Balance Sheet Vs Profit And Loss - Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.

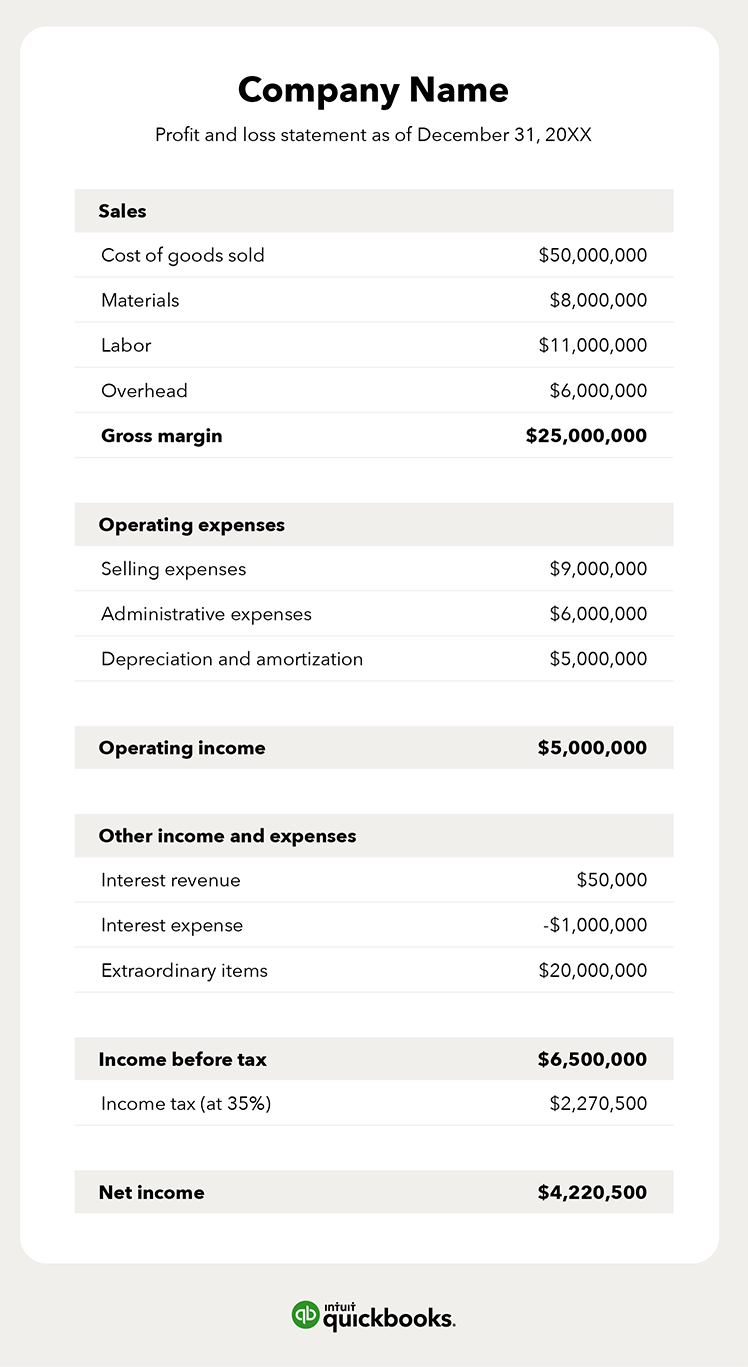

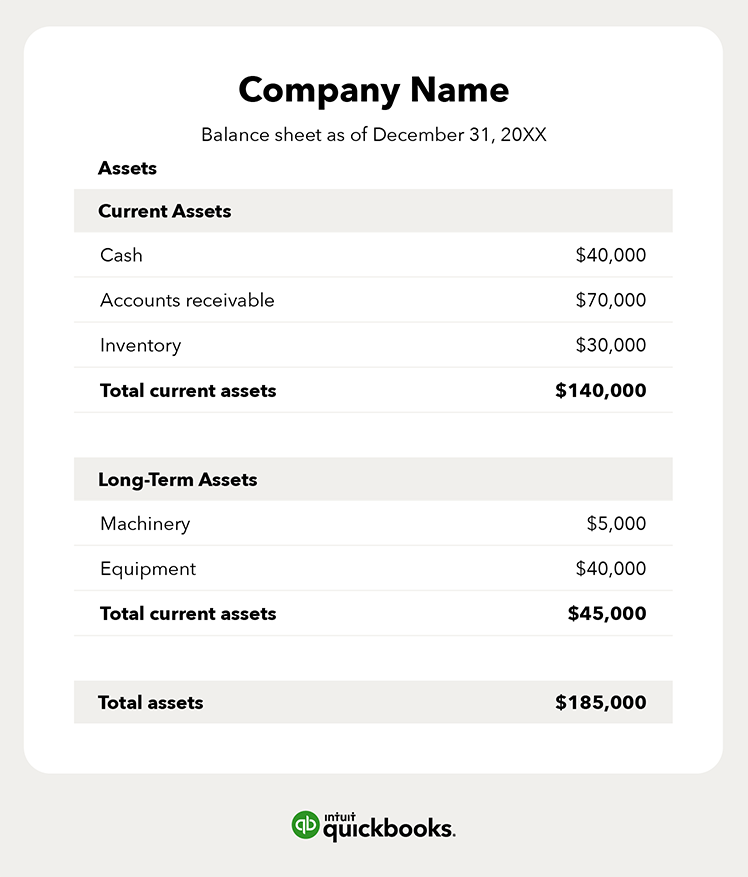

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.

Balance sheet vs. profit and loss statement Understanding the

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.

Balance sheet vs. profit and loss statement Understanding the

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.

Balance Sheet vs. Profit and Loss Differences

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.

Differences between Balance Sheet and ProfitLoss Account. YouTube

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.

Difference between the Profit and Loss account and Balance Sheet

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.

Balance Sheet and Profit & Loss Statement Explained The Audit Analytics

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.

Difference Between Balance Sheet And Profit And Loss Account at Jackson

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.

Difference between the Profit and Loss account and Balance Sheet

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.

The Difference Between a Balance Sheet and P&L Infographic

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.