Deferred Revenue On The Balance Sheet - Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or.

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or.

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or.

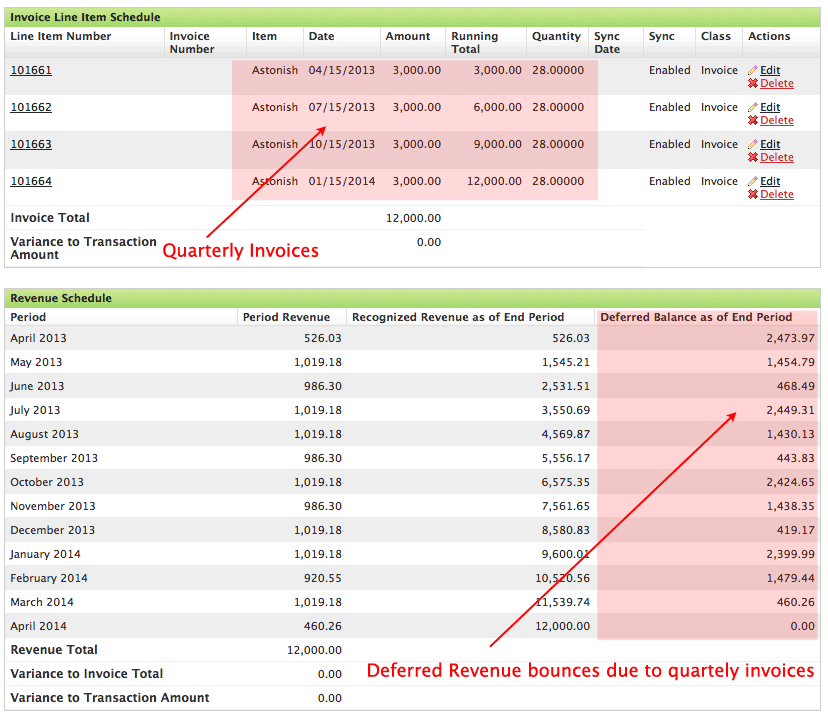

What is Deferred Revenue in a SaaS Business? SaaSOptics

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or.

How To Create a SaaS Financial Model For Forecasting Performance

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or.

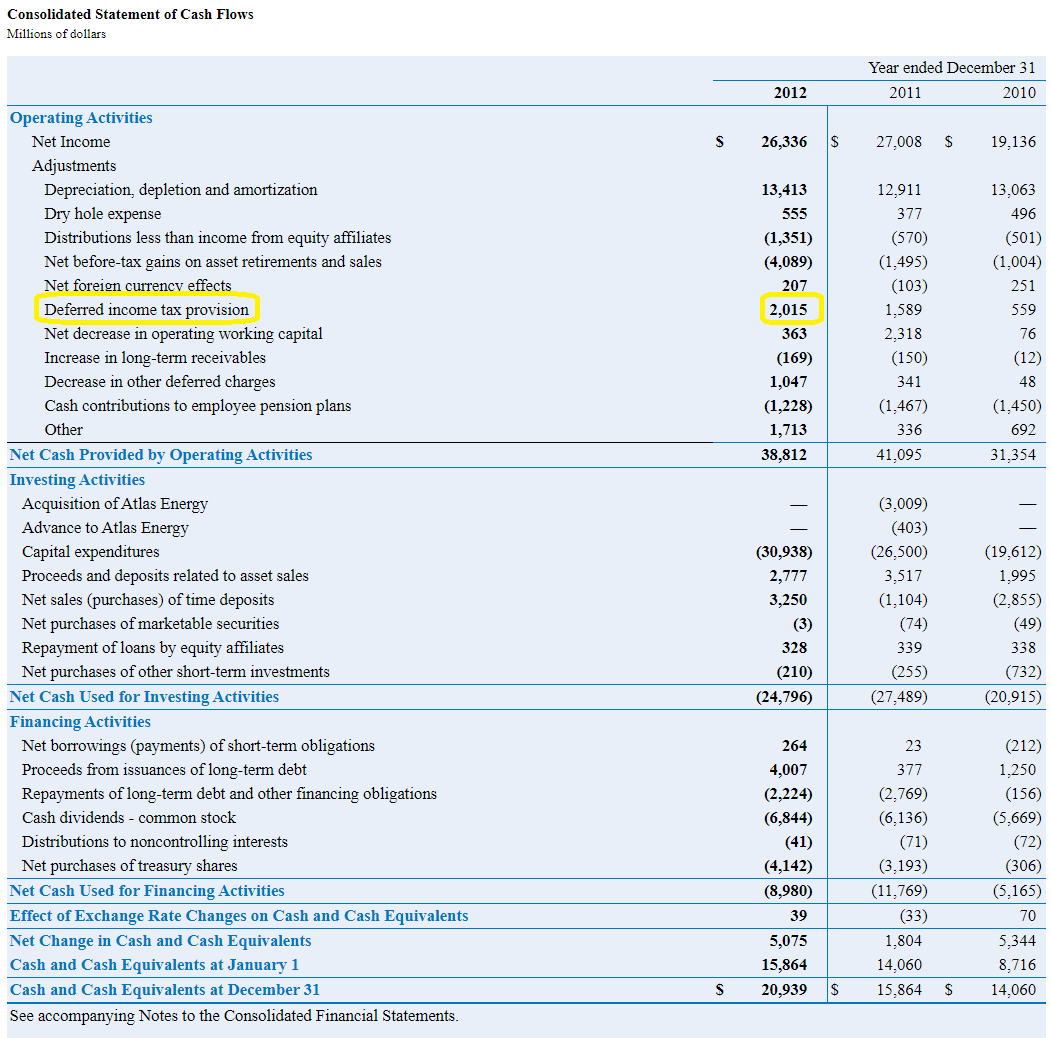

Deferred Revenue Debit or Credit and its Flow Through the Financials

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or.

