Business Tax Organizer Template - Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Please complete a separate organizer for each entity requiring a tax return. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. This form is only for s corporations, c corporations and partnerships. If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member llc, and did not use.

If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member llc, and did not use. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. This form is only for s corporations, c corporations and partnerships. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. Please complete a separate organizer for each entity requiring a tax return.

Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. This form is only for s corporations, c corporations and partnerships. If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member llc, and did not use. Please complete a separate organizer for each entity requiring a tax return.

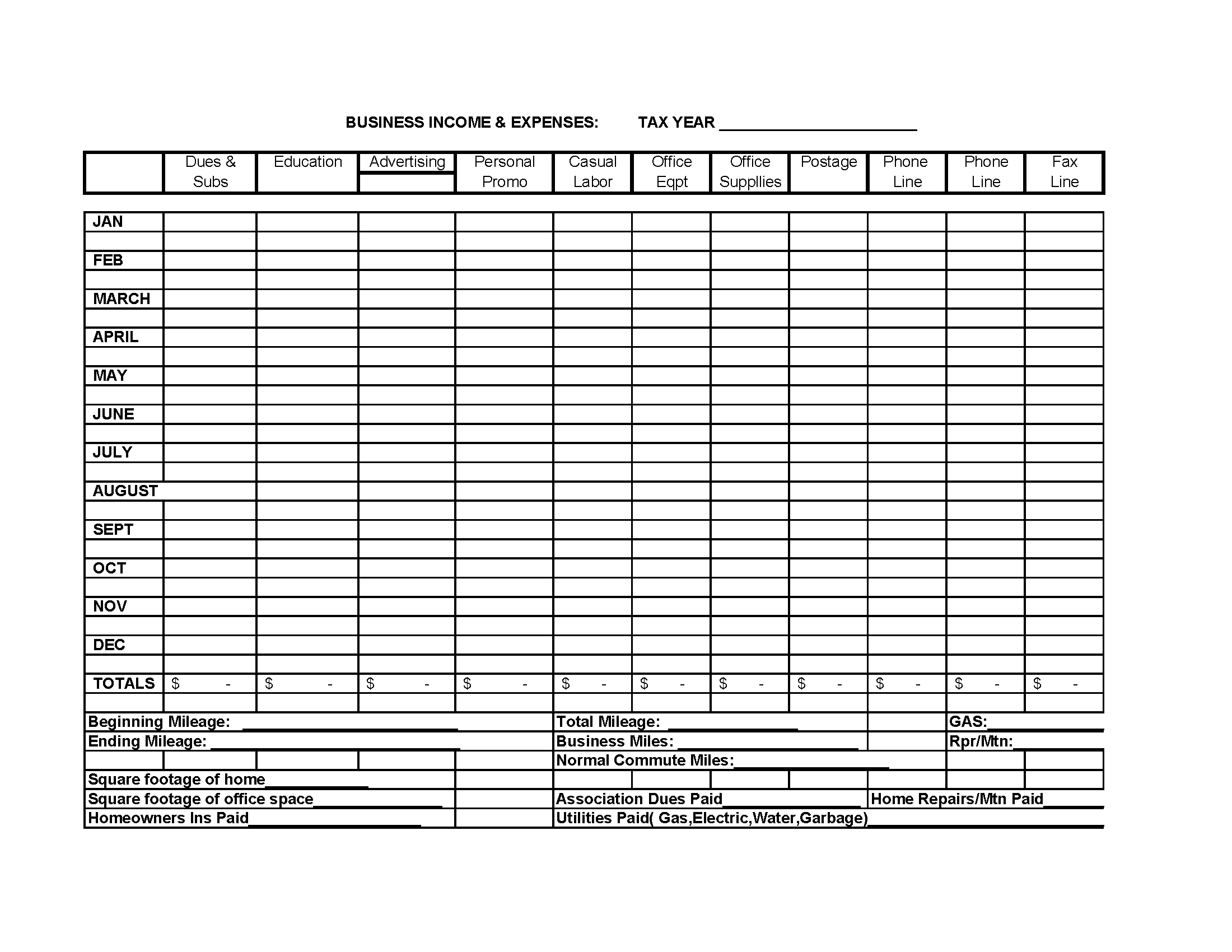

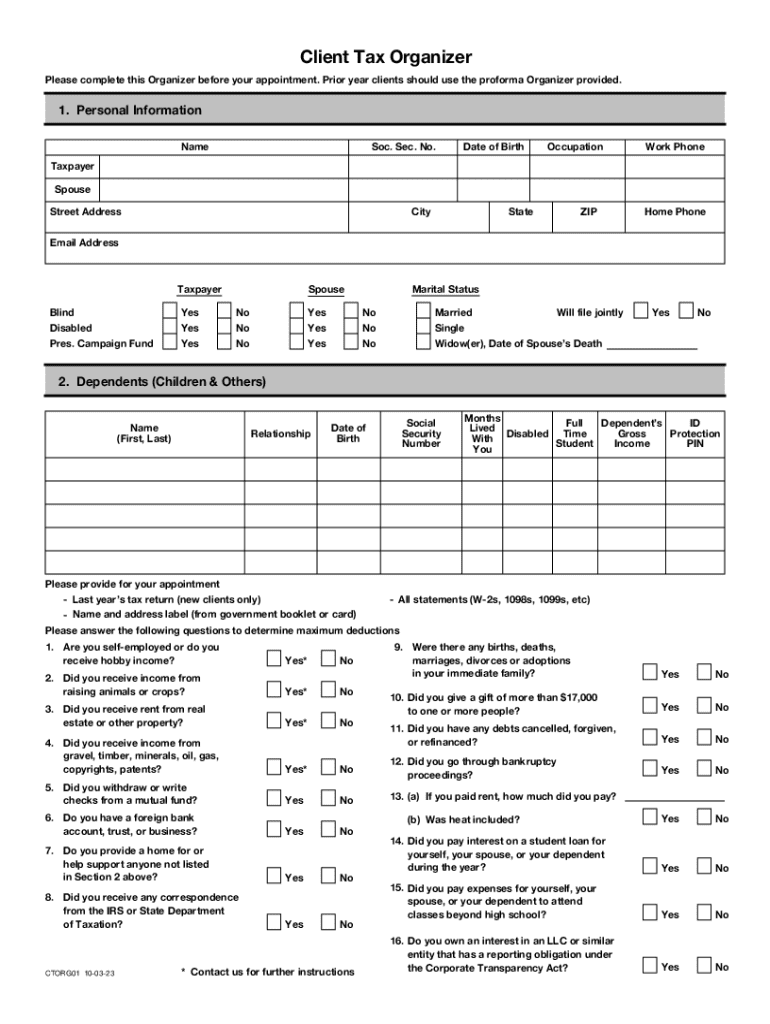

Business Tax Organizer Template

Please complete a separate organizer for each entity requiring a tax return. This form is only for s corporations, c corporations and partnerships. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. If you had.

Profit & Loss Tax Organizer Template for Small Businesses Etsy

Please complete a separate organizer for each entity requiring a tax return. This form is only for s corporations, c corporations and partnerships. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. If you had.

Business Tax Organizer Template

Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Please complete a separate organizer for each entity requiring a tax return. If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member llc, and did not use. This form is only for s corporations, c.

Business Tax Organizer Template

Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member llc, and did not use. This form.

