Deferred Revenue On Balance Sheet - Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big web. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. On the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. On august 31, the company would record revenue of $100 on the. Also called unearned revenue, it appears as a liability on.

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. On august 31, the company would record revenue of $100 on the. On the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big web. Also called unearned revenue, it appears as a liability on.

Also called unearned revenue, it appears as a liability on. On the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big web. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. On august 31, the company would record revenue of $100 on the. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income.

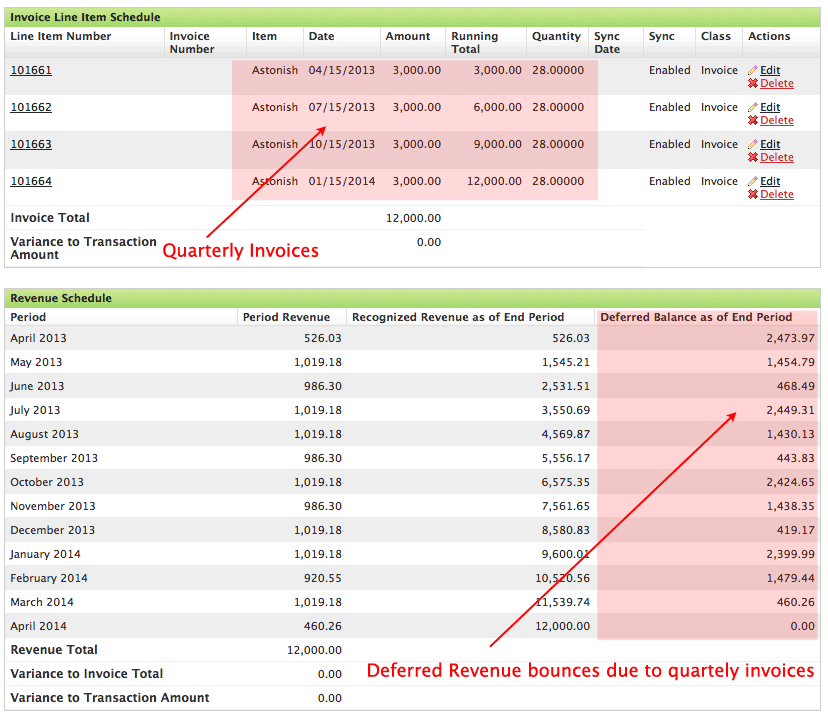

What is Deferred Revenue in a SaaS Business? SaaSOptics

Also called unearned revenue, it appears as a liability on. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big web. On august 31, the company would record revenue of $100 on the. Deferred revenue is recorded as a liability on the balance sheet,.

How To Record SaaS Deferred Revenue? FreeCashFlow.io

On august 31, the company would record revenue of $100 on the. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big web. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer.

How To Record SaaS Deferred Revenue? FreeCashFlow.io

Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big web. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Also called unearned revenue, it appears as a liability on. When a customer prepays.

What is Deferred Revenue? The Ultimate Guide (2022)

Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Deferred revenue is recorded as a liability on the balance.

