Calendar Year Proration Method - Assuming the buyer owns the day of closing and assuming a calendar year proration, which of the following statements is true regarding the. Proration is inclusive of both specified dates. The daily property tax is $1.23 and closing is august 31. Assuming the buyer owns the property on closing day, and the seller hasn't made any. Prorate a specified amount over a specified portion of the calendar year. 30 days x 12 months.

30 days x 12 months. Proration is inclusive of both specified dates. Prorate a specified amount over a specified portion of the calendar year. Assuming the buyer owns the day of closing and assuming a calendar year proration, which of the following statements is true regarding the. Assuming the buyer owns the property on closing day, and the seller hasn't made any. The daily property tax is $1.23 and closing is august 31.

Assuming the buyer owns the day of closing and assuming a calendar year proration, which of the following statements is true regarding the. Proration is inclusive of both specified dates. Prorate a specified amount over a specified portion of the calendar year. Assuming the buyer owns the property on closing day, and the seller hasn't made any. 30 days x 12 months. The daily property tax is $1.23 and closing is august 31.

Depreciation Calculation for Table and Calculated Methods (Oracle

30 days x 12 months. The daily property tax is $1.23 and closing is august 31. Prorate a specified amount over a specified portion of the calendar year. Assuming the buyer owns the day of closing and assuming a calendar year proration, which of the following statements is true regarding the. Assuming the buyer owns the property on closing day,.

Calendar Year Proration Method prntbl.concejomunicipaldechinu.gov.co

Assuming the buyer owns the property on closing day, and the seller hasn't made any. 30 days x 12 months. Assuming the buyer owns the day of closing and assuming a calendar year proration, which of the following statements is true regarding the. Prorate a specified amount over a specified portion of the calendar year. Proration is inclusive of both.

Calendar Year Proration Method prntbl.concejomunicipaldechinu.gov.co

Proration is inclusive of both specified dates. The daily property tax is $1.23 and closing is august 31. Prorate a specified amount over a specified portion of the calendar year. 30 days x 12 months. Assuming the buyer owns the property on closing day, and the seller hasn't made any.

Calendar Year Proration Method Real Estate Dasi Missie

The daily property tax is $1.23 and closing is august 31. Assuming the buyer owns the property on closing day, and the seller hasn't made any. Prorate a specified amount over a specified portion of the calendar year. 30 days x 12 months. Assuming the buyer owns the day of closing and assuming a calendar year proration, which of the.

Calendar Year Proration Method Good calendar idea

Assuming the buyer owns the day of closing and assuming a calendar year proration, which of the following statements is true regarding the. The daily property tax is $1.23 and closing is august 31. Proration is inclusive of both specified dates. Assuming the buyer owns the property on closing day, and the seller hasn't made any. Prorate a specified amount.

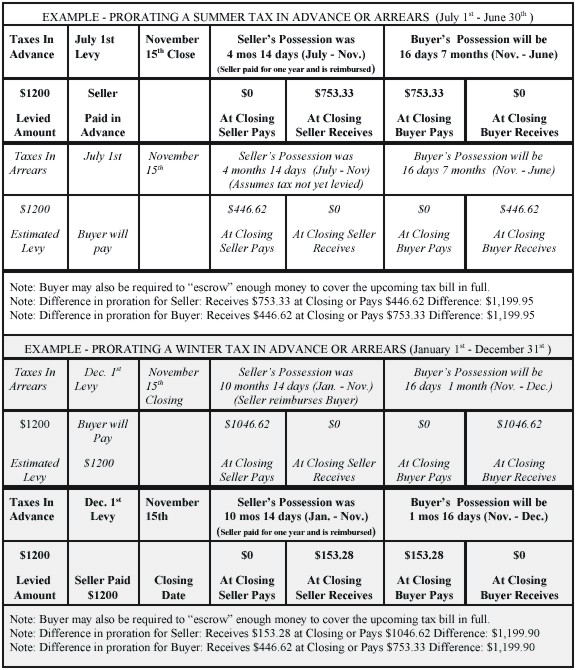

Prorating Real Estate Taxes in Michigan

The daily property tax is $1.23 and closing is august 31. Proration is inclusive of both specified dates. 30 days x 12 months. Prorate a specified amount over a specified portion of the calendar year. Assuming the buyer owns the property on closing day, and the seller hasn't made any.

Calendar Year Proration Method

Prorate a specified amount over a specified portion of the calendar year. Proration is inclusive of both specified dates. Assuming the buyer owns the property on closing day, and the seller hasn't made any. 30 days x 12 months. The daily property tax is $1.23 and closing is august 31.

Calendar Year Proration Method Good calendar idea

The daily property tax is $1.23 and closing is august 31. 30 days x 12 months. Prorate a specified amount over a specified portion of the calendar year. Assuming the buyer owns the property on closing day, and the seller hasn't made any. Proration is inclusive of both specified dates.

Calendar Year Proration Method Printable Computer Tools

Prorate a specified amount over a specified portion of the calendar year. Proration is inclusive of both specified dates. Assuming the buyer owns the day of closing and assuming a calendar year proration, which of the following statements is true regarding the. The daily property tax is $1.23 and closing is august 31. Assuming the buyer owns the property on.

How to Calculate Proration with DepositFix

Assuming the buyer owns the day of closing and assuming a calendar year proration, which of the following statements is true regarding the. Assuming the buyer owns the property on closing day, and the seller hasn't made any. Prorate a specified amount over a specified portion of the calendar year. The daily property tax is $1.23 and closing is august.

Assuming The Buyer Owns The Day Of Closing And Assuming A Calendar Year Proration, Which Of The Following Statements Is True Regarding The.

The daily property tax is $1.23 and closing is august 31. Assuming the buyer owns the property on closing day, and the seller hasn't made any. Proration is inclusive of both specified dates. Prorate a specified amount over a specified portion of the calendar year.

.png?1614945017)

(2).webp)