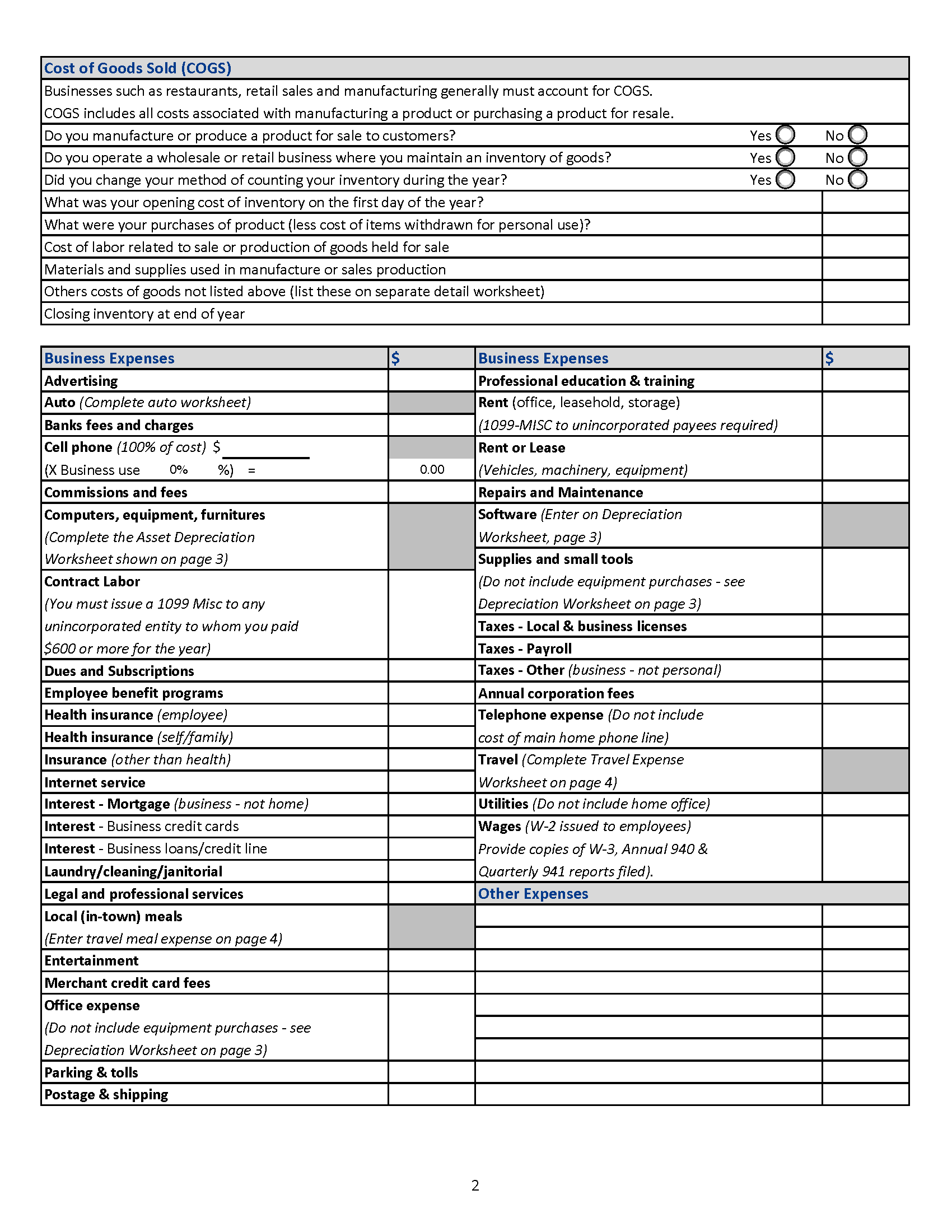

Printable Tax Organizer Template

If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member llc, and did not use. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. Please complete a separate organizer for each entity requiring a tax return. Download these income tax worksheets and.

