Balance Sheet Example Accounting - Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting. In short, the balance sheet is a financial statement that. The balance sheet (also known as the statement of financial position) reports a corporation’s assets, liabilities, and stockholders’ equity as of the final moment of an accounting period. The balance sheet displays the company’s total assets and how. The balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities, and owner’s equity of a business at a particular. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle.

In short, the balance sheet is a financial statement that. The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting. The balance sheet displays the company’s total assets and how. The balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities, and owner’s equity of a business at a particular. The balance sheet (also known as the statement of financial position) reports a corporation’s assets, liabilities, and stockholders’ equity as of the final moment of an accounting period. Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle.

The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. The balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities, and owner’s equity of a business at a particular. The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting. The balance sheet (also known as the statement of financial position) reports a corporation’s assets, liabilities, and stockholders’ equity as of the final moment of an accounting period. In short, the balance sheet is a financial statement that. The balance sheet displays the company’s total assets and how. Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure.

What Is a Financial Statement? Detailed Overview of Main Statements

The balance sheet displays the company’s total assets and how. In short, the balance sheet is a financial statement that. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. The balance sheet (also known as the statement of financial position) reports a corporation’s assets, liabilities, and stockholders’.

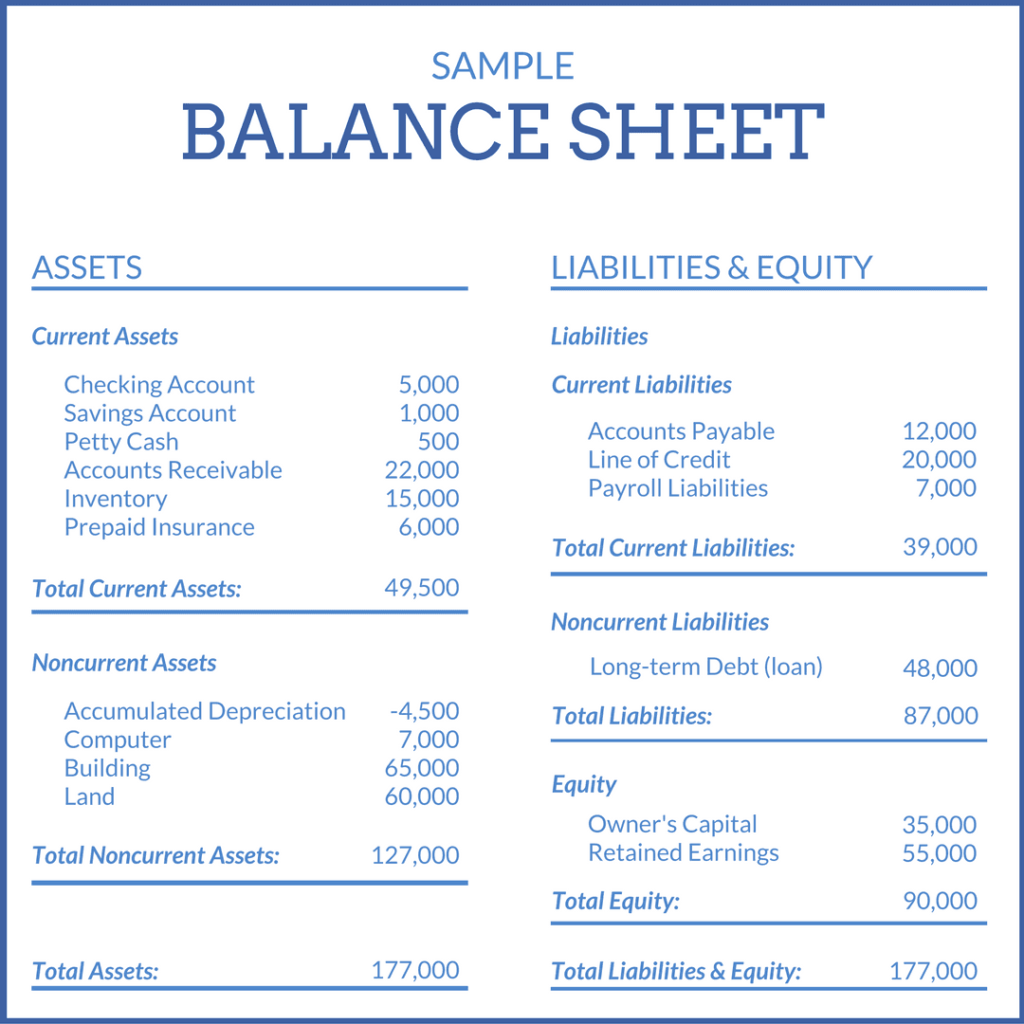

Balance Sheet Format, Example & Free Template Basic Accounting Help

Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. In short, the balance sheet is a financial statement that. The balance sheet displays the company’s total assets and how. The balance sheet (also known as the statement of financial position) reports a corporation’s assets, liabilities, and stockholders’ equity as of the.

