Balance Sheet Schedule L - A schedule l is the equivalent of a comparative balance sheet. Income tax return for an s corporation where the corporation. You need to review the total on. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. A comparative balance sheet lists assets, liabilities and equity over two years.

Income tax return for an s corporation where the corporation. A comparative balance sheet lists assets, liabilities and equity over two years. You need to review the total on. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. A schedule l is the equivalent of a comparative balance sheet.

A schedule l is the equivalent of a comparative balance sheet. Income tax return for an s corporation where the corporation. A comparative balance sheet lists assets, liabilities and equity over two years. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. You need to review the total on.

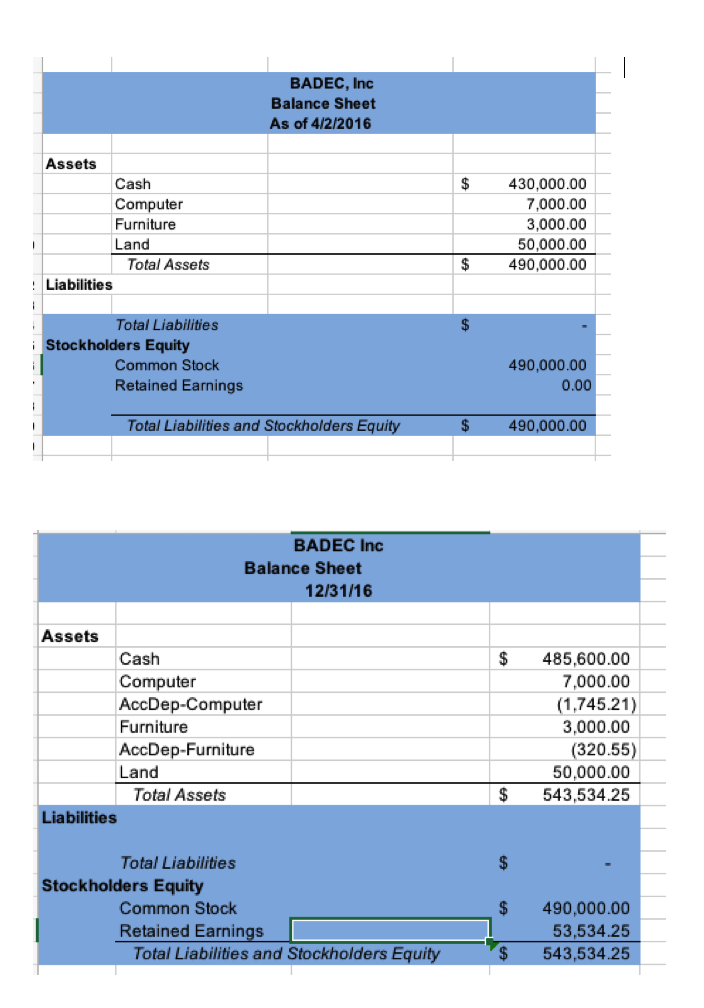

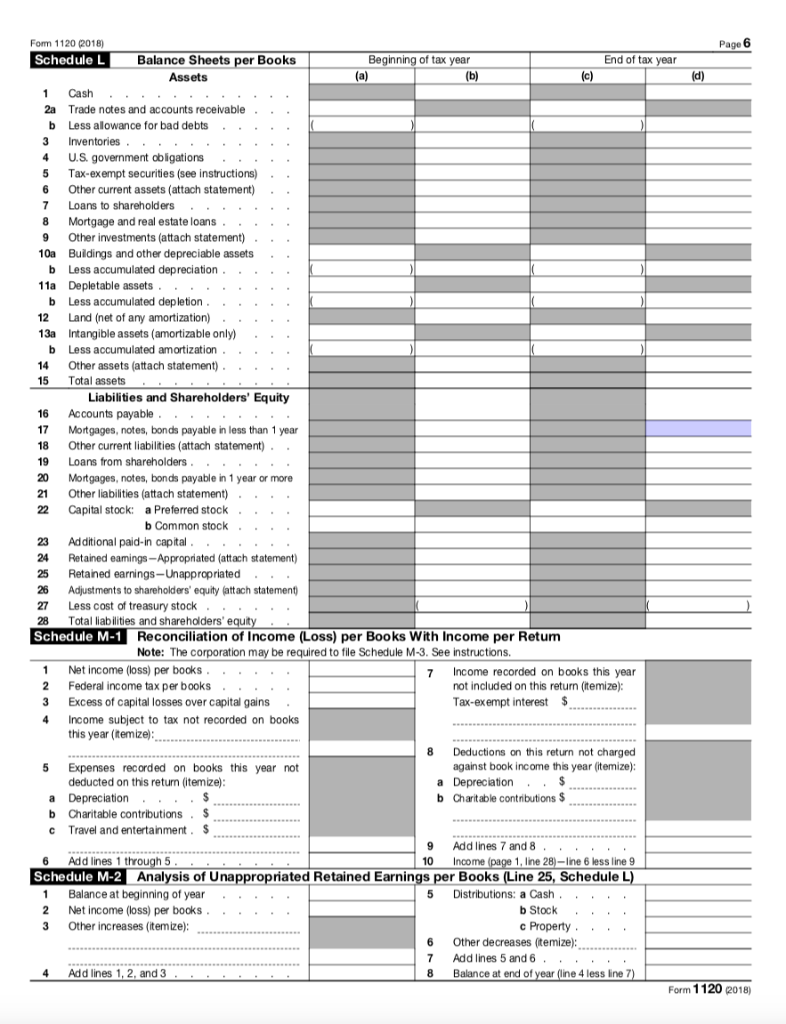

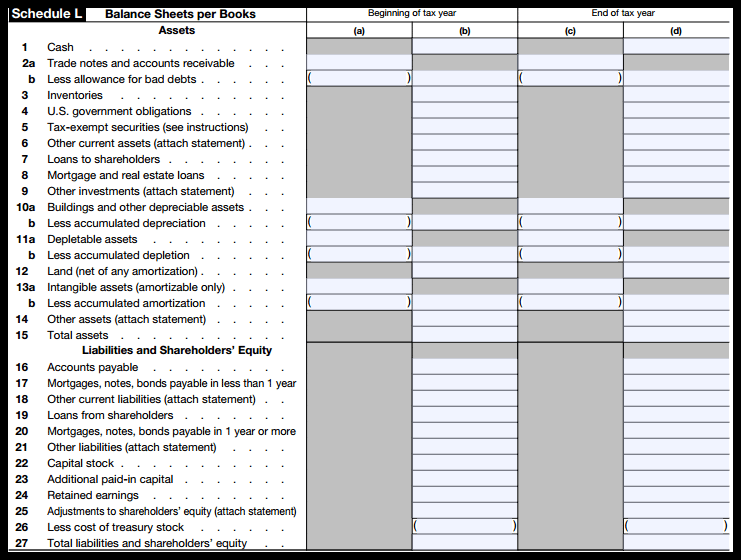

Solved Form complete Schedule L for the balance sheet

Income tax return for an s corporation where the corporation. You need to review the total on. A comparative balance sheet lists assets, liabilities and equity over two years. A schedule l is the equivalent of a comparative balance sheet. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity.

