Closing Balance Sheet - Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period. The closing balance refers to the amount of funds, assets, liabilities, or equity remaining in an account or financial statement.

Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period. The closing balance refers to the amount of funds, assets, liabilities, or equity remaining in an account or financial statement.

Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period. The closing balance refers to the amount of funds, assets, liabilities, or equity remaining in an account or financial statement.

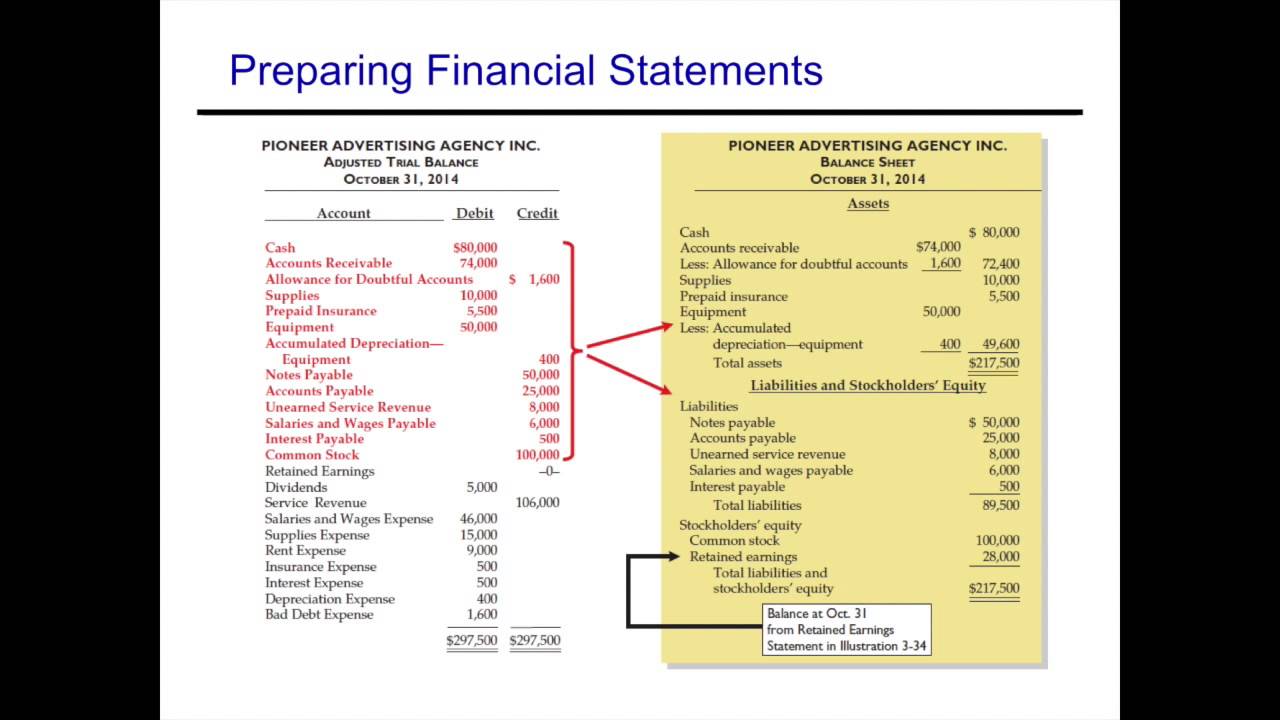

Accounting Cycle Financial Statements, Closing Entries & PostClosing

Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period. The closing balance refers to the amount of funds, assets, liabilities, or equity remaining in an account or financial statement.

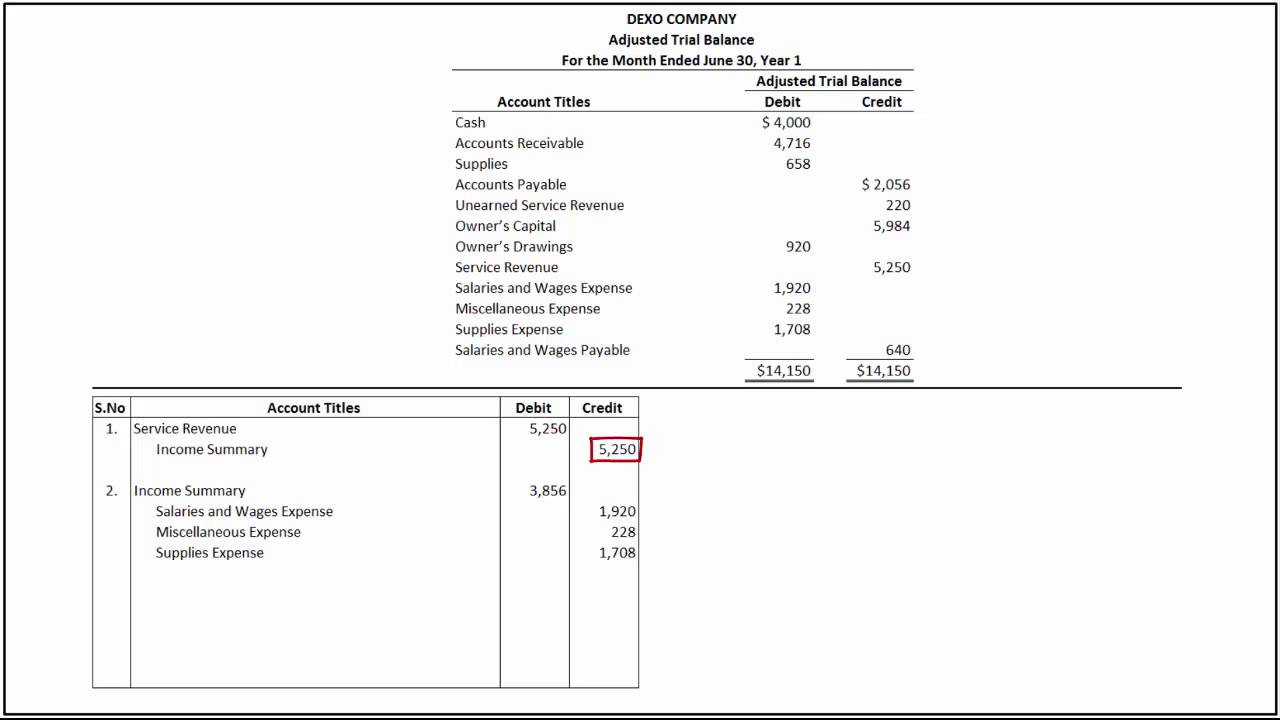

How to Prepare Closing Entries and Prepare a Post Closing Trial Balance

Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period. The closing balance refers to the amount of funds, assets, liabilities, or equity remaining in an account or financial statement.

Closing entries explanation, process and example Accounting For

The closing balance refers to the amount of funds, assets, liabilities, or equity remaining in an account or financial statement. Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period.

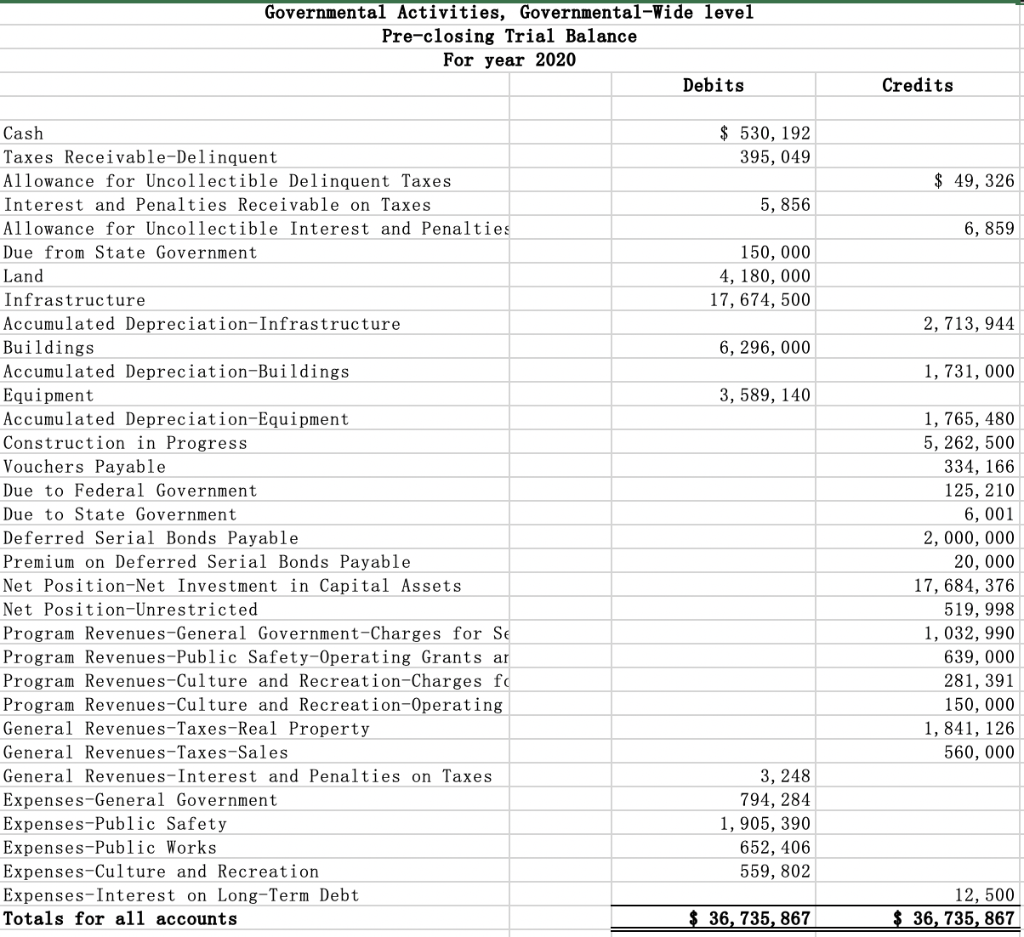

Example Of Post Closing Trial Balance Sheet sheet

Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period. The closing balance refers to the amount of funds, assets, liabilities, or equity remaining in an account or financial statement.

Closing Entries What Is The Post Closing Trial Balance? Example,

Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period. The closing balance refers to the amount of funds, assets, liabilities, or equity remaining in an account or financial statement.

Best Of The Best Tips About Closing Trial Balance Example Endband

The closing balance refers to the amount of funds, assets, liabilities, or equity remaining in an account or financial statement. Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period.

Closing Entries I Summary I Accountancy Knowledge

Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period. The closing balance refers to the amount of funds, assets, liabilities, or equity remaining in an account or financial statement.

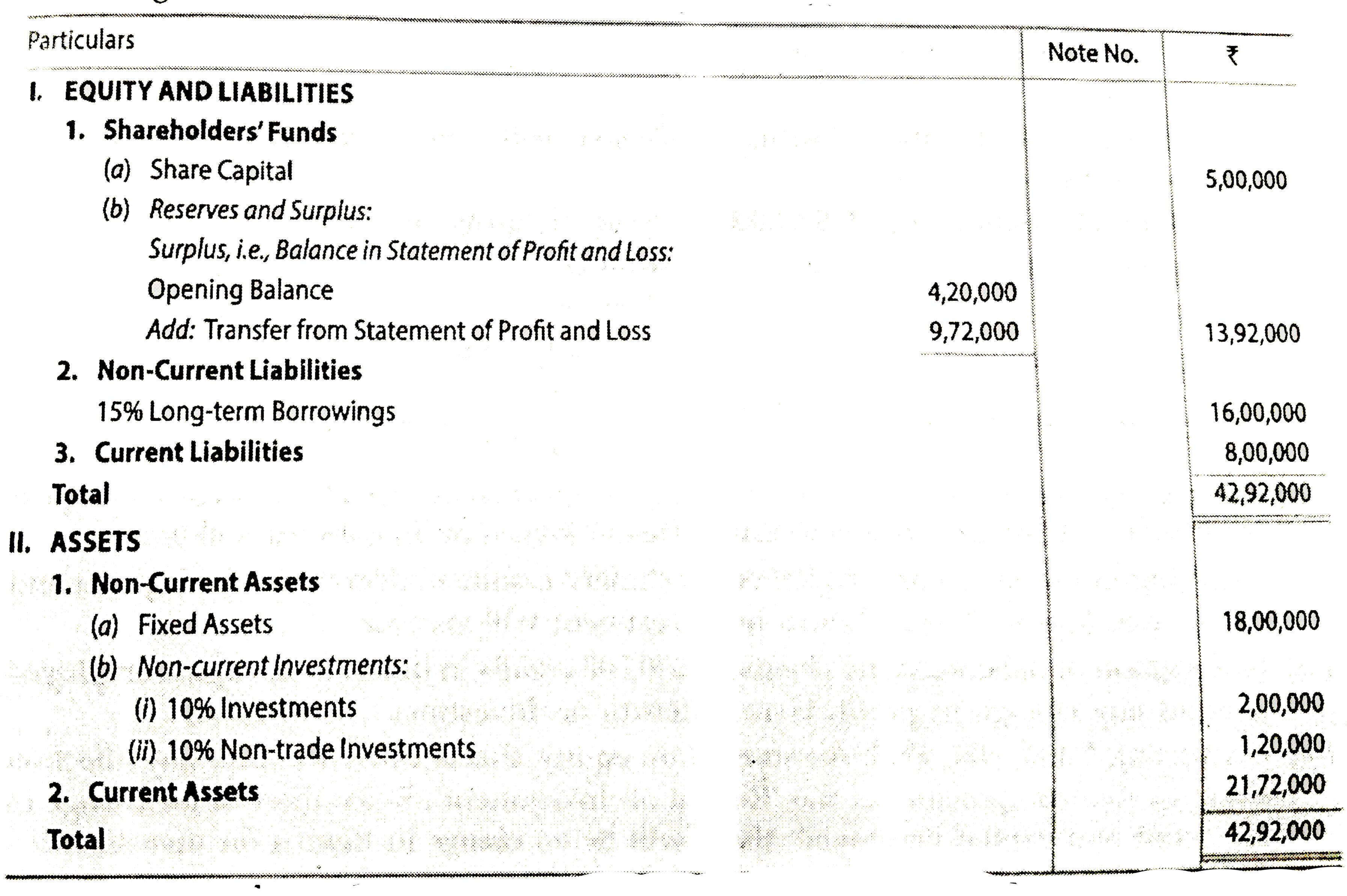

(Calculation of return on investment when closing balance sheet is gi

Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period. The closing balance refers to the amount of funds, assets, liabilities, or equity remaining in an account or financial statement.

Closing Statement Accounting

Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period. The closing balance refers to the amount of funds, assets, liabilities, or equity remaining in an account or financial statement.

Solved Need assistance with the closing entries and post

The closing balance refers to the amount of funds, assets, liabilities, or equity remaining in an account or financial statement. Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period.

The Closing Balance Refers To The Amount Of Funds, Assets, Liabilities, Or Equity Remaining In An Account Or Financial Statement.

Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period.