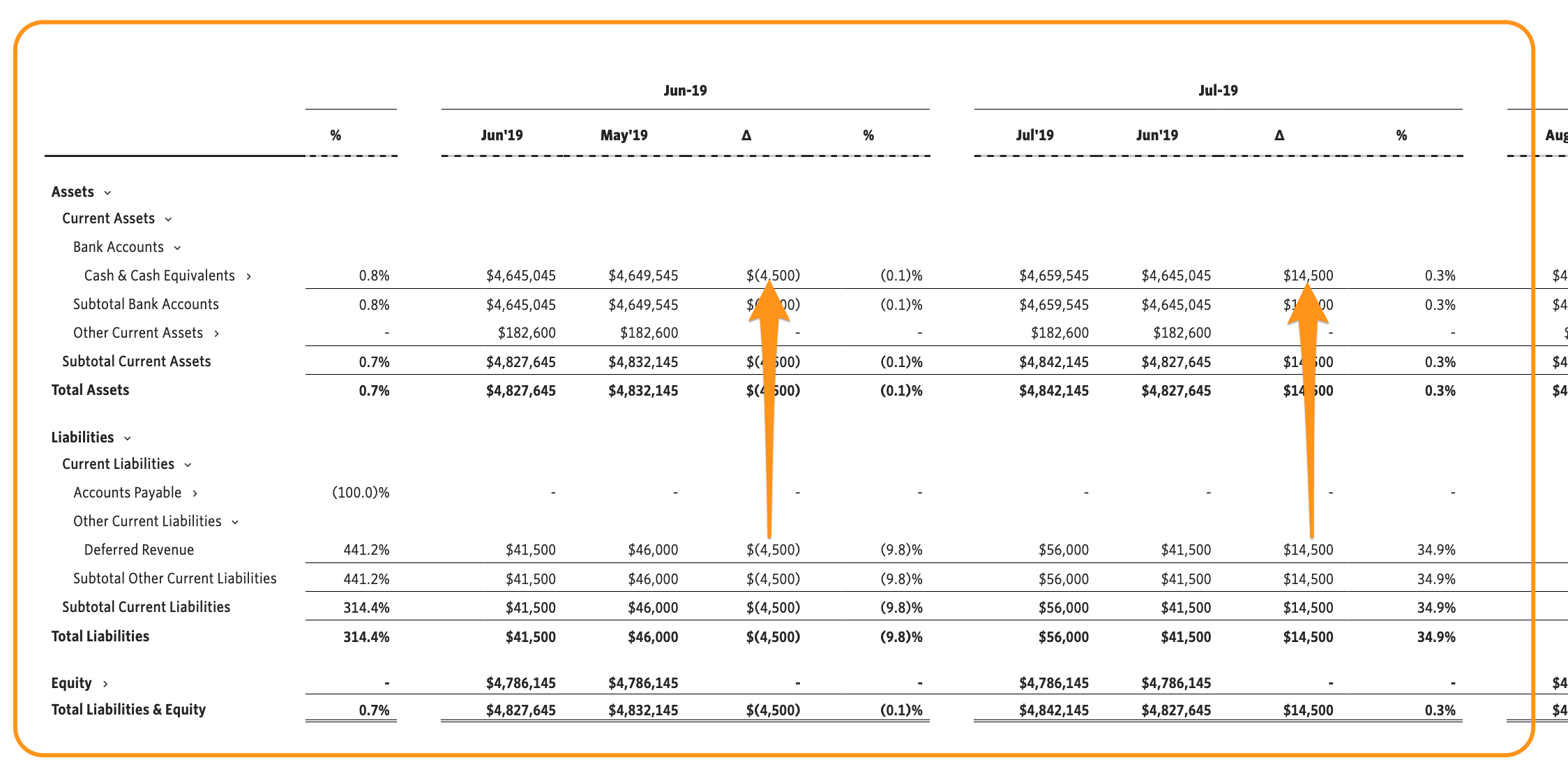

Simple Deferred Revenue with Jirav Pro

When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Also called unearned revenue, it appears as a liability on. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers.

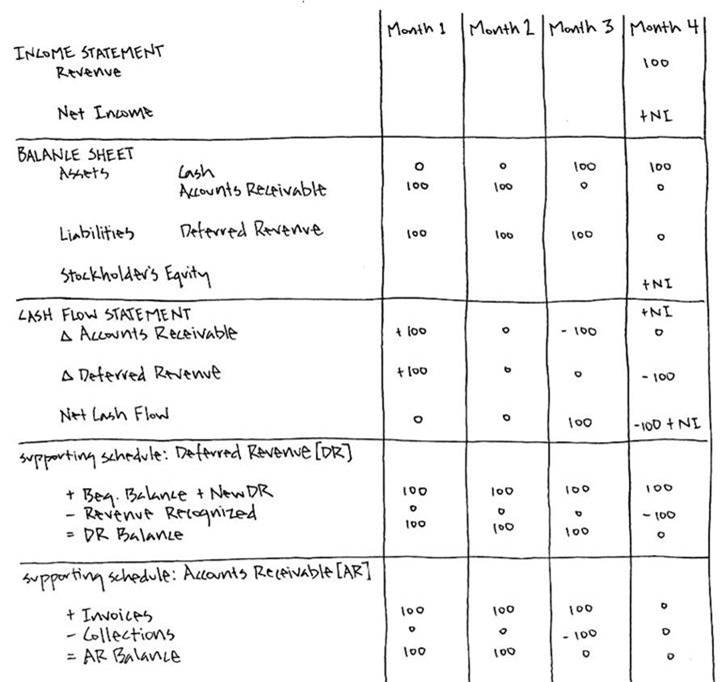

Deferred Revenue A Simple Model

On august 31, the company would record revenue of $100 on the. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Also called unearned revenue, it appears as a liability on. On the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be.

Deferred Revenue Accounting, Definition, Example

On august 31, the company would record revenue of $100 on the. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on.