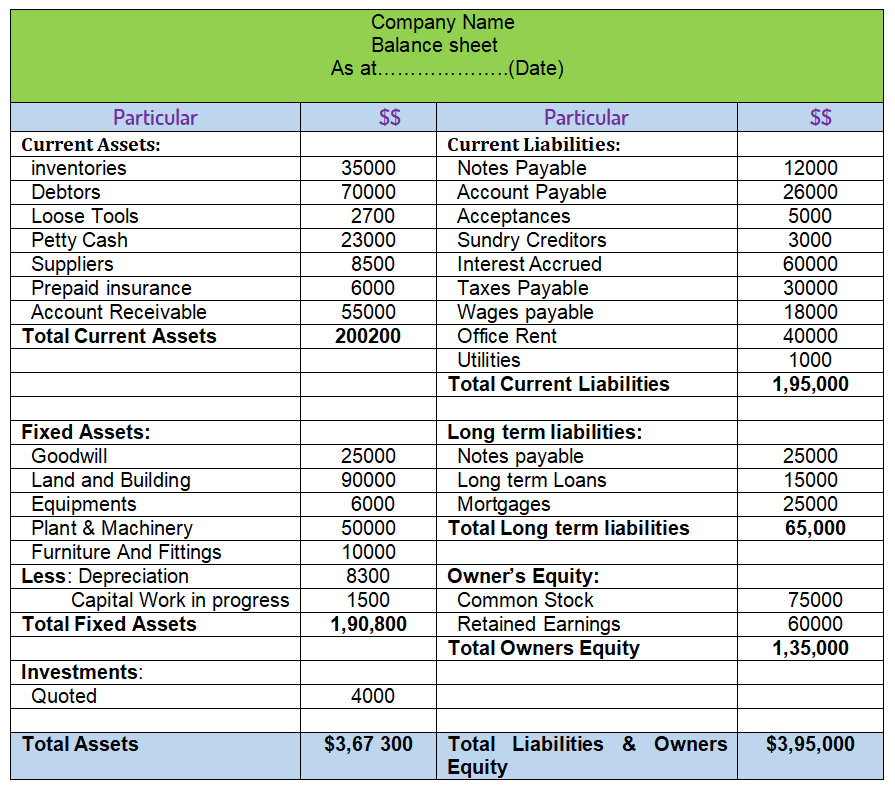

Balance Sheet Format Explained (With Examples) Googlesir

The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting. Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle..

