Delinquent Tax Warrant - It’s often one of the first steps that occur before a tax lien or. All delinquent debt is subject to having. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? A tax warrant, by contrast, functions more like a formal notice of tax delinquency. The judicial sale of land for delinquent taxes is allowed under the provisions of virginia code section 58.1. The duty of the tax enforcement team in the tax administration division of the finance. Sale of property for delinquent taxes.

What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? The judicial sale of land for delinquent taxes is allowed under the provisions of virginia code section 58.1. All delinquent debt is subject to having. A tax warrant, by contrast, functions more like a formal notice of tax delinquency. Sale of property for delinquent taxes. The duty of the tax enforcement team in the tax administration division of the finance. It’s often one of the first steps that occur before a tax lien or.

What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? A tax warrant, by contrast, functions more like a formal notice of tax delinquency. All delinquent debt is subject to having. The judicial sale of land for delinquent taxes is allowed under the provisions of virginia code section 58.1. Sale of property for delinquent taxes. The duty of the tax enforcement team in the tax administration division of the finance. It’s often one of the first steps that occur before a tax lien or.

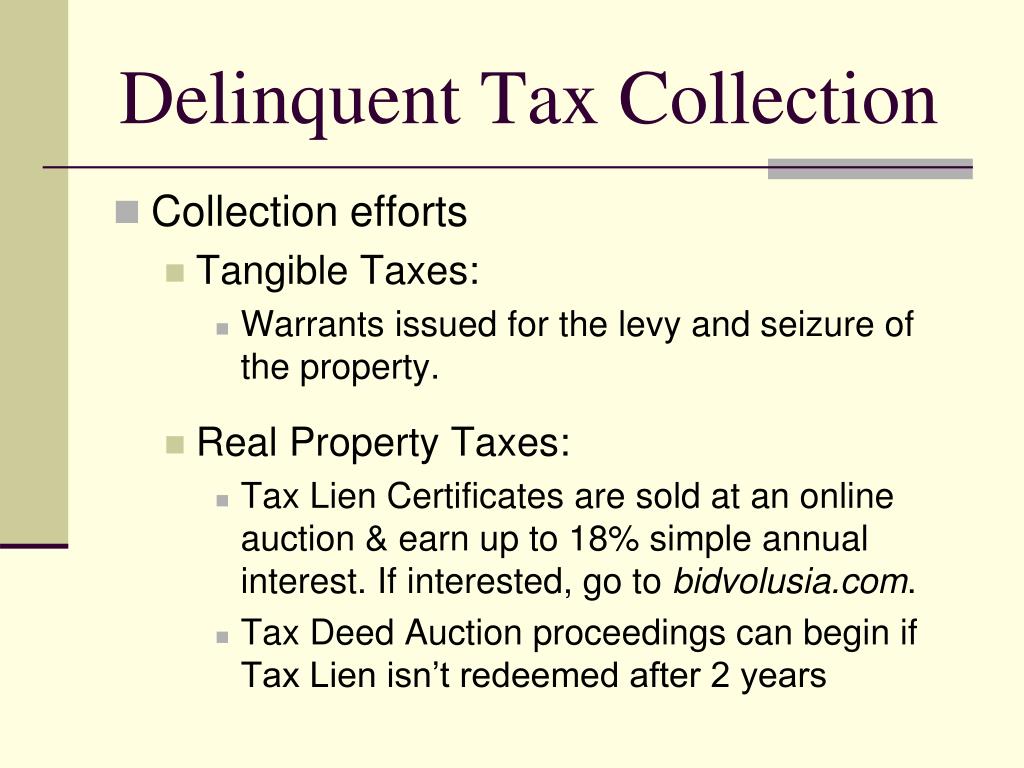

PPT Volusia County PowerPoint Presentation, free download ID5010276

Sale of property for delinquent taxes. A tax warrant, by contrast, functions more like a formal notice of tax delinquency. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? All delinquent debt is subject to having. It’s often one of the first steps that occur before a tax lien or.

