Rent Expense In Balance Sheet - Rent payment is recorded as a debit on the balance sheet, and any credit or reduction in rent is recorded as a credit on the accounting. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. How it's calculated, placement on the balance sheet, & more plus a. Learn everything you need to know about rent expense:

Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Rent payment is recorded as a debit on the balance sheet, and any credit or reduction in rent is recorded as a credit on the accounting. Learn everything you need to know about rent expense: How it's calculated, placement on the balance sheet, & more plus a.

Learn everything you need to know about rent expense: Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Rent payment is recorded as a debit on the balance sheet, and any credit or reduction in rent is recorded as a credit on the accounting. How it's calculated, placement on the balance sheet, & more plus a.

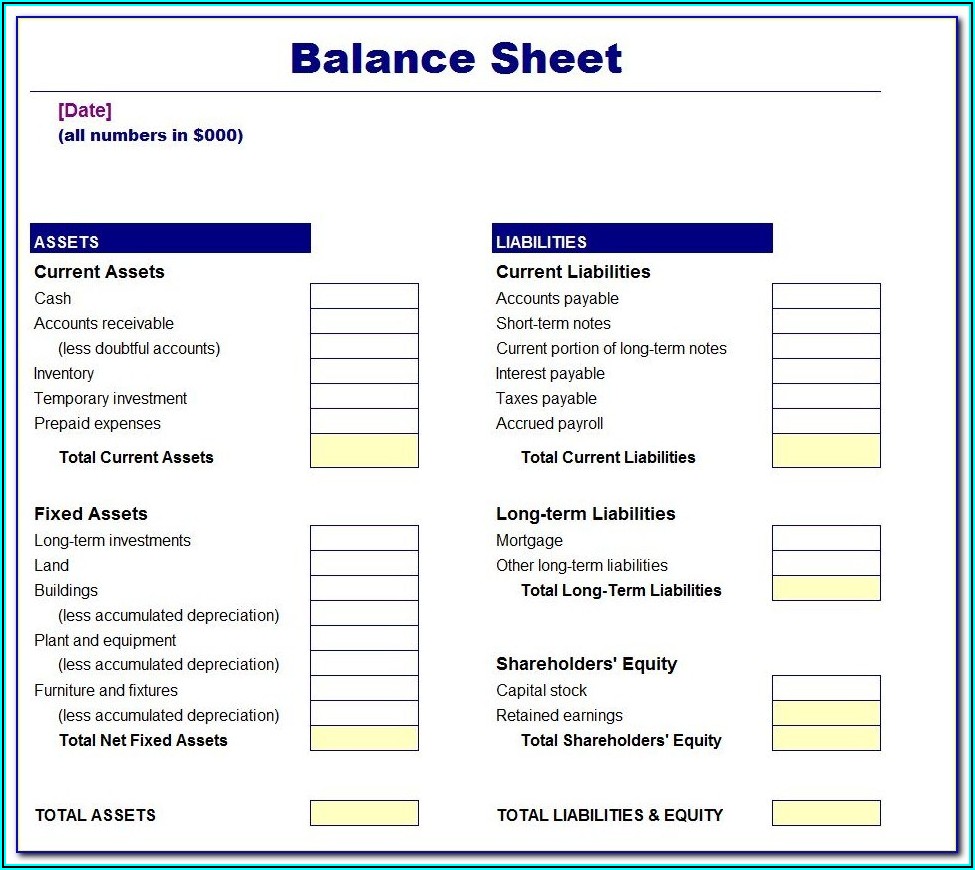

ASC 842 Balance Sheet Guide with Examples Visual Lease

Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Learn everything you need to know about rent expense: Rent payment is recorded as a debit on the balance sheet, and any credit or reduction in rent is recorded as a credit on the accounting. How it's calculated, placement on.

Putting rented assets on a company's balance sheet is long overdue

How it's calculated, placement on the balance sheet, & more plus a. Rent payment is recorded as a debit on the balance sheet, and any credit or reduction in rent is recorded as a credit on the accounting. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Learn everything.

