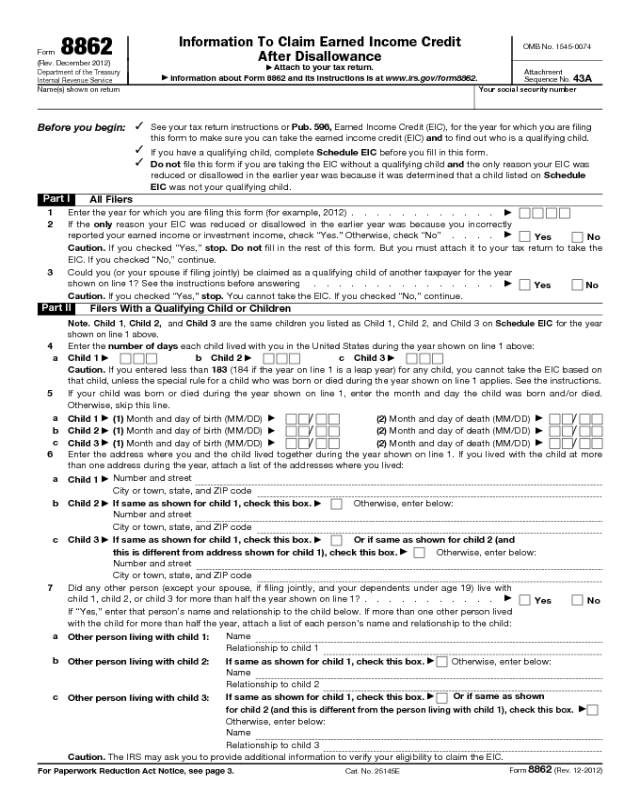

Form 8862 Printable - You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Their earned income credit (eic), child tax credit (ctc)/additional. Taxpayers complete form 8862 and attach it to their tax return if: Download or print the 2024 federal (information to claim earned income credit after disallowance) (2024) and other income tax forms from the. You must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the.

You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. You must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the. Taxpayers complete form 8862 and attach it to their tax return if: Download or print the 2024 federal (information to claim earned income credit after disallowance) (2024) and other income tax forms from the. Their earned income credit (eic), child tax credit (ctc)/additional.

Taxpayers complete form 8862 and attach it to their tax return if: You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. You must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the. Their earned income credit (eic), child tax credit (ctc)/additional. Download or print the 2024 federal (information to claim earned income credit after disallowance) (2024) and other income tax forms from the.

8862 Tax Form Fill and Sign Printable Template Online US Legal Forms

Their earned income credit (eic), child tax credit (ctc)/additional. Taxpayers complete form 8862 and attach it to their tax return if: You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Download or print the 2024 federal (information to claim earned income.

Top 14 Form 8862 Templates free to download in PDF format

Their earned income credit (eic), child tax credit (ctc)/additional. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Download or print the 2024 federal (information to claim earned income credit after disallowance) (2024) and other income tax forms from the. You.

Irs Form 8862 Printable Master of Documents

Their earned income credit (eic), child tax credit (ctc)/additional. You must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria..

What Is IRS Form 8862?

Taxpayers complete form 8862 and attach it to their tax return if: Download or print the 2024 federal (information to claim earned income credit after disallowance) (2024) and other income tax forms from the. You must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the. Their earned income.

Form 8862 For 2019 PERINGKAT

Taxpayers complete form 8862 and attach it to their tax return if: You must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the. Download or print the 2024 federal (information to claim earned income credit after disallowance) (2024) and other income tax forms from the. You must complete.