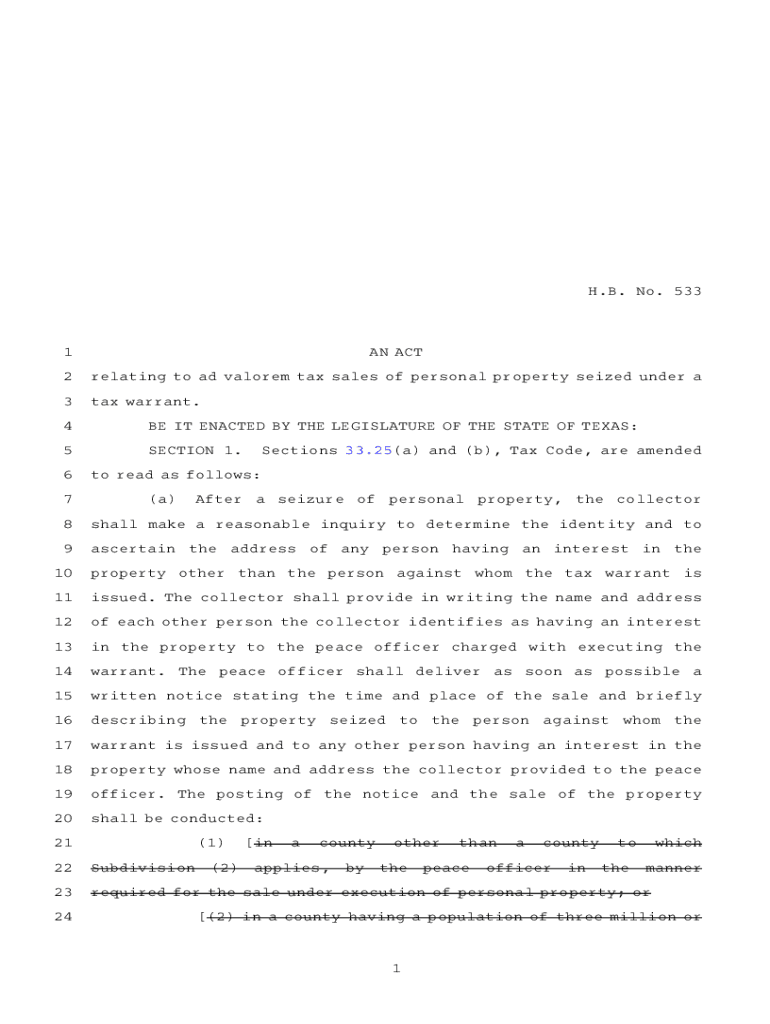

Fillable Online What Every Lawyer Should Know About Delinquent Tax

What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? All delinquent debt is subject to having. The judicial sale of land for delinquent taxes is allowed under the provisions of virginia code section 58.1. Sale of property for delinquent taxes. A tax warrant, by contrast, functions more like a formal notice of.

Delinquent Real Estate Tax List For 2022 — County of Meade

What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? The judicial sale of land for delinquent taxes is allowed under the provisions of virginia code section 58.1. All delinquent debt is subject to having. The duty of the tax enforcement team in the tax administration division of the finance. A tax warrant,.

What is the Delinquent Tax Revolving Fund, and how does it works

A tax warrant, by contrast, functions more like a formal notice of tax delinquency. The duty of the tax enforcement team in the tax administration division of the finance. Sale of property for delinquent taxes. It’s often one of the first steps that occur before a tax lien or. What is a tax warrant and when does the wisconsin department.

Everything You Need To Know About Getting Your County's "Delinquent Tax

Sale of property for delinquent taxes. The judicial sale of land for delinquent taxes is allowed under the provisions of virginia code section 58.1. A tax warrant, by contrast, functions more like a formal notice of tax delinquency. It’s often one of the first steps that occur before a tax lien or. All delinquent debt is subject to having.

Tax Preparation and Accounting Services Accounting and Tax Services

What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? The judicial sale of land for delinquent taxes is allowed under the provisions of virginia code section 58.1. A tax warrant, by contrast, functions more like a formal notice of tax delinquency. Sale of property for delinquent taxes. All delinquent debt is subject.

Everything You Need To Know About Getting Your County's "Delinquent Tax

The duty of the tax enforcement team in the tax administration division of the finance. It’s often one of the first steps that occur before a tax lien or. A tax warrant, by contrast, functions more like a formal notice of tax delinquency. All delinquent debt is subject to having. Sale of property for delinquent taxes.

Teknosis Unlawful Delinquent Tax Warrants, State of Wisconsin / Leo

All delinquent debt is subject to having. The judicial sale of land for delinquent taxes is allowed under the provisions of virginia code section 58.1. Sale of property for delinquent taxes. The duty of the tax enforcement team in the tax administration division of the finance. What is a tax warrant and when does the wisconsin department of revenue file.

What delinquent collection methods does the Treasurer's Office use

What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? The duty of the tax enforcement team in the tax administration division of the finance. Sale of property for delinquent taxes. The judicial sale of land for delinquent taxes is allowed under the provisions of virginia code section 58.1. A tax warrant, by.

