Calendar Call Spread - There are two types of calendar spreads: Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. Additionally, two variations of each type are possible using call or put options.

Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. Additionally, two variations of each type are possible using call or put options. There are two types of calendar spreads: Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates.

Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. Additionally, two variations of each type are possible using call or put options. There are two types of calendar spreads:

Calendar Call Spread Options Edge

Additionally, two variations of each type are possible using call or put options. Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. There are two types of calendar spreads: Learn how to run a calendar spread with calls, selling and buying options with the same strike price.

Long Call Calendar Spread Strategy Nesta Adelaide

Additionally, two variations of each type are possible using call or put options. Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. There are two.

Calendar Spread Calculator Printable Computer Tools

There are two types of calendar spreads: Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. Learn how to use a calendar spread, an options strategy that.

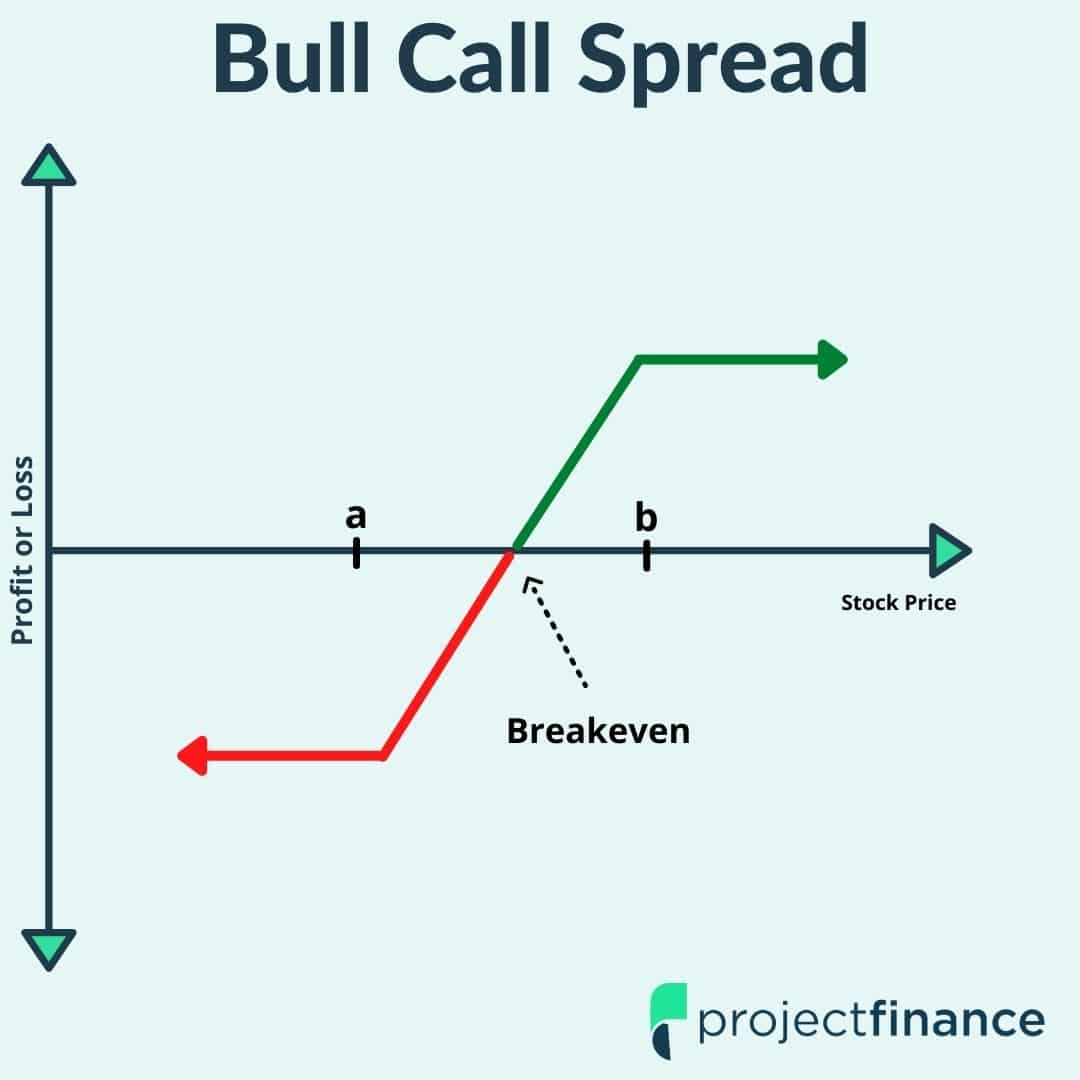

Credit Spread Options Strategies (Visuals and Examples) projectfinance

Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. There are two types of calendar spreads: Additionally, two variations of each type are possible using.

Calendar Call Definition, Purpose, Advantages, and Disadvantages

Additionally, two variations of each type are possible using call or put options. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. There are two types of calendar spreads: Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the.

CALENDARSPREAD Simpler Trading

Additionally, two variations of each type are possible using call or put options. Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. Learn how to use a.

Calendar Call Spread Mella Siobhan

Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. There are two types of calendar spreads: Additionally, two variations of each type are possible using call or put options. Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike.

Using Calendar Trading and Spread Option Strategies

Additionally, two variations of each type are possible using call or put options. Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. There are two types of calendar spreads: Learn how to run a calendar spread with calls, selling and buying options with the same strike price.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Additionally, two variations of each type are possible using call or put options. Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. There are two types of.

Trading Guide on Calendar Call Spread AALAP

Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. Additionally, two variations of each type are possible using call or put options. Learn how to use a.

Learn How To Run A Calendar Spread With Calls, Selling And Buying Options With The Same Strike Price But Different Expiration Dates.

Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. There are two types of calendar spreads: Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. Additionally, two variations of each type are possible using call or put options.

:max_bytes(150000):strip_icc()/dotdash_Final_Using_Calendar_Trading_and_Spread_Option_Strategies_Nov_2020-01-b1d47a55f4684e1b9d37580d219dc778.jpg)

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)