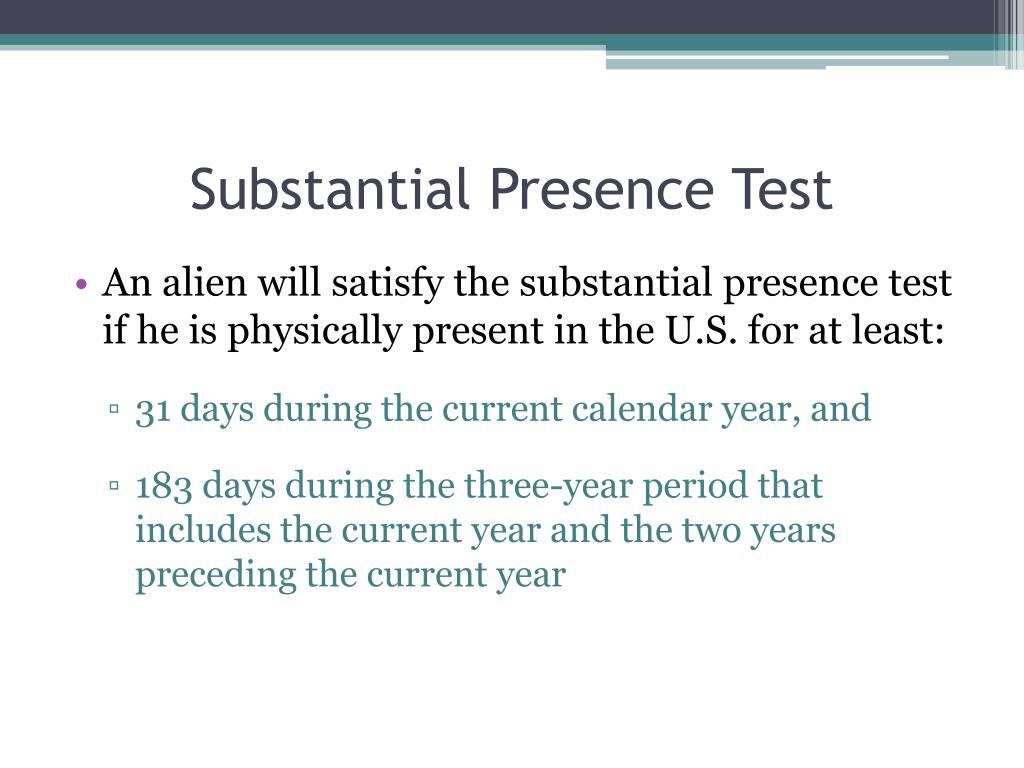

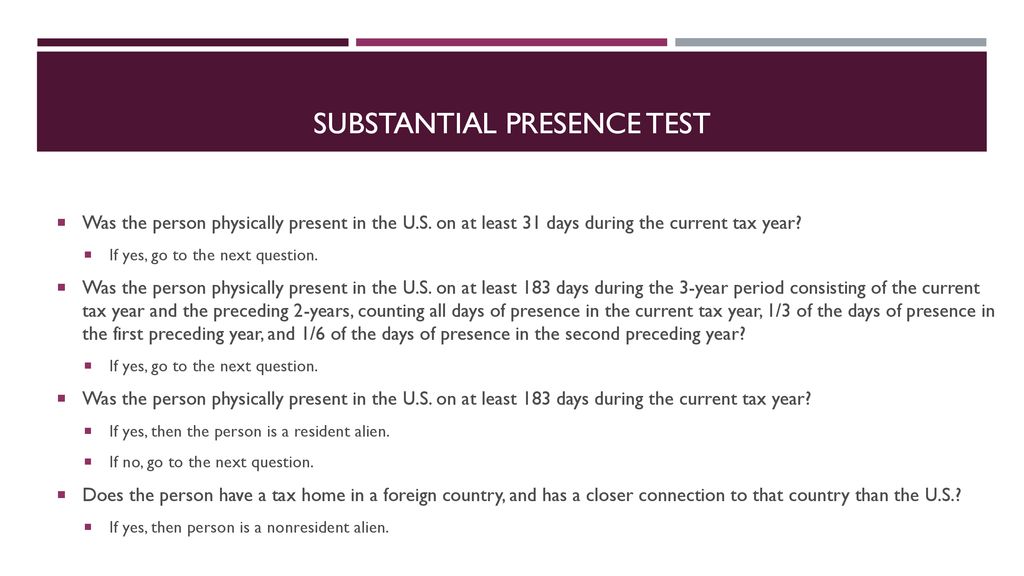

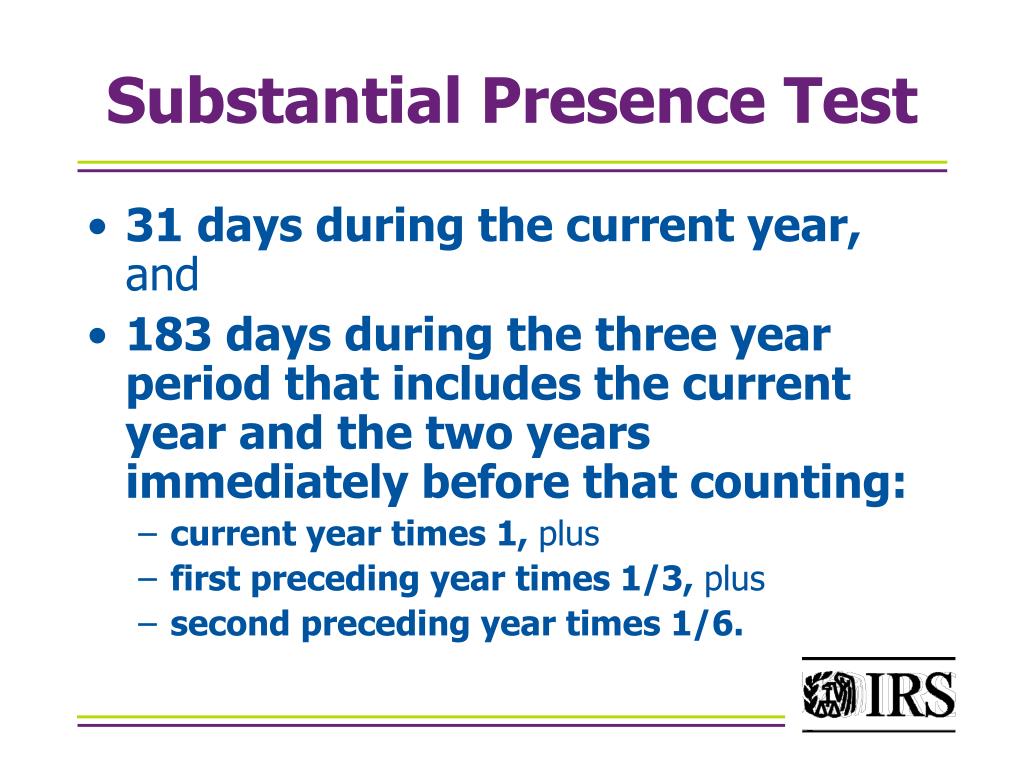

Substantial Presence Test For The Calendar Year - So, 2012 is the “first calendar year”, even though the. To meet the substantial presence test, you must be physically present in the united states on at least: If you are not a u.s. 31 days during the current tax year you. Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count.

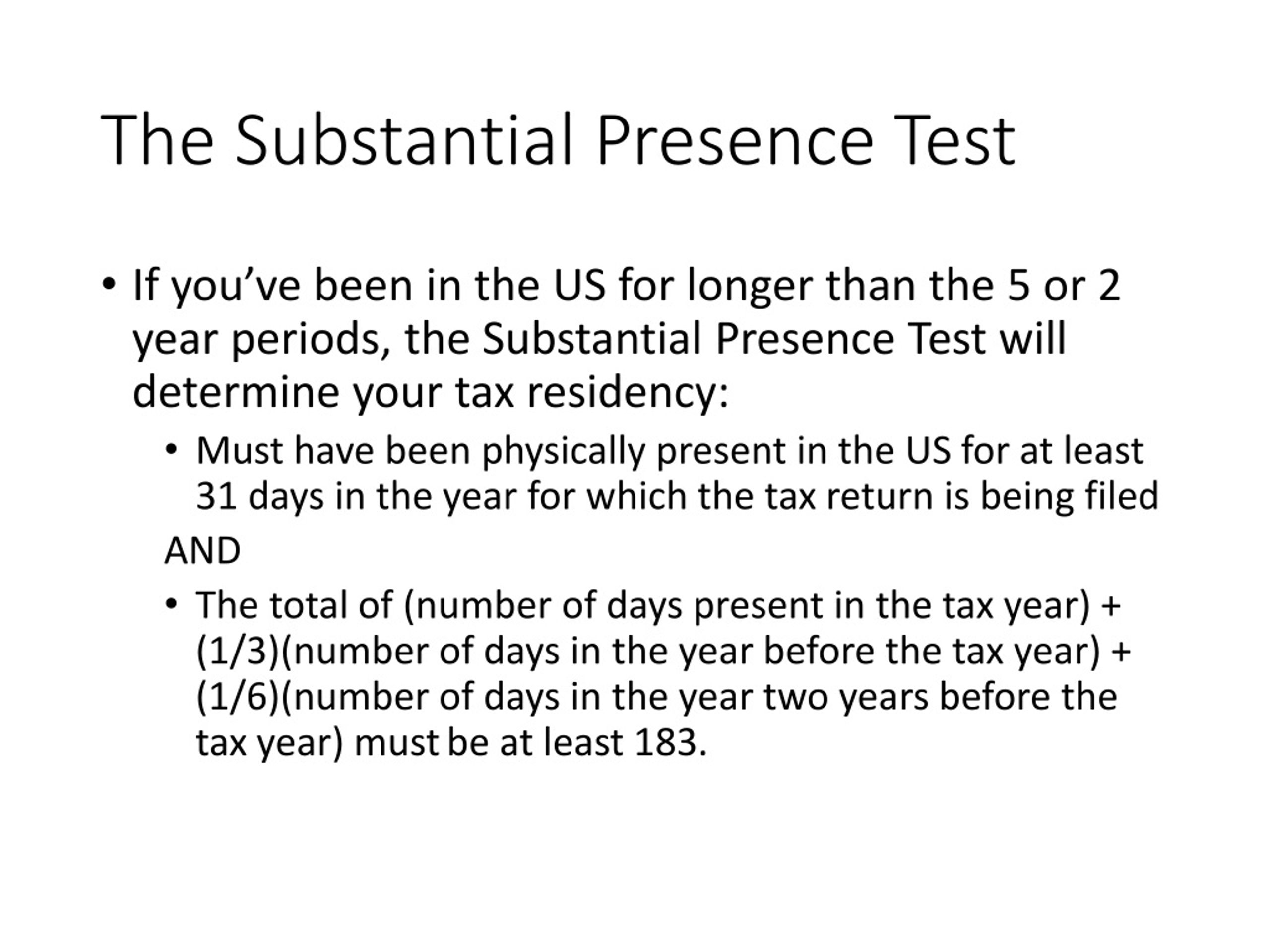

Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count. So, 2012 is the “first calendar year”, even though the. To meet the substantial presence test, you must be physically present in the united states on at least: 31 days during the current tax year you. If you are not a u.s.

To meet the substantial presence test, you must be physically present in the united states on at least: 31 days during the current tax year you. If you are not a u.s. So, 2012 is the “first calendar year”, even though the. Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count.

Inpatriate/ Nonresident Alien ppt video online download

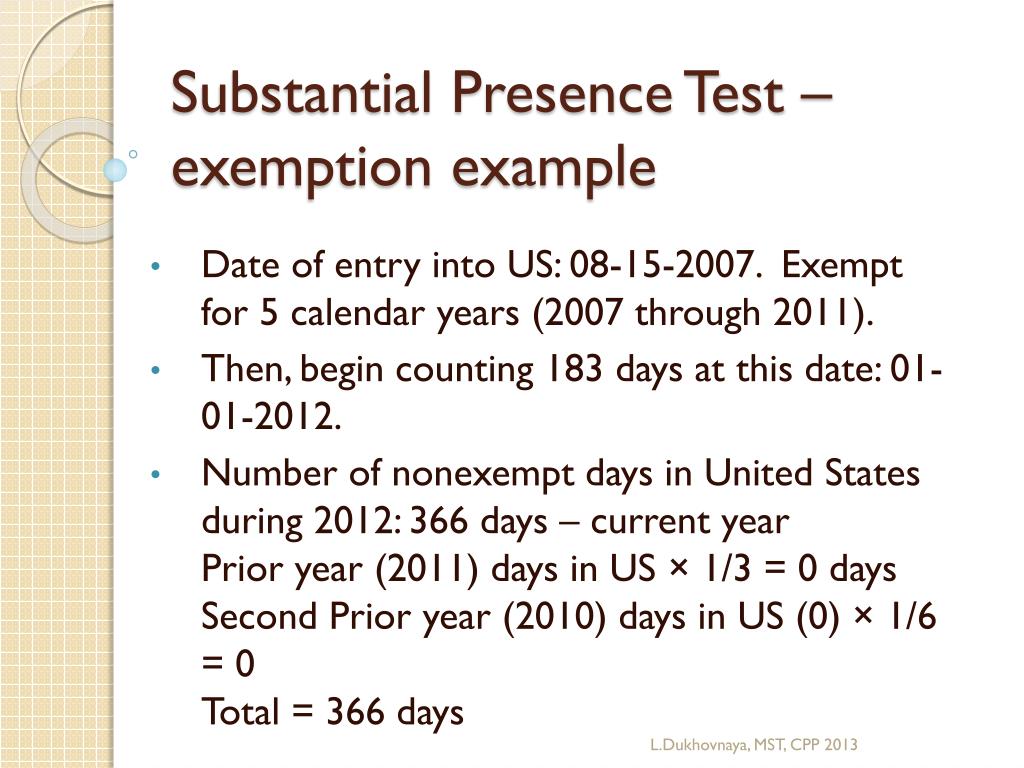

So, 2012 is the “first calendar year”, even though the. If you are not a u.s. To meet the substantial presence test, you must be physically present in the united states on at least: Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count. 31 days during the current tax year you.

