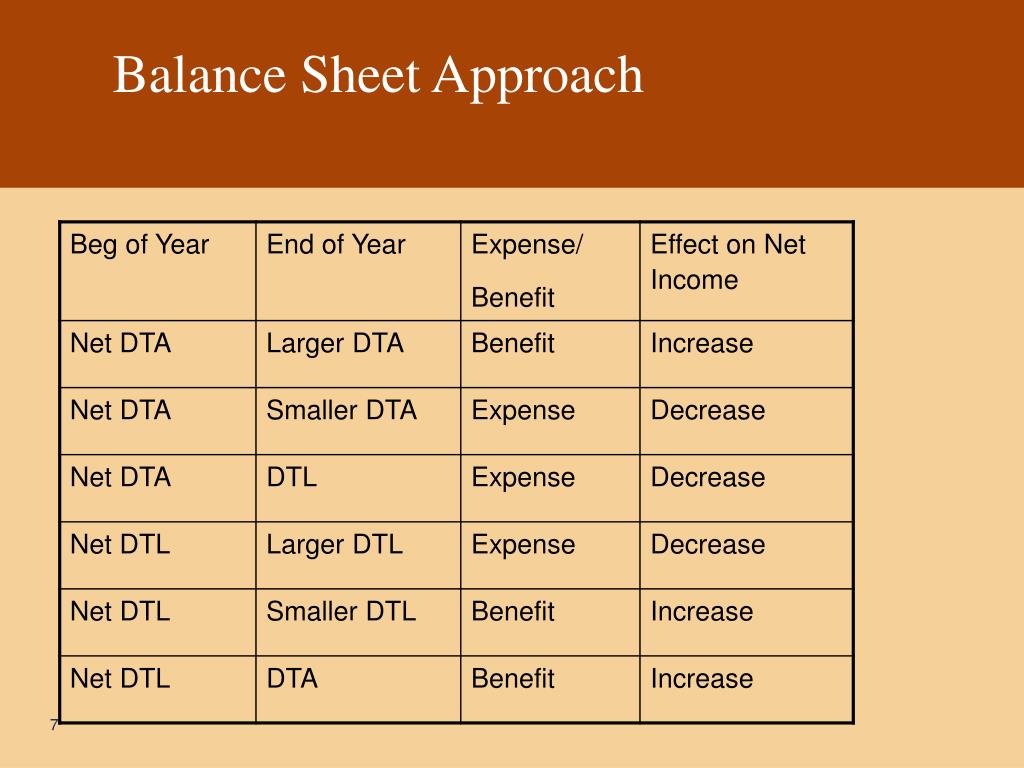

Tax Balance Sheet - The difference between the way you report assets in a regular balance sheet and a tax basis balance sheet is that tax basis balance. Asc 740 takes a balance sheet approach to income tax calculations and thus the amounts recorded in the income statement are generally. Just as the financial statement balance sheet represents the book basis of assets and liabilities in accordance with gaap, the tax.

The difference between the way you report assets in a regular balance sheet and a tax basis balance sheet is that tax basis balance. Asc 740 takes a balance sheet approach to income tax calculations and thus the amounts recorded in the income statement are generally. Just as the financial statement balance sheet represents the book basis of assets and liabilities in accordance with gaap, the tax.

Just as the financial statement balance sheet represents the book basis of assets and liabilities in accordance with gaap, the tax. The difference between the way you report assets in a regular balance sheet and a tax basis balance sheet is that tax basis balance. Asc 740 takes a balance sheet approach to income tax calculations and thus the amounts recorded in the income statement are generally.