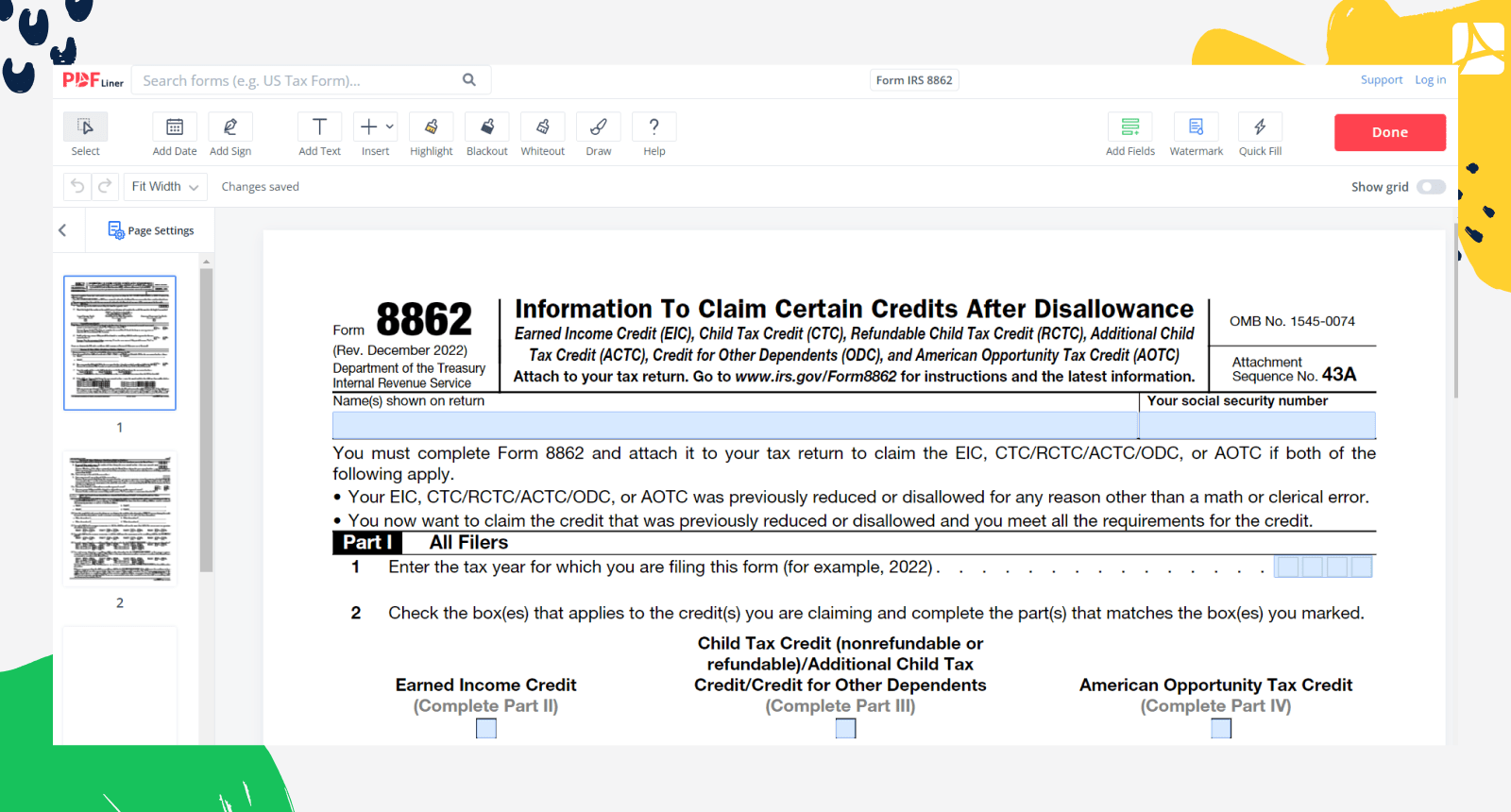

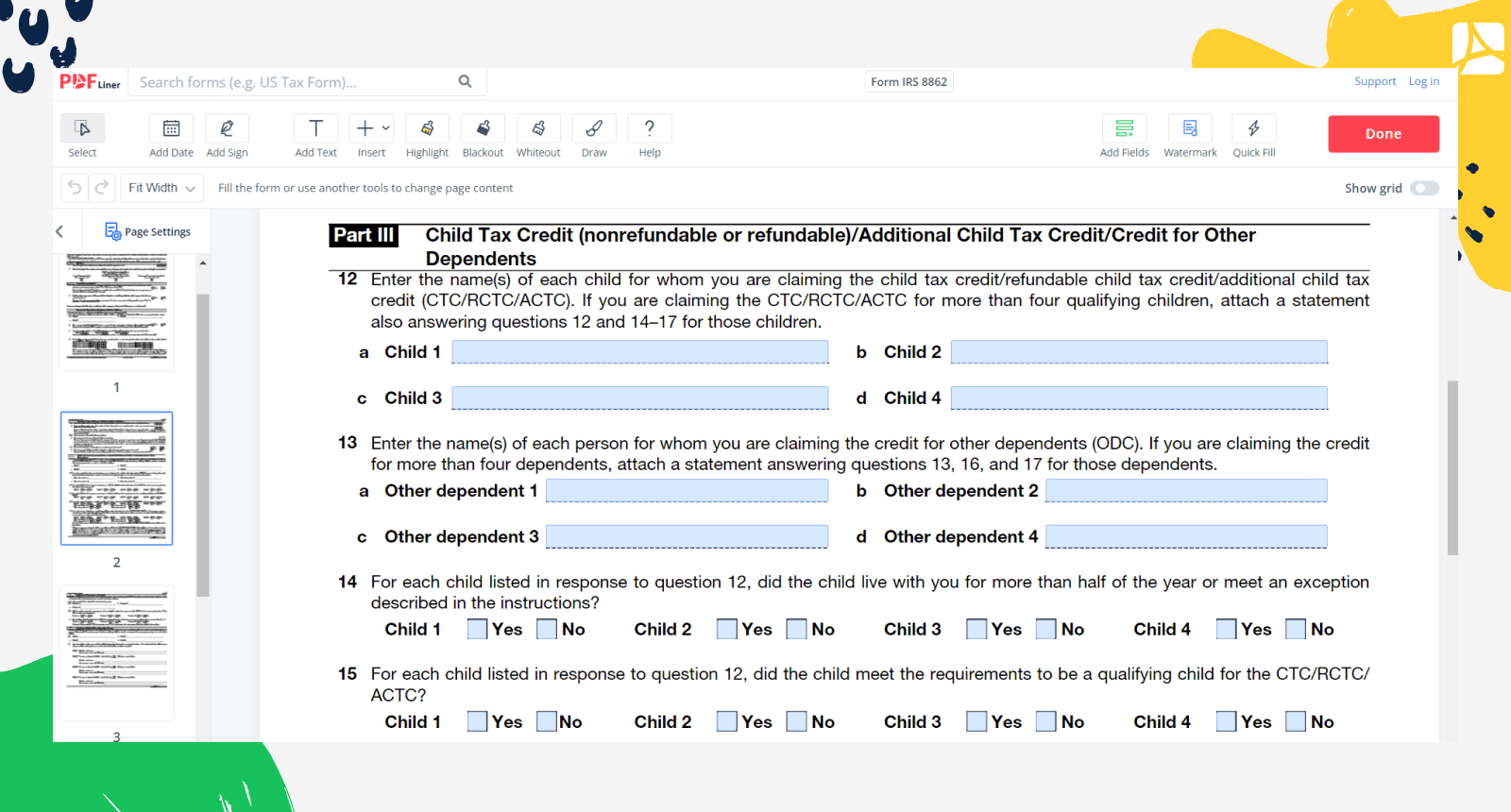

Form IRS 8862 Printable and Fillable forms online — PDFliner

Their earned income credit (eic), child tax credit (ctc)/additional. Taxpayers complete form 8862 and attach it to their tax return if: You must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the. Download or print the 2024 federal (information to claim earned income credit after disallowance) (2024) and.

Form IRS 8862 Printable and Fillable forms online — PDFliner

Their earned income credit (eic), child tax credit (ctc)/additional. You must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the. Taxpayers complete form 8862 and attach it to their tax return if: You must complete form 8862 and attach it to your tax return to claim the eic,.

Fill Free fillable Form 8862 Information To Claim Certain Credits After (IRS) PDF form

You must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the. Taxpayers complete form 8862 and attach it to their tax return if: Download or print the 2024 federal (information to claim earned income credit after disallowance) (2024) and other income tax forms from the. You must complete.

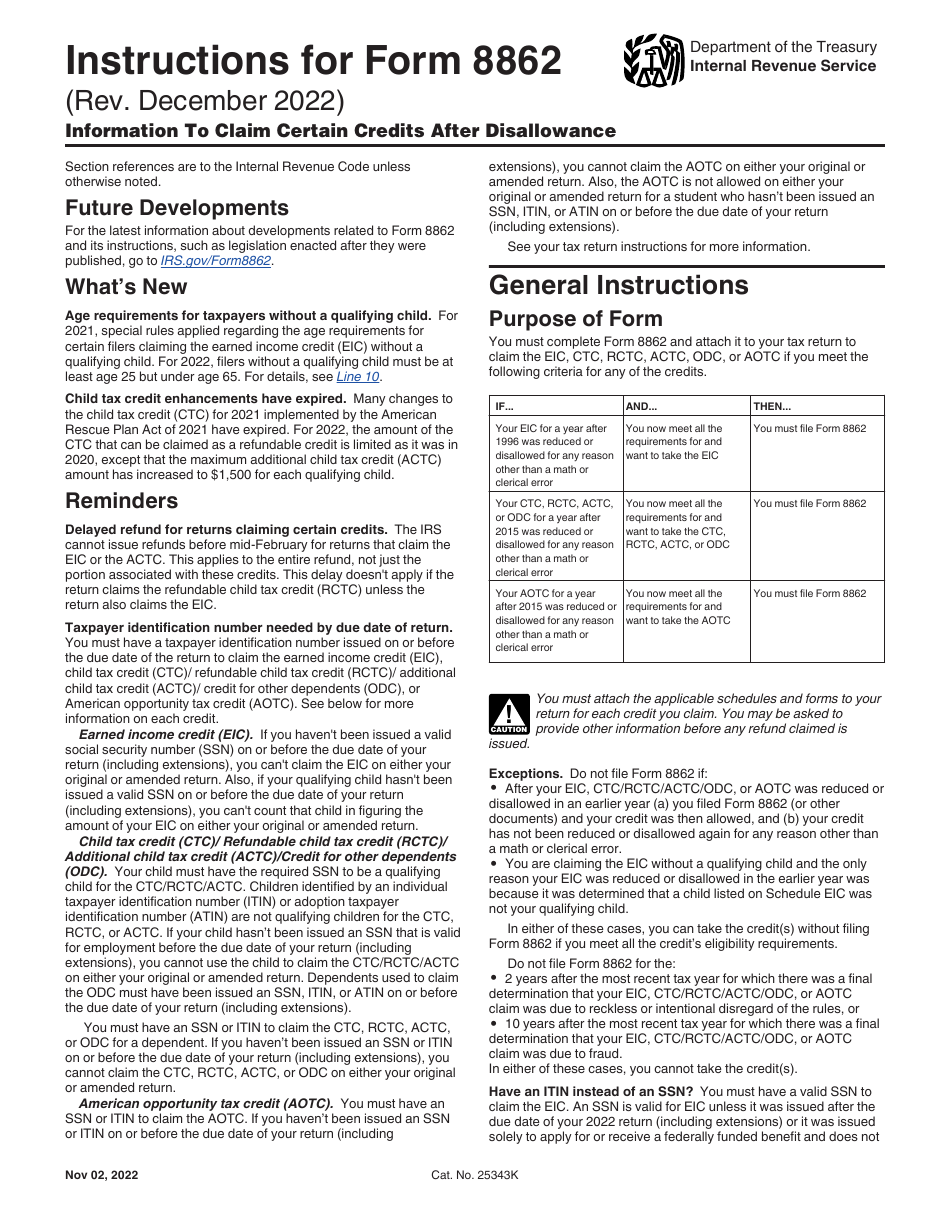

Download Instructions for IRS Form 8862 Information to Claim Certain Credits After Disallowance

Their earned income credit (eic), child tax credit (ctc)/additional. You must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria..

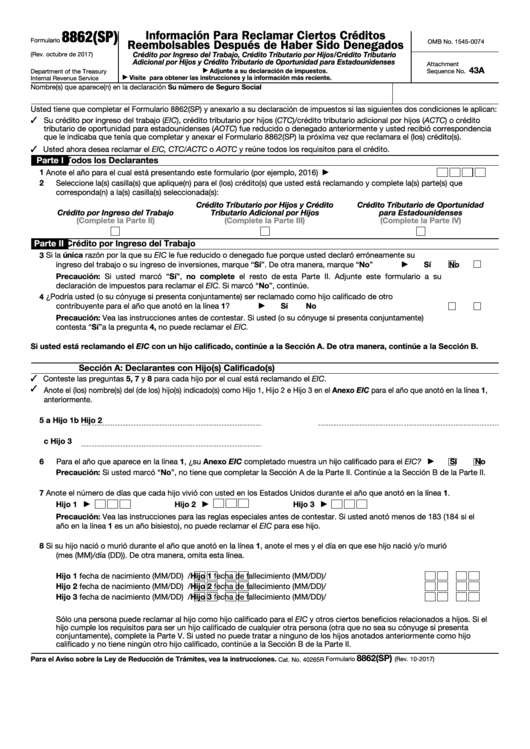

Top 14 Form 8862 Templates free to download in PDF format

Their earned income credit (eic), child tax credit (ctc)/additional. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Taxpayers complete form 8862 and attach it to their tax return if: Download or print the 2024 federal (information to claim earned income.

You Must Complete Form 8862 And Attach It To Your Tax Return To Claim The Eic, Ctc/Rctc/Actc/Odc, Or Aotc If Both Of The.

You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Download or print the 2024 federal (information to claim earned income credit after disallowance) (2024) and other income tax forms from the. Taxpayers complete form 8862 and attach it to their tax return if: Their earned income credit (eic), child tax credit (ctc)/additional.

:max_bytes(150000):strip_icc()/2022-01-1111_48_02-Form8862Rev.December2021-f23f0eab085a467eb521f33bd3758904.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)