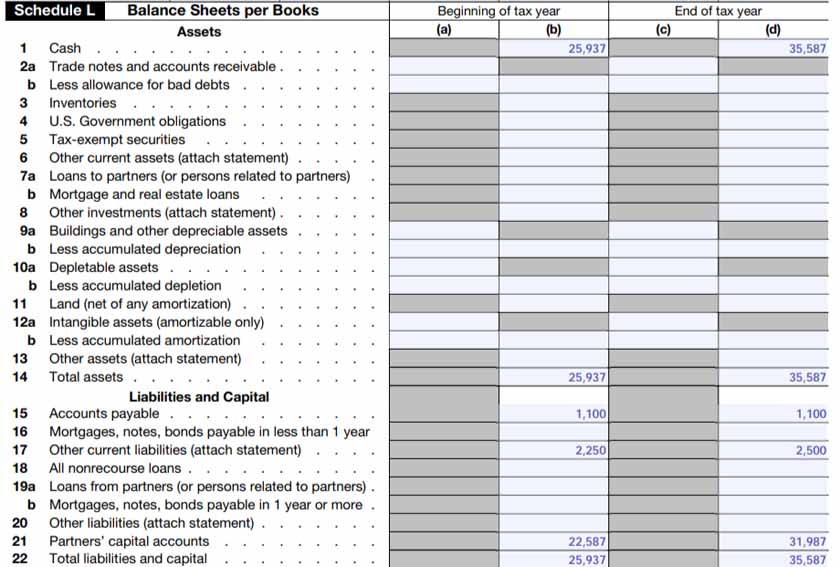

IRS Form 1065 Schedules L, M1, and M2 (2020) Balance Sheets (L

Income tax return for an s corporation where the corporation. A schedule l is the equivalent of a comparative balance sheet. You need to review the total on. A comparative balance sheet lists assets, liabilities and equity over two years. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity.

Form 1065 StepbyStep Instructions (+Free Checklist)

Income tax return for an s corporation where the corporation. A comparative balance sheet lists assets, liabilities and equity over two years. A schedule l is the equivalent of a comparative balance sheet. You need to review the total on. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity.

Form 1065 Instructions in 8 Steps (+ Free Checklist)

A comparative balance sheet lists assets, liabilities and equity over two years. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. Income tax return for an s corporation where the corporation. You need to review the total on. A schedule l is the equivalent of a comparative balance sheet.

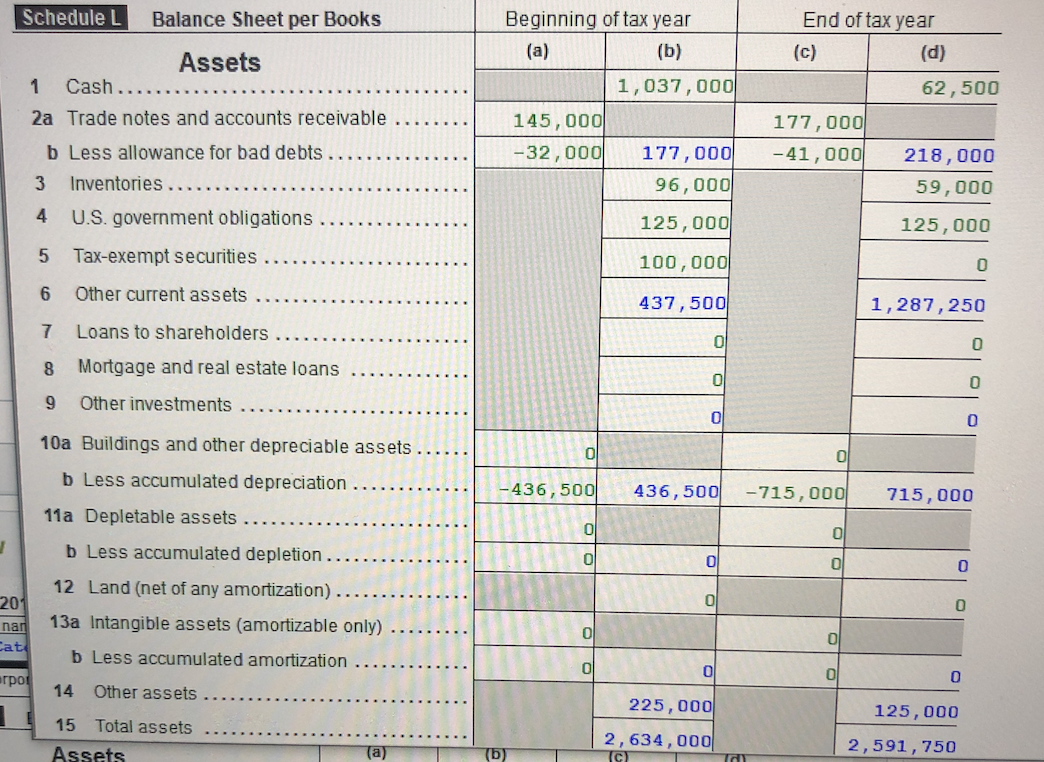

IRS Form 1120 Schedules L, M1, and M2 (2019) Balance Sheet (L

A comparative balance sheet lists assets, liabilities and equity over two years. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. You need to review the total on. Income tax return for an s corporation where the corporation. A schedule l is the equivalent of a comparative balance sheet.

