Does Depreciation Go On The Balance Sheet - Depreciation expense itself does not appear as a separate line item on the balance sheet. Instead, it affects the value of the asset. When an asset is sold or retired, its cost and accumulated depreciation are removed from the balance sheet.

Depreciation expense itself does not appear as a separate line item on the balance sheet. Instead, it affects the value of the asset. When an asset is sold or retired, its cost and accumulated depreciation are removed from the balance sheet.

Instead, it affects the value of the asset. Depreciation expense itself does not appear as a separate line item on the balance sheet. When an asset is sold or retired, its cost and accumulated depreciation are removed from the balance sheet.

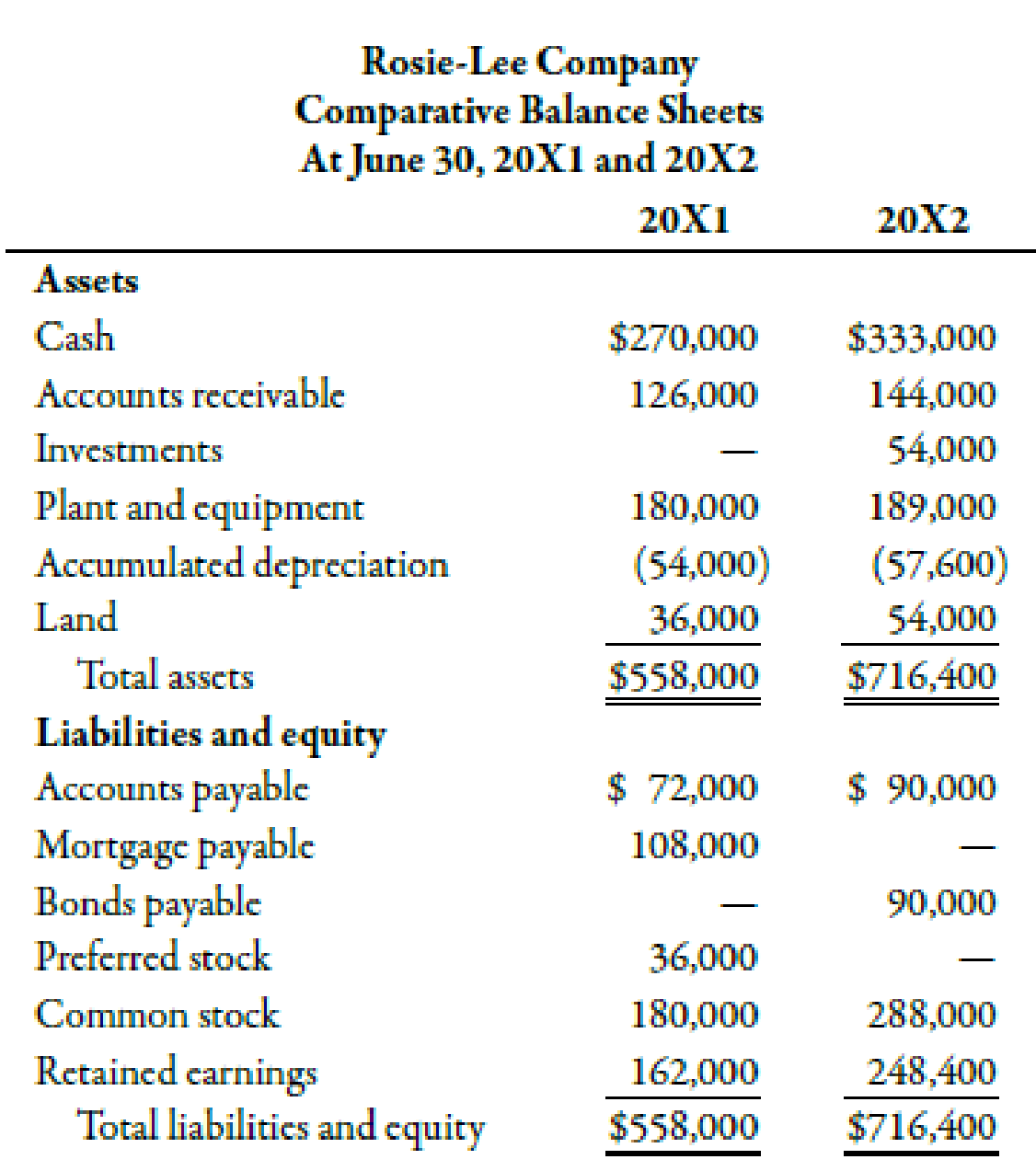

Where Is Accumulated Depreciation on the Balance Sheet?

When an asset is sold or retired, its cost and accumulated depreciation are removed from the balance sheet. Depreciation expense itself does not appear as a separate line item on the balance sheet. Instead, it affects the value of the asset.

