What Is Deferred Revenue On A Balance Sheet - The deferred revenue account is normally classified as a current liability on the balance sheet. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. It can be classified as a long. Deferred revenue is a concept in accounting that affects how companies recognize income. Explore how deferred revenue is classified on the balance sheet and its implications for financial reporting and tax. It represents payments received for.

It can be classified as a long. It represents payments received for. The deferred revenue account is normally classified as a current liability on the balance sheet. Deferred revenue is a concept in accounting that affects how companies recognize income. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Explore how deferred revenue is classified on the balance sheet and its implications for financial reporting and tax.

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue is a concept in accounting that affects how companies recognize income. The deferred revenue account is normally classified as a current liability on the balance sheet. It can be classified as a long. Explore how deferred revenue is classified on the balance sheet and its implications for financial reporting and tax. It represents payments received for.

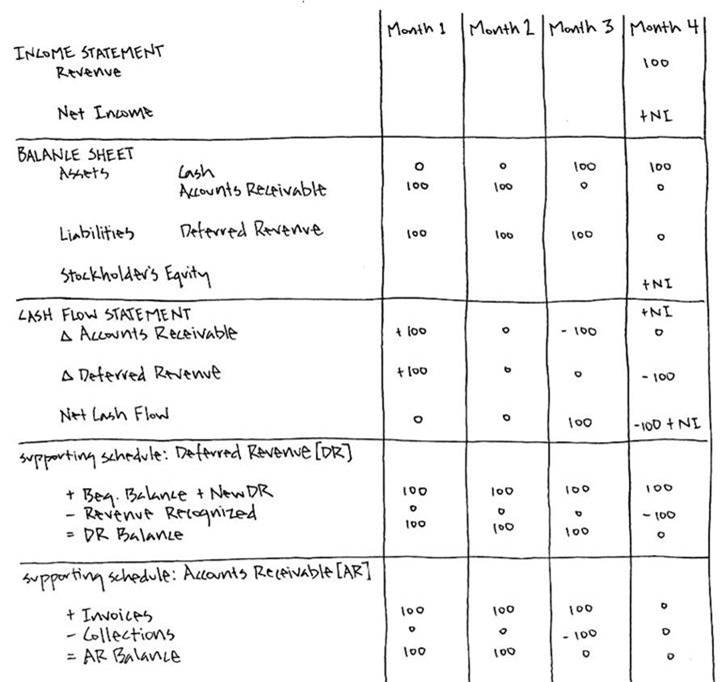

Deferred Revenue A Simple Model

It can be classified as a long. Explore how deferred revenue is classified on the balance sheet and its implications for financial reporting and tax. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue is a concept in accounting that affects how companies recognize income..

Deferred Revenue AwesomeFinTech Blog

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. It represents payments received for. The deferred revenue account is normally classified as a current liability on the balance sheet. Deferred revenue is a concept in accounting that affects how companies recognize income. It can be classified as.

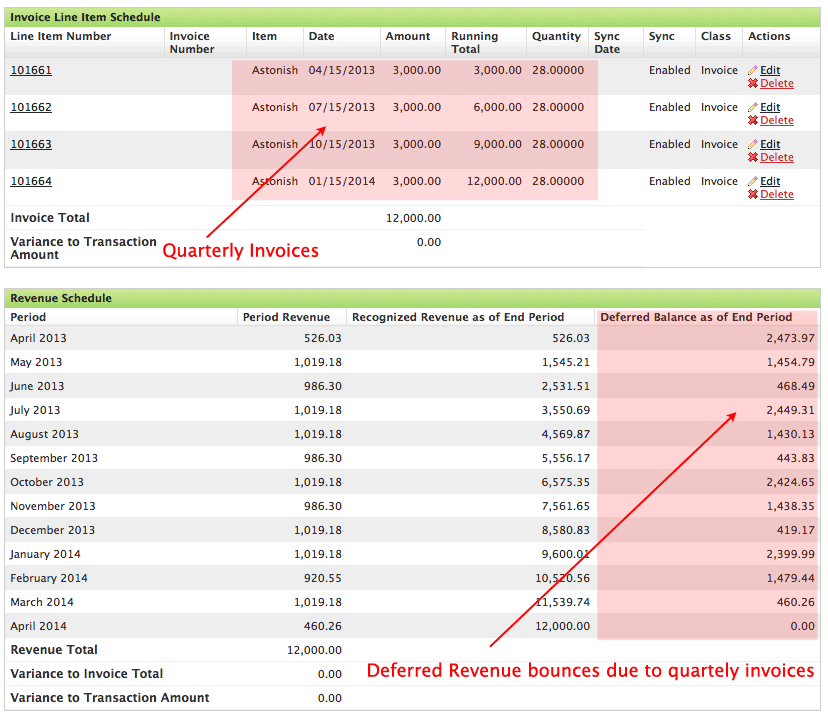

How To Record SaaS Deferred Revenue? FreeCashFlow.io

The deferred revenue account is normally classified as a current liability on the balance sheet. Deferred revenue is a concept in accounting that affects how companies recognize income. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Explore how deferred revenue is classified on the balance sheet.

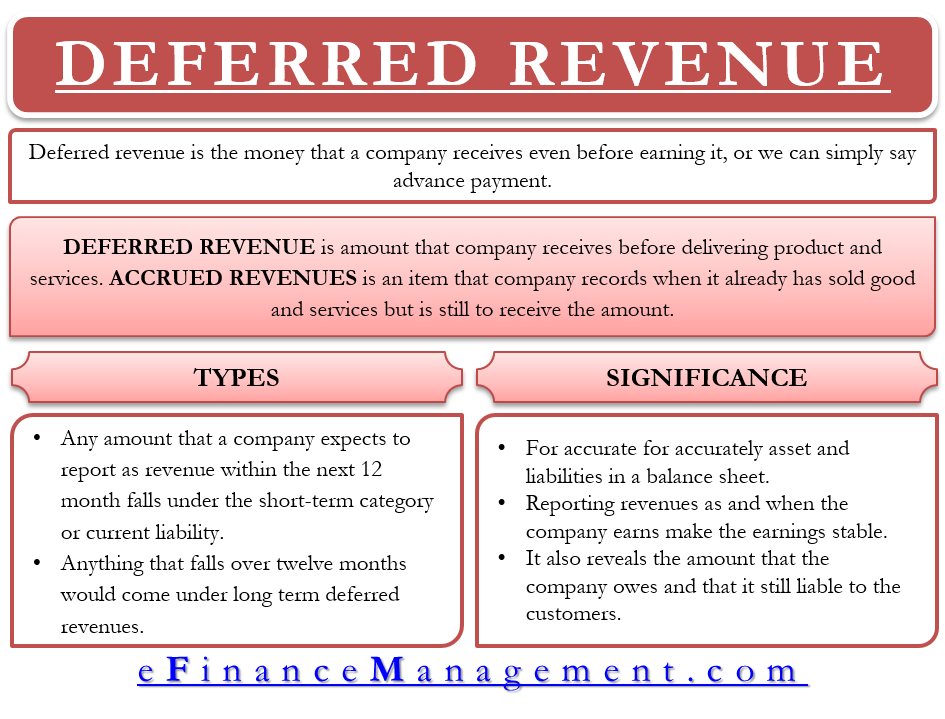

What is Deferred Revenue? The Ultimate Guide (2022)

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. It can be classified as a long. The deferred revenue account is normally classified as a current liability on the balance sheet. Deferred revenue is a concept in accounting that affects how companies recognize income. It represents payments.

Deferred Revenue Balance Sheet Ppt Powerpoint Presentation Visual Aids

It can be classified as a long. Deferred revenue is a concept in accounting that affects how companies recognize income. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Explore how deferred revenue is classified on the balance sheet and its implications for financial reporting and tax..

What is Deferred Revenue in a SaaS Business? SaaSOptics

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Explore how deferred revenue is classified on the balance sheet and its implications for financial reporting and tax. Deferred revenue is a concept in accounting that affects how companies recognize income. The deferred revenue account is normally classified.

Deferred Revenue Meaning, Importance And More

The deferred revenue account is normally classified as a current liability on the balance sheet. Explore how deferred revenue is classified on the balance sheet and its implications for financial reporting and tax. Deferred revenue is a concept in accounting that affects how companies recognize income. It can be classified as a long. Deferred revenue is recorded as a liability.

Simple Deferred Revenue with Jirav Pro

It can be classified as a long. It represents payments received for. Deferred revenue is a concept in accounting that affects how companies recognize income. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Explore how deferred revenue is classified on the balance sheet and its implications.

What Is Deferred Revenue? Complete Guide Pareto Labs

It can be classified as a long. Explore how deferred revenue is classified on the balance sheet and its implications for financial reporting and tax. Deferred revenue is a concept in accounting that affects how companies recognize income. The deferred revenue account is normally classified as a current liability on the balance sheet. It represents payments received for.

Deferred Revenue Debit or Credit and its Flow Through the Financials

The deferred revenue account is normally classified as a current liability on the balance sheet. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Explore how deferred revenue is classified on the balance sheet and its implications for financial reporting and tax. Deferred revenue is a concept.

Explore How Deferred Revenue Is Classified On The Balance Sheet And Its Implications For Financial Reporting And Tax.

It can be classified as a long. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. The deferred revenue account is normally classified as a current liability on the balance sheet. It represents payments received for.