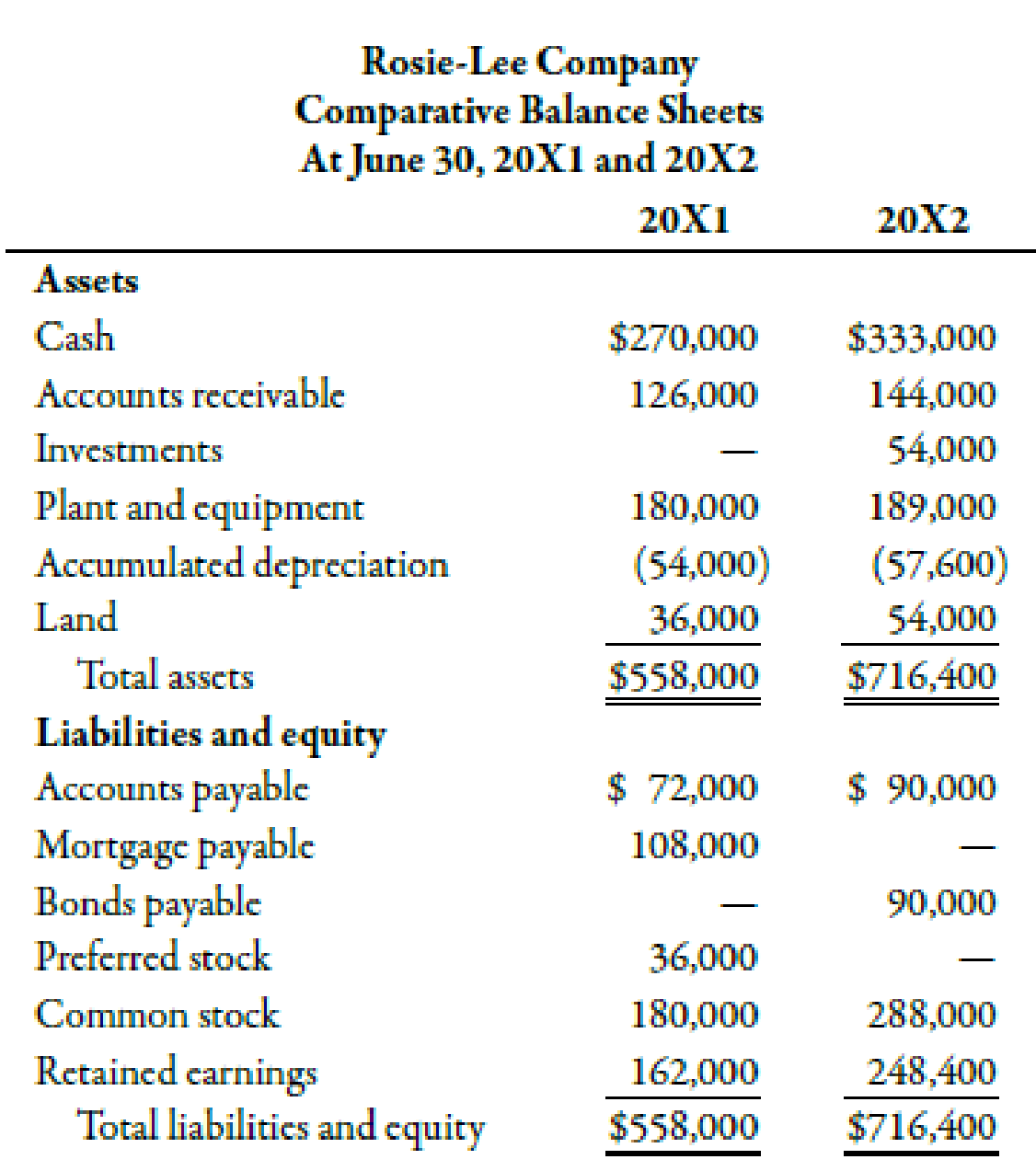

Balance Sheet Depreciation - On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life.

Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its.

Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its.

Depreciation

Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes.

What Is Accumulated Depreciation Equipment On A Balance Sheet at Idell

On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life.

Why is accumulated depreciation a credit balance?

Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life.

How is accumulated depreciation on a balance sheet? Leia aqui Is

Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its.

Accumulated Depreciation

Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes.

Fixed Asset Depreciation Excel Spreadsheet for 013 Accounting Balance

On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life.

Balance Sheet Example With Depreciation

On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes.

How do you account for depreciation on a balance sheet? Leia aqui Is

Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its.

Accumulated Depreciation Definition and Examples

Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its.

Balance Sheet Example With Depreciation

On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life.

Depreciation Is A Systematic Procedure For Allocating The Acquisition Cost Of A Capital Asset Over Its Useful Life.

Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)