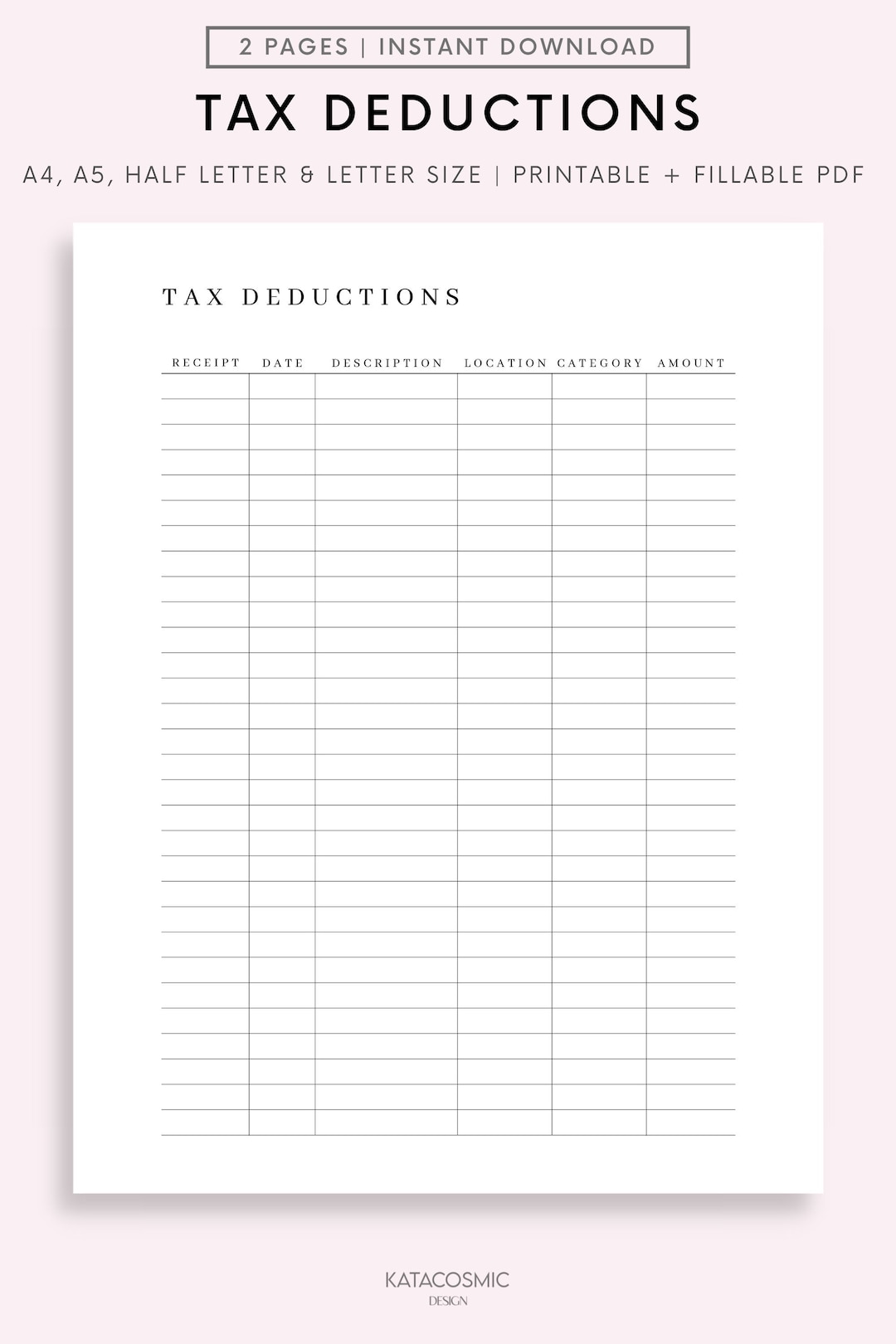

Printable Tax Deduction Tracker, Business Tax Log, Purchase Records

Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Please complete a separate organizer for each entity requiring a tax return. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. If you had a business in 2024, in which you were a 1099 contractor,.

