Tax Warrant Oklahoma - The county treasurer shall issue tax warrants for the collection of delinquent personal taxes upon demand of any person, or whenever the. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt. All state warrants are paid by the state treasurer. A tax warrant in oklahoma is issued when an individual or business fails to pay state taxes owed to the oklahoma tax commission. The state treasurer uses a positive pay type of account reconciliation. A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving the.

In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt. The county treasurer shall issue tax warrants for the collection of delinquent personal taxes upon demand of any person, or whenever the. A tax warrant in oklahoma is issued when an individual or business fails to pay state taxes owed to the oklahoma tax commission. The state treasurer uses a positive pay type of account reconciliation. All state warrants are paid by the state treasurer. A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving the.

All state warrants are paid by the state treasurer. The state treasurer uses a positive pay type of account reconciliation. A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving the. A tax warrant in oklahoma is issued when an individual or business fails to pay state taxes owed to the oklahoma tax commission. The county treasurer shall issue tax warrants for the collection of delinquent personal taxes upon demand of any person, or whenever the. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt.

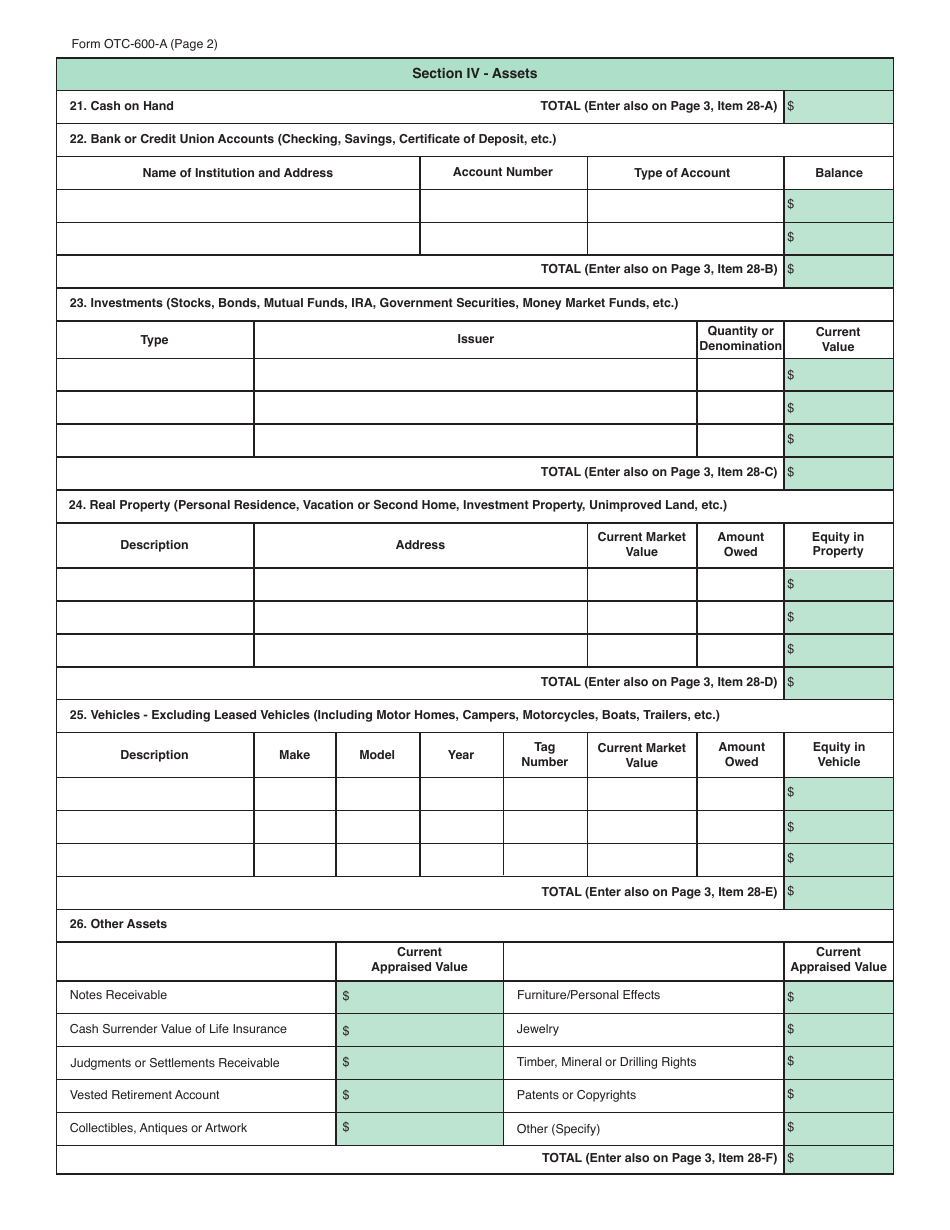

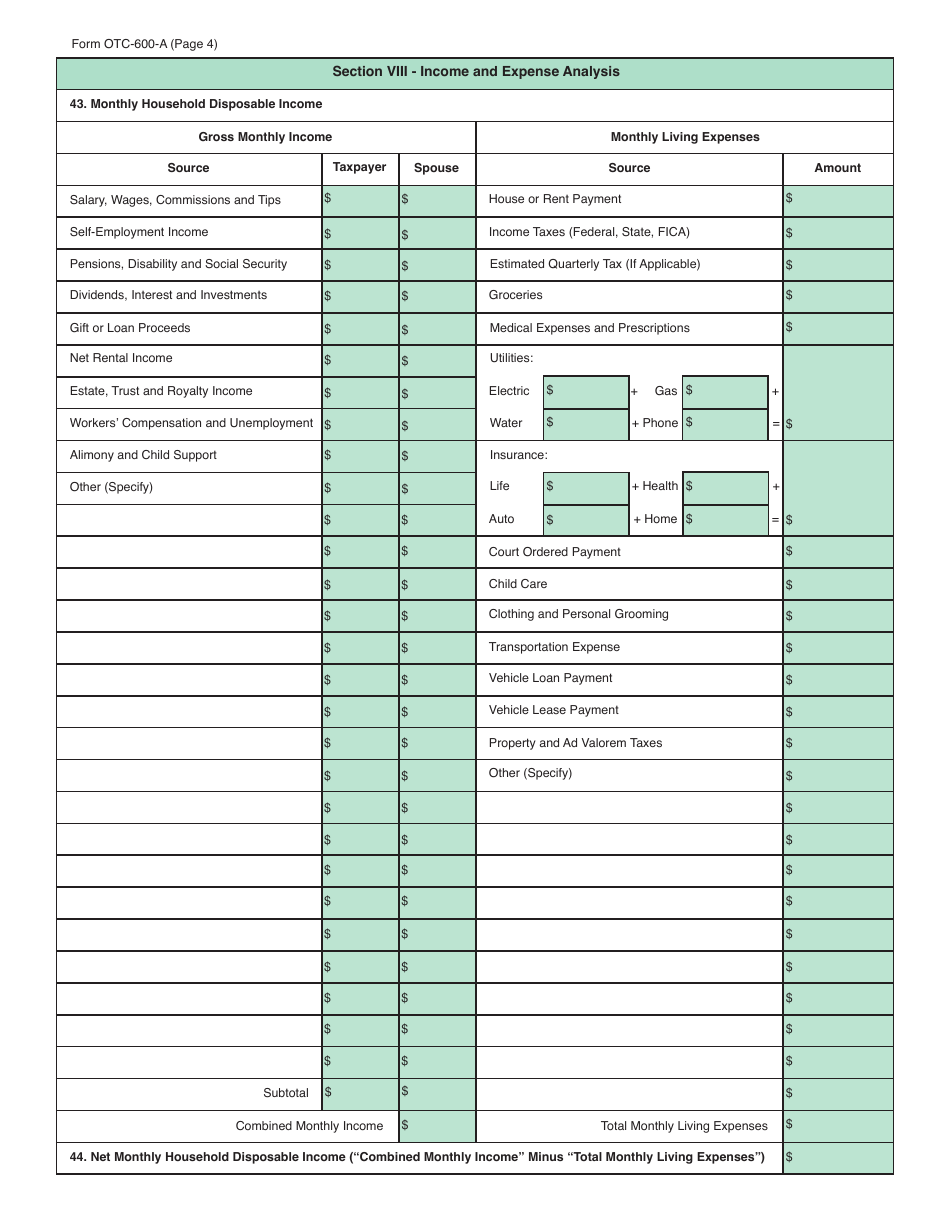

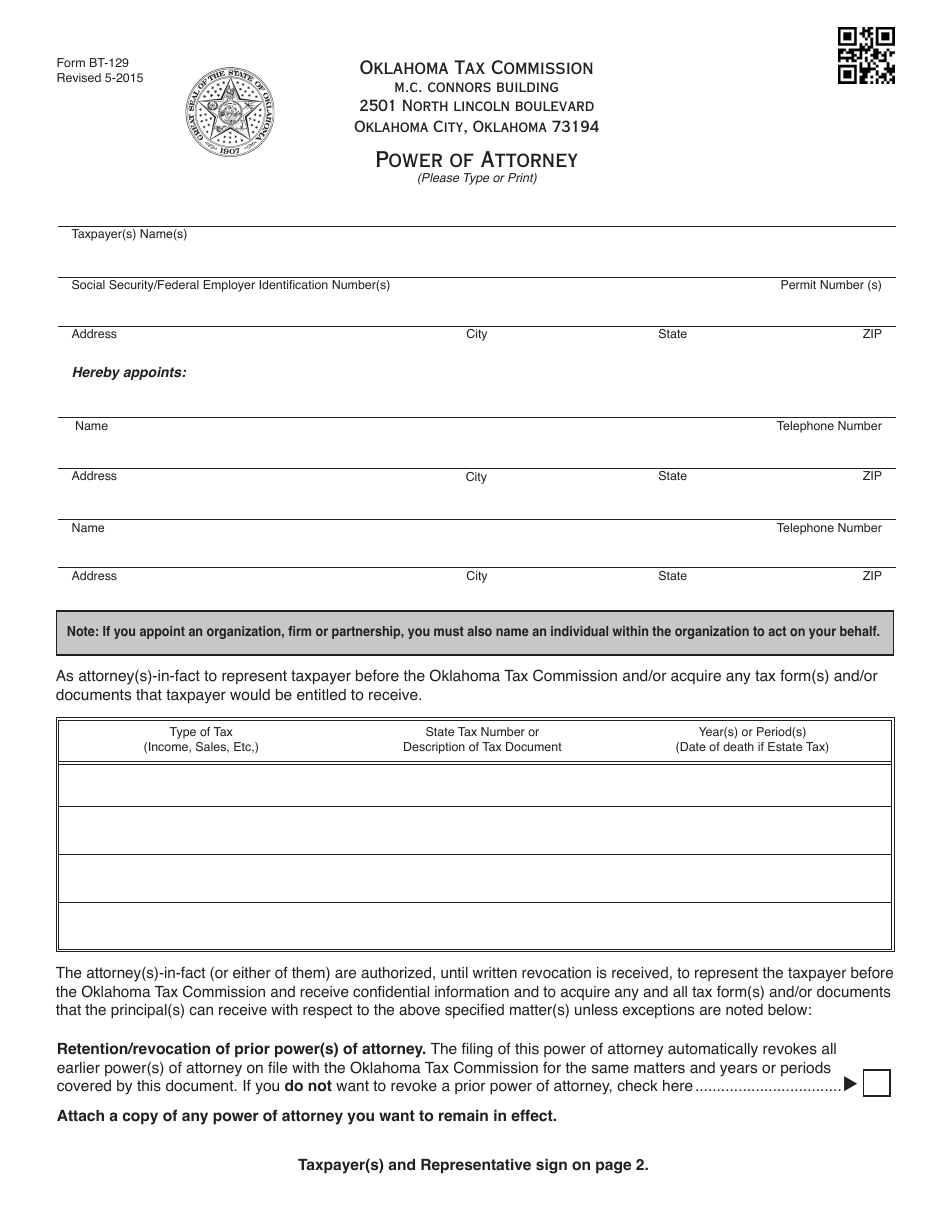

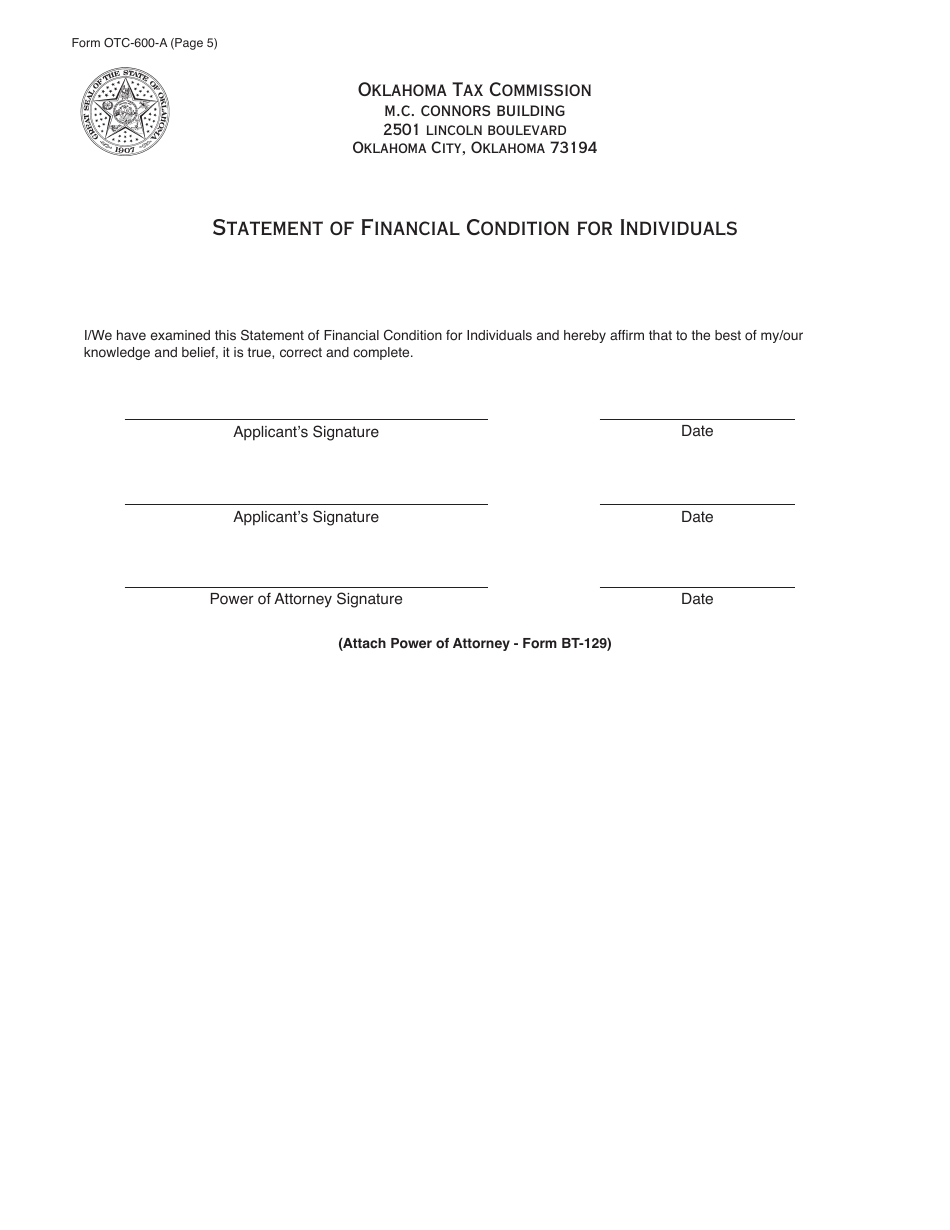

Oklahoma Packet S Application for Settlement of Tax Liability

All state warrants are paid by the state treasurer. The county treasurer shall issue tax warrants for the collection of delinquent personal taxes upon demand of any person, or whenever the. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt. The state treasurer uses a positive pay type of.

Tax Warrants

A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving the. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt. The state treasurer uses a positive pay type of account reconciliation. All state warrants are paid by the state treasurer. A.

What Happens When A Tax Warrant Is Issued? Beem

The county treasurer shall issue tax warrants for the collection of delinquent personal taxes upon demand of any person, or whenever the. The state treasurer uses a positive pay type of account reconciliation. All state warrants are paid by the state treasurer. A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving.

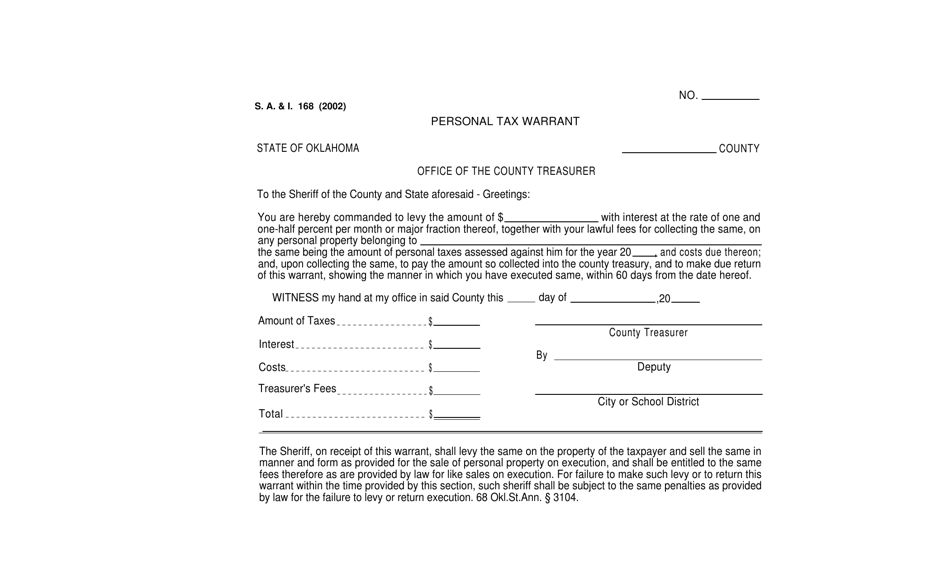

Form S.A.& I.168 Fill Out, Sign Online and Download Printable PDF

The county treasurer shall issue tax warrants for the collection of delinquent personal taxes upon demand of any person, or whenever the. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt. All state warrants are paid by the state treasurer. A tax warrant in oklahoma is issued when an.

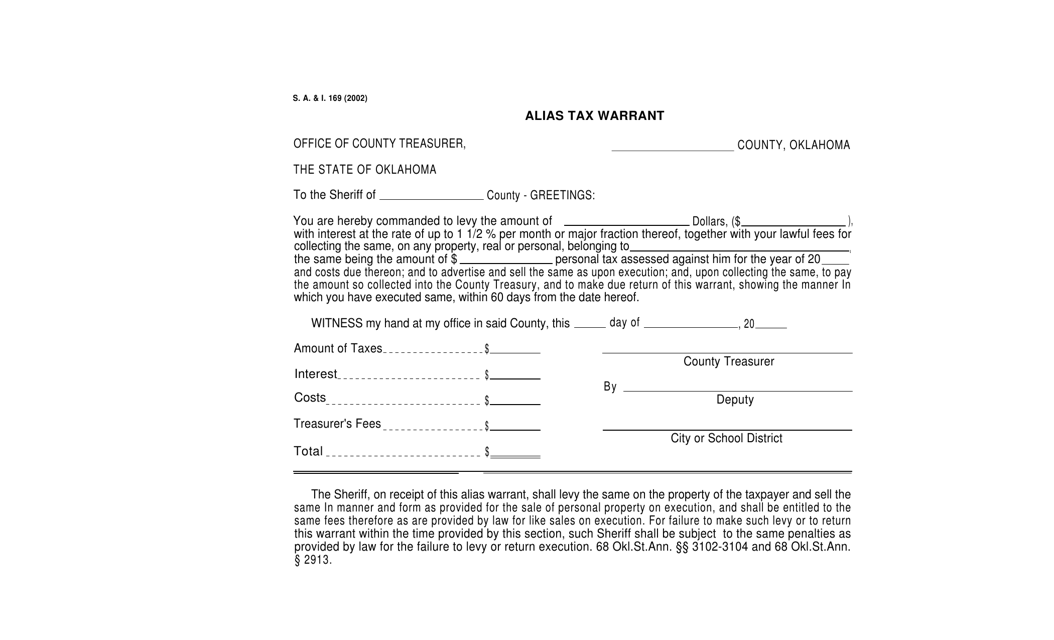

Form S.A.& I.169 Fill Out, Sign Online and Download Printable PDF

A tax warrant in oklahoma is issued when an individual or business fails to pay state taxes owed to the oklahoma tax commission. All state warrants are paid by the state treasurer. The state treasurer uses a positive pay type of account reconciliation. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy.

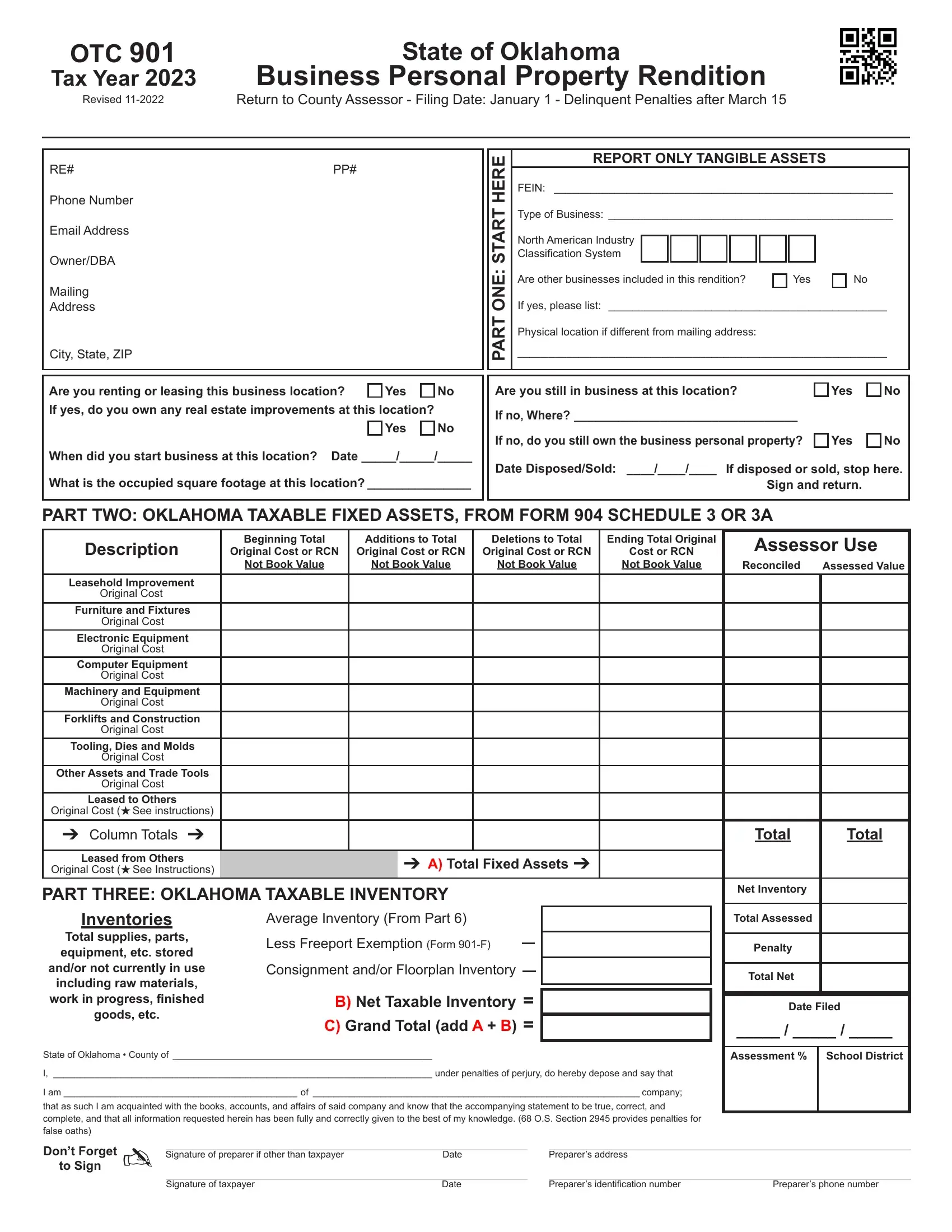

Otc 901 Oklahoma Tax Form ≡ Fill Out Printable PDF Forms Online

The county treasurer shall issue tax warrants for the collection of delinquent personal taxes upon demand of any person, or whenever the. The state treasurer uses a positive pay type of account reconciliation. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt. All state warrants are paid by the.

Tax Warrants — DeKalb County Sheriff's Office

The county treasurer shall issue tax warrants for the collection of delinquent personal taxes upon demand of any person, or whenever the. All state warrants are paid by the state treasurer. A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving the. The state treasurer uses a positive pay type of account.

Oklahoma Packet S Application for Settlement of Tax Liability

The state treasurer uses a positive pay type of account reconciliation. A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving the. All state warrants are paid by the state treasurer. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt. The.

Oklahoma Packet S Application for Settlement of Tax Liability

A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving the. A tax warrant in oklahoma is issued when an individual or business fails to pay state taxes owed to the oklahoma tax commission. The state treasurer uses a positive pay type of account reconciliation. All state warrants are paid by the.

Oklahoma Packet S Application for Settlement of Tax Liability

The county treasurer shall issue tax warrants for the collection of delinquent personal taxes upon demand of any person, or whenever the. A tax warrant in oklahoma is issued when an individual or business fails to pay state taxes owed to the oklahoma tax commission. The state treasurer uses a positive pay type of account reconciliation. In certain circumstances, the.

A Tax Warrant In Oklahoma Is Essentially A Legal Document Issued By The Oklahoma Tax Commission (Otc) Giving The.

A tax warrant in oklahoma is issued when an individual or business fails to pay state taxes owed to the oklahoma tax commission. All state warrants are paid by the state treasurer. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt. The state treasurer uses a positive pay type of account reconciliation.