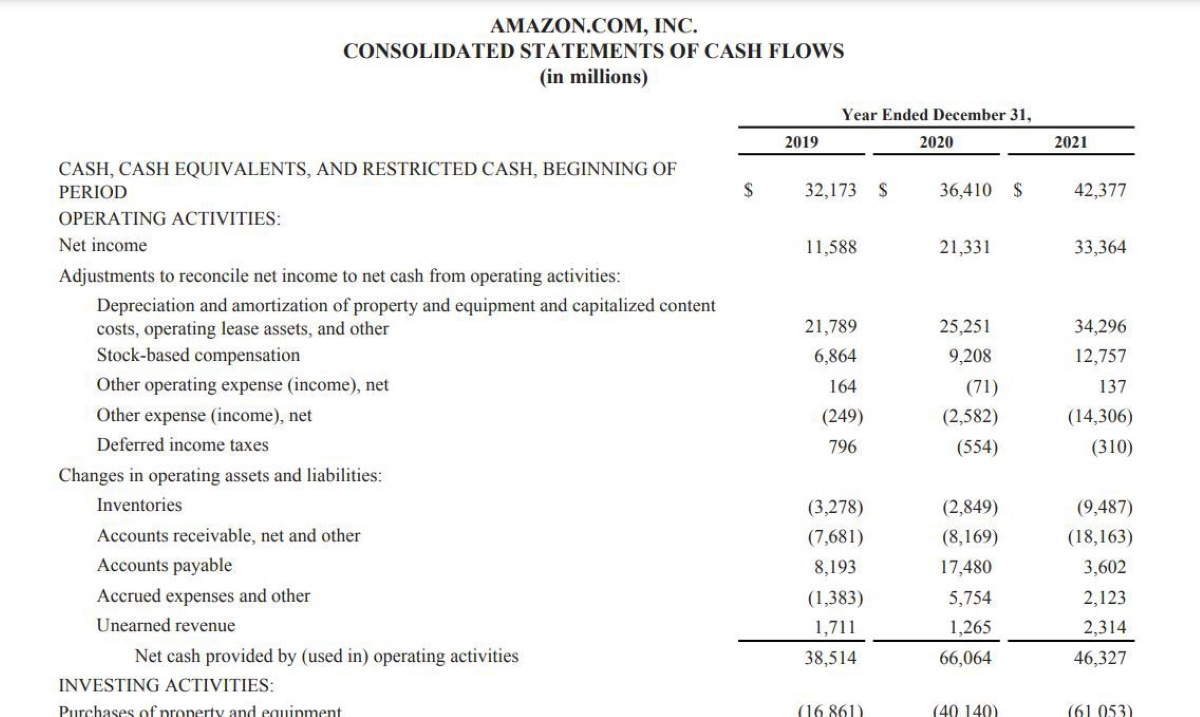

Depreciation

Depreciation expense itself does not appear as a separate line item on the balance sheet. Instead, it affects the value of the asset. When an asset is sold or retired, its cost and accumulated depreciation are removed from the balance sheet.

Balance Sheet Example With Depreciation

Depreciation expense itself does not appear as a separate line item on the balance sheet. When an asset is sold or retired, its cost and accumulated depreciation are removed from the balance sheet. Instead, it affects the value of the asset.

Balance Sheet Example With Depreciation

Depreciation expense itself does not appear as a separate line item on the balance sheet. When an asset is sold or retired, its cost and accumulated depreciation are removed from the balance sheet. Instead, it affects the value of the asset.

Balance Sheet Example With Depreciation

Depreciation expense itself does not appear as a separate line item on the balance sheet. When an asset is sold or retired, its cost and accumulated depreciation are removed from the balance sheet. Instead, it affects the value of the asset.

Where Does Depreciation Expense Go On A Balance Sheet LiveWell

Depreciation expense itself does not appear as a separate line item on the balance sheet. Instead, it affects the value of the asset. When an asset is sold or retired, its cost and accumulated depreciation are removed from the balance sheet.

Where Does Depreciation Expense Go On A Balance Sheet LiveWell

Depreciation expense itself does not appear as a separate line item on the balance sheet. When an asset is sold or retired, its cost and accumulated depreciation are removed from the balance sheet. Instead, it affects the value of the asset.

How do you account for depreciation on a balance sheet? Leia aqui Is

When an asset is sold or retired, its cost and accumulated depreciation are removed from the balance sheet. Depreciation expense itself does not appear as a separate line item on the balance sheet. Instead, it affects the value of the asset.

Balance Sheet Example With Depreciation

When an asset is sold or retired, its cost and accumulated depreciation are removed from the balance sheet. Depreciation expense itself does not appear as a separate line item on the balance sheet. Instead, it affects the value of the asset.

Where Does Depreciation Expense Go On A Balance Sheet LiveWell

Depreciation expense itself does not appear as a separate line item on the balance sheet. When an asset is sold or retired, its cost and accumulated depreciation are removed from the balance sheet. Instead, it affects the value of the asset.

Depreciation Expense Itself Does Not Appear As A Separate Line Item On The Balance Sheet.

When an asset is sold or retired, its cost and accumulated depreciation are removed from the balance sheet. Instead, it affects the value of the asset.