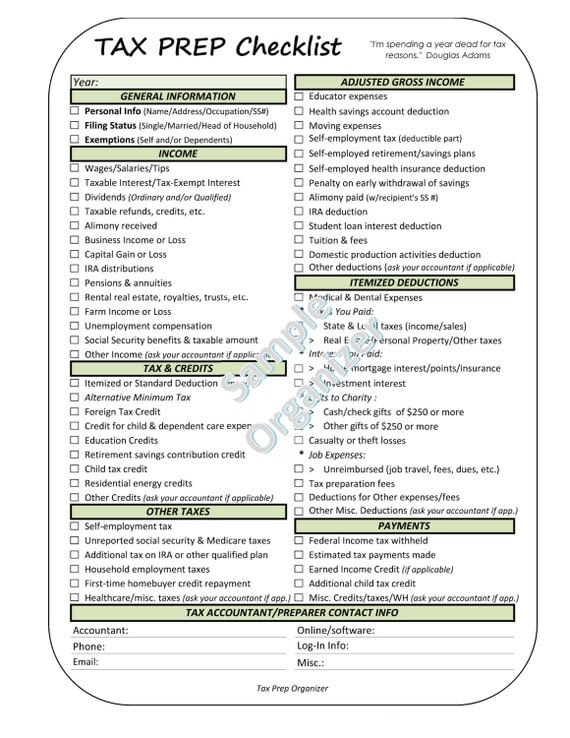

Tax Organizer Template Excel Fill Online, Printable, Fillable, Blank

Please complete a separate organizer for each entity requiring a tax return. This form is only for s corporations, c corporations and partnerships. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member.

Printable Tax Organizer Template

This form is only for s corporations, c corporations and partnerships. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. Please complete a separate organizer for each entity requiring a tax return. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. If you had.

Excel Tax Organizer Template For Your Needs

Please complete a separate organizer for each entity requiring a tax return. If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member llc, and did not use. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. This form is only for s.

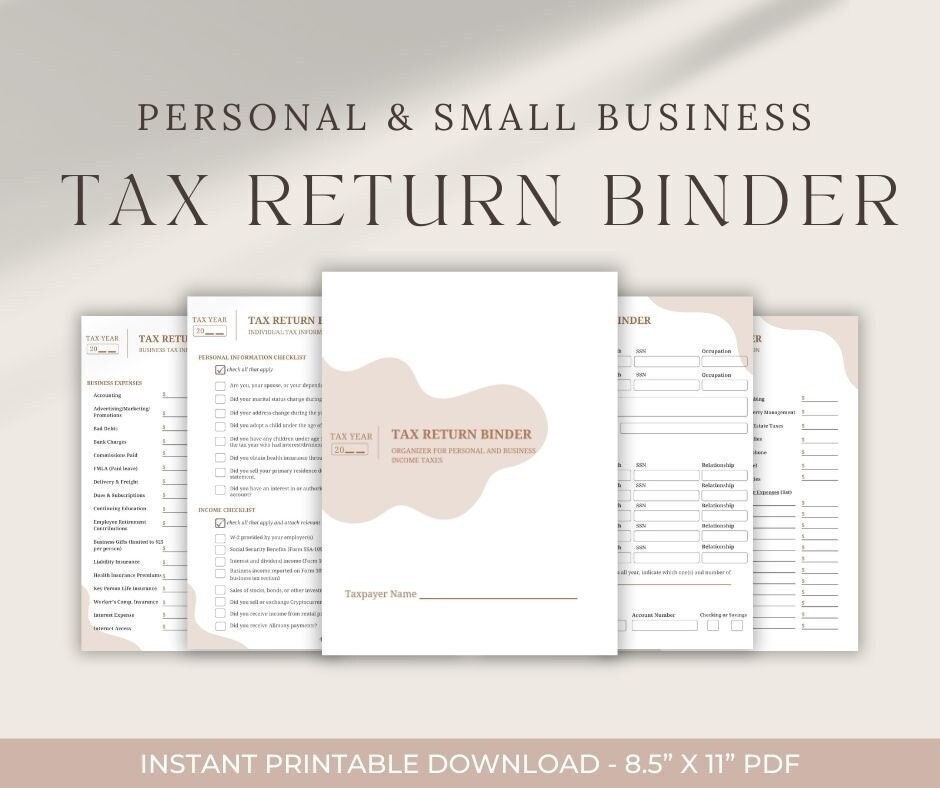

Printable Tax Return Binder for Personal and Business Taxes, Tax Return

If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member llc, and did not use. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. This form is only for s corporations, c corporations and partnerships. Please complete a separate organizer for each entity requiring.

Please Complete A Separate Organizer For Each Entity Requiring A Tax Return.

If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member llc, and did not use. This form is only for s corporations, c corporations and partnerships. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions.