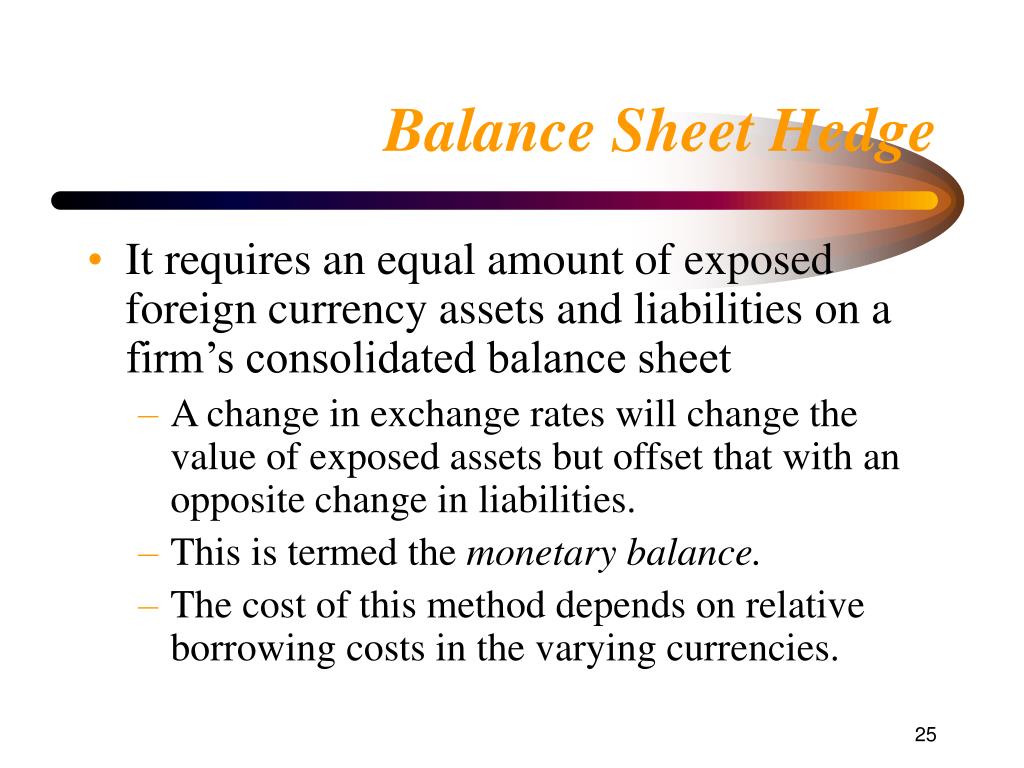

Balance Sheet Hedge - Balance sheet hedges document and translate foreign assets into u.s. Currency hedging can mitigate the risks created by fx market volatility, including reducing earnings volatility and protecting the value of. Understand the key components of a hedge fund balance sheet, including asset composition, liabilities, and valuation methods. Balance sheet hedging mitigates foreign currency gains and losses caused by the difference in currency rates. Dollars as protection against currency fluctuations,. In this blog post, we will explore the common approaches to balance sheet hedging, identify their weaknesses, and provide insights.

Understand the key components of a hedge fund balance sheet, including asset composition, liabilities, and valuation methods. Balance sheet hedging mitigates foreign currency gains and losses caused by the difference in currency rates. Currency hedging can mitigate the risks created by fx market volatility, including reducing earnings volatility and protecting the value of. Dollars as protection against currency fluctuations,. In this blog post, we will explore the common approaches to balance sheet hedging, identify their weaknesses, and provide insights. Balance sheet hedges document and translate foreign assets into u.s.

Understand the key components of a hedge fund balance sheet, including asset composition, liabilities, and valuation methods. Currency hedging can mitigate the risks created by fx market volatility, including reducing earnings volatility and protecting the value of. Dollars as protection against currency fluctuations,. Balance sheet hedges document and translate foreign assets into u.s. In this blog post, we will explore the common approaches to balance sheet hedging, identify their weaknesses, and provide insights. Balance sheet hedging mitigates foreign currency gains and losses caused by the difference in currency rates.

