Double Calendar Spread - A double calendar option spread is an advanced trading strategy that combines two calendar spreads—one with calls and another. See examples of profitable and losing. Learn how to set up, manage and adjust double calendar spreads, a long vega option trading strategy that involves selling near and. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush.

See examples of profitable and losing. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. Learn how to set up, manage and adjust double calendar spreads, a long vega option trading strategy that involves selling near and. A double calendar option spread is an advanced trading strategy that combines two calendar spreads—one with calls and another.

A double calendar option spread is an advanced trading strategy that combines two calendar spreads—one with calls and another. See examples of profitable and losing. Learn how to set up, manage and adjust double calendar spreads, a long vega option trading strategy that involves selling near and. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush.

Double Calendar Spreads

A double calendar option spread is an advanced trading strategy that combines two calendar spreads—one with calls and another. See examples of profitable and losing. Learn how to set up, manage and adjust double calendar spreads, a long vega option trading strategy that involves selling near and. Learn how to trade double calendar spreads (dcs) around earnings to take advantage.

Double Calendar Spread Options Infographic Poster

A double calendar option spread is an advanced trading strategy that combines two calendar spreads—one with calls and another. See examples of profitable and losing. Learn how to set up, manage and adjust double calendar spreads, a long vega option trading strategy that involves selling near and. Learn how to trade double calendar spreads (dcs) around earnings to take advantage.