What Is Deferred Revenue? Complete Guide Pareto Labs

On the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Also called unearned revenue, it appears as a liability on. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. On august.

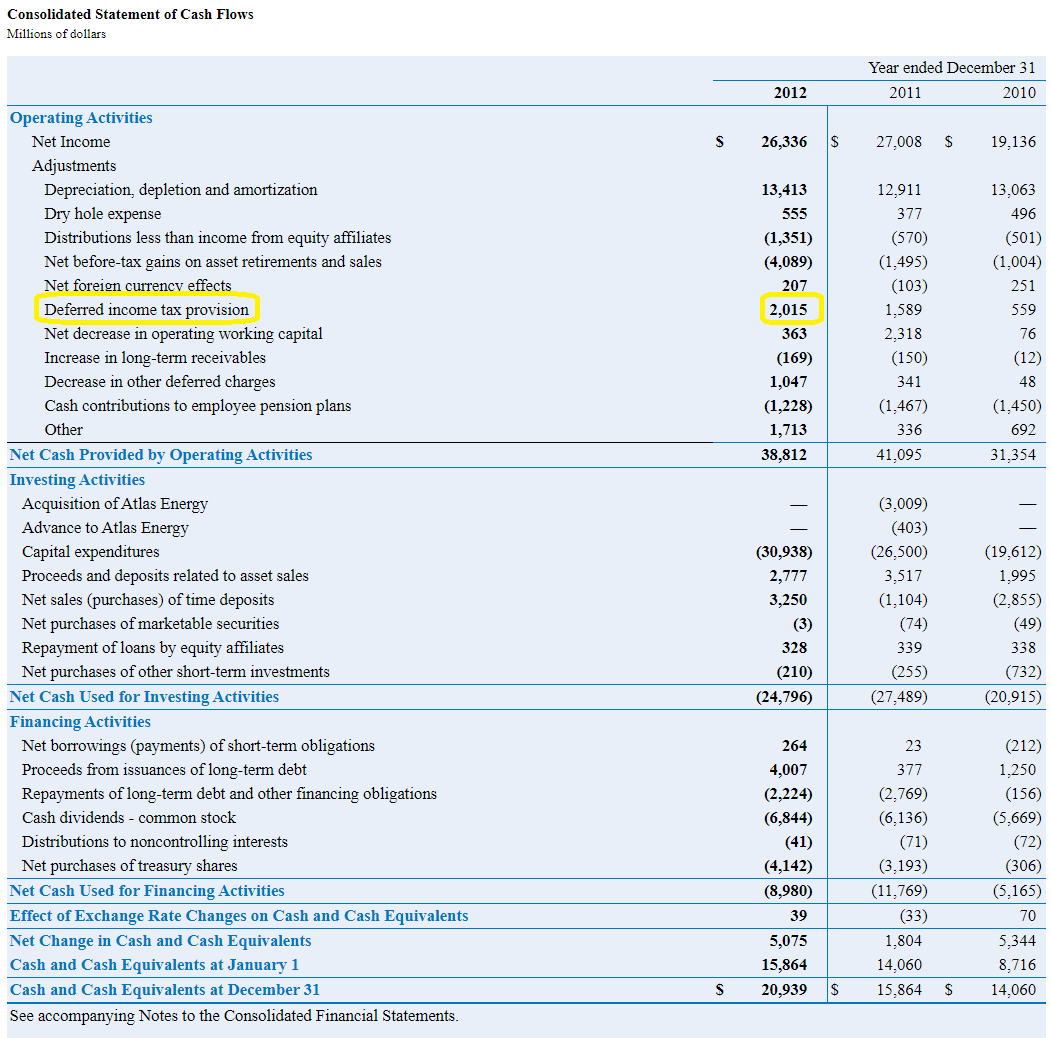

Deferred Tax Liabilities Explained (with RealLife Example in a

Also called unearned revenue, it appears as a liability on. On the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big web. On august 31,.

Deferred Revenue Debit or Credit and its Flow Through the Financials

When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Also called unearned revenue, it appears as a liability on. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to.

When A Customer Prepays For Goods Or Services, The Business Must Record The Receipt Of Cash As Deferred Revenue On The Balance Sheet And Only Recognize The Revenue On The Income.

On august 31, the company would record revenue of $100 on the. On the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Also called unearned revenue, it appears as a liability on. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big web.

Deferred Revenue Is Recorded As A Liability On The Balance Sheet, Since The Company Has An Unmet Obligation To The Customer Until The Product Or Service Is Delivered.

Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered.