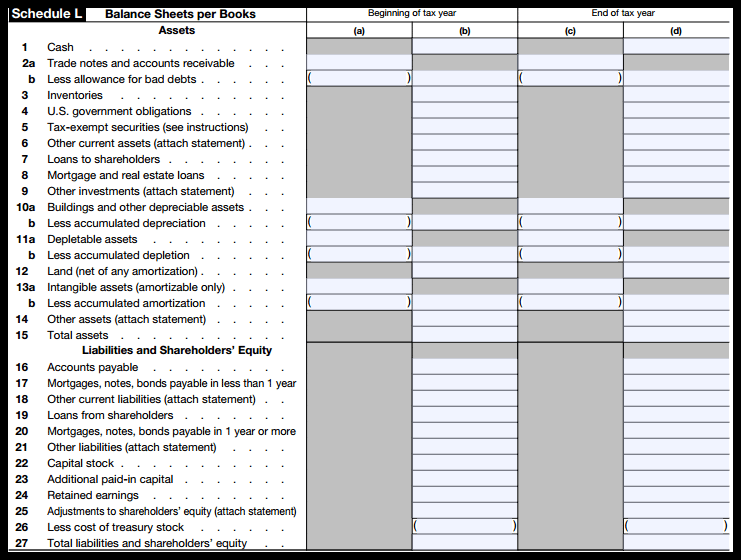

Schedule L Balance Sheet - If the corporation is required to complete schedule l, enter the total assets from schedule l, line 15, column (d), on page 1, item d. This allows users to record each type of asset, providing a detailed breakdown to ensure accurate reporting on the balance sheet in schedule l. You need to review the total on.

If the corporation is required to complete schedule l, enter the total assets from schedule l, line 15, column (d), on page 1, item d. You need to review the total on. This allows users to record each type of asset, providing a detailed breakdown to ensure accurate reporting on the balance sheet in schedule l.

This allows users to record each type of asset, providing a detailed breakdown to ensure accurate reporting on the balance sheet in schedule l. If the corporation is required to complete schedule l, enter the total assets from schedule l, line 15, column (d), on page 1, item d. You need to review the total on.

IRS Form 1120S Schedules L, M1, and M2 (2020) Balance Sheet (L

This allows users to record each type of asset, providing a detailed breakdown to ensure accurate reporting on the balance sheet in schedule l. If the corporation is required to complete schedule l, enter the total assets from schedule l, line 15, column (d), on page 1, item d. You need to review the total on.

