How To Do Common Size Balance Sheet - A statement that shows the percentage relation of each asset/liability to the total assets/total of equity and liabilities, is.

A statement that shows the percentage relation of each asset/liability to the total assets/total of equity and liabilities, is.

A statement that shows the percentage relation of each asset/liability to the total assets/total of equity and liabilities, is.

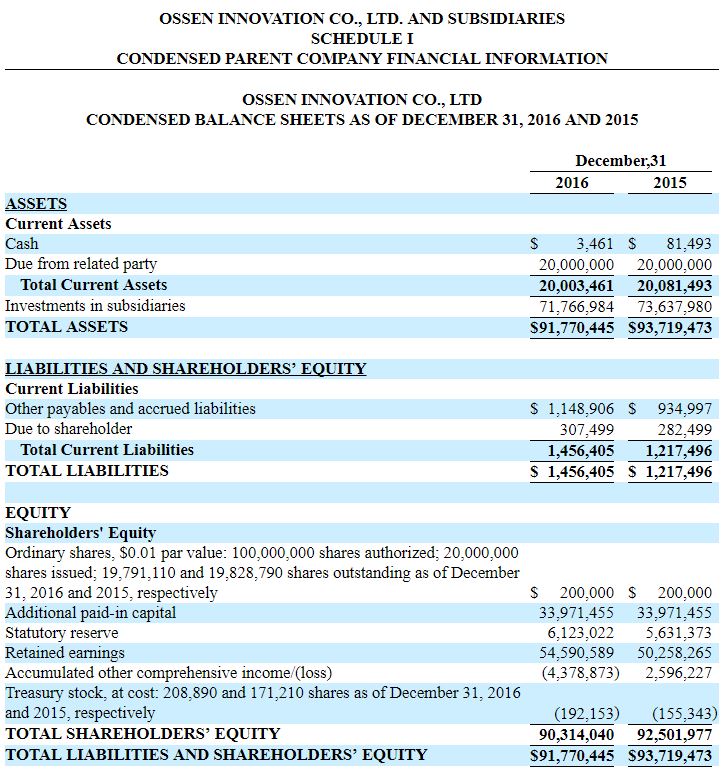

Common Size Balance Sheet Template

A statement that shows the percentage relation of each asset/liability to the total assets/total of equity and liabilities, is.

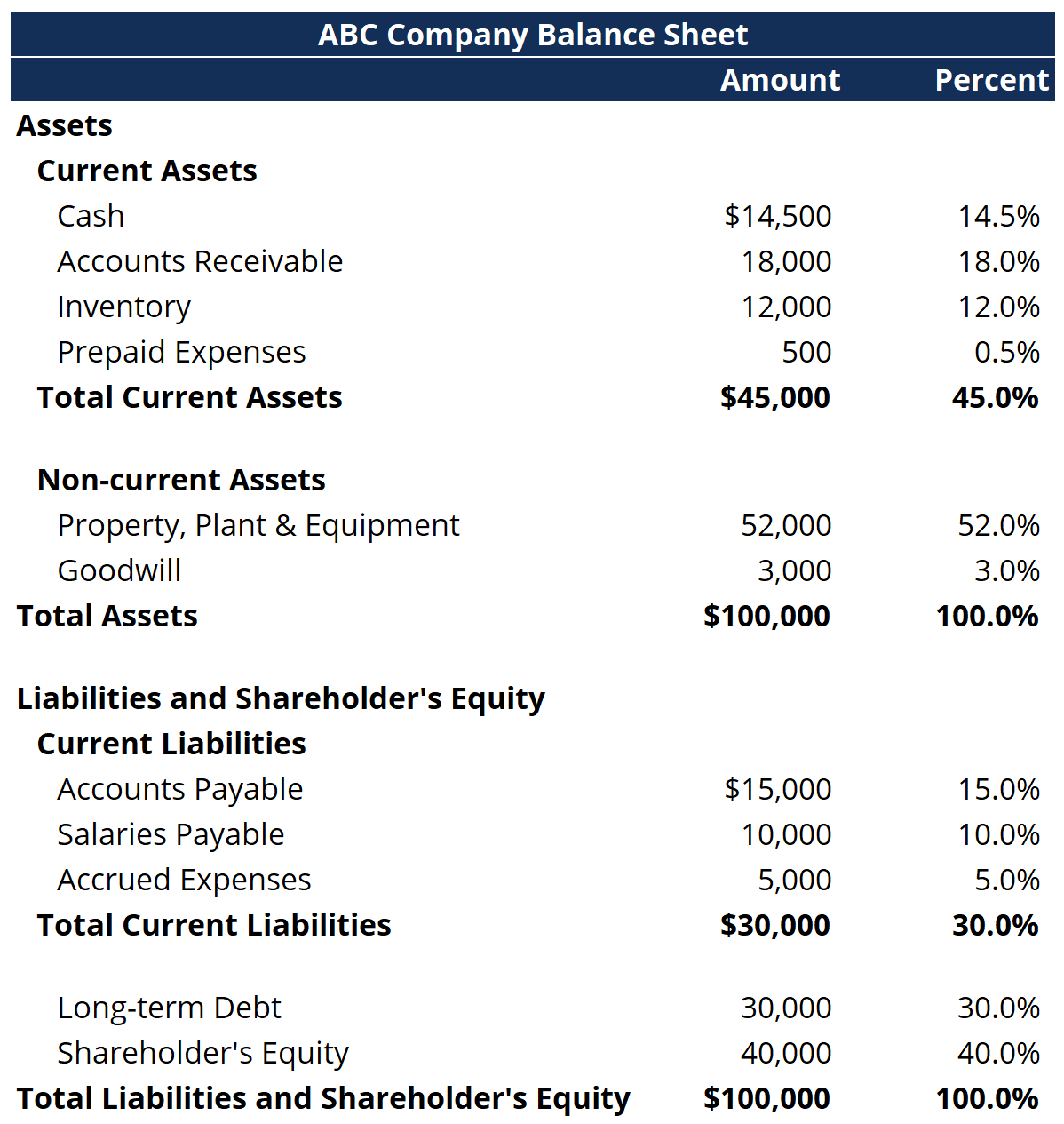

Common Size Balance Sheet

A statement that shows the percentage relation of each asset/liability to the total assets/total of equity and liabilities, is.

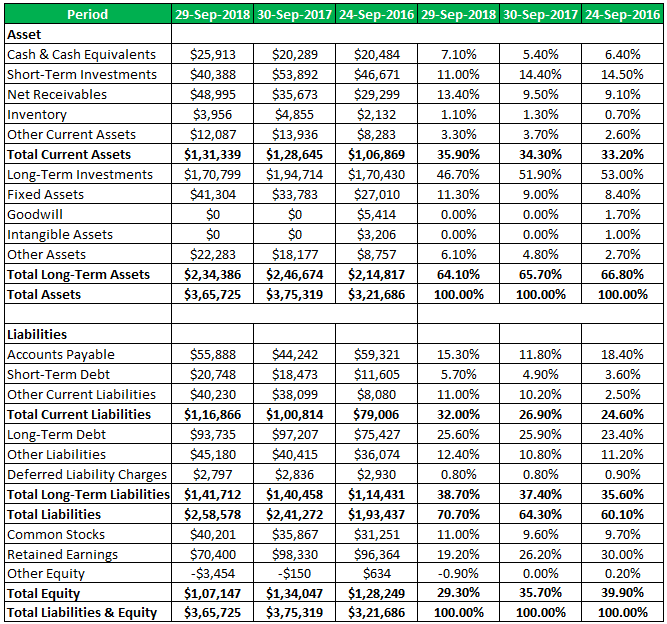

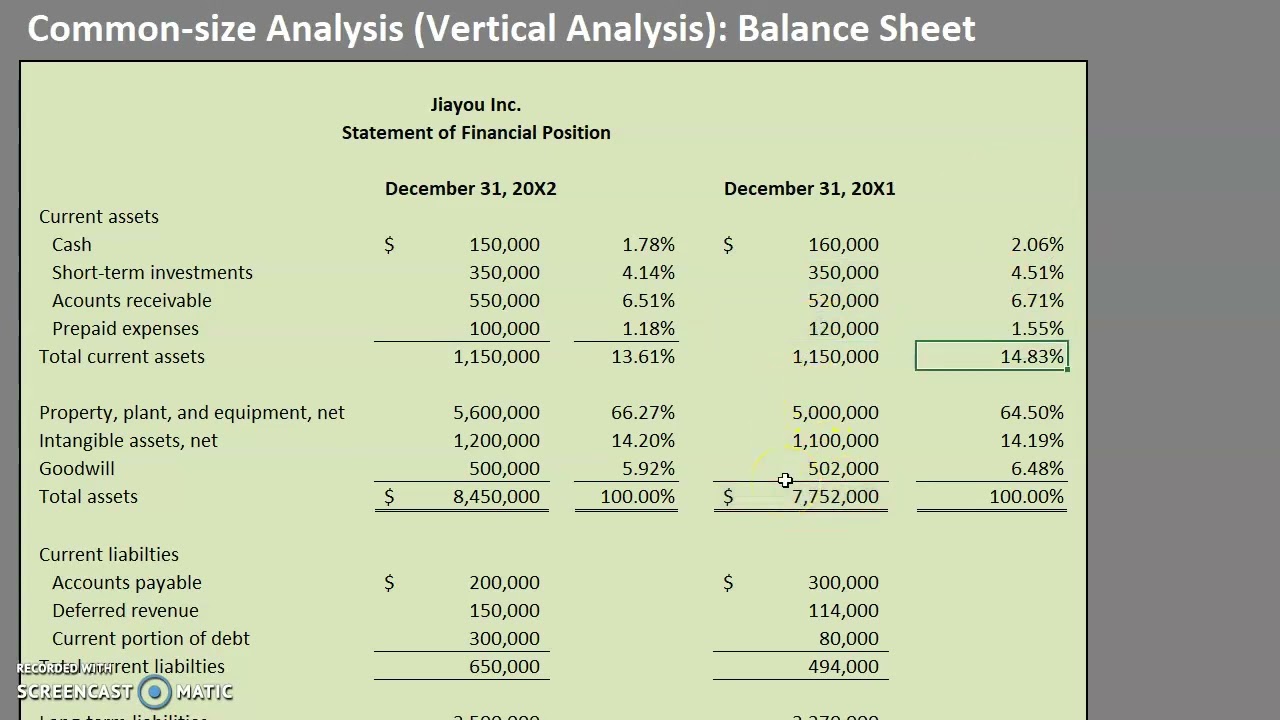

Common Size Balance Sheet Analysis (Format, Examples)

A statement that shows the percentage relation of each asset/liability to the total assets/total of equity and liabilities, is.

How To Create A Common Size Balance Sheet In Excel Design Talk

A statement that shows the percentage relation of each asset/liability to the total assets/total of equity and liabilities, is.

What is a CommonSize Balance Sheet? 365 Financial Analyst

A statement that shows the percentage relation of each asset/liability to the total assets/total of equity and liabilities, is.

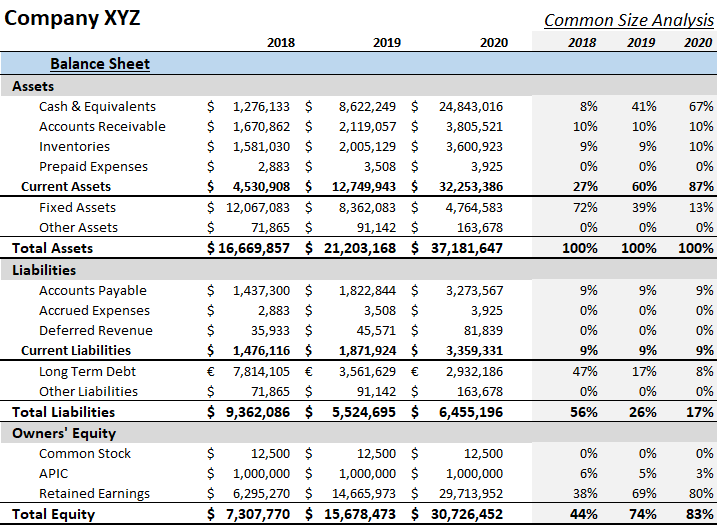

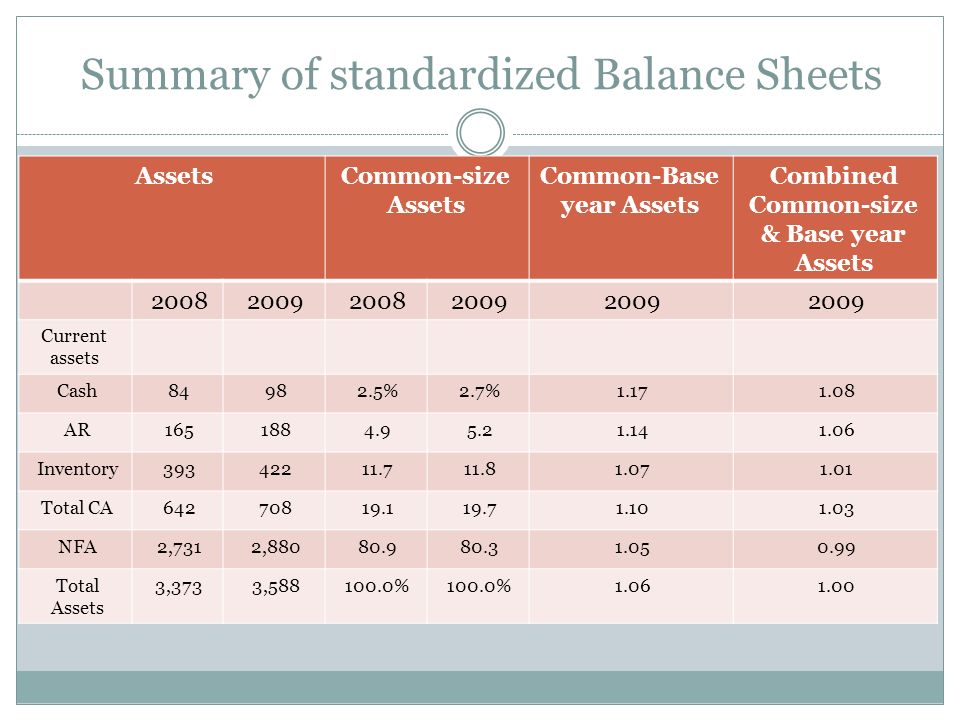

Common Size Analysis Overview, Examples, How to Perform

A statement that shows the percentage relation of each asset/liability to the total assets/total of equity and liabilities, is.

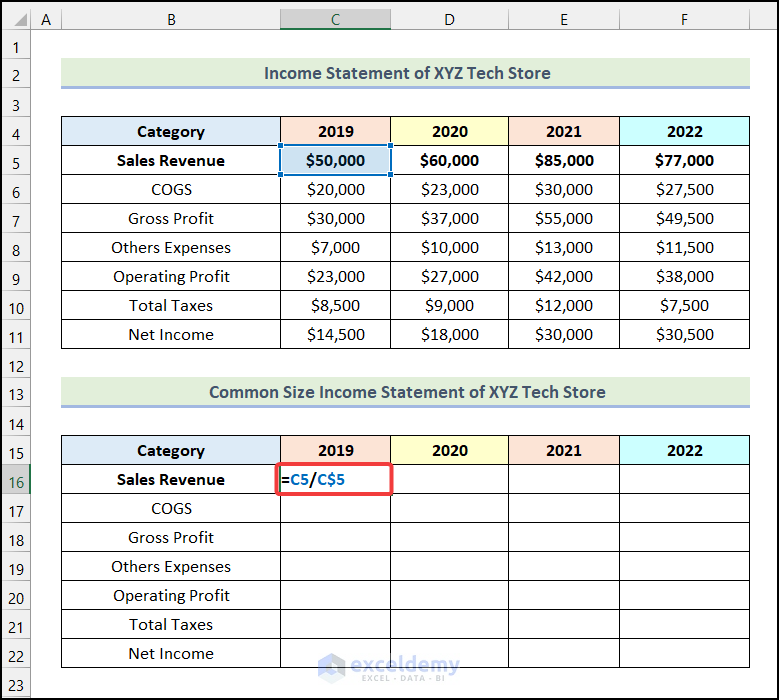

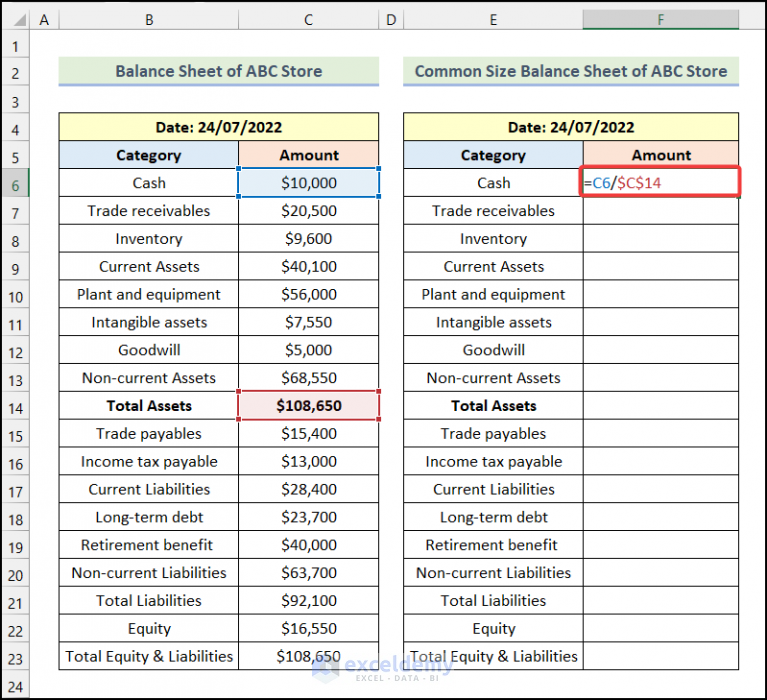

How to Create Common Size Balance Sheet in Excel (3 Simple Steps

A statement that shows the percentage relation of each asset/liability to the total assets/total of equity and liabilities, is.

Common Size Balance Sheet Analysis Format, Examples The WashBasins

A statement that shows the percentage relation of each asset/liability to the total assets/total of equity and liabilities, is.

How to Figure the Common Size BalanceSheet Percentages Online Accounting

A statement that shows the percentage relation of each asset/liability to the total assets/total of equity and liabilities, is.