Cheat Sheet For Accounting - Textbook summary of corporate financial accounting 10e, ch 1, by warren/reeve/duchac. From an accounting viewpoint, it is a business entity separate from the affairs of the owner. Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. Explore key concepts to enhance your knowledge of. From a legal standpoint, they are not separate. Access the ultimate accounting basics cheat sheet in this article.

Explore key concepts to enhance your knowledge of. Textbook summary of corporate financial accounting 10e, ch 1, by warren/reeve/duchac. Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. From an accounting viewpoint, it is a business entity separate from the affairs of the owner. From a legal standpoint, they are not separate. Access the ultimate accounting basics cheat sheet in this article.

From a legal standpoint, they are not separate. From an accounting viewpoint, it is a business entity separate from the affairs of the owner. Explore key concepts to enhance your knowledge of. Textbook summary of corporate financial accounting 10e, ch 1, by warren/reeve/duchac. Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. Access the ultimate accounting basics cheat sheet in this article.

Accounting Cheat Sheet Infographics Accounting Financ vrogue.co

Explore key concepts to enhance your knowledge of. Access the ultimate accounting basics cheat sheet in this article. Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. From a legal standpoint, they are not separate. From an accounting viewpoint, it is a business entity separate from the affairs of the owner.

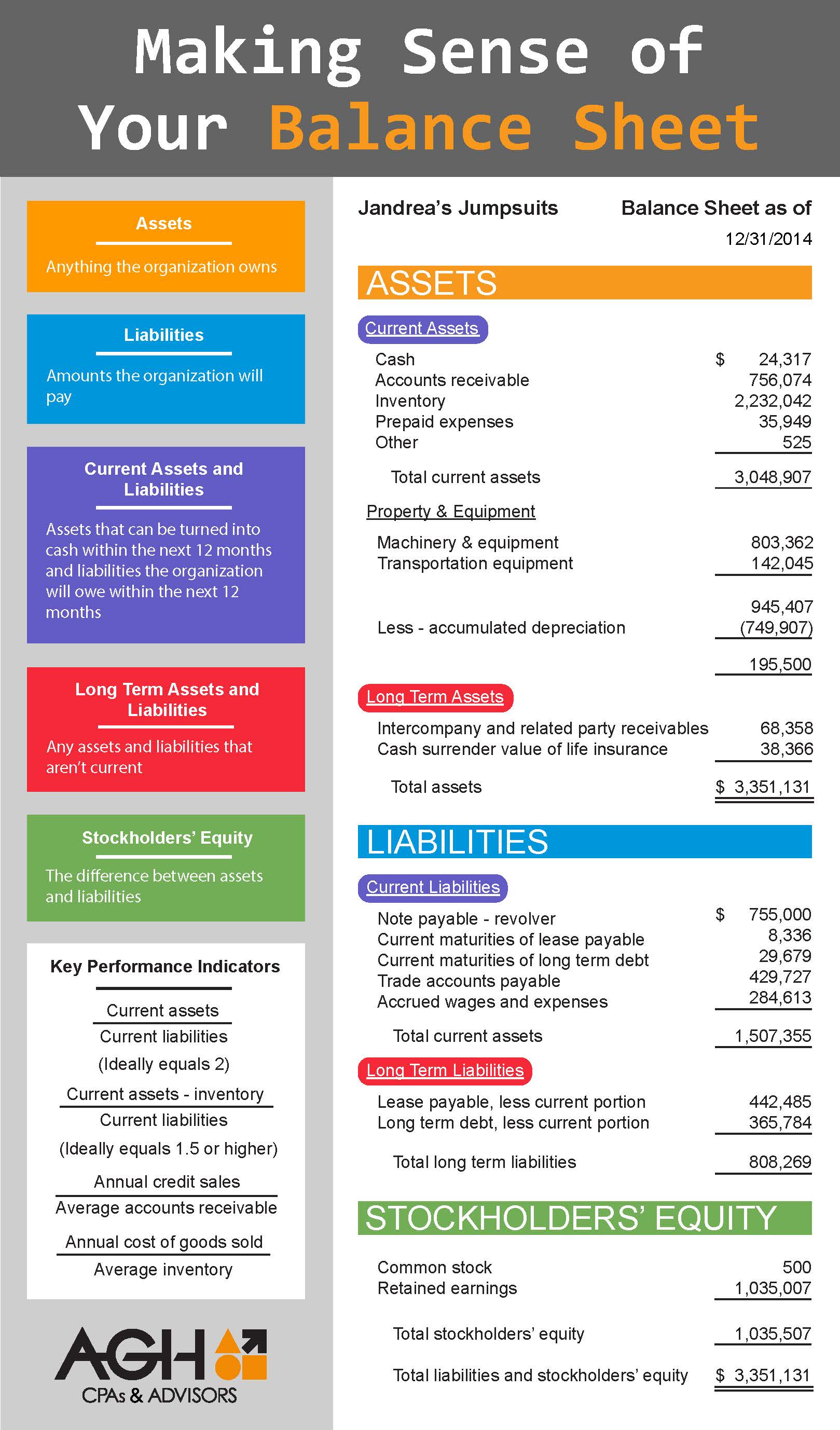

Balance Sheet Cheat Sheet

Access the ultimate accounting basics cheat sheet in this article. Explore key concepts to enhance your knowledge of. Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. From an accounting viewpoint, it is a business entity separate from the affairs of the owner. From a legal standpoint, they are not separate.

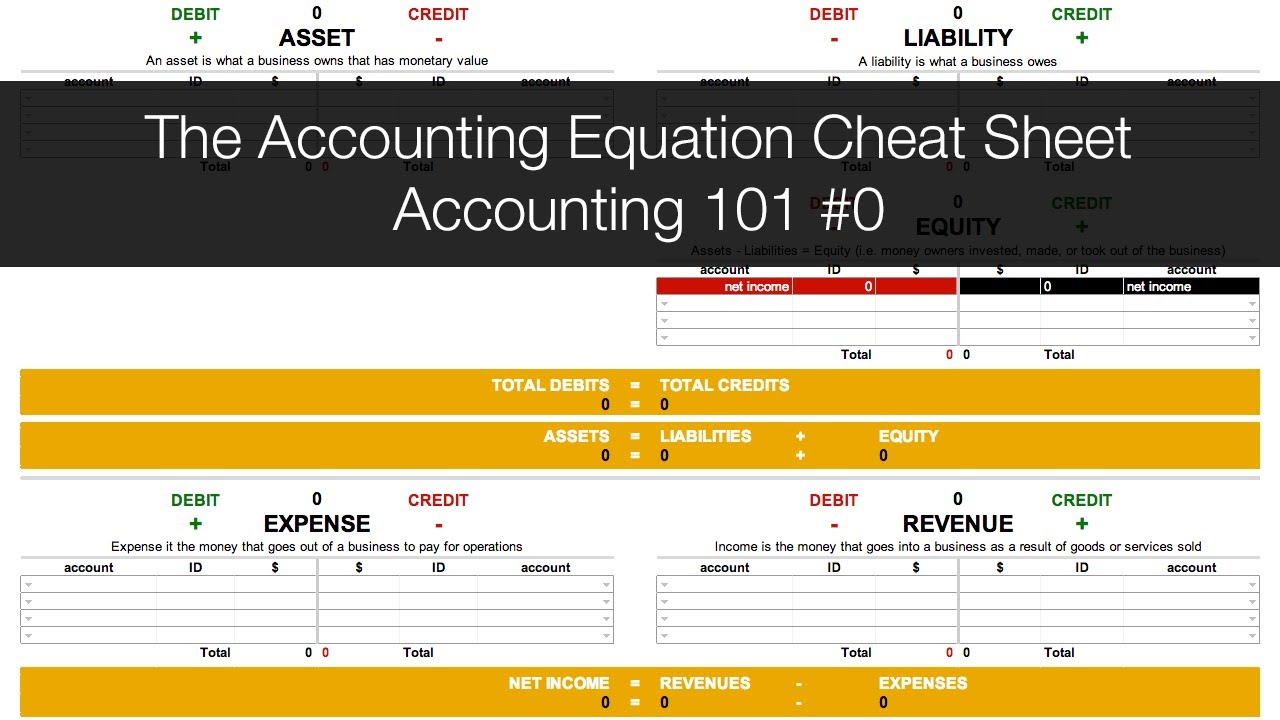

Accounting Equation Cheat Sheet Tessshebaylo

Textbook summary of corporate financial accounting 10e, ch 1, by warren/reeve/duchac. From an accounting viewpoint, it is a business entity separate from the affairs of the owner. Explore key concepts to enhance your knowledge of. Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. From a legal standpoint, they are not separate.

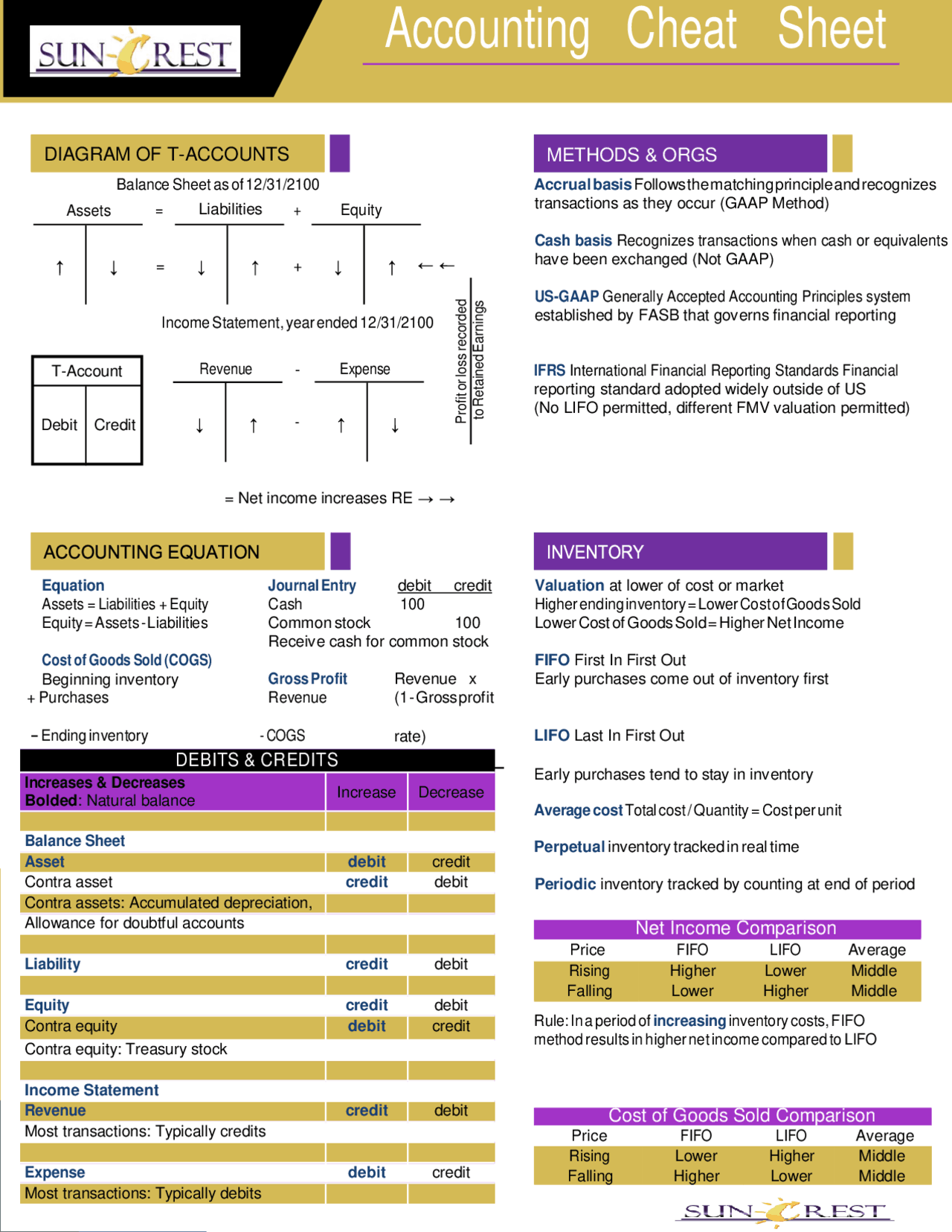

Accounting Cheat Sheet Cheat Sheet Accounting Docsity

Textbook summary of corporate financial accounting 10e, ch 1, by warren/reeve/duchac. Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. From a legal standpoint, they are not separate. Explore key concepts to enhance your knowledge of. From an accounting viewpoint, it is a business entity separate from the affairs of the owner.

Accountant Lamp Picture มิถุนายน 2013

Access the ultimate accounting basics cheat sheet in this article. From an accounting viewpoint, it is a business entity separate from the affairs of the owner. Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. Explore key concepts to enhance your knowledge of. From a legal standpoint, they are not separate.

The Basics of Accounting Cheat Sheet by psx Download free from

From an accounting viewpoint, it is a business entity separate from the affairs of the owner. Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. Textbook summary of corporate financial accounting 10e, ch 1, by warren/reeve/duchac. Access the ultimate accounting basics cheat sheet in this article. Explore key concepts to enhance your knowledge.

Accounting Cheat Sheet Infographics Financial Account vrogue.co

Textbook summary of corporate financial accounting 10e, ch 1, by warren/reeve/duchac. From a legal standpoint, they are not separate. Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. From an accounting viewpoint, it is a business entity separate from the affairs of the owner. Explore key concepts to enhance your knowledge of.