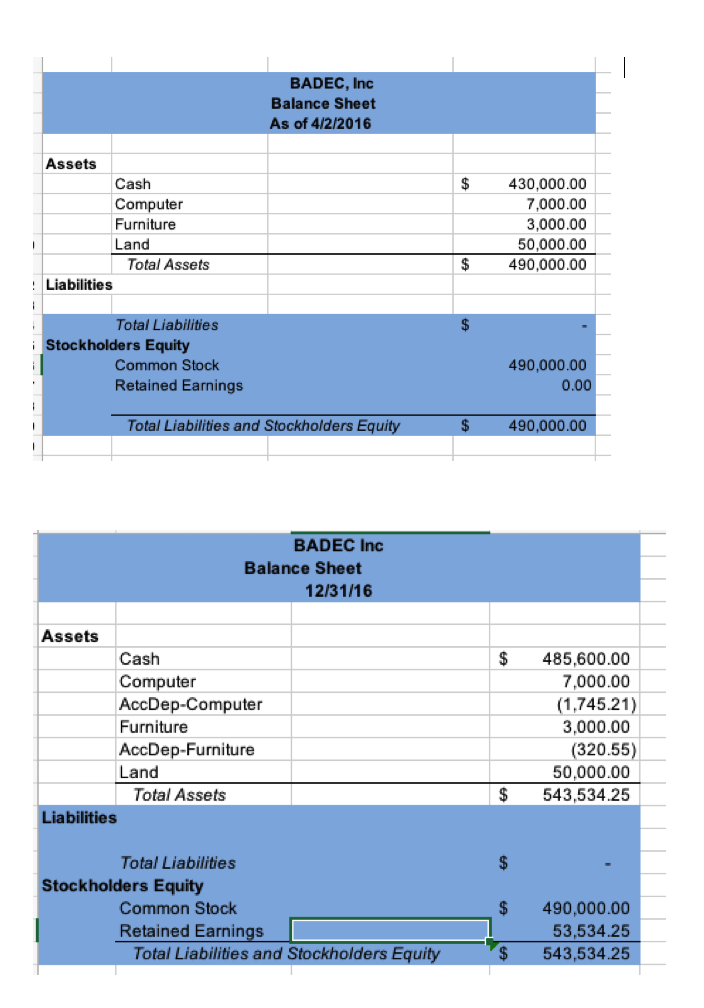

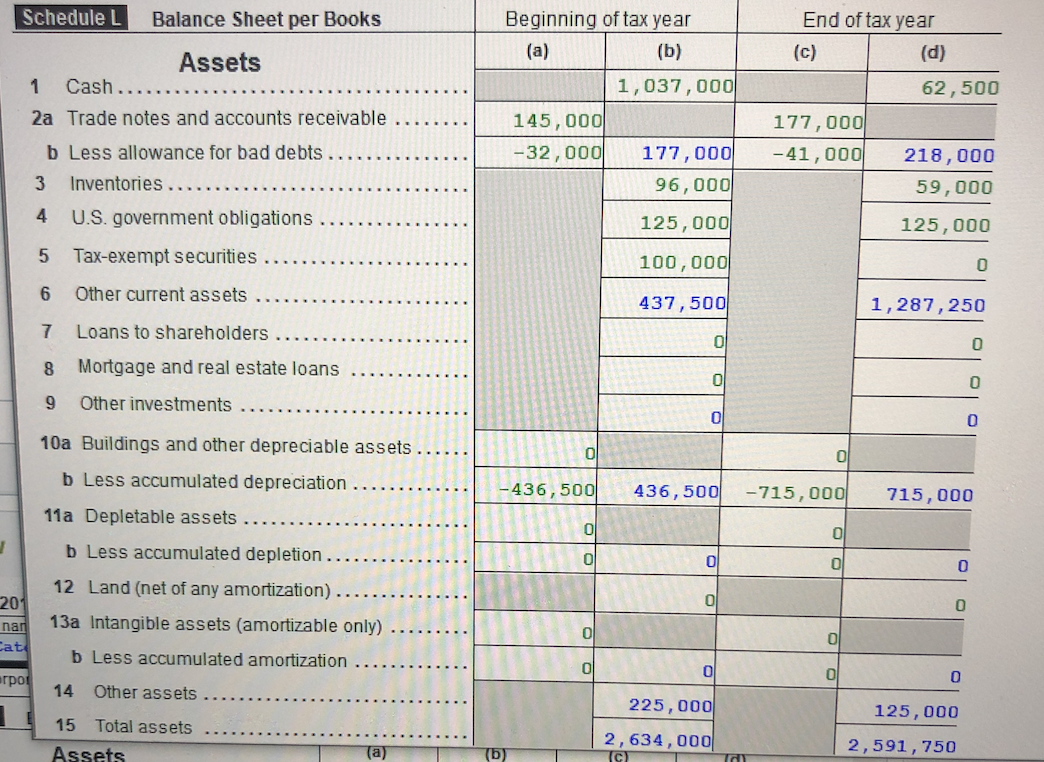

Solved Form complete Schedule L for the balance sheet

You need to review the total on. If the corporation is required to complete schedule l, enter the total assets from schedule l, line 15, column (d), on page 1, item d. This allows users to record each type of asset, providing a detailed breakdown to ensure accurate reporting on the balance sheet in schedule l.

IRS Form 1120 Schedules L, M1, and M2 (2019) Balance Sheet (L

If the corporation is required to complete schedule l, enter the total assets from schedule l, line 15, column (d), on page 1, item d. This allows users to record each type of asset, providing a detailed breakdown to ensure accurate reporting on the balance sheet in schedule l. You need to review the total on.

Schedule L (Balance Sheets per Books) for Form 1120S White Coat Investor

If the corporation is required to complete schedule l, enter the total assets from schedule l, line 15, column (d), on page 1, item d. You need to review the total on. This allows users to record each type of asset, providing a detailed breakdown to ensure accurate reporting on the balance sheet in schedule l.

IRS Form 1120S Schedules L, M1, and M2 (2018) Balance Sheet (L

If the corporation is required to complete schedule l, enter the total assets from schedule l, line 15, column (d), on page 1, item d. This allows users to record each type of asset, providing a detailed breakdown to ensure accurate reporting on the balance sheet in schedule l. You need to review the total on.

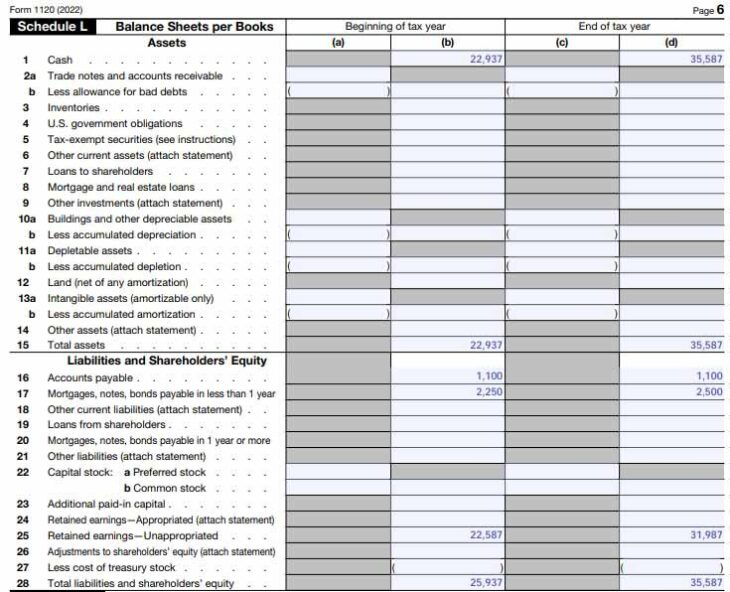

How to Complete Form 1120S Tax Return for an S Corp

This allows users to record each type of asset, providing a detailed breakdown to ensure accurate reporting on the balance sheet in schedule l. If the corporation is required to complete schedule l, enter the total assets from schedule l, line 15, column (d), on page 1, item d. You need to review the total on.

Solved Schedule L Balance Sheet per Books Assets 1 Cash.. 2a

If the corporation is required to complete schedule l, enter the total assets from schedule l, line 15, column (d), on page 1, item d. This allows users to record each type of asset, providing a detailed breakdown to ensure accurate reporting on the balance sheet in schedule l. You need to review the total on.

How To Fill Out Form 1120 (With Example)

If the corporation is required to complete schedule l, enter the total assets from schedule l, line 15, column (d), on page 1, item d. This allows users to record each type of asset, providing a detailed breakdown to ensure accurate reporting on the balance sheet in schedule l. You need to review the total on.

Schedule L (Balance Sheets per Books) for Form 1120S White Coat Investor

This allows users to record each type of asset, providing a detailed breakdown to ensure accurate reporting on the balance sheet in schedule l. If the corporation is required to complete schedule l, enter the total assets from schedule l, line 15, column (d), on page 1, item d. You need to review the total on.

Schedule L (Balance Sheets per Books) for Form 1120S White Coat Investor

You need to review the total on. If the corporation is required to complete schedule l, enter the total assets from schedule l, line 15, column (d), on page 1, item d. This allows users to record each type of asset, providing a detailed breakdown to ensure accurate reporting on the balance sheet in schedule l.

If The Corporation Is Required To Complete Schedule L, Enter The Total Assets From Schedule L, Line 15, Column (D), On Page 1, Item D.

This allows users to record each type of asset, providing a detailed breakdown to ensure accurate reporting on the balance sheet in schedule l. You need to review the total on.