What Is Equity Capital In Balance Sheet - Equity capital is funds paid into a business by investors in exchange for common stock or preferred stock. Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company. Capital = 80,000 + 20,000. Instead, shareholders gain ownership stakes and. Key different between equity and capital. Equity is one of the main components present on the. This represents the core funding of a business,. Equity capital represents the funds a company raises by issuing shares to investors. Unlike debt, equity does not require repayment.

Capital = 80,000 + 20,000. Unlike debt, equity does not require repayment. Instead, shareholders gain ownership stakes and. Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company. Equity is one of the main components present on the. This represents the core funding of a business,. Equity capital is funds paid into a business by investors in exchange for common stock or preferred stock. Equity capital represents the funds a company raises by issuing shares to investors. Key different between equity and capital.

Capital = 80,000 + 20,000. Equity is one of the main components present on the. Equity capital is funds paid into a business by investors in exchange for common stock or preferred stock. Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company. This represents the core funding of a business,. Instead, shareholders gain ownership stakes and. Unlike debt, equity does not require repayment. Equity capital represents the funds a company raises by issuing shares to investors. Key different between equity and capital.

How balance sheet structure content reveal financial position Artofit

Equity capital represents the funds a company raises by issuing shares to investors. Instead, shareholders gain ownership stakes and. Unlike debt, equity does not require repayment. Capital = 80,000 + 20,000. Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company.

How to Read a Balance Sheet (Free Download) Poindexter Blog

Equity is one of the main components present on the. Instead, shareholders gain ownership stakes and. Equity capital represents the funds a company raises by issuing shares to investors. Key different between equity and capital. Unlike debt, equity does not require repayment.

Equity Method of Accounting Excel, Video, and Full Examples

This represents the core funding of a business,. Instead, shareholders gain ownership stakes and. Unlike debt, equity does not require repayment. Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company. Key different between equity and capital.

Owners’ Equity, Stockholders' Equity, Shareholders' Equity Business

Unlike debt, equity does not require repayment. Equity is one of the main components present on the. Instead, shareholders gain ownership stakes and. This represents the core funding of a business,. Capital = 80,000 + 20,000.

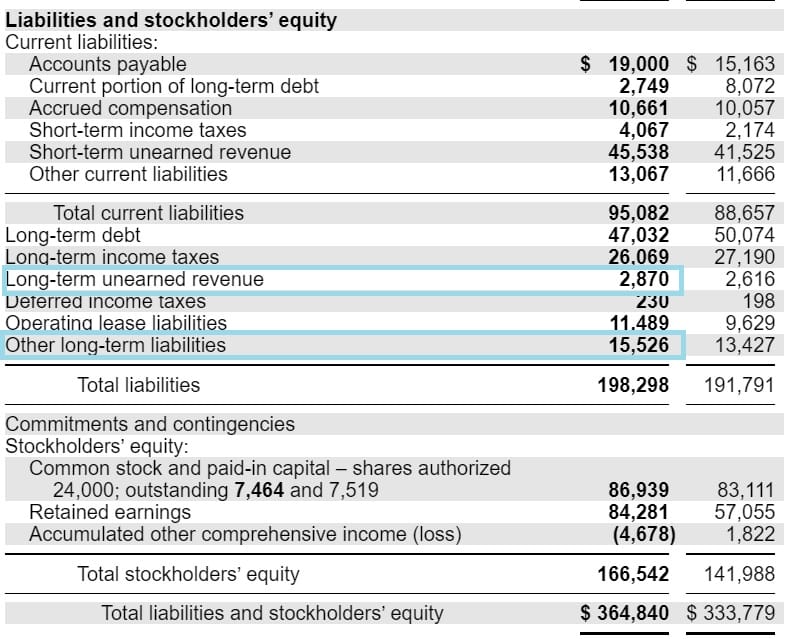

Balance Sheets 101 Understanding Assets, Liabilities and Equity HBS

Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company. Capital = 80,000 + 20,000. Key different between equity and capital. Equity capital is funds paid into a business by investors in exchange for common stock or preferred stock. Equity is one of the.

The Balance Sheet

Capital = 80,000 + 20,000. This represents the core funding of a business,. Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company. Equity capital represents the funds a company raises by issuing shares to investors. Key different between equity and capital.

Invested Capital Formula The Exact Balance Sheet Line Items to Use

Capital = 80,000 + 20,000. Unlike debt, equity does not require repayment. Equity capital is funds paid into a business by investors in exchange for common stock or preferred stock. Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company. Equity is one of.

Balance Sheet Key Indicators of Business Success

Unlike debt, equity does not require repayment. Capital = 80,000 + 20,000. This represents the core funding of a business,. Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company. Equity is one of the main components present on the.

Balance Sheet Definition & Examples (Assets = Liabilities + Equity)

Instead, shareholders gain ownership stakes and. This represents the core funding of a business,. Capital = 80,000 + 20,000. Equity capital represents the funds a company raises by issuing shares to investors. Equity is one of the main components present on the.

Balance Sheet Definition Formula & Examples

Instead, shareholders gain ownership stakes and. Capital = 80,000 + 20,000. Equity capital is funds paid into a business by investors in exchange for common stock or preferred stock. Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company. Unlike debt, equity does not.

Equity Capital Refers To The Capital Collected By A Company From Its Owners And Other Shareholders In Exchange For A Portion Of Ownership In The Company.

Equity is one of the main components present on the. This represents the core funding of a business,. Capital = 80,000 + 20,000. Instead, shareholders gain ownership stakes and.

Equity Capital Represents The Funds A Company Raises By Issuing Shares To Investors.

Equity capital is funds paid into a business by investors in exchange for common stock or preferred stock. Unlike debt, equity does not require repayment. Key different between equity and capital.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)