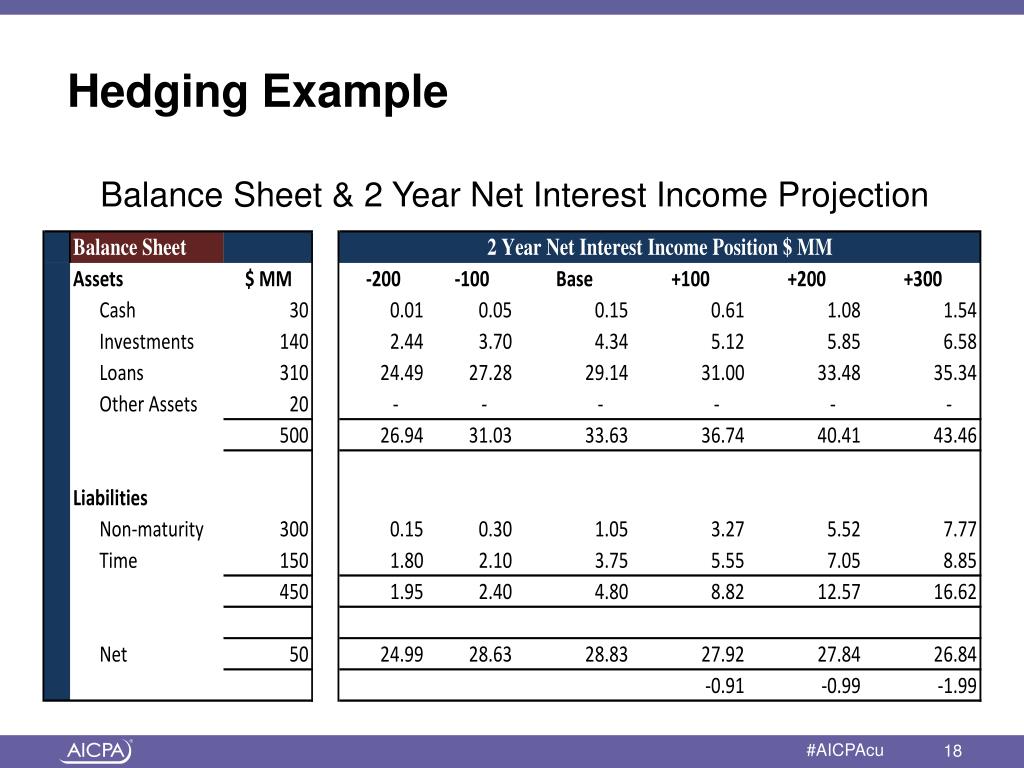

Balance Sheet for Cash Flow Hedge Example PayFixed/ReceiveLIBOR Swap

Balance sheet hedging mitigates foreign currency gains and losses caused by the difference in currency rates. In this blog post, we will explore the common approaches to balance sheet hedging, identify their weaknesses, and provide insights. Balance sheet hedges document and translate foreign assets into u.s. Understand the key components of a hedge fund balance sheet, including asset composition, liabilities,.

What Is A Balance Sheet Hedge at Yi Voss blog

Dollars as protection against currency fluctuations,. Currency hedging can mitigate the risks created by fx market volatility, including reducing earnings volatility and protecting the value of. Understand the key components of a hedge fund balance sheet, including asset composition, liabilities, and valuation methods. In this blog post, we will explore the common approaches to balance sheet hedging, identify their weaknesses,.

