Unearned Revenue On Balance Sheet - When you record unearned fees or revenue it only hits the balance sheet. Unearned revenues are recognized when customers pay up front for the. Unearned revenue is a liability and is included on the credit side of the balance sheet. The revenue recognized in this scenario is referred to as deferred revenue or unearned revenue. it occurs when a company records sales revenue in its financial. Unearned rent is never actually closed but actually brought down to a zero balance account.for example, your company was paid rent for december 2010, and january and.

Unearned rent is never actually closed but actually brought down to a zero balance account.for example, your company was paid rent for december 2010, and january and. The revenue recognized in this scenario is referred to as deferred revenue or unearned revenue. it occurs when a company records sales revenue in its financial. When you record unearned fees or revenue it only hits the balance sheet. Unearned revenues are recognized when customers pay up front for the. Unearned revenue is a liability and is included on the credit side of the balance sheet.

Unearned revenue is a liability and is included on the credit side of the balance sheet. When you record unearned fees or revenue it only hits the balance sheet. The revenue recognized in this scenario is referred to as deferred revenue or unearned revenue. it occurs when a company records sales revenue in its financial. Unearned rent is never actually closed but actually brought down to a zero balance account.for example, your company was paid rent for december 2010, and january and. Unearned revenues are recognized when customers pay up front for the.

