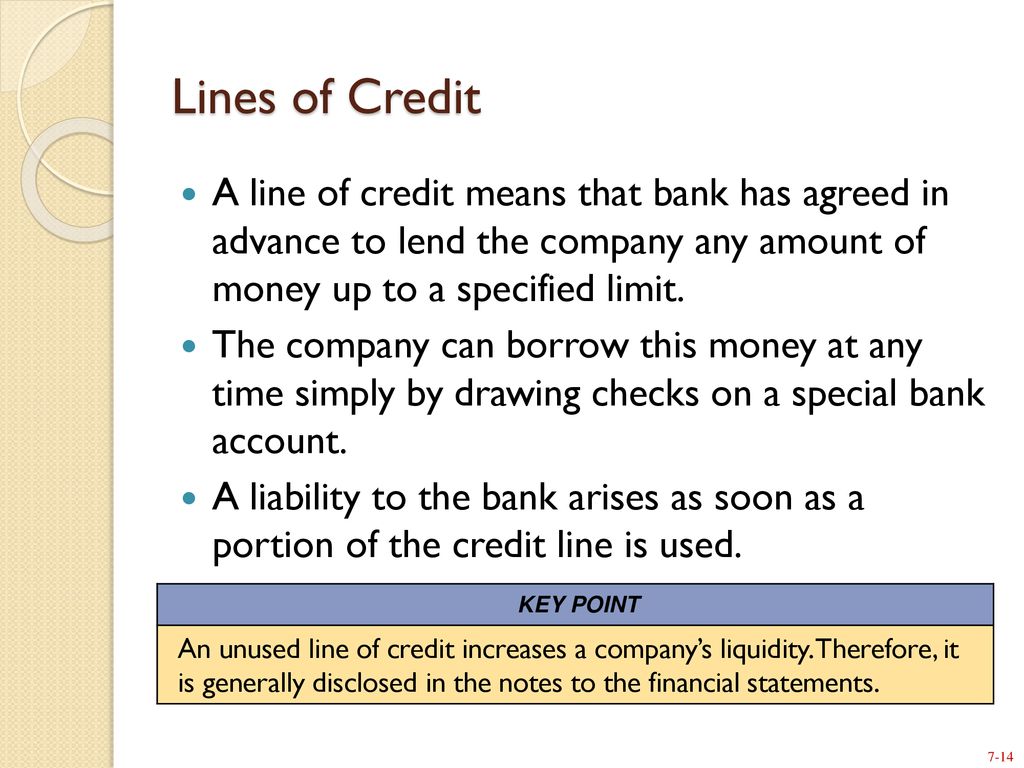

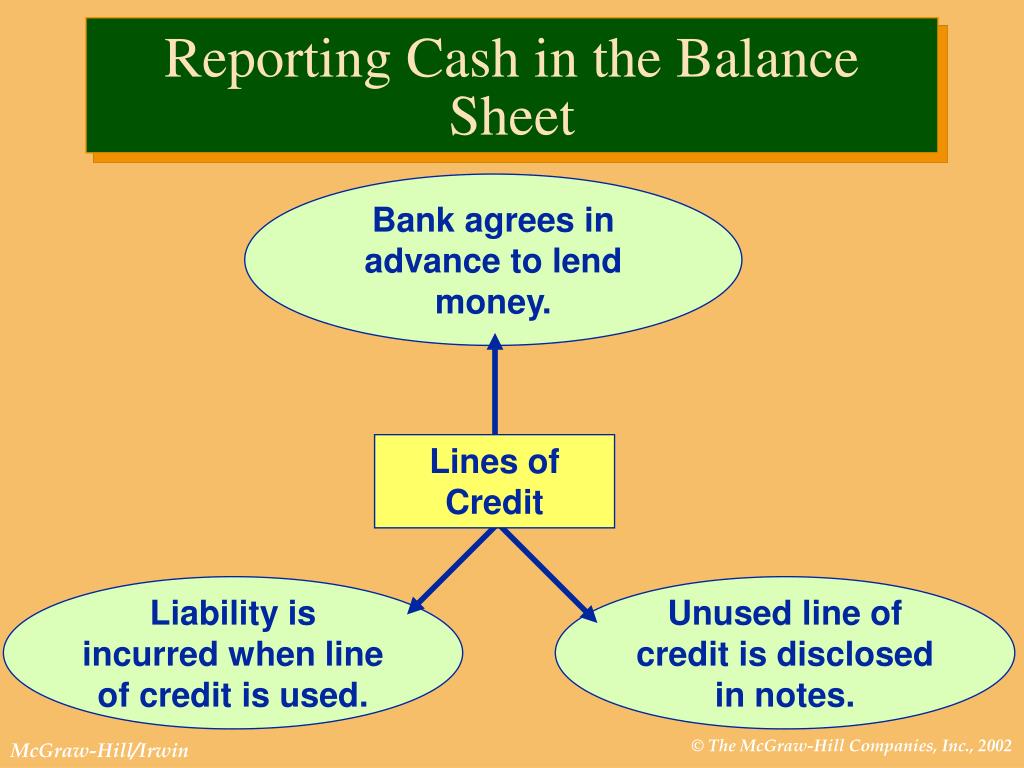

Unused Line Of Credit On Balance Sheet - If the line of credit has not yet been used, it is unnecessary to record entries on your general ledger. This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books. You do not need to reflect an. Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. Open lines of credit do not need. If you have not yet used your line of credit, no journal entry is necessary to your accounting ledger.

Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. If you have not yet used your line of credit, no journal entry is necessary to your accounting ledger. Open lines of credit do not need. Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books. You do not need to reflect an. If the line of credit has not yet been used, it is unnecessary to record entries on your general ledger.

You do not need to reflect an. Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. Open lines of credit do not need. This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books. Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. If you have not yet used your line of credit, no journal entry is necessary to your accounting ledger. If the line of credit has not yet been used, it is unnecessary to record entries on your general ledger.

PPT FINANCIAL ASSETS PowerPoint Presentation, free download ID5945026

Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. Open lines of credit do not need. Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. This means that a reporting entity may have paid.

Chapter 7 Financial Assets. ppt download

This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books. Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. Classify the outstanding borrowings as noncurrent only if it is reasonable.

PPT FINANCIAL ASSETS PowerPoint Presentation, free download ID5945026

Open lines of credit do not need. Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. If you have not yet used your line of.

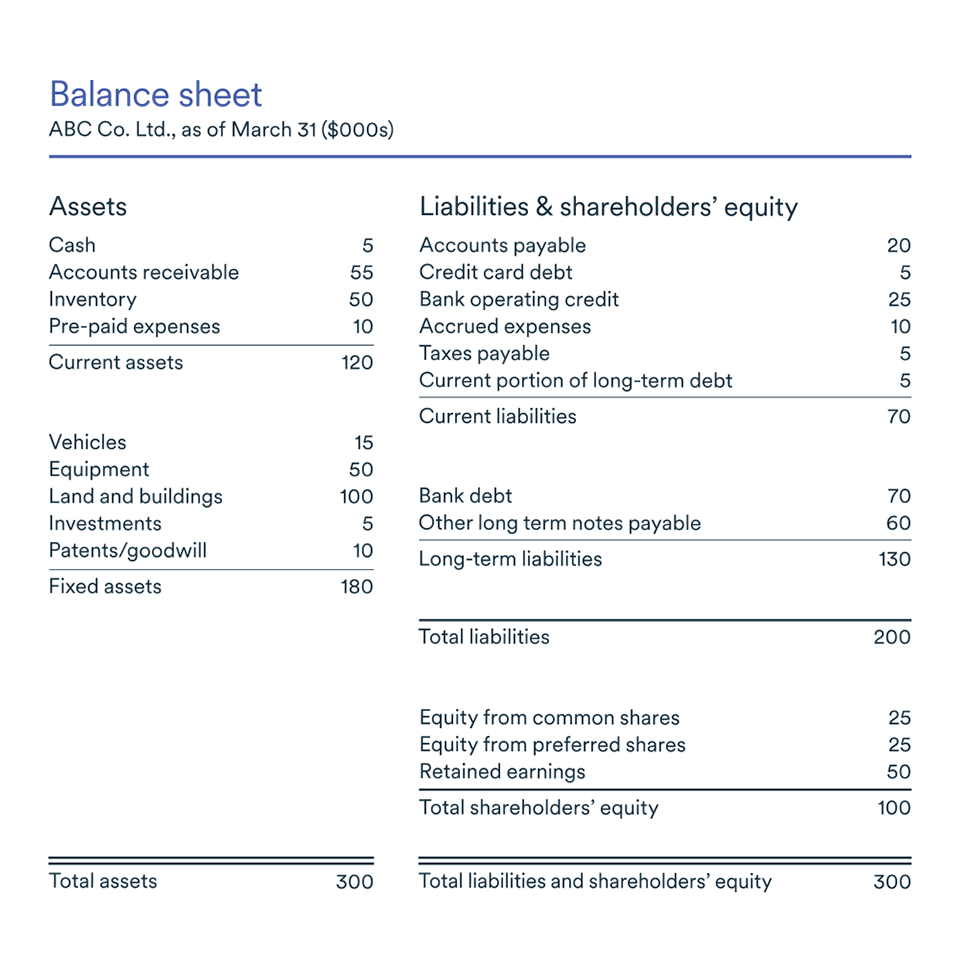

Glory Line Of Credit On Balance Sheet Marketing Expenses Statement

This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books. Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. You do not need to reflect an. If you have not.

