Pay Tax Warrant - Tax warrant for collection of tax. If you can’t pay your tax debt in full, you may be able. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. You must pay your total warranted balance in full to satisfy your tax warrant. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. Penalties and interest will continue to grow until you pay the. Pay your tax balance due, estimated payments or part of a payment plan.

Pay your tax balance due, estimated payments or part of a payment plan. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. If you can’t pay your tax debt in full, you may be able. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. Penalties and interest will continue to grow until you pay the. Tax warrant for collection of tax. You must pay your total warranted balance in full to satisfy your tax warrant.

If you can’t pay your tax debt in full, you may be able. Penalties and interest will continue to grow until you pay the. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. You must pay your total warranted balance in full to satisfy your tax warrant. Tax warrant for collection of tax. Pay your tax balance due, estimated payments or part of a payment plan.

New York State Tax Collections When NYS Wants Back Due Tax Debt

If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. Tax warrant for collection of tax. Pay your tax balance due, estimated payments or.

What Happens When the IRS Issues a Tax Warrant Against Me?

Tax warrant for collection of tax. If you can’t pay your tax debt in full, you may be able. You must pay your total warranted balance in full to satisfy your tax warrant. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. Penalties and interest will continue to grow.

pay indiana tax warrant online Reyes Ralph

Penalties and interest will continue to grow until you pay the. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. Pay your tax balance due, estimated payments or part of a payment plan. You must pay your total warranted balance in full to.

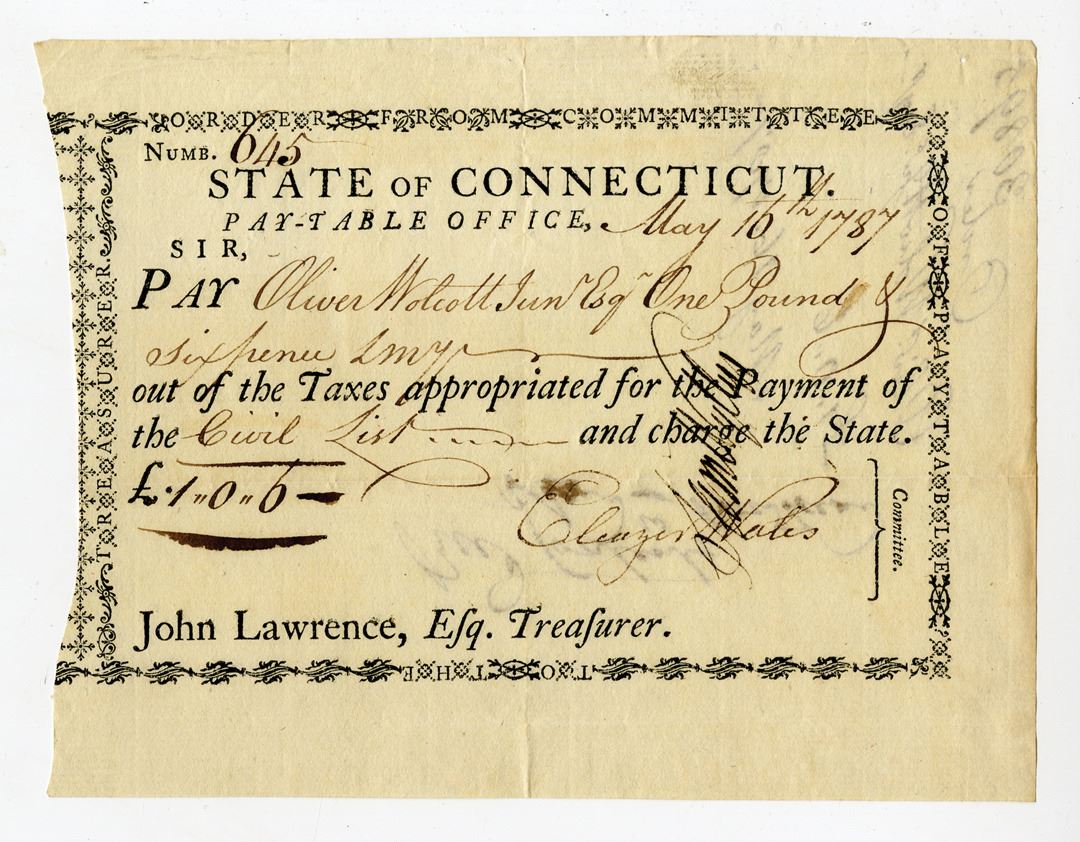

State of Connecticut, PayTable Office, 1787, Tax Warrant, Signed by

Pay your tax balance due, estimated payments or part of a payment plan. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. If you can’t pay your tax debt in full, you may be able. Tax warrant for collection of tax. You must pay your total warranted balance in.

pay indiana tax warrant online Reyes Ralph

Tax warrant for collection of tax. If you can’t pay your tax debt in full, you may be able. Pay your tax balance due, estimated payments or part of a payment plan. Penalties and interest will continue to grow until you pay the. You must pay your total warranted balance in full to satisfy your tax warrant.

pay indiana tax warrant online Reyes Ralph

You must pay your total warranted balance in full to satisfy your tax warrant. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. If you can’t pay your tax debt in full, you may be able. A tax warrant is a legal action that can be brought against you.

pay indiana tax warrant online Reyes Ralph

If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. If you can’t pay your tax debt in full, you may be able. Tax warrant for collection of tax. You must pay your total warranted balance in full to satisfy your tax warrant. A tax warrant is a legal action.

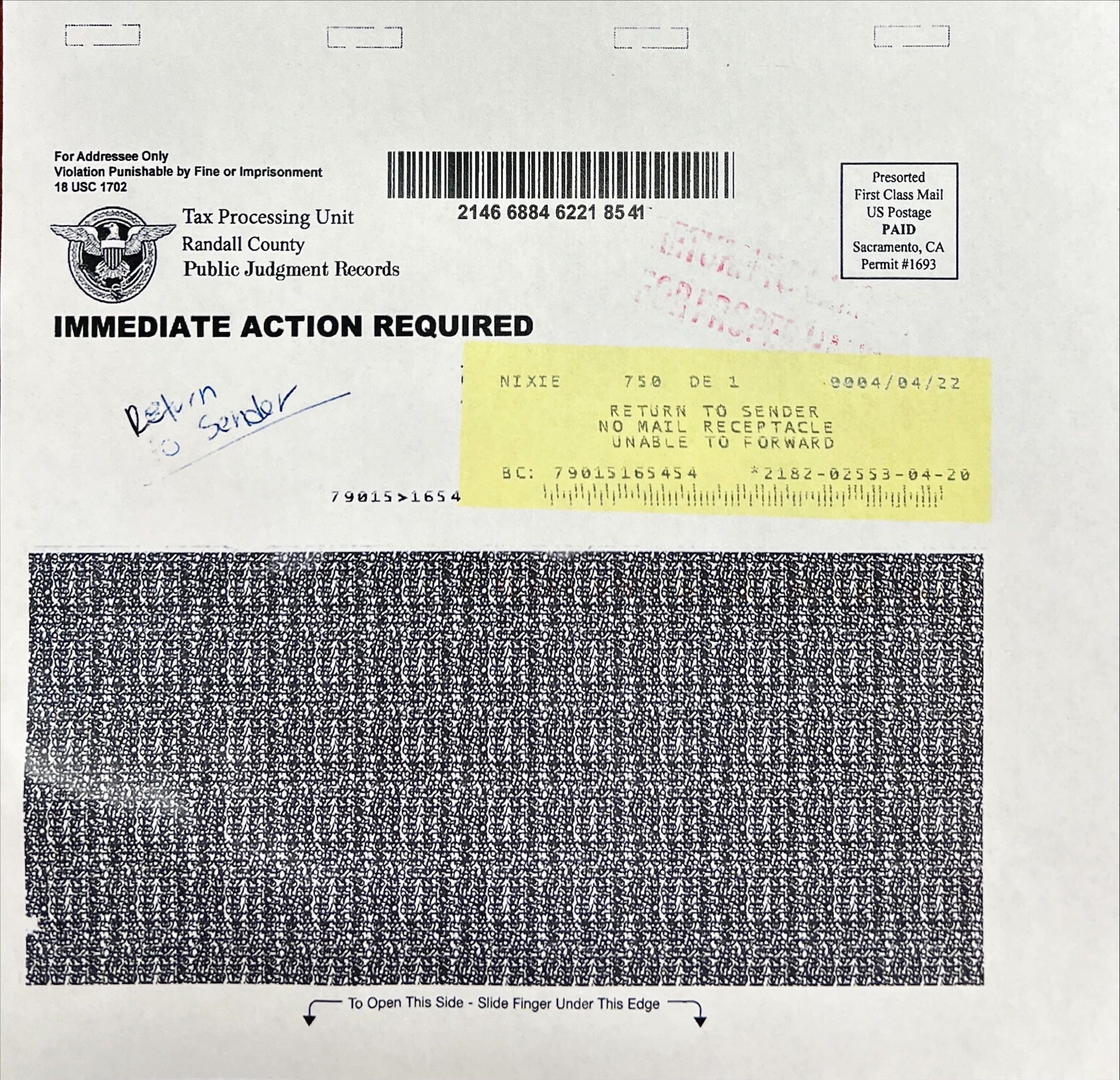

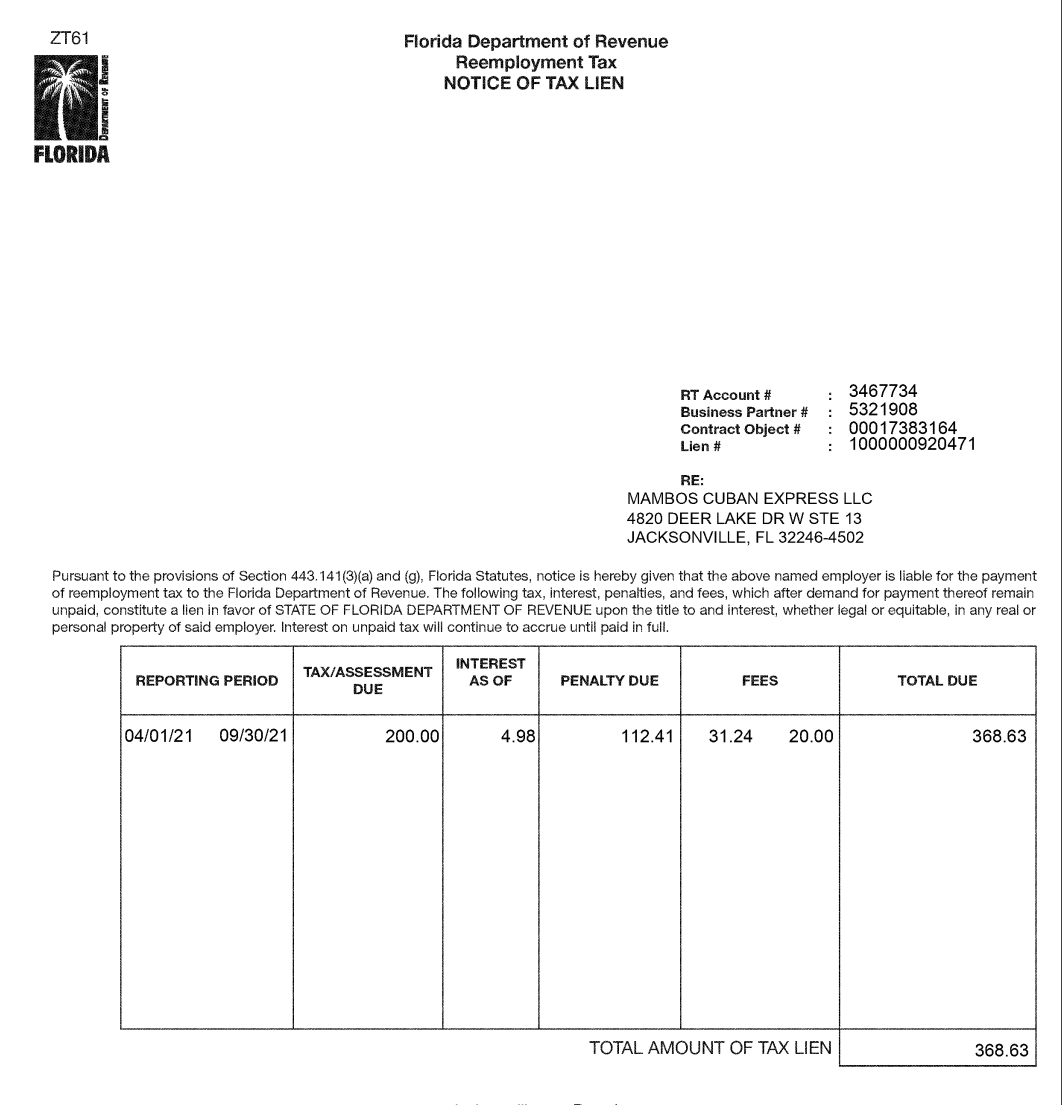

Jacksonville City Council Candidate Raul Arias Struggles to pay his

A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. Pay your tax balance due, estimated payments or part of a payment plan. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. Tax.

Tax Warrants — DeKalb County Sheriff's Office

You must pay your total warranted balance in full to satisfy your tax warrant. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. Tax warrant for collection of tax. Pay your tax balance due, estimated payments or part of a payment plan. If.

pay indiana tax warrant online Reyes Ralph

You must pay your total warranted balance in full to satisfy your tax warrant. Penalties and interest will continue to grow until you pay the. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. Pay your tax balance due, estimated payments or part of a payment plan. A tax.

If You Can’t Pay Your Tax Debt In Full, You May Be Able.

Penalties and interest will continue to grow until you pay the. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. Pay your tax balance due, estimated payments or part of a payment plan. You must pay your total warranted balance in full to satisfy your tax warrant.

A Tax Warrant Is A Legal Action That Can Be Brought Against You By The State Or Federal Government If You Fail To Pay Your Taxes.

Tax warrant for collection of tax.

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)