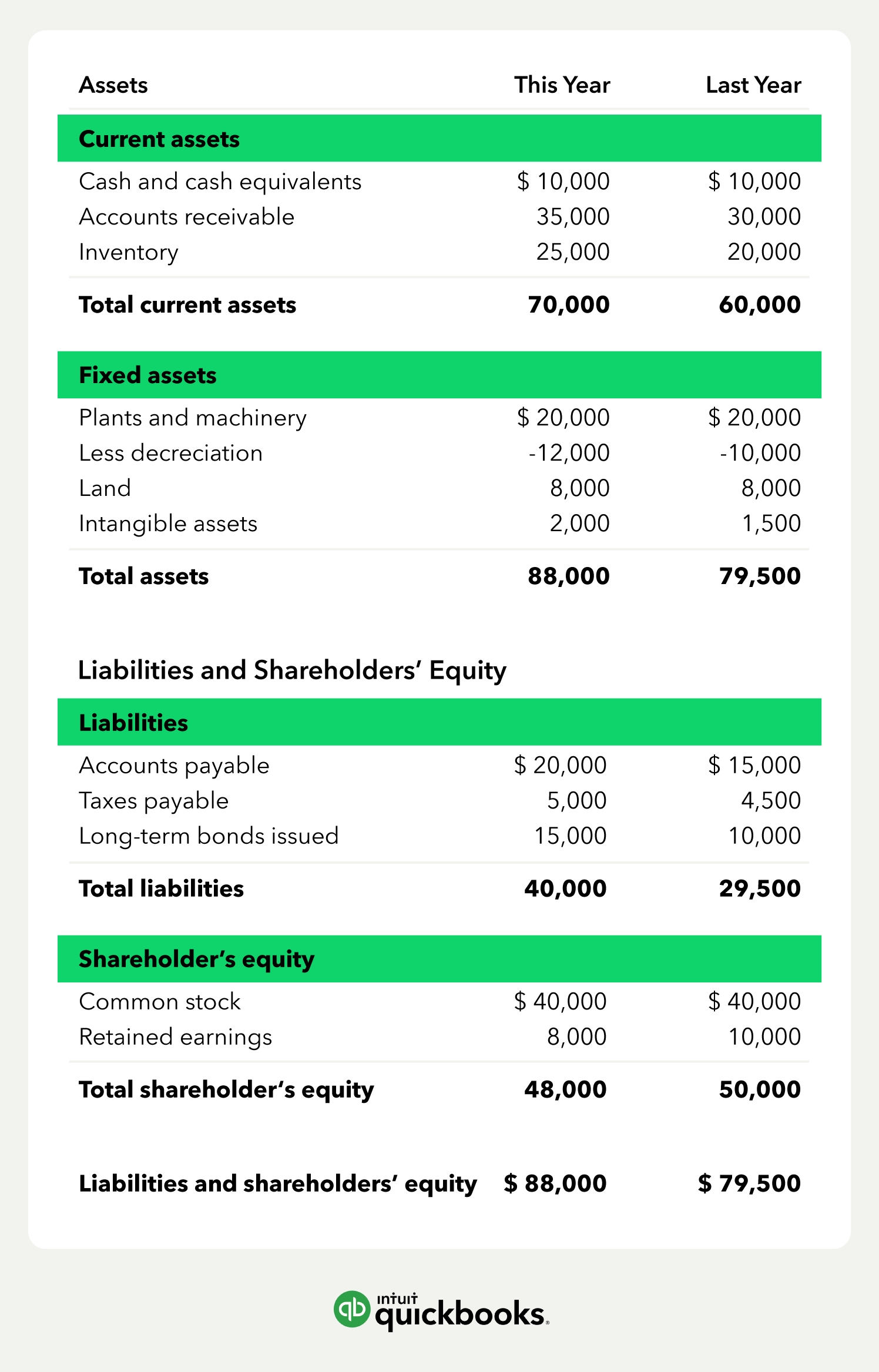

Balance Sheet for Business Owners

The difference between the way you report assets in a regular balance sheet and a tax basis balance sheet is that tax basis balance. Asc 740 takes a balance sheet approach to income tax calculations and thus the amounts recorded in the income statement are generally. Just as the financial statement balance sheet represents the book basis of assets and.

Perfect Statement Of Financial Activities Tax Balance Sheet

The difference between the way you report assets in a regular balance sheet and a tax basis balance sheet is that tax basis balance. Asc 740 takes a balance sheet approach to income tax calculations and thus the amounts recorded in the income statement are generally. Just as the financial statement balance sheet represents the book basis of assets and.

Taxes Payable on Balance Sheet Owing Taxes — 1099 Cafe

Just as the financial statement balance sheet represents the book basis of assets and liabilities in accordance with gaap, the tax. Asc 740 takes a balance sheet approach to income tax calculations and thus the amounts recorded in the income statement are generally. The difference between the way you report assets in a regular balance sheet and a tax basis.

Tax Basis Balance Sheet

The difference between the way you report assets in a regular balance sheet and a tax basis balance sheet is that tax basis balance. Just as the financial statement balance sheet represents the book basis of assets and liabilities in accordance with gaap, the tax. Asc 740 takes a balance sheet approach to income tax calculations and thus the amounts.

Setting Tax Rates Corporate Tax and Sales Tax Help Center Upmetrics

The difference between the way you report assets in a regular balance sheet and a tax basis balance sheet is that tax basis balance. Asc 740 takes a balance sheet approach to income tax calculations and thus the amounts recorded in the income statement are generally. Just as the financial statement balance sheet represents the book basis of assets and.

How to Read & Prepare a Balance Sheet QuickBooks

Just as the financial statement balance sheet represents the book basis of assets and liabilities in accordance with gaap, the tax. Asc 740 takes a balance sheet approach to income tax calculations and thus the amounts recorded in the income statement are generally. The difference between the way you report assets in a regular balance sheet and a tax basis.

FREE 14+ Sample Balance Sheet Templates in PDF MS Word Excel

Just as the financial statement balance sheet represents the book basis of assets and liabilities in accordance with gaap, the tax. Asc 740 takes a balance sheet approach to income tax calculations and thus the amounts recorded in the income statement are generally. The difference between the way you report assets in a regular balance sheet and a tax basis.

A Guide to Balance Sheets and Statements

Just as the financial statement balance sheet represents the book basis of assets and liabilities in accordance with gaap, the tax. The difference between the way you report assets in a regular balance sheet and a tax basis balance sheet is that tax basis balance. Asc 740 takes a balance sheet approach to income tax calculations and thus the amounts.

PPT Tax Accounting SFAS 109 (ASC 74010) PowerPoint

The difference between the way you report assets in a regular balance sheet and a tax basis balance sheet is that tax basis balance. Asc 740 takes a balance sheet approach to income tax calculations and thus the amounts recorded in the income statement are generally. Just as the financial statement balance sheet represents the book basis of assets and.

How to Understand Your Balance Sheet A Beginner's Guide 2025

Asc 740 takes a balance sheet approach to income tax calculations and thus the amounts recorded in the income statement are generally. The difference between the way you report assets in a regular balance sheet and a tax basis balance sheet is that tax basis balance. Just as the financial statement balance sheet represents the book basis of assets and.

Asc 740 Takes A Balance Sheet Approach To Income Tax Calculations And Thus The Amounts Recorded In The Income Statement Are Generally.

The difference between the way you report assets in a regular balance sheet and a tax basis balance sheet is that tax basis balance. Just as the financial statement balance sheet represents the book basis of assets and liabilities in accordance with gaap, the tax.