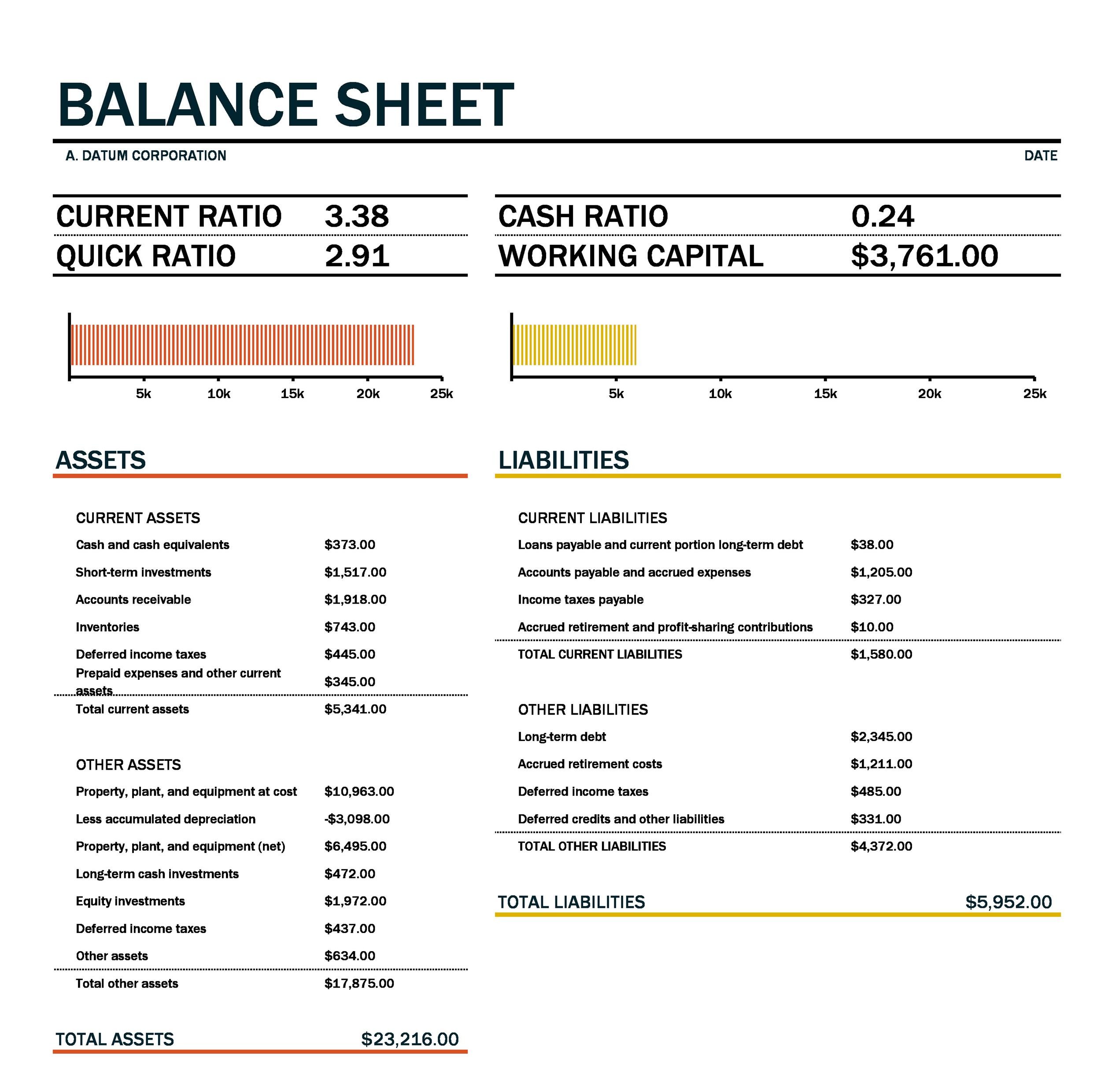

Mastering The Basic Balance Sheet Template A Guide For Financial

The balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities, and owner’s equity of a business at a particular. In short, the balance sheet is a financial statement that. The balance sheet displays the company’s total assets and how. The balance sheet is one of the three fundamental financial statements.

Balance Sheet Example Template Format Analysis Explanation

In short, the balance sheet is a financial statement that. The balance sheet displays the company’s total assets and how. The balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities, and owner’s equity of a business at a particular. Balance sheets provide the basis for computing rates of return for.

balancesheetexample

In short, the balance sheet is a financial statement that. The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting. The balance sheet (also known as the statement of financial position) reports a corporation’s assets, liabilities, and stockholders’ equity as of the final moment of an accounting period. The balance.

How to Read & Prepare a Balance Sheet QuickBooks

The balance sheet (also known as the statement of financial position) reports a corporation’s assets, liabilities, and stockholders’ equity as of the final moment of an accounting period. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. Balance sheets provide the basis for computing rates of return.

Balance Sheet InDepth Explanation with Examples AccountingCoach

In short, the balance sheet is a financial statement that. The balance sheet (also known as the statement of financial position) reports a corporation’s assets, liabilities, and stockholders’ equity as of the final moment of an accounting period. The balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities, and owner’s.

Balance sheet example track assets and liabilities

The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. In short, the balance sheet is a financial statement that. The balance sheet displays the company’s total assets and how. The balance sheet (also known as the statement of financial position) is a financial statement that shows the.

38 Free Balance Sheet Templates & Examples Template Lab

In short, the balance sheet is a financial statement that. Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. The balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities, and owner’s equity of a business at a particular. The balance sheet.

The Balance Sheet Is One Of The Three Fundamental Financial Statements And Is Key To Both Financial Modeling And Accounting.

In short, the balance sheet is a financial statement that. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. The balance sheet displays the company’s total assets and how. The balance sheet (also known as the statement of financial position) reports a corporation’s assets, liabilities, and stockholders’ equity as of the final moment of an accounting period.

The Balance Sheet (Also Known As The Statement Of Financial Position) Is A Financial Statement That Shows The Assets, Liabilities, And Owner’s Equity Of A Business At A Particular.

Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure.