Deferred Gain On Balance Sheet - Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. The internal revenue service allows taxes on gains from the sale of business. What is a deferred gain on a balance sheet?

What is a deferred gain on a balance sheet? Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. The internal revenue service allows taxes on gains from the sale of business.

What is a deferred gain on a balance sheet? Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. The internal revenue service allows taxes on gains from the sale of business.

Deferred tax and temporary differences The Footnotes Analyst

The internal revenue service allows taxes on gains from the sale of business. Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. What is a deferred gain on a balance sheet?

Net Operating Losses & Deferred Tax Assets Tutorial

The internal revenue service allows taxes on gains from the sale of business. Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. What is a deferred gain on a balance sheet?

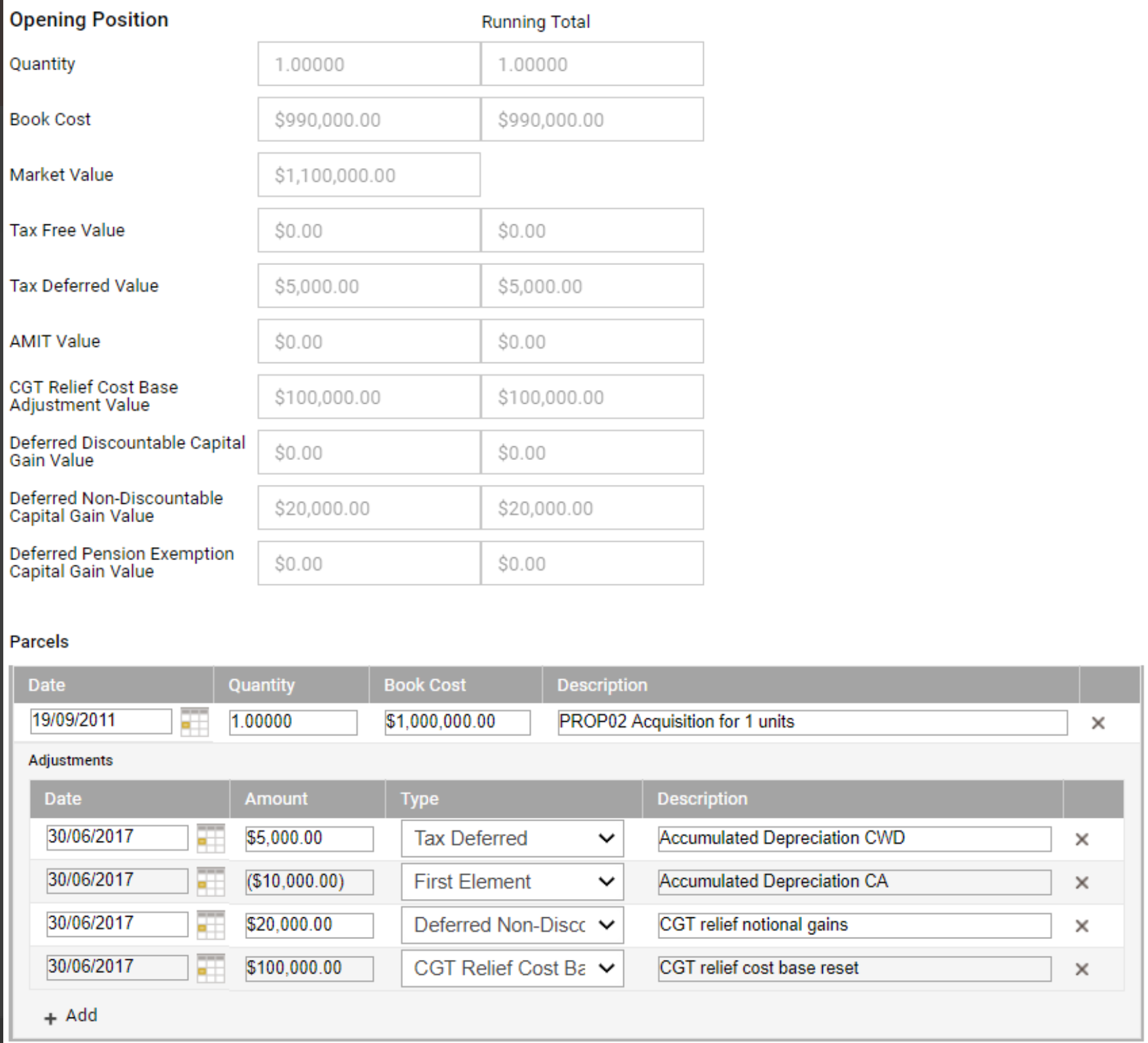

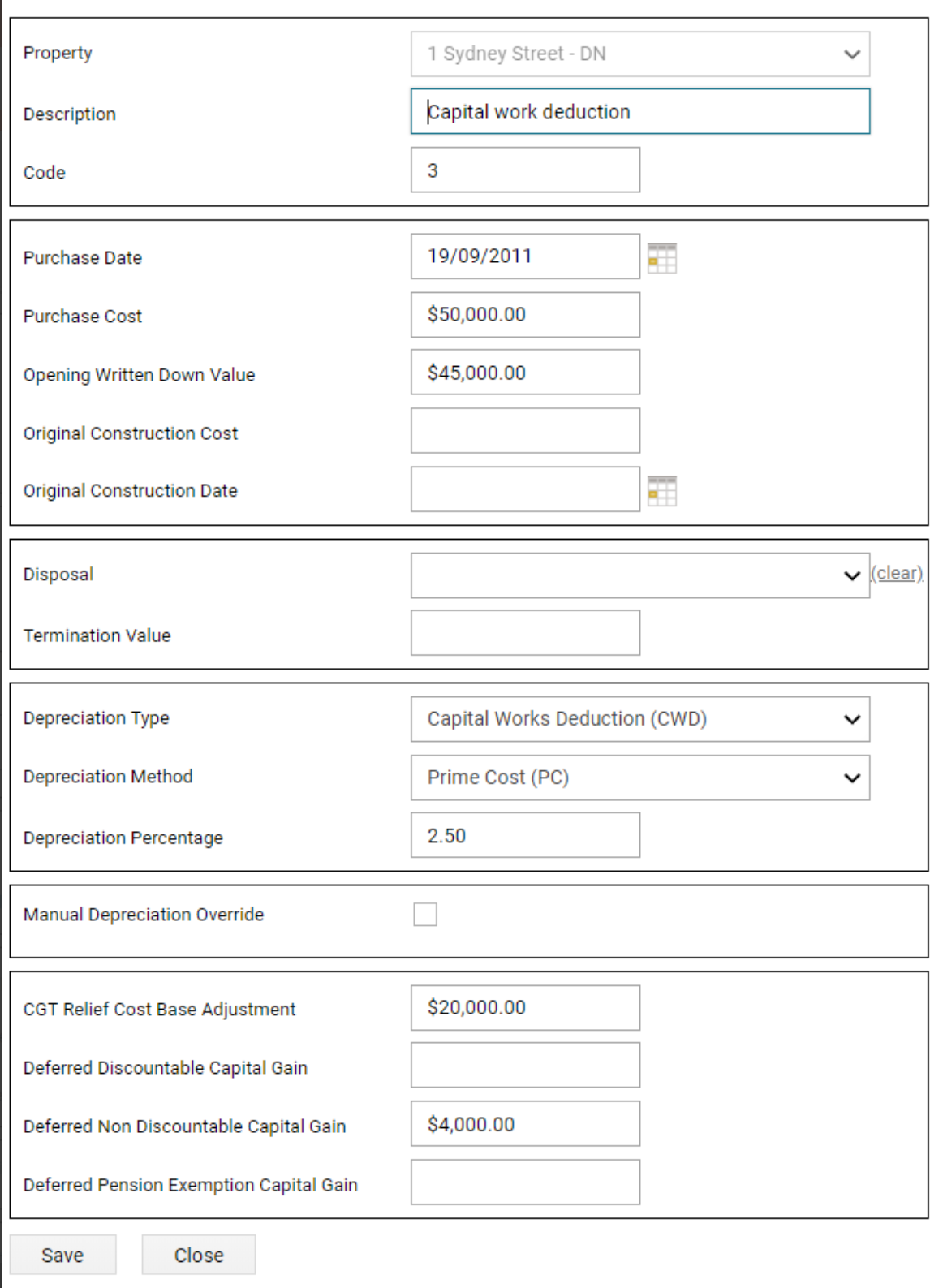

Worked example How to enter deferred notional gains and reset cost

Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. The internal revenue service allows taxes on gains from the sale of business. What is a deferred gain on a balance sheet?