Fun Rent Expense In Balance Sheet Target 2018

Learn everything you need to know about rent expense: Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Rent payment is recorded as a debit on the balance sheet, and any credit or reduction in rent is recorded as a credit on the accounting. How it's calculated, placement on.

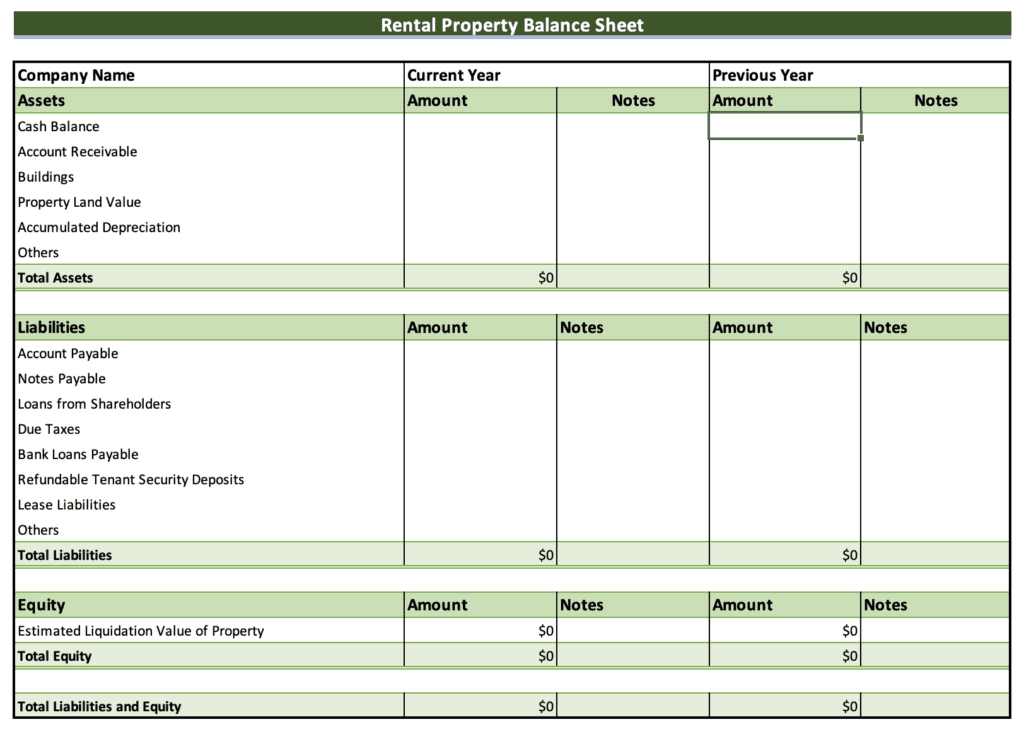

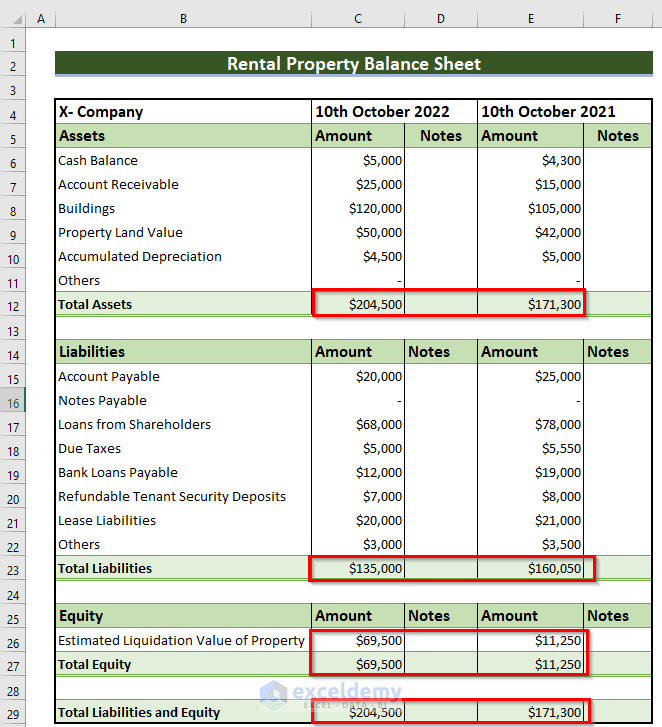

Rental Property Balance Sheet Template Excel

How it's calculated, placement on the balance sheet, & more plus a. Rent payment is recorded as a debit on the balance sheet, and any credit or reduction in rent is recorded as a credit on the accounting. Learn everything you need to know about rent expense: Learn how to accurately account for rent expenses in financial statements and understand.

Ultimate Guide to Rental Property Balance Sheets 2025 Free Templates

Rent payment is recorded as a debit on the balance sheet, and any credit or reduction in rent is recorded as a credit on the accounting. Learn everything you need to know about rent expense: Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. How it's calculated, placement on.

The Potential Impact of Lease Accounting on Equity Valuation The CPA

Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Rent payment is recorded as a debit on the balance sheet, and any credit or reduction in rent is recorded as a credit on the accounting. How it's calculated, placement on the balance sheet, & more plus a. Learn everything.

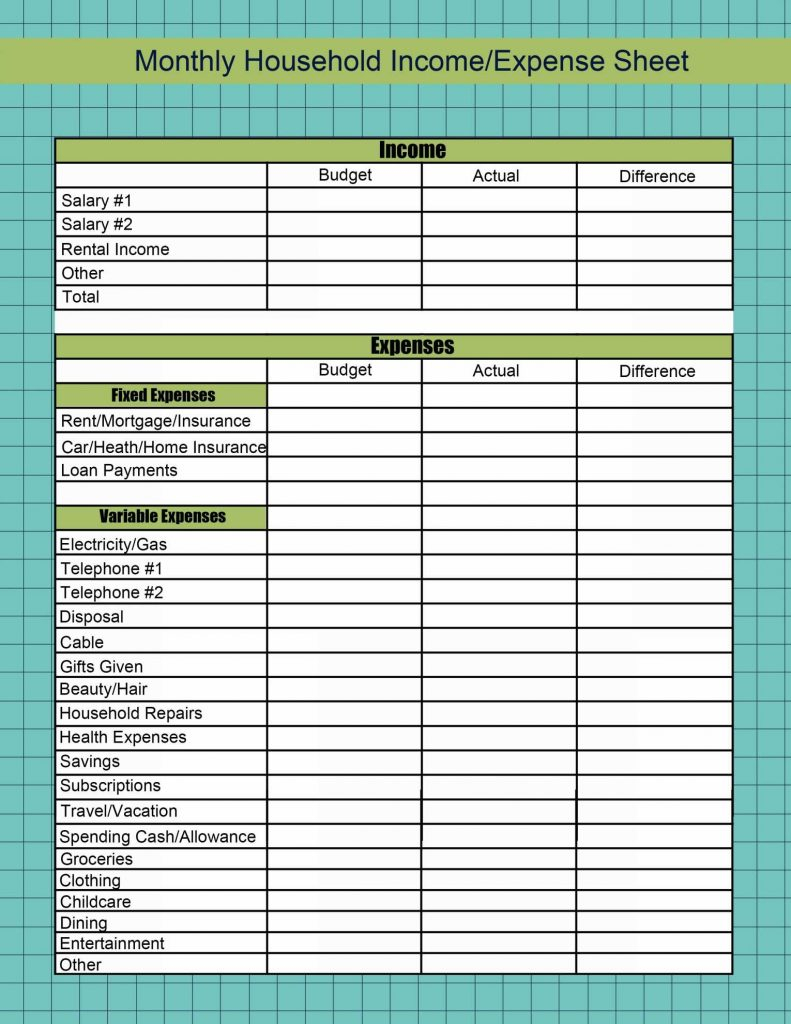

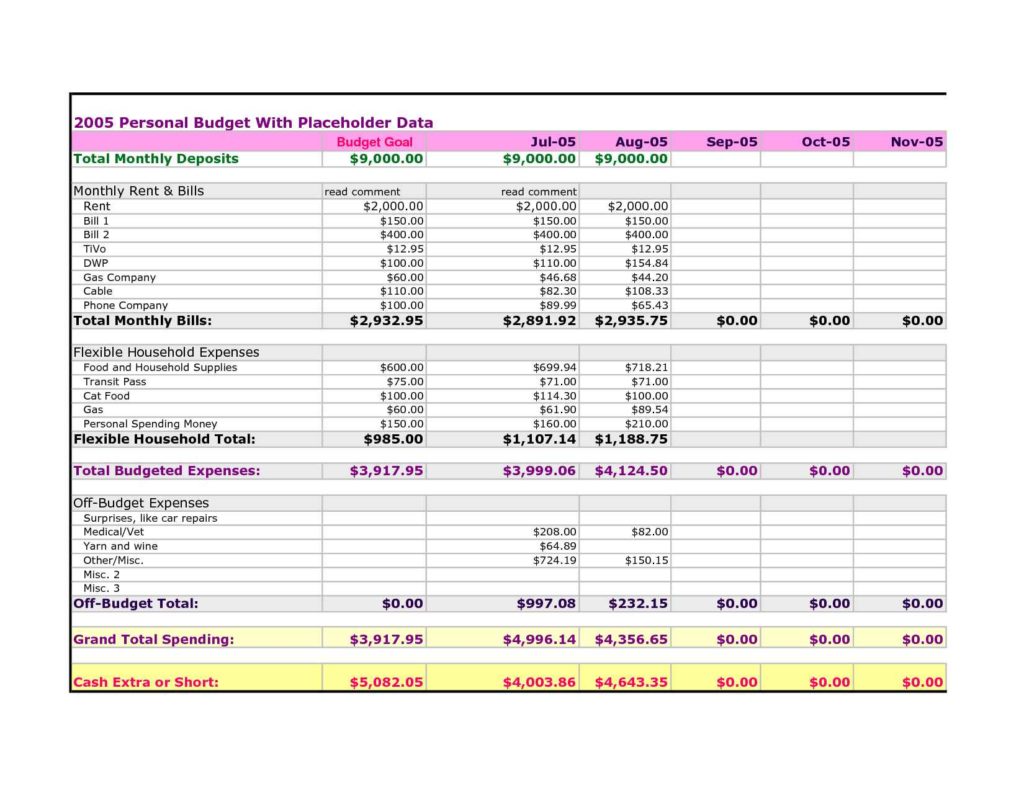

Rental And Expense Spreadsheet Template 1 Printable Spreadshee

Learn everything you need to know about rent expense: How it's calculated, placement on the balance sheet, & more plus a. Rent payment is recorded as a debit on the balance sheet, and any credit or reduction in rent is recorded as a credit on the accounting. Learn how to accurately account for rent expenses in financial statements and understand.

Rental Expense Worksheets

How it's calculated, placement on the balance sheet, & more plus a. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Rent payment is recorded as a debit on the balance sheet, and any credit or reduction in rent is recorded as a credit on the accounting. Learn everything.

Rental & Expense Spreadsheet for up to 10 Properties in POUNDS

How it's calculated, placement on the balance sheet, & more plus a. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Rent payment is recorded as a debit on the balance sheet, and any credit or reduction in rent is recorded as a credit on the accounting. Learn everything.

Rental Property Balance Sheet in Excel 2 Methods (Free Template)

How it's calculated, placement on the balance sheet, & more plus a. Learn everything you need to know about rent expense: Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Rent payment is recorded as a debit on the balance sheet, and any credit or reduction in rent is.

How It's Calculated, Placement On The Balance Sheet, & More Plus A.

Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Learn everything you need to know about rent expense: Rent payment is recorded as a debit on the balance sheet, and any credit or reduction in rent is recorded as a credit on the accounting.