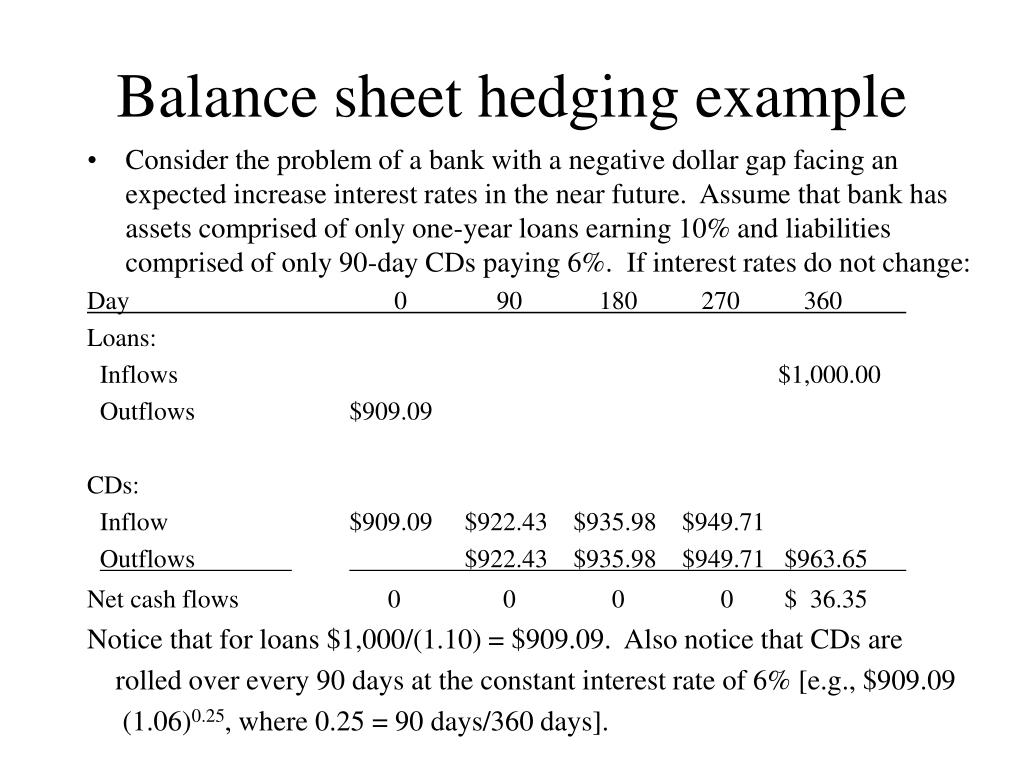

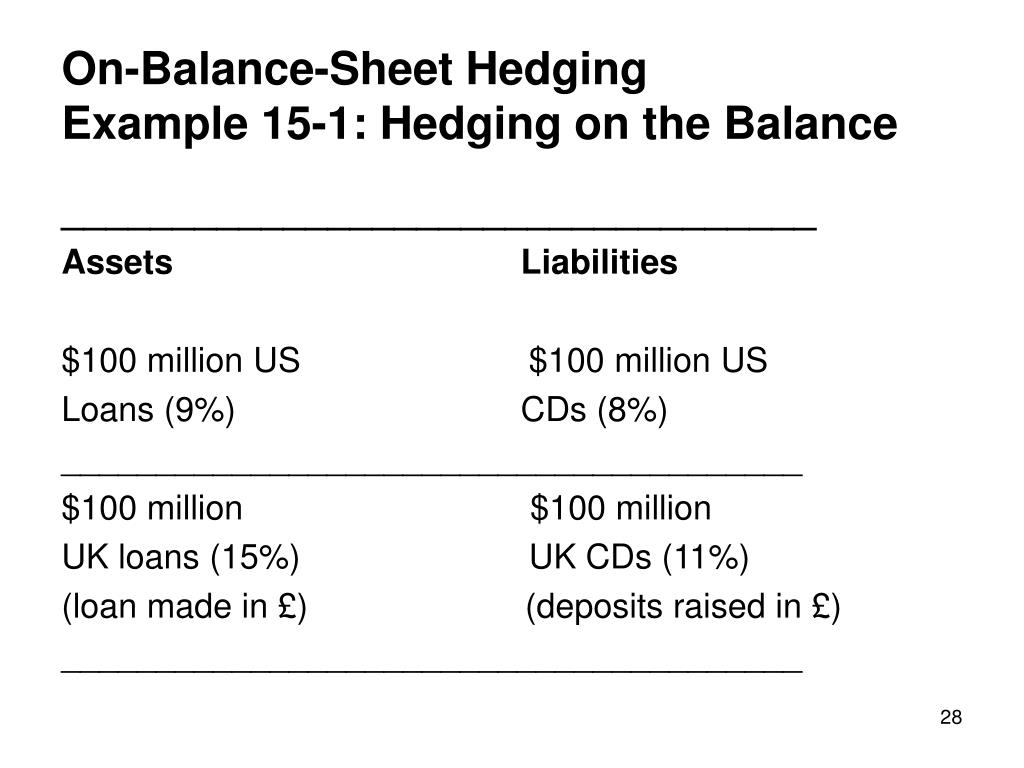

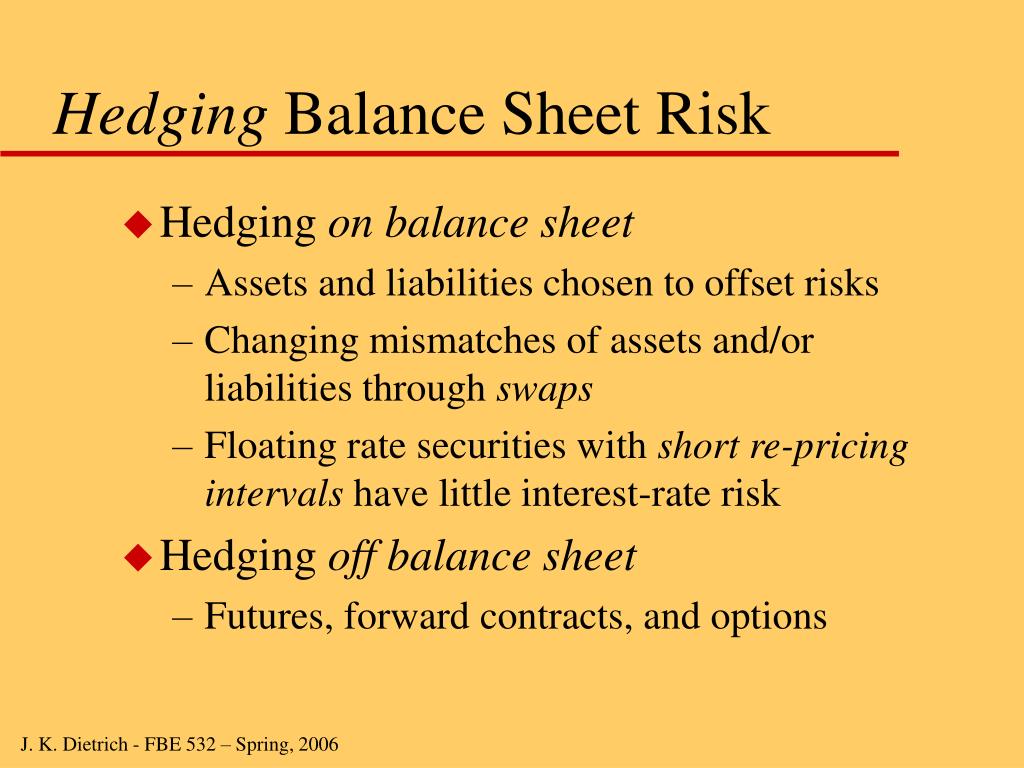

PPT Techniques of asset/liability management Futures, options, and

Currency hedging can mitigate the risks created by fx market volatility, including reducing earnings volatility and protecting the value of. Dollars as protection against currency fluctuations,. In this blog post, we will explore the common approaches to balance sheet hedging, identify their weaknesses, and provide insights. Balance sheet hedges document and translate foreign assets into u.s. Understand the key components.

How to Calculate Net Asset Value for a Hedge Fund

Currency hedging can mitigate the risks created by fx market volatility, including reducing earnings volatility and protecting the value of. In this blog post, we will explore the common approaches to balance sheet hedging, identify their weaknesses, and provide insights. Balance sheet hedging mitigates foreign currency gains and losses caused by the difference in currency rates. Balance sheet hedges document.

What Is A Balance Sheet Hedge at Yi Voss blog

Currency hedging can mitigate the risks created by fx market volatility, including reducing earnings volatility and protecting the value of. Balance sheet hedges document and translate foreign assets into u.s. Understand the key components of a hedge fund balance sheet, including asset composition, liabilities, and valuation methods. Dollars as protection against currency fluctuations,. Balance sheet hedging mitigates foreign currency gains.

PPT BANK 501 ASSET AND LIABILITY MANAGEMENT PowerPoint Presentation

In this blog post, we will explore the common approaches to balance sheet hedging, identify their weaknesses, and provide insights. Understand the key components of a hedge fund balance sheet, including asset composition, liabilities, and valuation methods. Balance sheet hedging mitigates foreign currency gains and losses caused by the difference in currency rates. Dollars as protection against currency fluctuations,. Currency.

PPT Module III AssetLiability Management PowerPoint Presentation