American Bar Association Section of Taxation Committee on U. S ppt

If you are not a u.s. So, 2012 is the “first calendar year”, even though the. 31 days during the current tax year you. To meet the substantial presence test, you must be physically present in the united states on at least: Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count.

PPT Inpatriate / Nonresident Alien PowerPoint Presentation, free

If you are not a u.s. To meet the substantial presence test, you must be physically present in the united states on at least: 31 days during the current tax year you. Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count. So, 2012 is the “first calendar year”, even though the.

Substantial Presence Test Finance and Treasury

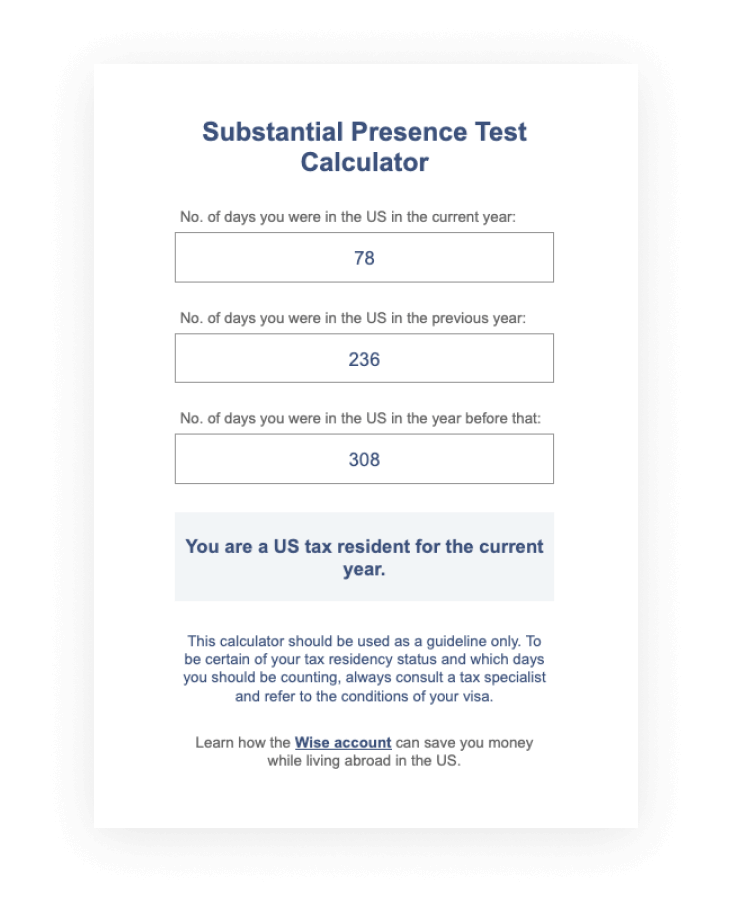

Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count. So, 2012 is the “first calendar year”, even though the. If you are not a u.s. 31 days during the current tax year you. To meet the substantial presence test, you must be physically present in the united states on at least:

Substantial Presence Test Calculator Wise

31 days during the current tax year you. To meet the substantial presence test, you must be physically present in the united states on at least: If you are not a u.s. So, 2012 is the “first calendar year”, even though the. Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count.

PPT East Tennessee State University PowerPoint Presentation, free

So, 2012 is the “first calendar year”, even though the. Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count. If you are not a u.s. 31 days during the current tax year you. To meet the substantial presence test, you must be physically present in the united states on at least:

PPT Tax basics for international students Informational session

31 days during the current tax year you. If you are not a u.s. Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count. To meet the substantial presence test, you must be physically present in the united states on at least: So, 2012 is the “first calendar year”, even though the.

Unique filing status and exemption situations ppt download

So, 2012 is the “first calendar year”, even though the. Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count. If you are not a u.s. To meet the substantial presence test, you must be physically present in the united states on at least: 31 days during the current tax year you.

sherycove Blog

To meet the substantial presence test, you must be physically present in the united states on at least: 31 days during the current tax year you. Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count. So, 2012 is the “first calendar year”, even though the. If you are not a u.s.

PPT International Students and Scholars PowerPoint Presentation, free

So, 2012 is the “first calendar year”, even though the. 31 days during the current tax year you. To meet the substantial presence test, you must be physically present in the united states on at least: Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count. If you are not a u.s.

31 Days During The Current Tax Year You.

If you are not a u.s. So, 2012 is the “first calendar year”, even though the. To meet the substantial presence test, you must be physically present in the united states on at least: Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count.