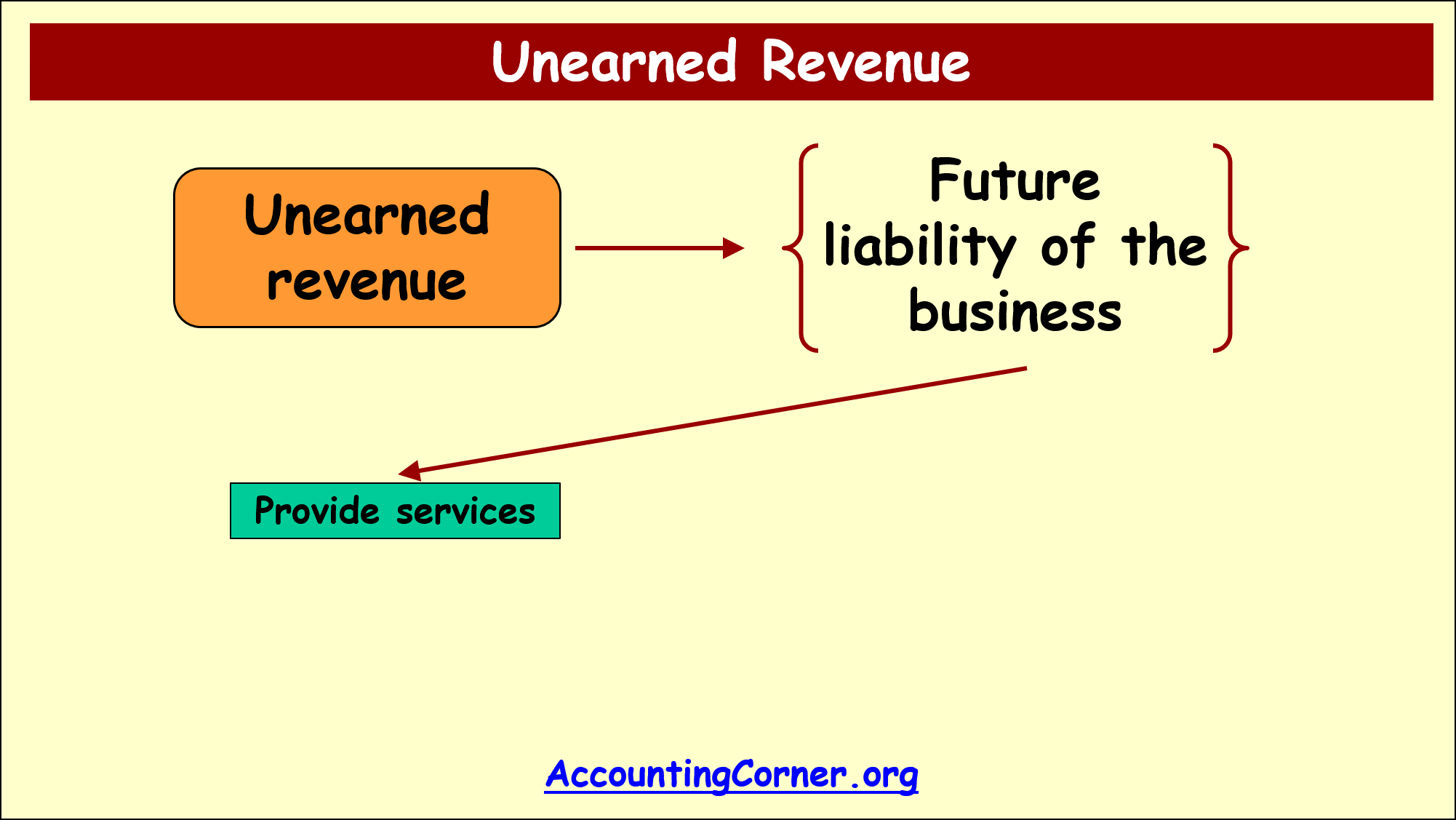

Unearned Revenue Accounting Corner

When you record unearned fees or revenue it only hits the balance sheet. Unearned revenues are recognized when customers pay up front for the. The revenue recognized in this scenario is referred to as deferred revenue or unearned revenue. it occurs when a company records sales revenue in its financial. Unearned revenue is a liability and is included on the.

What is Unearned Revenue? QuickBooks Australia

Unearned rent is never actually closed but actually brought down to a zero balance account.for example, your company was paid rent for december 2010, and january and. When you record unearned fees or revenue it only hits the balance sheet. The revenue recognized in this scenario is referred to as deferred revenue or unearned revenue. it occurs when a company.

Unearned Revenue (Sales) on Balance Sheet Example Journal Entries

Unearned revenue is a liability and is included on the credit side of the balance sheet. The revenue recognized in this scenario is referred to as deferred revenue or unearned revenue. it occurs when a company records sales revenue in its financial. Unearned revenues are recognized when customers pay up front for the. Unearned rent is never actually closed but.

What is Unearned Revenue? QuickBooks Canada Blog

Unearned revenue is a liability and is included on the credit side of the balance sheet. The revenue recognized in this scenario is referred to as deferred revenue or unearned revenue. it occurs when a company records sales revenue in its financial. When you record unearned fees or revenue it only hits the balance sheet. Unearned rent is never actually.

Is unearned revenue a revenue? Leia aqui What is unearned revenue

Unearned revenue is a liability and is included on the credit side of the balance sheet. When you record unearned fees or revenue it only hits the balance sheet. Unearned revenues are recognized when customers pay up front for the. Unearned rent is never actually closed but actually brought down to a zero balance account.for example, your company was paid.

What Is Unearned Revenue? A Definition and Examples for Small Businesses

The revenue recognized in this scenario is referred to as deferred revenue or unearned revenue. it occurs when a company records sales revenue in its financial. Unearned rent is never actually closed but actually brought down to a zero balance account.for example, your company was paid rent for december 2010, and january and. When you record unearned fees or revenue.

Unearned Revenue Balance Sheet Ppt Powerpoint Presentation Gallery

Unearned revenue is a liability and is included on the credit side of the balance sheet. When you record unearned fees or revenue it only hits the balance sheet. Unearned revenues are recognized when customers pay up front for the. The revenue recognized in this scenario is referred to as deferred revenue or unearned revenue. it occurs when a company.

Unearned Revenue Balance Sheet Ppt Powerpoint Presentation Professional

Unearned revenue is a liability and is included on the credit side of the balance sheet. When you record unearned fees or revenue it only hits the balance sheet. The revenue recognized in this scenario is referred to as deferred revenue or unearned revenue. it occurs when a company records sales revenue in its financial. Unearned revenues are recognized when.

Unearned Revenue Chart Of Accounts Ponasa

The revenue recognized in this scenario is referred to as deferred revenue or unearned revenue. it occurs when a company records sales revenue in its financial. Unearned rent is never actually closed but actually brought down to a zero balance account.for example, your company was paid rent for december 2010, and january and. Unearned revenues are recognized when customers pay.

Unearned revenue examples and journal entries Financial

When you record unearned fees or revenue it only hits the balance sheet. Unearned revenues are recognized when customers pay up front for the. The revenue recognized in this scenario is referred to as deferred revenue or unearned revenue. it occurs when a company records sales revenue in its financial. Unearned revenue is a liability and is included on the.

Unearned Revenue Is A Liability And Is Included On The Credit Side Of The Balance Sheet.

When you record unearned fees or revenue it only hits the balance sheet. Unearned rent is never actually closed but actually brought down to a zero balance account.for example, your company was paid rent for december 2010, and january and. The revenue recognized in this scenario is referred to as deferred revenue or unearned revenue. it occurs when a company records sales revenue in its financial. Unearned revenues are recognized when customers pay up front for the.