Dollars as protection against currency fluctuations,. Balance sheet hedges document and translate foreign assets into u.s. Currency hedging can mitigate the risks created by fx market volatility, including reducing earnings volatility and protecting the value of. In this blog post, we will explore the common approaches to balance sheet hedging, identify their weaknesses, and provide insights. Understand the key components.

PPT Chapter Objective PowerPoint Presentation, free download ID

Balance sheet hedges document and translate foreign assets into u.s. Dollars as protection against currency fluctuations,. Currency hedging can mitigate the risks created by fx market volatility, including reducing earnings volatility and protecting the value of. In this blog post, we will explore the common approaches to balance sheet hedging, identify their weaknesses, and provide insights. Understand the key components.

PPT Accounting for Interest Rate Derivatives FAS ASC 815 PowerPoint

In this blog post, we will explore the common approaches to balance sheet hedging, identify their weaknesses, and provide insights. Balance sheet hedges document and translate foreign assets into u.s. Understand the key components of a hedge fund balance sheet, including asset composition, liabilities, and valuation methods. Dollars as protection against currency fluctuations,. Balance sheet hedging mitigates foreign currency gains.

PPT Measuring and Managing Foreign Exchange Exposure PowerPoint

Dollars as protection against currency fluctuations,. Balance sheet hedges document and translate foreign assets into u.s. Currency hedging can mitigate the risks created by fx market volatility, including reducing earnings volatility and protecting the value of. In this blog post, we will explore the common approaches to balance sheet hedging, identify their weaknesses, and provide insights. Balance sheet hedging mitigates.

Balance Sheet Hedging Mitigates Foreign Currency Gains And Losses Caused By The Difference In Currency Rates.

Understand the key components of a hedge fund balance sheet, including asset composition, liabilities, and valuation methods. In this blog post, we will explore the common approaches to balance sheet hedging, identify their weaknesses, and provide insights. Currency hedging can mitigate the risks created by fx market volatility, including reducing earnings volatility and protecting the value of. Balance sheet hedges document and translate foreign assets into u.s.