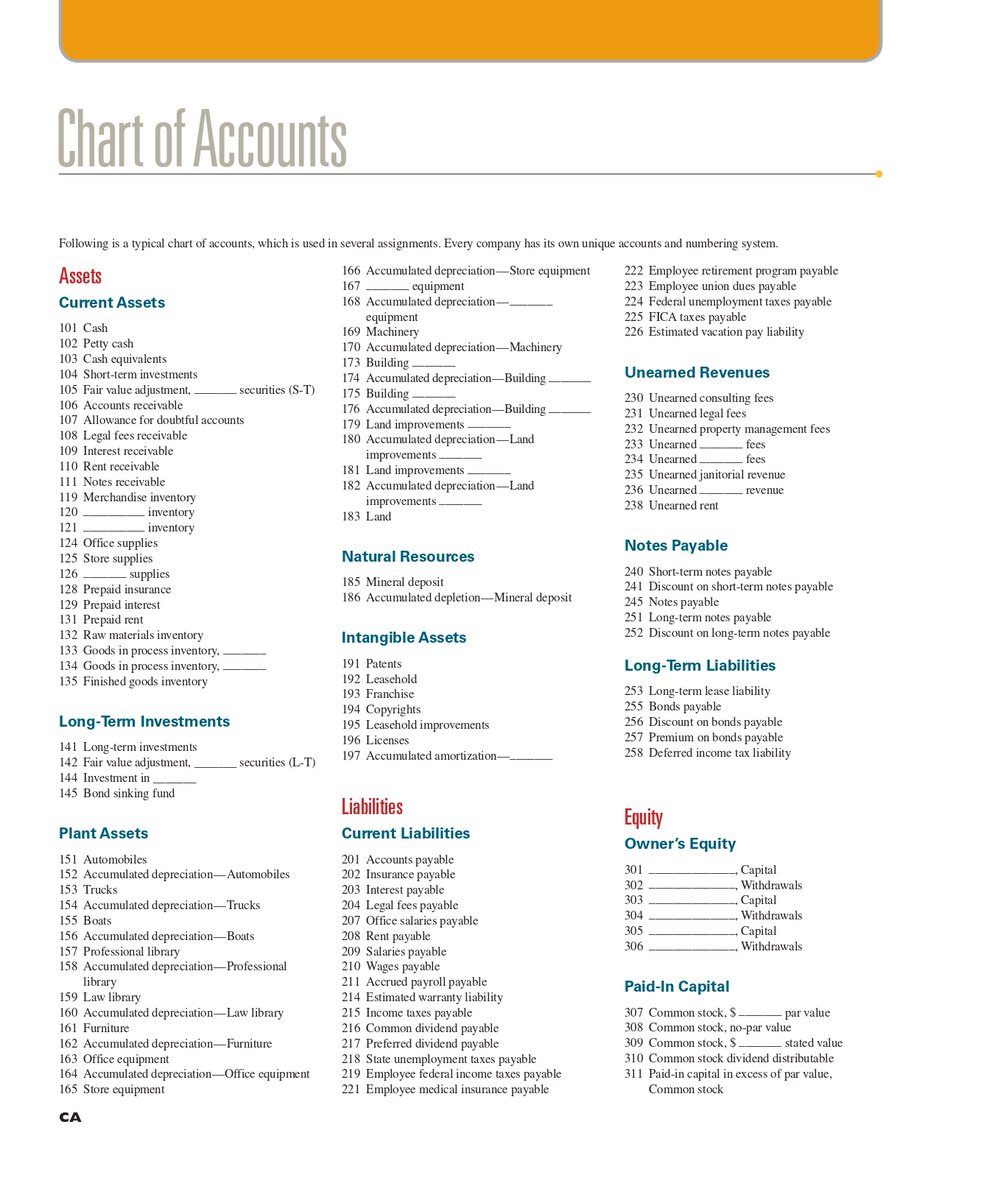

Chart Of Accounts Cheat Sheet

From an accounting viewpoint, it is a business entity separate from the affairs of the owner. Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. Explore key concepts to enhance your knowledge of. From a legal standpoint, they are not separate. Access the ultimate accounting basics cheat sheet in this article.

Printable Debits And Credits Cheat Sheet

Access the ultimate accounting basics cheat sheet in this article. From an accounting viewpoint, it is a business entity separate from the affairs of the owner. Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. Explore key concepts to enhance your knowledge of. From a legal standpoint, they are not separate.

Accounting Cheat Sheet Your CFO Guy

Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. Access the ultimate accounting basics cheat sheet in this article. From a legal standpoint, they are not separate. Textbook summary of corporate financial accounting 10e, ch 1, by warren/reeve/duchac. Explore key concepts to enhance your knowledge of.

Revenue Recognition Recognize (Book Into Accounting Record) Revenue When It Is Earned And Realizable Expense Recognition.

Access the ultimate accounting basics cheat sheet in this article. From an accounting viewpoint, it is a business entity separate from the affairs of the owner. Textbook summary of corporate financial accounting 10e, ch 1, by warren/reeve/duchac. Explore key concepts to enhance your knowledge of.