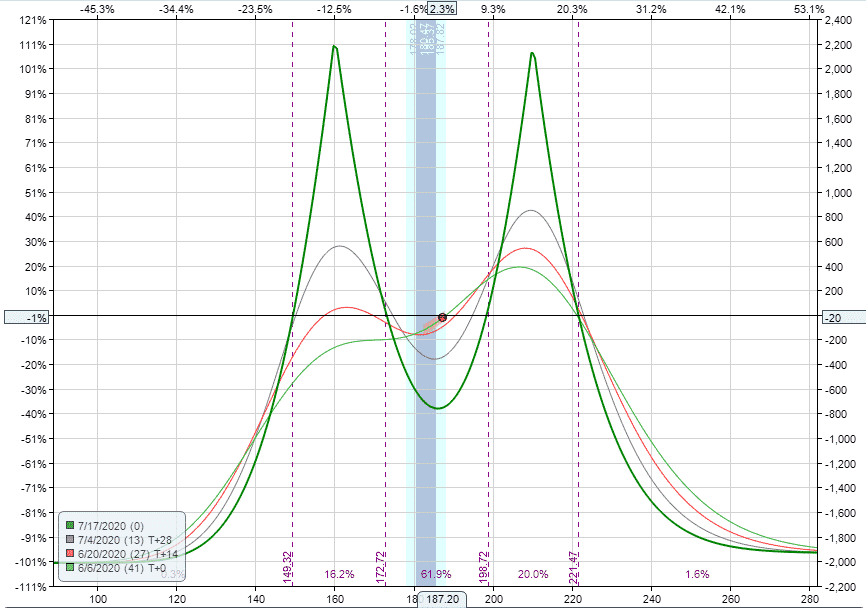

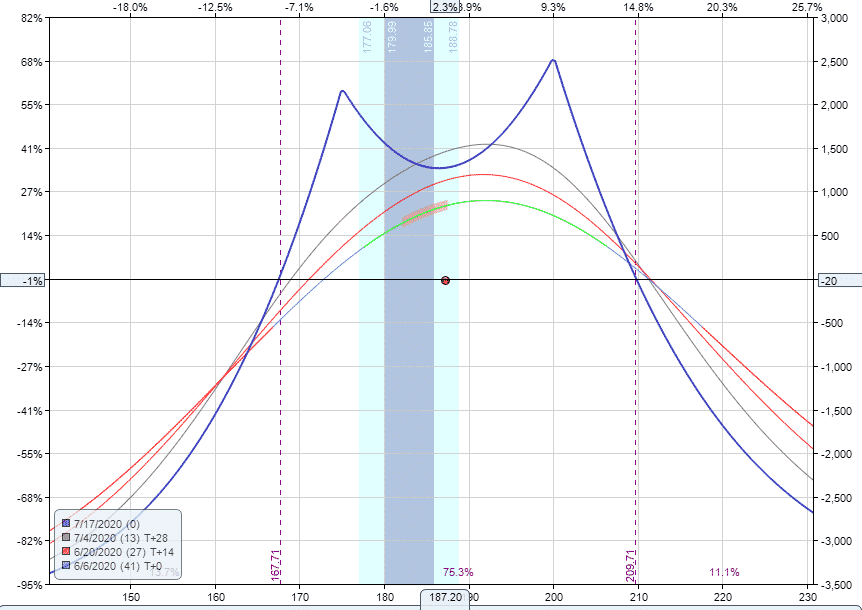

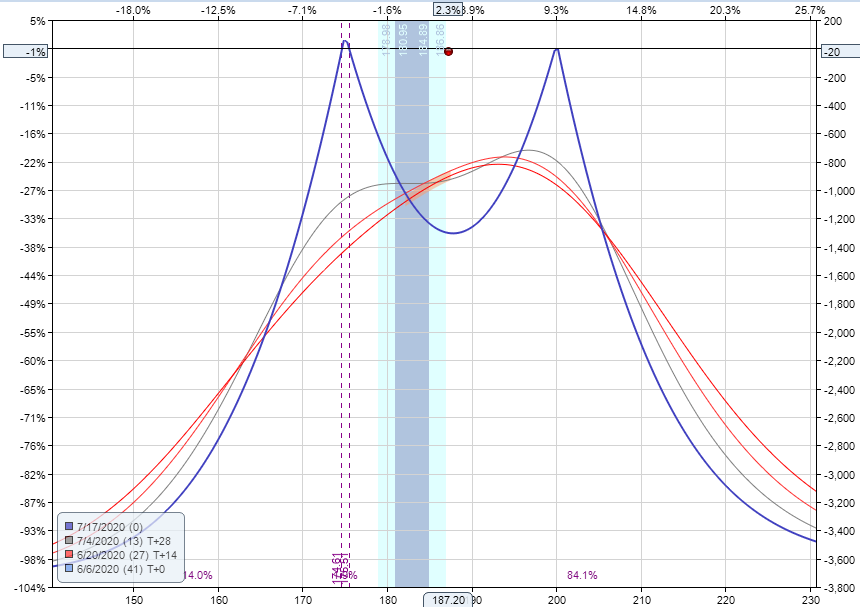

Double Calendar Spread Adjustment videos link in Description

See examples of profitable and losing. A double calendar option spread is an advanced trading strategy that combines two calendar spreads—one with calls and another. Learn how to set up, manage and adjust double calendar spreads, a long vega option trading strategy that involves selling near and. Learn how to trade double calendar spreads (dcs) around earnings to take advantage.

Double Calendar Spreads Ultimate Guide With Examples

A double calendar option spread is an advanced trading strategy that combines two calendar spreads—one with calls and another. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. See examples of profitable and losing. Learn how to set up, manage and adjust double calendar spreads, a long vega option trading strategy that.

Calendar and Double Calendar Spreads

A double calendar option spread is an advanced trading strategy that combines two calendar spreads—one with calls and another. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. Learn how to set up, manage and adjust double calendar spreads, a long vega option trading strategy that involves selling near and. See examples.

Pin on Option strategies

Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. Learn how to set up, manage and adjust double calendar spreads, a long vega option trading strategy that involves selling near and. See examples of profitable and losing. A double calendar option spread is an advanced trading strategy that combines two calendar spreads—one.

What Is A Calendar Spread Option Strategy Mab Millicent

Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. See examples of profitable and losing. Learn how to set up, manage and adjust double calendar spreads, a long vega option trading strategy that involves selling near and. A double calendar option spread is an advanced trading strategy that combines two calendar spreads—one.

Double Calendar Spreads Ultimate Guide With Examples

Learn how to set up, manage and adjust double calendar spreads, a long vega option trading strategy that involves selling near and. A double calendar option spread is an advanced trading strategy that combines two calendar spreads—one with calls and another. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. See examples.

Double Calendar Spreads Ultimate Guide With Examples

See examples of profitable and losing. A double calendar option spread is an advanced trading strategy that combines two calendar spreads—one with calls and another. Learn how to set up, manage and adjust double calendar spreads, a long vega option trading strategy that involves selling near and. Learn how to trade double calendar spreads (dcs) around earnings to take advantage.

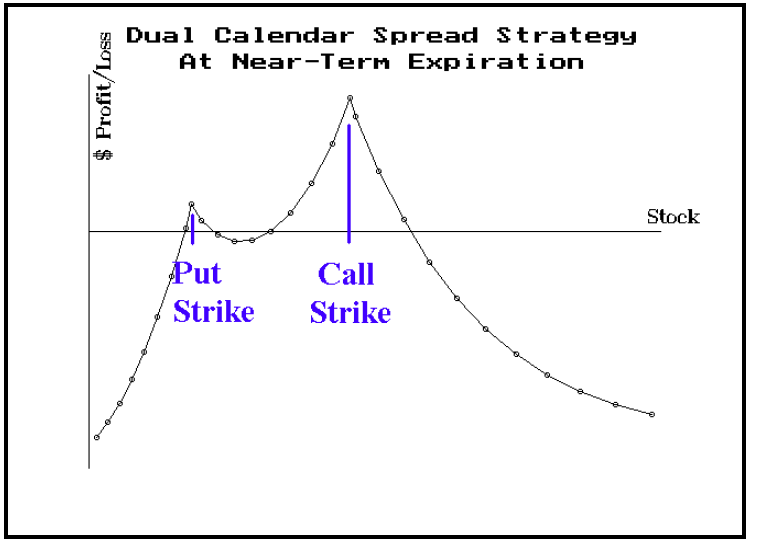

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

See examples of profitable and losing. Learn how to set up, manage and adjust double calendar spreads, a long vega option trading strategy that involves selling near and. Learn how to trade double calendar spreads (dcs) around earnings to take advantage of a volatility crush. A double calendar option spread is an advanced trading strategy that combines two calendar spreads—one.

Learn How To Trade Double Calendar Spreads (Dcs) Around Earnings To Take Advantage Of A Volatility Crush.

Learn how to set up, manage and adjust double calendar spreads, a long vega option trading strategy that involves selling near and. A double calendar option spread is an advanced trading strategy that combines two calendar spreads—one with calls and another. See examples of profitable and losing.