How Are Liabilities Listed On The Balance Sheet - Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds. Recording liabilities on the balance sheet is a fundamental accounting task that directly affects a company’s financial health.

Recording liabilities on the balance sheet is a fundamental accounting task that directly affects a company’s financial health. Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds.

Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds. Recording liabilities on the balance sheet is a fundamental accounting task that directly affects a company’s financial health.

Balance Sheets 101 Understanding Assets, Liabilities and Equity HBS

Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds. Recording liabilities on the balance sheet is a fundamental accounting task that directly affects a company’s financial health.

How to Understand Your Balance Sheet A Beginner's Guide 2025

Recording liabilities on the balance sheet is a fundamental accounting task that directly affects a company’s financial health. Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds.

Balance Sheet Explained Structure, Assets, Liabilities with Examples

Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds. Recording liabilities on the balance sheet is a fundamental accounting task that directly affects a company’s financial health.

Balance sheet example track assets and liabilities

Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds. Recording liabilities on the balance sheet is a fundamental accounting task that directly affects a company’s financial health.

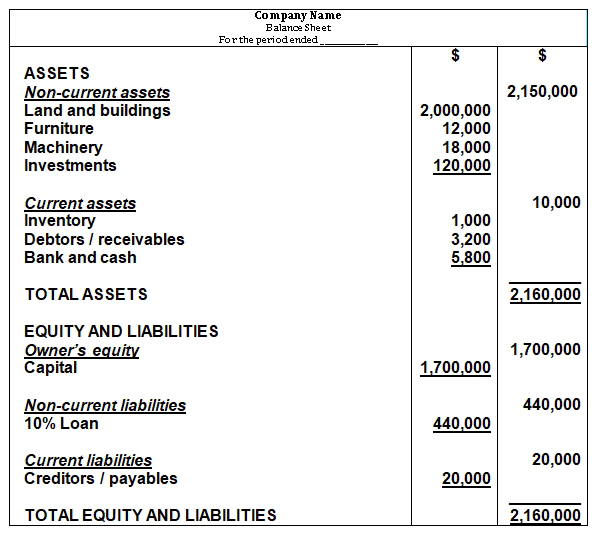

The Balance Sheet

Recording liabilities on the balance sheet is a fundamental accounting task that directly affects a company’s financial health. Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds.