Tax Warrants Sandhenge Publications

A tax warrant, by contrast, functions more like a formal notice of tax delinquency. All delinquent debt is subject to having. It’s often one of the first steps that occur before a tax lien or. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? Sale of property for delinquent taxes.

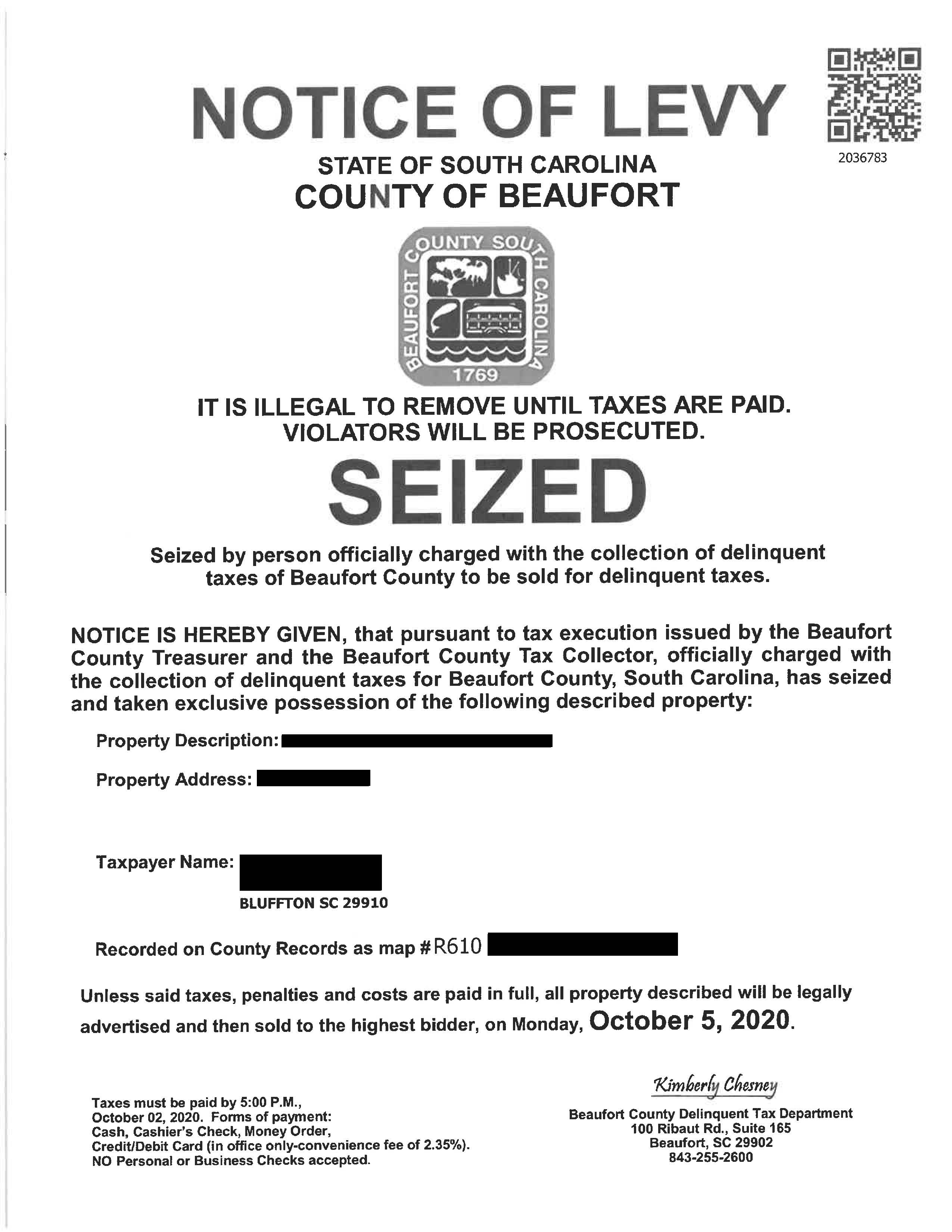

Sale Of Property For Delinquent Taxes.

The duty of the tax enforcement team in the tax administration division of the finance. A tax warrant, by contrast, functions more like a formal notice of tax delinquency. All delinquent debt is subject to having. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant?

The Judicial Sale Of Land For Delinquent Taxes Is Allowed Under The Provisions Of Virginia Code Section 58.1.

It’s often one of the first steps that occur before a tax lien or.