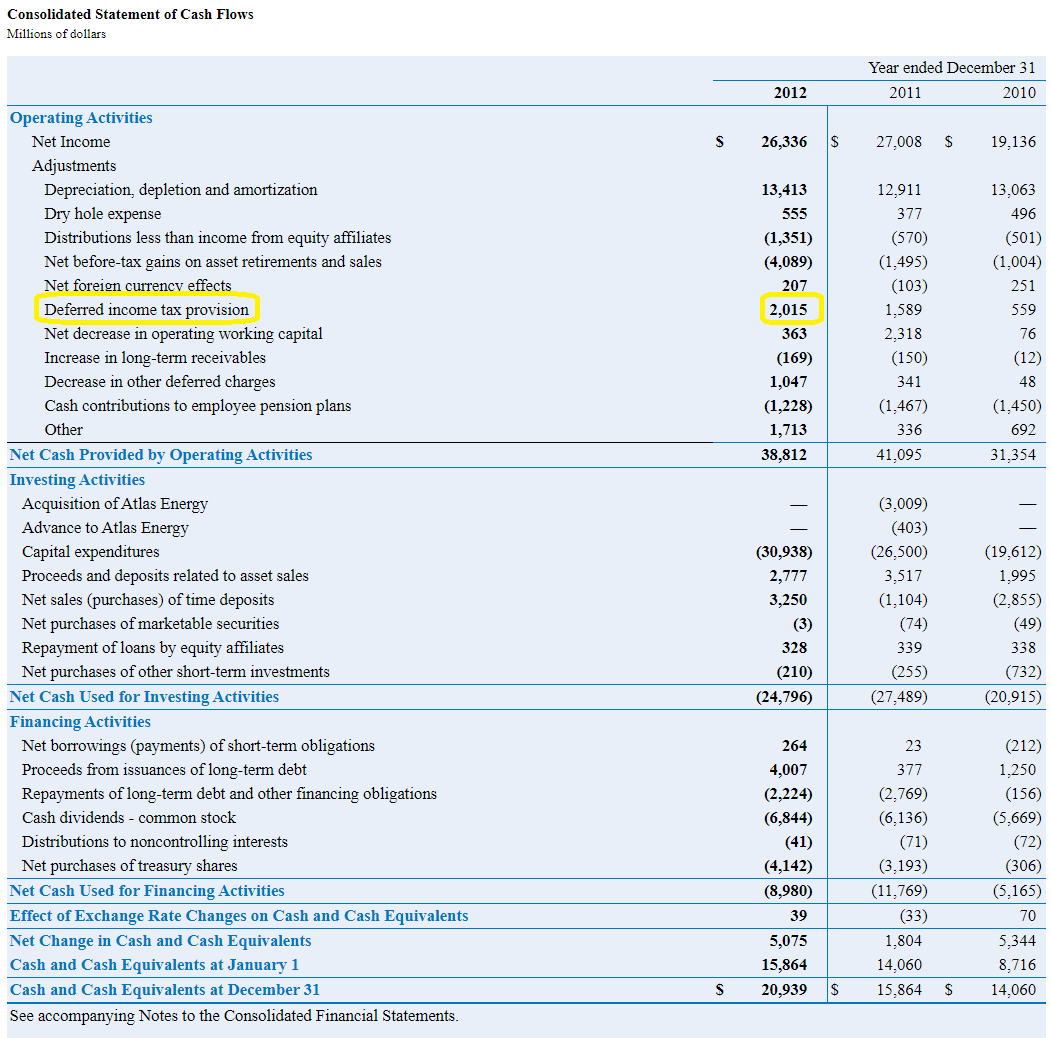

Deferred Tax Liabilities Explained (with RealLife Example in a

What is a deferred gain on a balance sheet? The internal revenue service allows taxes on gains from the sale of business. Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance.

