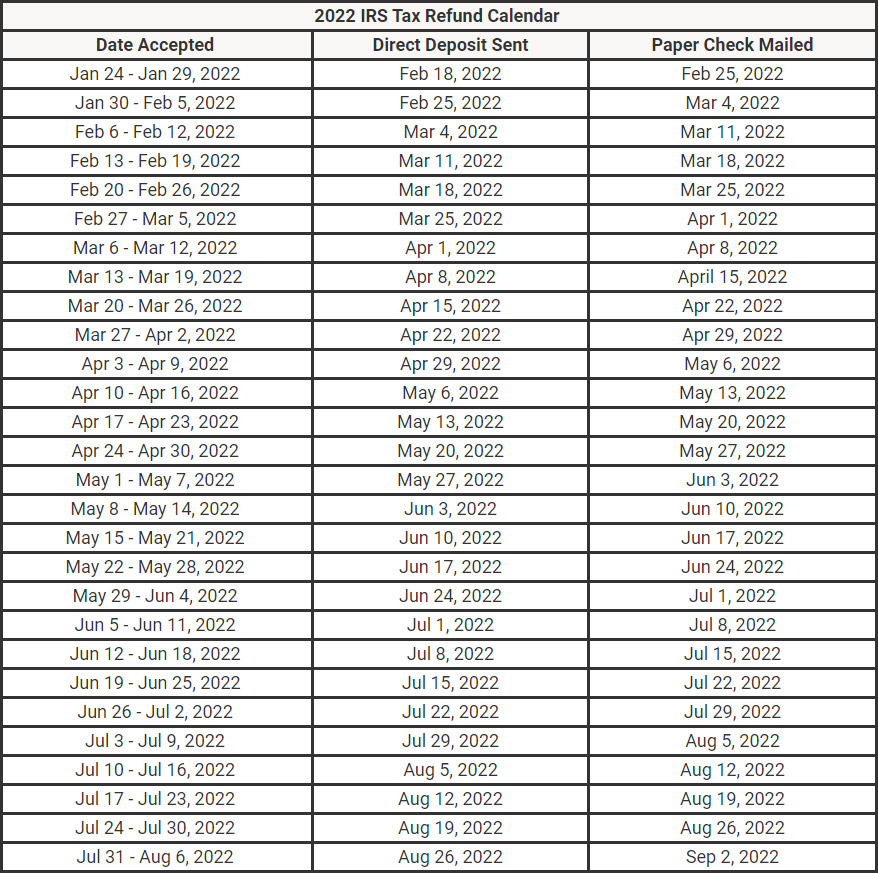

Tax Refund Calendar 2026 With Dependents - Mark your calendars for the key deadlines in 2026: Deadline for filing your federal tax return for the 2025 tax. Use this year's tax calculator to estimate your refund or. Answer questions to see if you. To claim a dependent for tax credits or deductions, the dependent must meet specific requirements. Need a tax amendment for an accepted irs and/or state tax return? By understanding the 2026 tax refund schedule and filing early, you can secure your refund on time and avoid unnecessary. Find out if your child or relative qualifies as a dependent by using the dependucator.

Answer questions to see if you. Need a tax amendment for an accepted irs and/or state tax return? By understanding the 2026 tax refund schedule and filing early, you can secure your refund on time and avoid unnecessary. Mark your calendars for the key deadlines in 2026: Find out if your child or relative qualifies as a dependent by using the dependucator. Deadline for filing your federal tax return for the 2025 tax. To claim a dependent for tax credits or deductions, the dependent must meet specific requirements. Use this year's tax calculator to estimate your refund or.

By understanding the 2026 tax refund schedule and filing early, you can secure your refund on time and avoid unnecessary. Mark your calendars for the key deadlines in 2026: Find out if your child or relative qualifies as a dependent by using the dependucator. Need a tax amendment for an accepted irs and/or state tax return? Answer questions to see if you. Use this year's tax calculator to estimate your refund or. To claim a dependent for tax credits or deductions, the dependent must meet specific requirements. Deadline for filing your federal tax return for the 2025 tax.

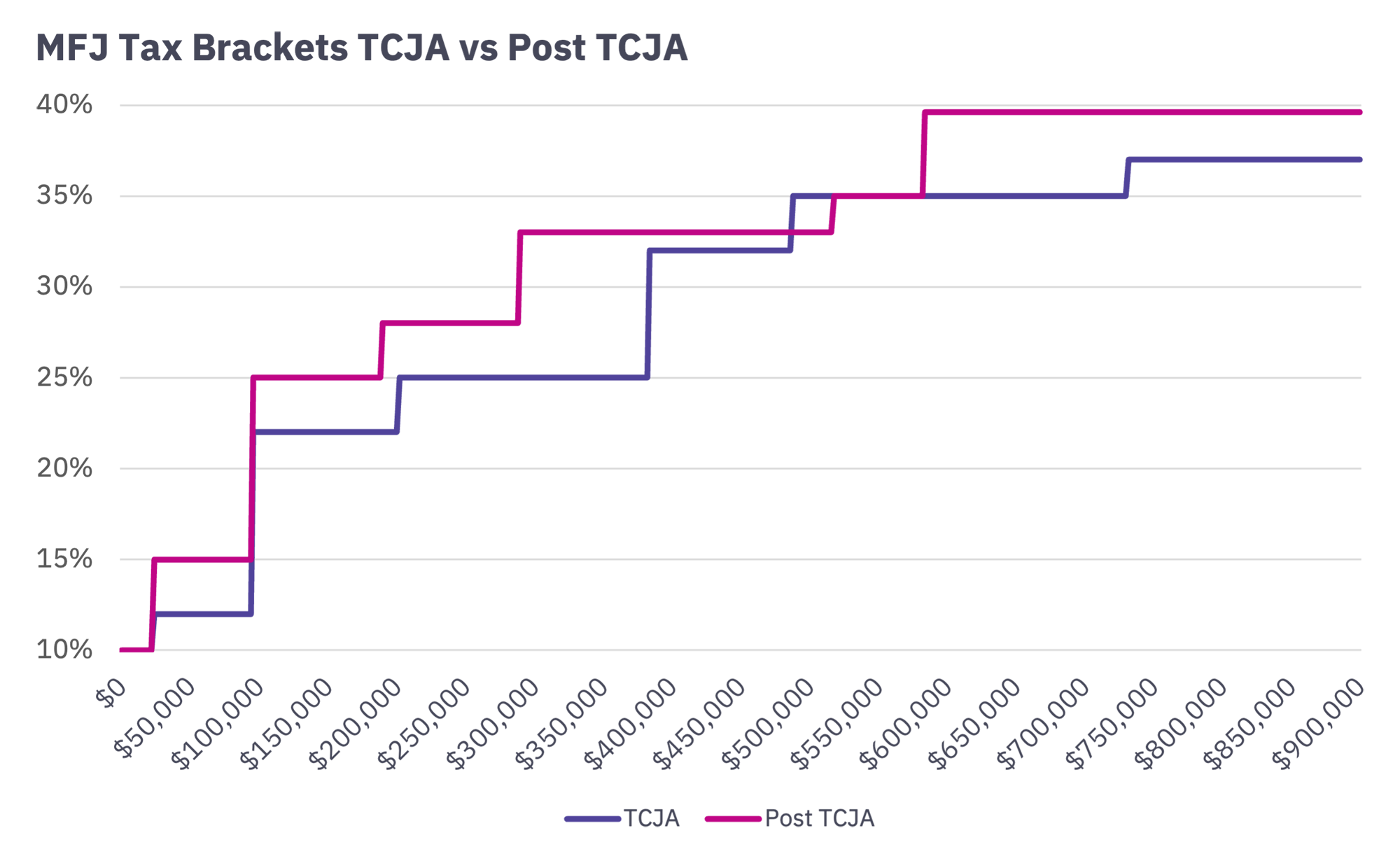

20252026 Tax Brackets A Comprehensive Overview John D. Hylton

To claim a dependent for tax credits or deductions, the dependent must meet specific requirements. Deadline for filing your federal tax return for the 2025 tax. Need a tax amendment for an accepted irs and/or state tax return? Answer questions to see if you. Mark your calendars for the key deadlines in 2026:

Planning for Personal Tax Laws Changing in 2026 Mercer Advisors

Use this year's tax calculator to estimate your refund or. Answer questions to see if you. Mark your calendars for the key deadlines in 2026: Deadline for filing your federal tax return for the 2025 tax. Find out if your child or relative qualifies as a dependent by using the dependucator.

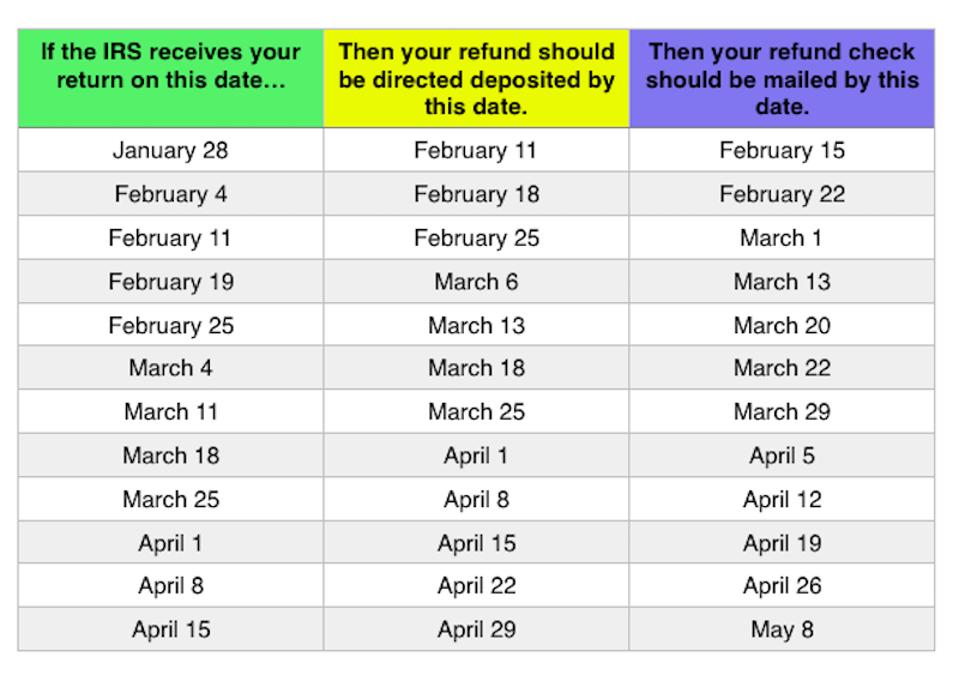

2023 Tax Refund Chart Printable Forms Free Online

Need a tax amendment for an accepted irs and/or state tax return? Mark your calendars for the key deadlines in 2026: Deadline for filing your federal tax return for the 2025 tax. By understanding the 2026 tax refund schedule and filing early, you can secure your refund on time and avoid unnecessary. Answer questions to see if you.

Unlocking the IRS Refund Schedule 2026 What You Need to Know

Mark your calendars for the key deadlines in 2026: Answer questions to see if you. To claim a dependent for tax credits or deductions, the dependent must meet specific requirements. Find out if your child or relative qualifies as a dependent by using the dependucator. Need a tax amendment for an accepted irs and/or state tax return?

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2022 GLASS

By understanding the 2026 tax refund schedule and filing early, you can secure your refund on time and avoid unnecessary. Mark your calendars for the key deadlines in 2026: To claim a dependent for tax credits or deductions, the dependent must meet specific requirements. Use this year's tax calculator to estimate your refund or. Need a tax amendment for an.

20252026 Tax Brackets A Comprehensive Overview Makayla B. Collier

Find out if your child or relative qualifies as a dependent by using the dependucator. Mark your calendars for the key deadlines in 2026: By understanding the 2026 tax refund schedule and filing early, you can secure your refund on time and avoid unnecessary. To claim a dependent for tax credits or deductions, the dependent must meet specific requirements. Answer.

Irs Tax Rebate Calendar Alice J. Molvig

To claim a dependent for tax credits or deductions, the dependent must meet specific requirements. Find out if your child or relative qualifies as a dependent by using the dependucator. Answer questions to see if you. Deadline for filing your federal tax return for the 2025 tax. Use this year's tax calculator to estimate your refund or.

Tax Refund Schedule 2025 With Dependents Jilly Clementia

Mark your calendars for the key deadlines in 2026: Deadline for filing your federal tax return for the 2025 tax. Use this year's tax calculator to estimate your refund or. Answer questions to see if you. Need a tax amendment for an accepted irs and/or state tax return?

Irs Calendar For Direct Deposit 2025 Rikke A. Clausen

Need a tax amendment for an accepted irs and/or state tax return? Use this year's tax calculator to estimate your refund or. Deadline for filing your federal tax return for the 2025 tax. Answer questions to see if you. Mark your calendars for the key deadlines in 2026:

Mich State Tax Refund Calendar 20252026 Amanda Hermina

Answer questions to see if you. Mark your calendars for the key deadlines in 2026: Use this year's tax calculator to estimate your refund or. Find out if your child or relative qualifies as a dependent by using the dependucator. By understanding the 2026 tax refund schedule and filing early, you can secure your refund on time and avoid unnecessary.

Deadline For Filing Your Federal Tax Return For The 2025 Tax.

Answer questions to see if you. Need a tax amendment for an accepted irs and/or state tax return? Mark your calendars for the key deadlines in 2026: To claim a dependent for tax credits or deductions, the dependent must meet specific requirements.

Use This Year's Tax Calculator To Estimate Your Refund Or.

By understanding the 2026 tax refund schedule and filing early, you can secure your refund on time and avoid unnecessary. Find out if your child or relative qualifies as a dependent by using the dependucator.