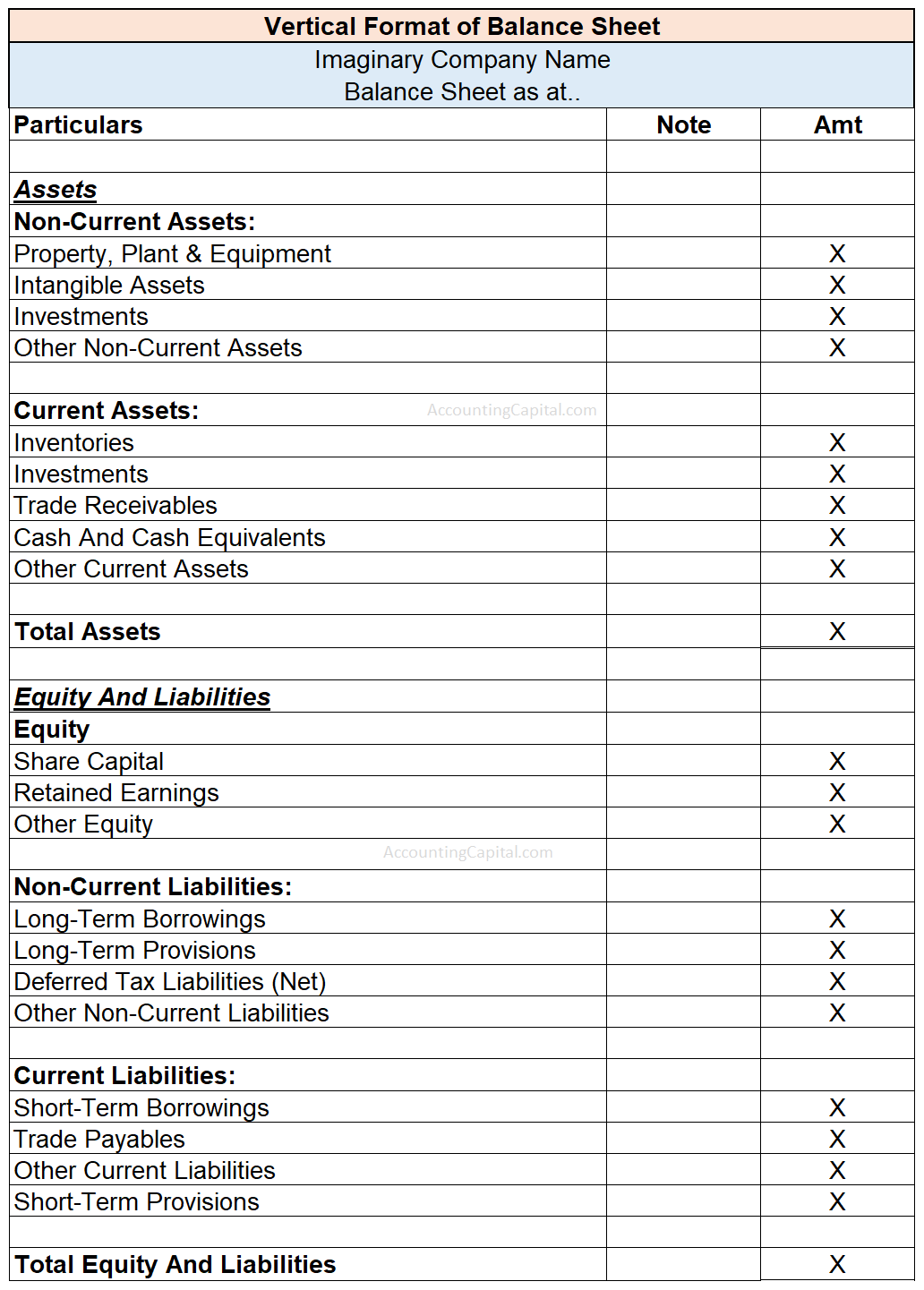

Format of Balance Sheet (explained with pdf) Accounting Capital

Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds. Recording liabilities on the balance sheet is a fundamental accounting task that directly affects a company’s financial health.

How to Read a Balance Sheet (Free Download) Poindexter Blog

Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds. Recording liabilities on the balance sheet is a fundamental accounting task that directly affects a company’s financial health.

Liabilities Side of Balance Sheet

Recording liabilities on the balance sheet is a fundamental accounting task that directly affects a company’s financial health. Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds.

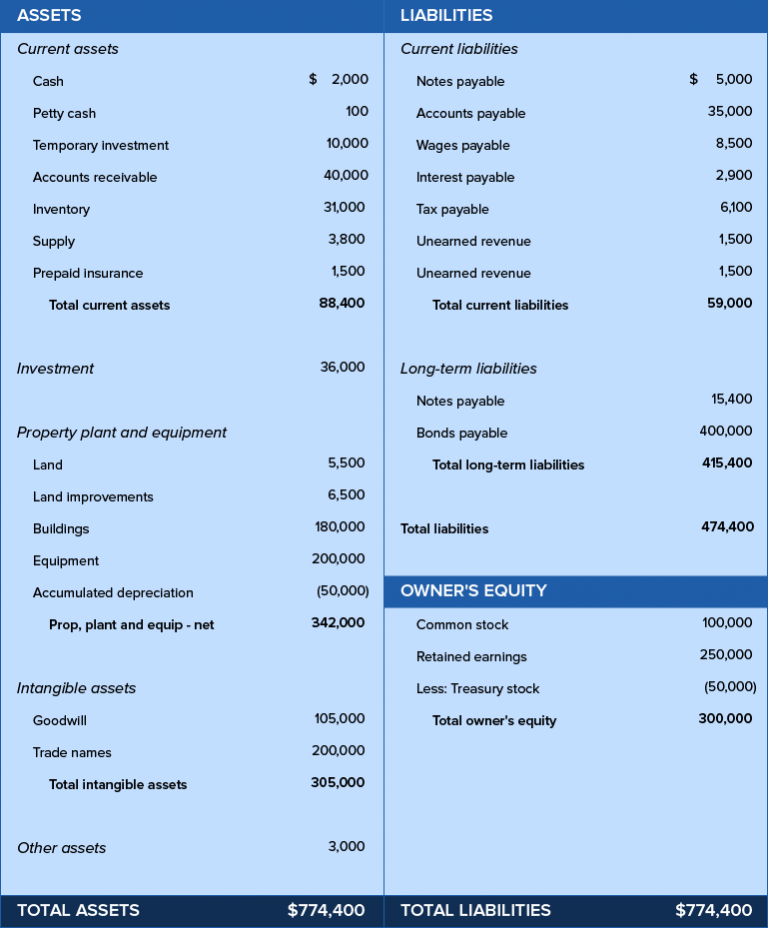

Balance Sheet Definition & Examples (Assets = Liabilities + Equity)

Recording liabilities on the balance sheet is a fundamental accounting task that directly affects a company’s financial health. Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds.

Liabilities Are Listed At The Top Of The Balance Sheet Because, In Case Of Bankruptcy, They Are Paid Back First Before Any Other Funds.

Recording liabilities on the balance sheet is a fundamental accounting task that directly affects a company’s financial health.