Deferred Tax Liabilities Explained (with RealLife Example in a

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or.

What is Deferred Revenue? The Ultimate Guide (2022)

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or.

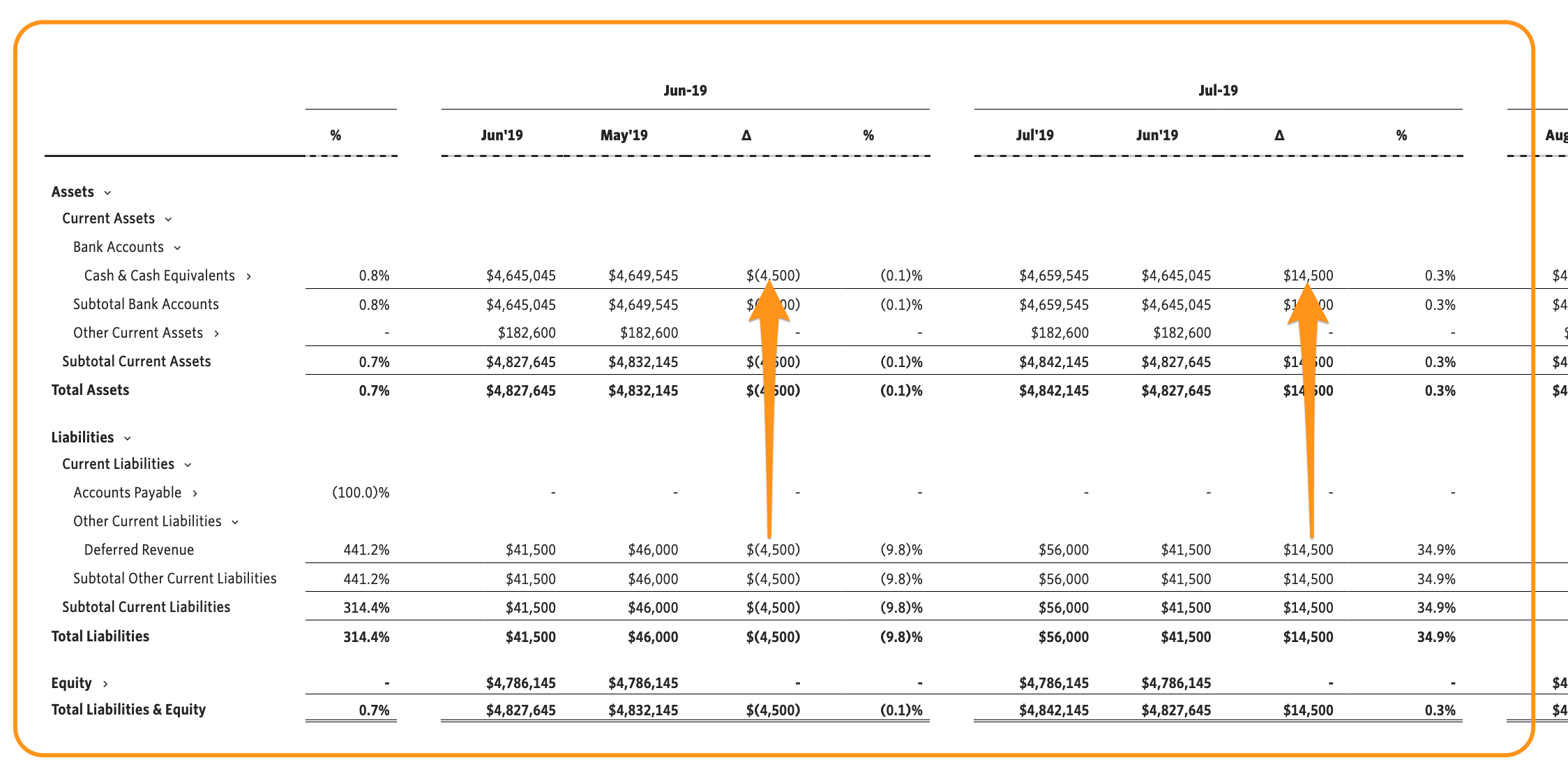

What Is Deferred Revenue? Complete Guide Pareto Labs

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or.

Simple Deferred Revenue with Jirav Pro

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or.

How To Record SaaS Deferred Revenue? FreeCashFlow.io

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or.

What Is Unearned Revenue? QuickBooks Global

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or.