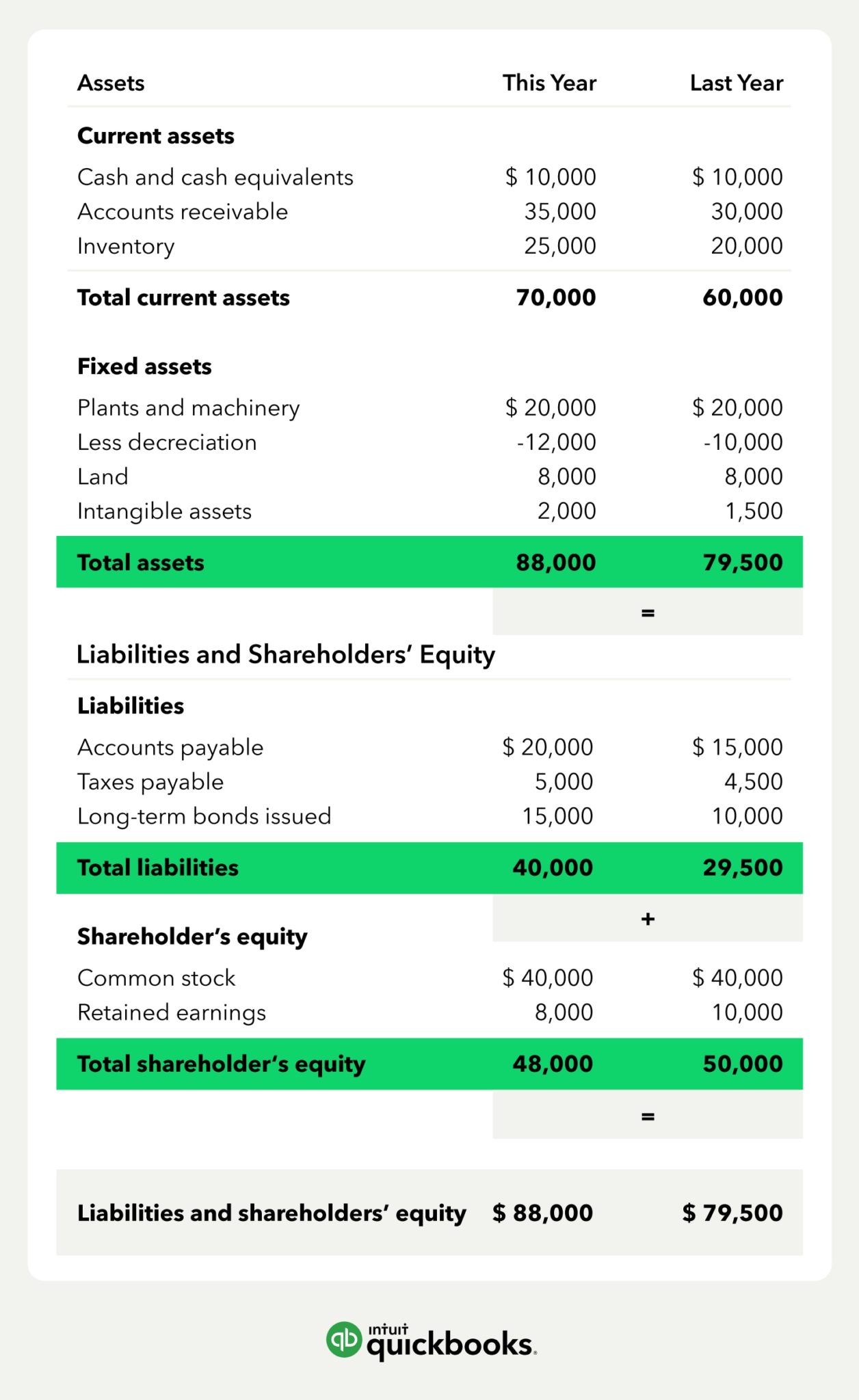

Ideal Withholding Tax Payable In Balance Sheet Gain And Loss

The internal revenue service allows taxes on gains from the sale of business. Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. What is a deferred gain on a balance sheet?

Worked example How to enter deferred notional gains and reset cost

Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. What is a deferred gain on a balance sheet? The internal revenue service allows taxes on gains from the sale of business.

Deferred Tax Liabilities Explained (with RealLife Example in a

The internal revenue service allows taxes on gains from the sale of business. Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. What is a deferred gain on a balance sheet?

What Is Deferred Revenue? Complete Guide Pareto Labs

What is a deferred gain on a balance sheet? Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. The internal revenue service allows taxes on gains from the sale of business.

What Is a Deferred Gain on a Balance Sheet? Bizfluent

The internal revenue service allows taxes on gains from the sale of business. What is a deferred gain on a balance sheet? Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance.

Understanding Negative Balances in Your Financial Statements Fortiviti

What is a deferred gain on a balance sheet? Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. The internal revenue service allows taxes on gains from the sale of business.

The Internal Revenue Service Allows Taxes On Gains From The Sale Of Business.

Asc 740 provides specific guidance for the balance sheet presentation of deferred tax accounts and any related valuation allowance. What is a deferred gain on a balance sheet?

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)