PPT Financial Assets PowerPoint Presentation, free download ID626273

Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books. If the line of credit has not yet been used, it.

Financial Assets Chapter 7 Chapter 7 Financial Assets. ppt download

Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. Open lines of credit do not need. If the line of credit has not yet been used, it is unnecessary to record entries on your general ledger. This means that a reporting entity may have paid.

Revolving Credit Facilities What Is It, Vs Term Loan

If the line of credit has not yet been used, it is unnecessary to record entries on your general ledger. This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books. Open lines of credit do not need. You do not need.

PPT FINANCIAL ASSETS PowerPoint Presentation, free download ID5945026

You do not need to reflect an. If you have not yet used your line of credit, no journal entry is necessary to your accounting ledger. Open lines of credit do not need. Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. Unused credit lines.

What is a line of credit? BDC.ca

Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. You do not need to reflect an. Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months. Open lines of credit do not need. If the.

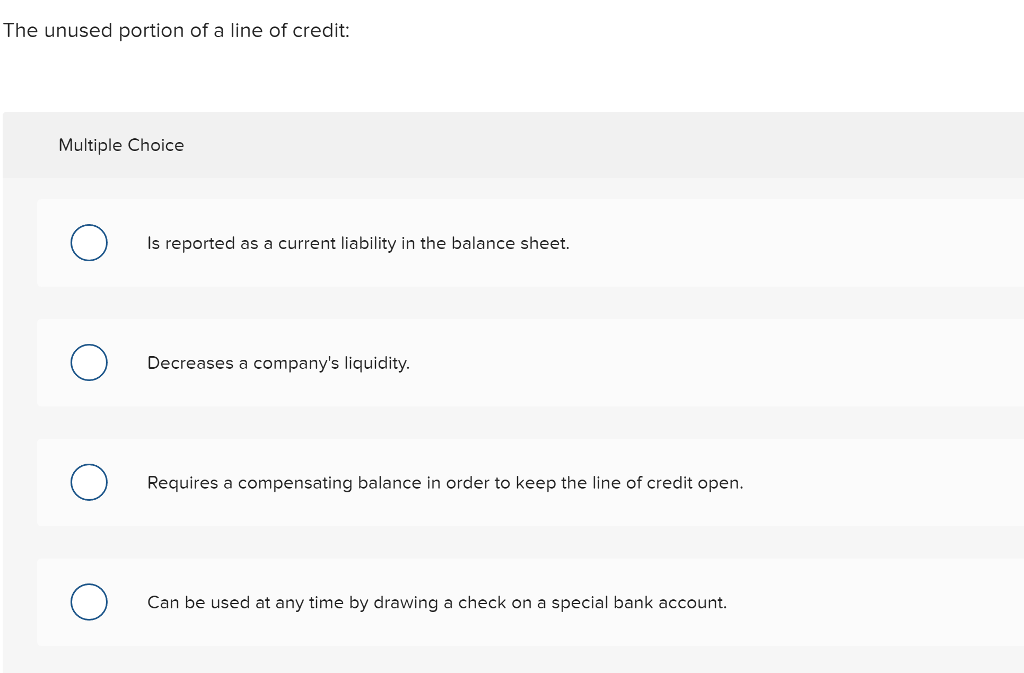

Solved The unused portion of a line of credit Multiple

If the line of credit has not yet been used, it is unnecessary to record entries on your general ledger. Open lines of credit do not need. This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books. Classify the outstanding borrowings.

You Do Not Need To Reflect An.

If the line of credit has not yet been used, it is unnecessary to record entries on your general ledger. Unused credit lines are noted in the footnotes of accounting documents to improve the perceived financial health of the company. Open lines of credit do not need. Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months.

If You Have Not Yet Used Your Line Of Credit, No Journal Entry Is Necessary To Your Accounting Ledger.

This means that a reporting entity may have paid the fee to provide access to the revolving line of credit but may not have a liability on its books.