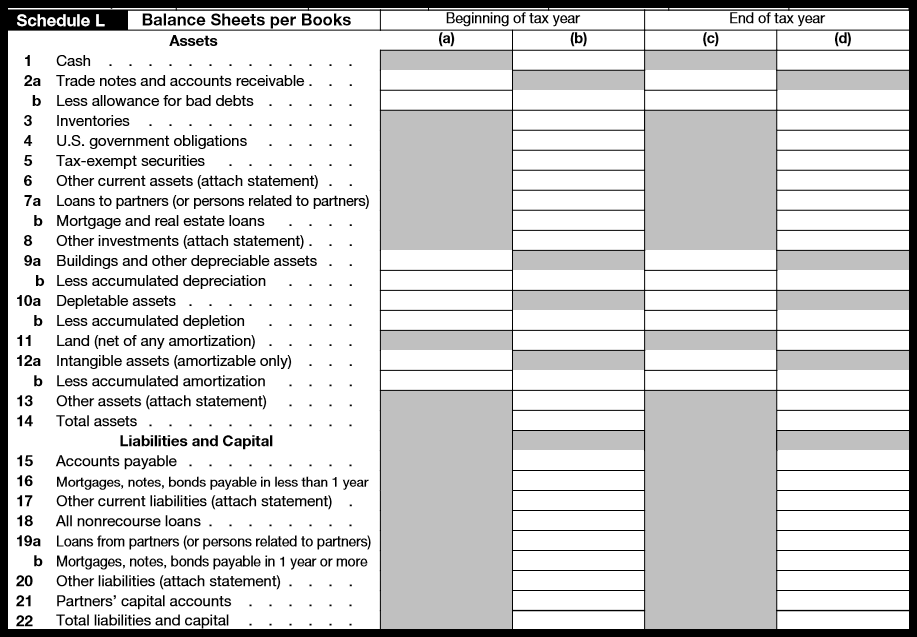

Solved Schedule L Balance Sheet per Books Assets 1 Cash.. 2a

A comparative balance sheet lists assets, liabilities and equity over two years. A schedule l is the equivalent of a comparative balance sheet. Income tax return for an s corporation where the corporation. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. You need to review the total on.

Solved Form complete Schedule L for the balance sheet

Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. You need to review the total on. A comparative balance sheet lists assets, liabilities and equity over two years. A schedule l is the equivalent of a comparative balance sheet. Income tax return for an s corporation where the corporation.

IRS Form 1120S Schedules L, M1, and M2 (2021) Balance Sheet (L

Income tax return for an s corporation where the corporation. A comparative balance sheet lists assets, liabilities and equity over two years. A schedule l is the equivalent of a comparative balance sheet. You need to review the total on. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity.

IRS Form 1120S Schedules L, M1, and M2 (2018) Balance Sheet (L

A schedule l is the equivalent of a comparative balance sheet. You need to review the total on. Income tax return for an s corporation where the corporation. A comparative balance sheet lists assets, liabilities and equity over two years. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity.

How to Complete Form 1120S Tax Return for an S Corp

A schedule l is the equivalent of a comparative balance sheet. You need to review the total on. A comparative balance sheet lists assets, liabilities and equity over two years. Income tax return for an s corporation where the corporation. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity.

Schedule L Mirrors A Standard Balance Sheet, Dividing Financial Data Into Assets, Liabilities, And Shareholders’ Equity.

A comparative balance sheet lists assets, liabilities and equity over two years. Income tax return for an s corporation where the corporation. A schedule l is the equivalent of a comparative balance sheet. You need to review the total on.