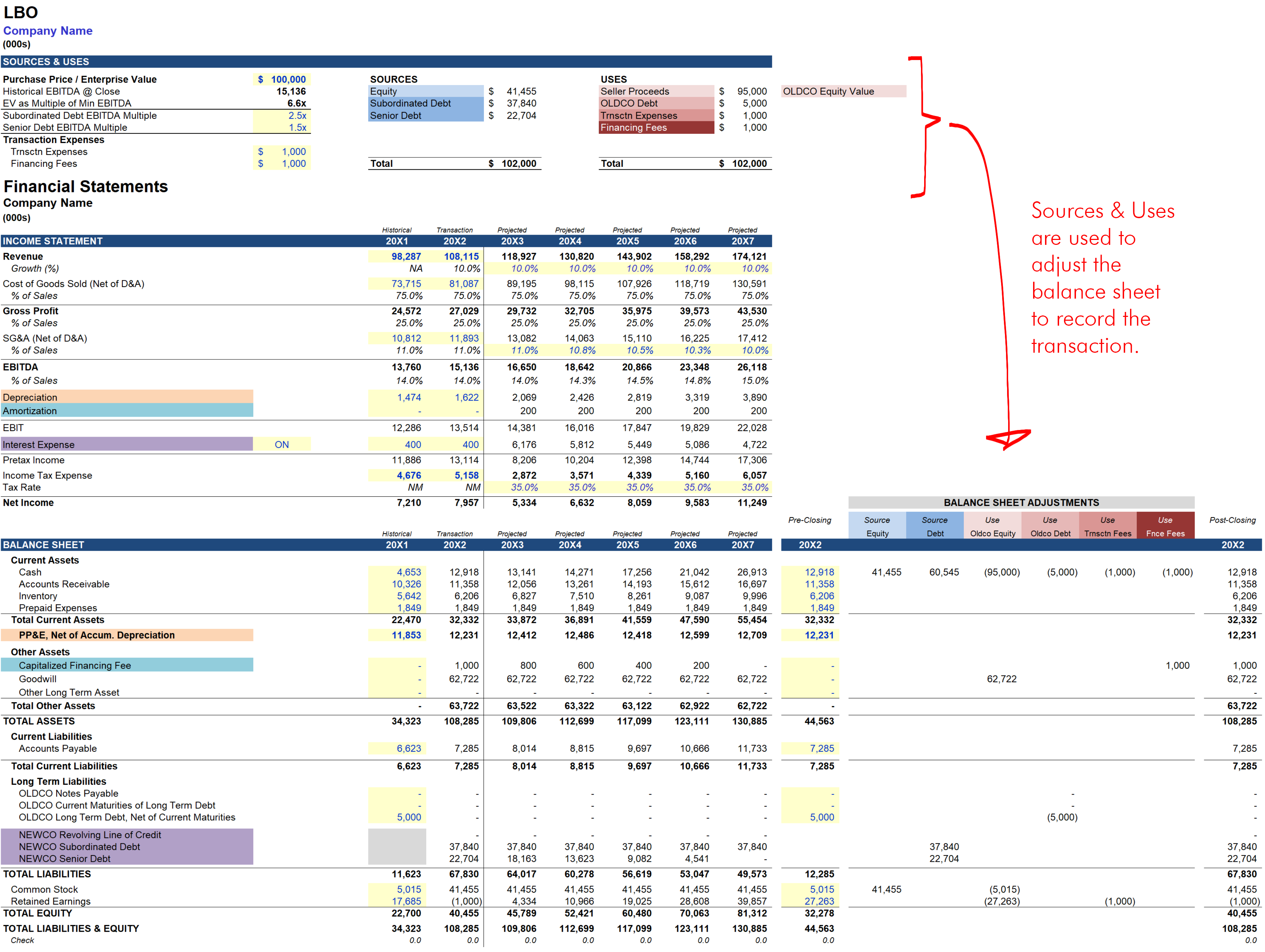

Leveraged Buyout Model A Simple Model

The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control. Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company. Before we.

Taking into account the following adjustments prep and balance sheet as

The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control. Explain adjustment entries relating to above. Before we start seeing all the adjustments one by one, some matters must be considered at the time of adjustment: Understand the adjustments relating to closing.

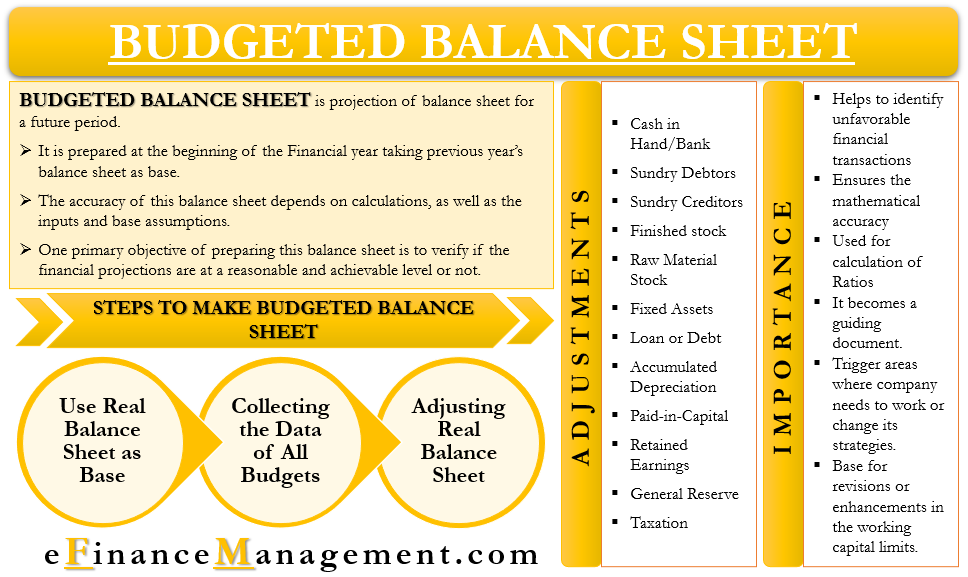

Budgeted Balance Sheet Importance, Steps, Adjustments and More

Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and depreciation on fixed assets; The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control. Before we start seeing all the adjustments one by one, some matters must be considered at.

Explain Adjustment Entries Relating To Above.

A reasonable way to begin the process is by reviewing the amount. Accounting for items mentioned in the trial balance will be. Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and depreciation on fixed assets; Before we start seeing all the adjustments one by one, some matters must be considered at the time of adjustment:

The Purpose Of This Post Is To Translate The Language Surrounding Purchase Accounting Into A Financial Template With Instructions That Cover The Balance Sheet Adjustments For Most Control.

Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company.