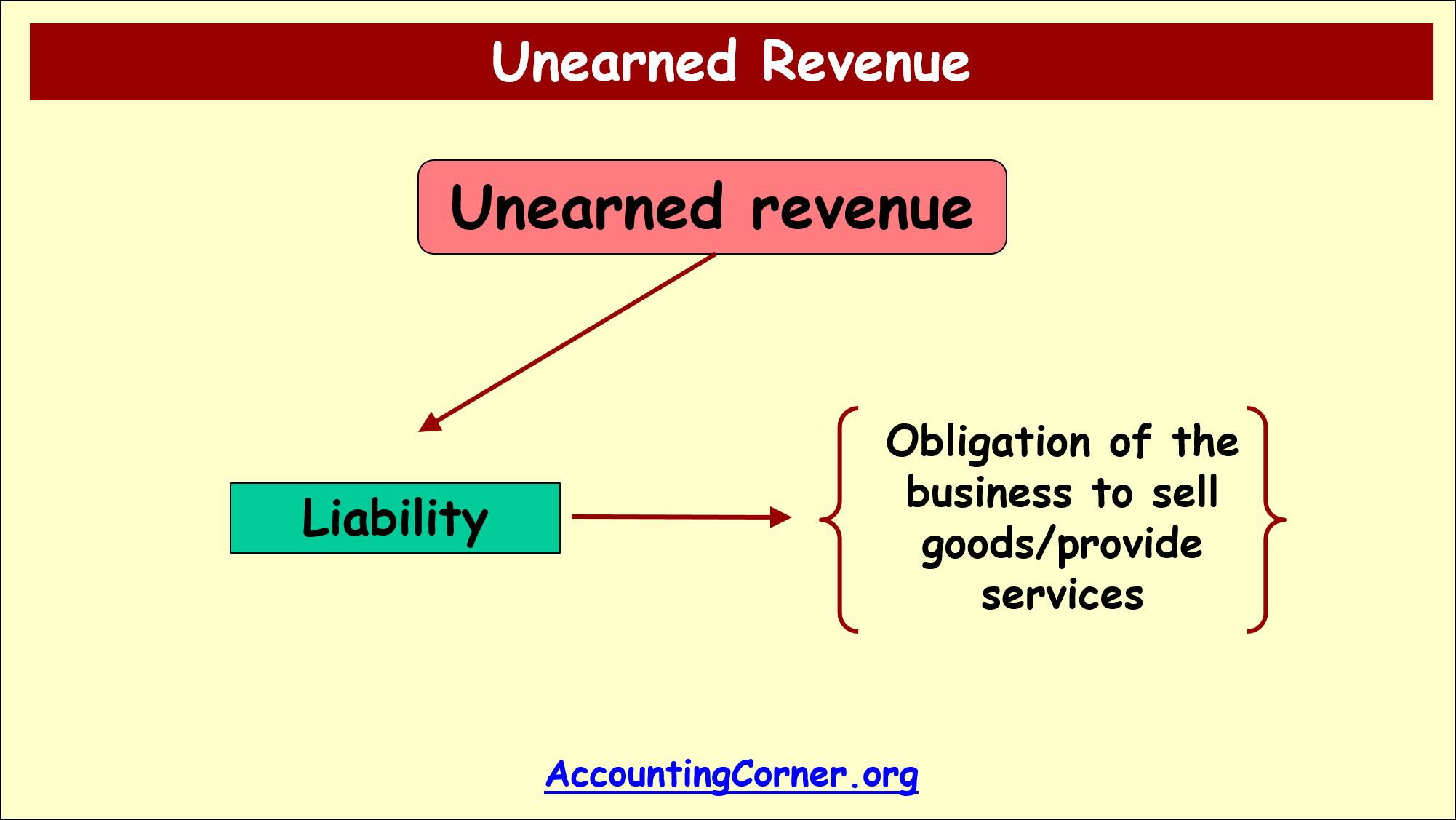

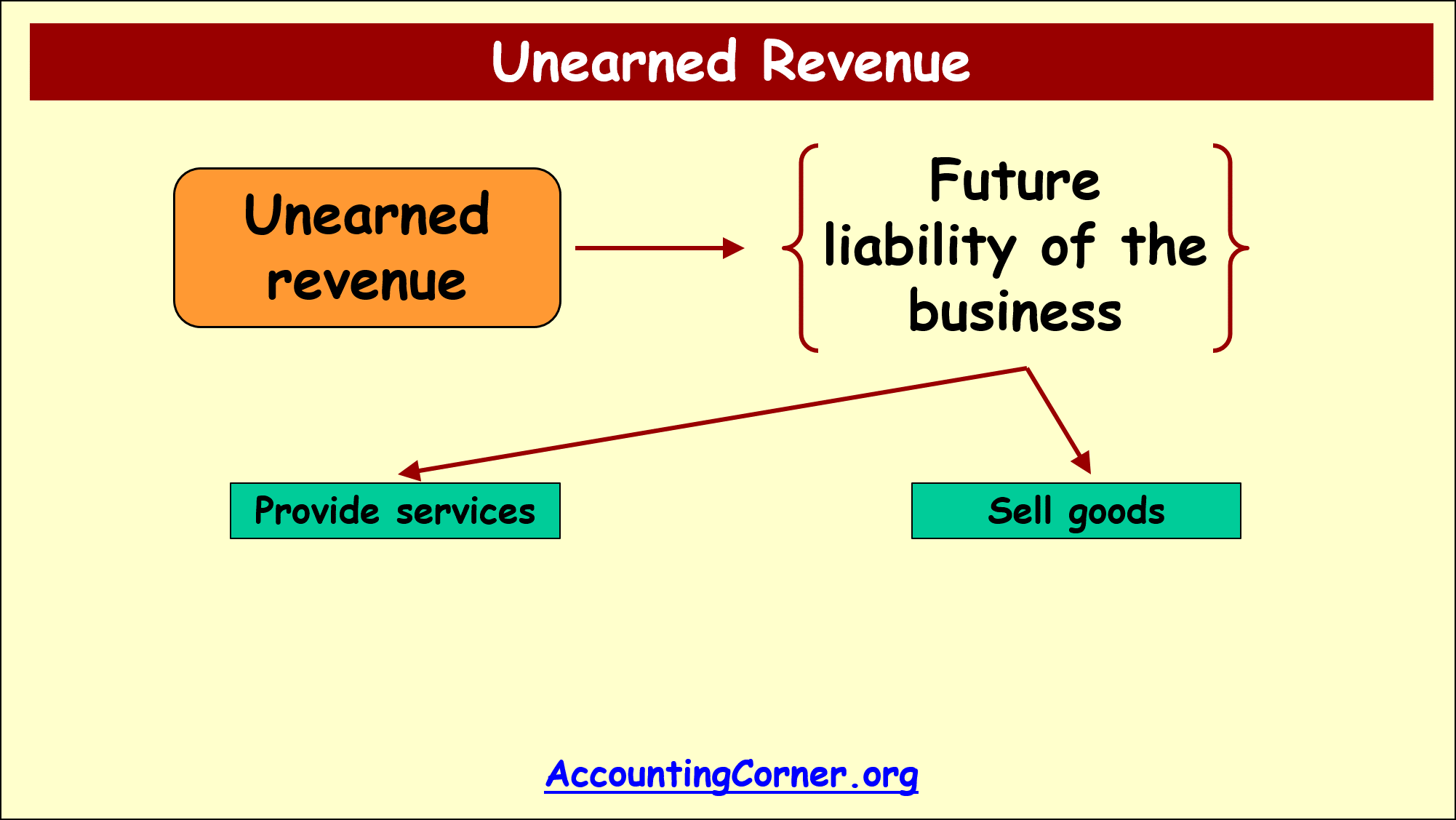

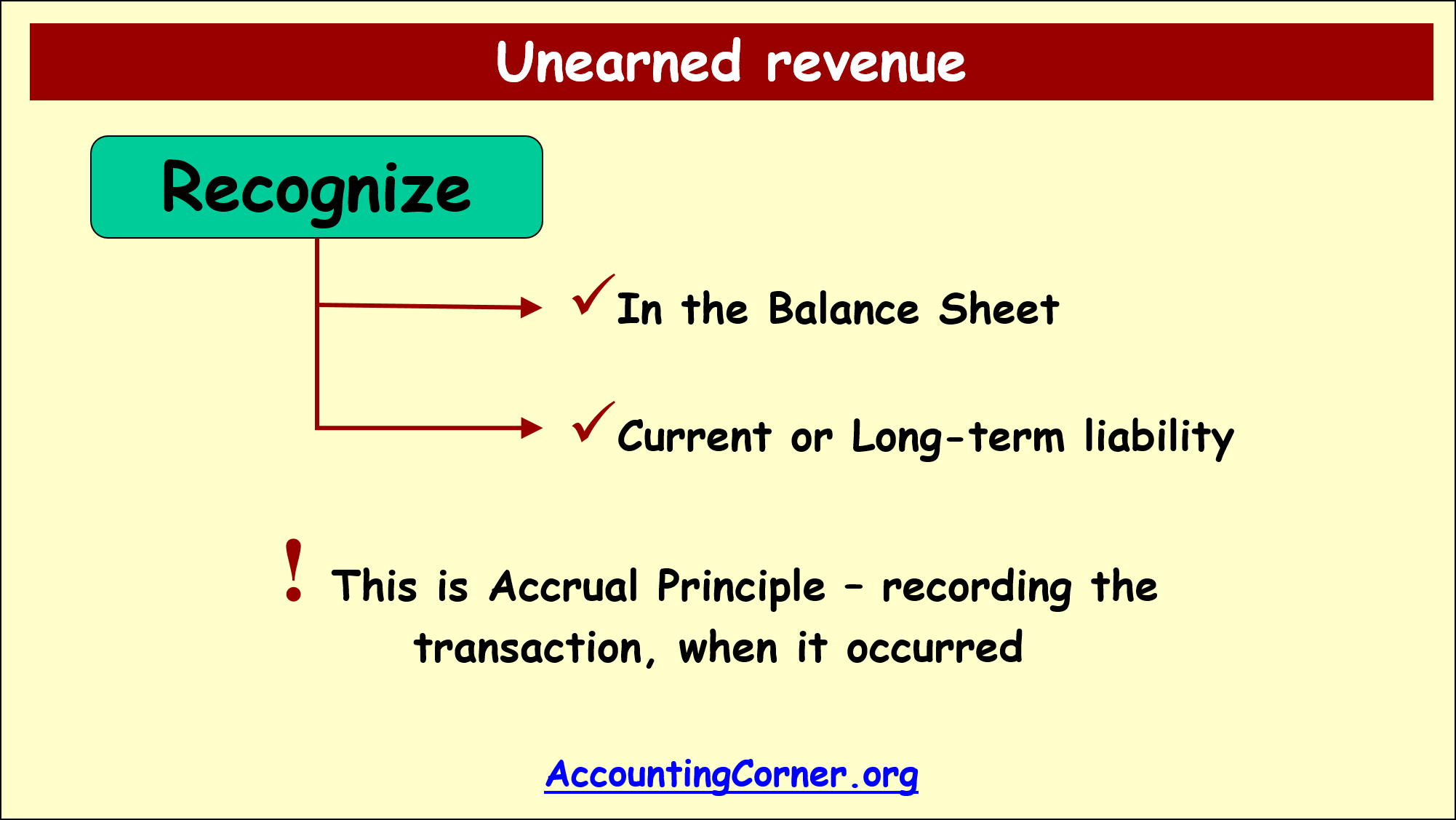

What Is Unearned Revenue On A Balance Sheet - Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. It’s considered a liability, or an amount a business owes. Unearned revenue or deferred revenue appears as a liability on the balance sheet. It does not initially appear on the income. Unearned revenue is an account in financial accounting. Unearned revenue is the number of advance payments which the company has received for the goods or services which are still pending for the. Unearned revenue, sometimes referred to as deferred revenue, is payment received by a company from a.

Unearned revenue is an account in financial accounting. Unearned revenue, sometimes referred to as deferred revenue, is payment received by a company from a. Unearned revenue or deferred revenue appears as a liability on the balance sheet. It’s considered a liability, or an amount a business owes. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Unearned revenue is the number of advance payments which the company has received for the goods or services which are still pending for the. It does not initially appear on the income.

Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Unearned revenue or deferred revenue appears as a liability on the balance sheet. Unearned revenue, sometimes referred to as deferred revenue, is payment received by a company from a. It’s considered a liability, or an amount a business owes. It does not initially appear on the income. Unearned revenue is an account in financial accounting. Unearned revenue is the number of advance payments which the company has received for the goods or services which are still pending for the.

Unearned Revenue Accounting Corner

It’s considered a liability, or an amount a business owes. Unearned revenue or deferred revenue appears as a liability on the balance sheet. Unearned revenue is an account in financial accounting. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Unearned revenue, sometimes referred to as deferred revenue,.

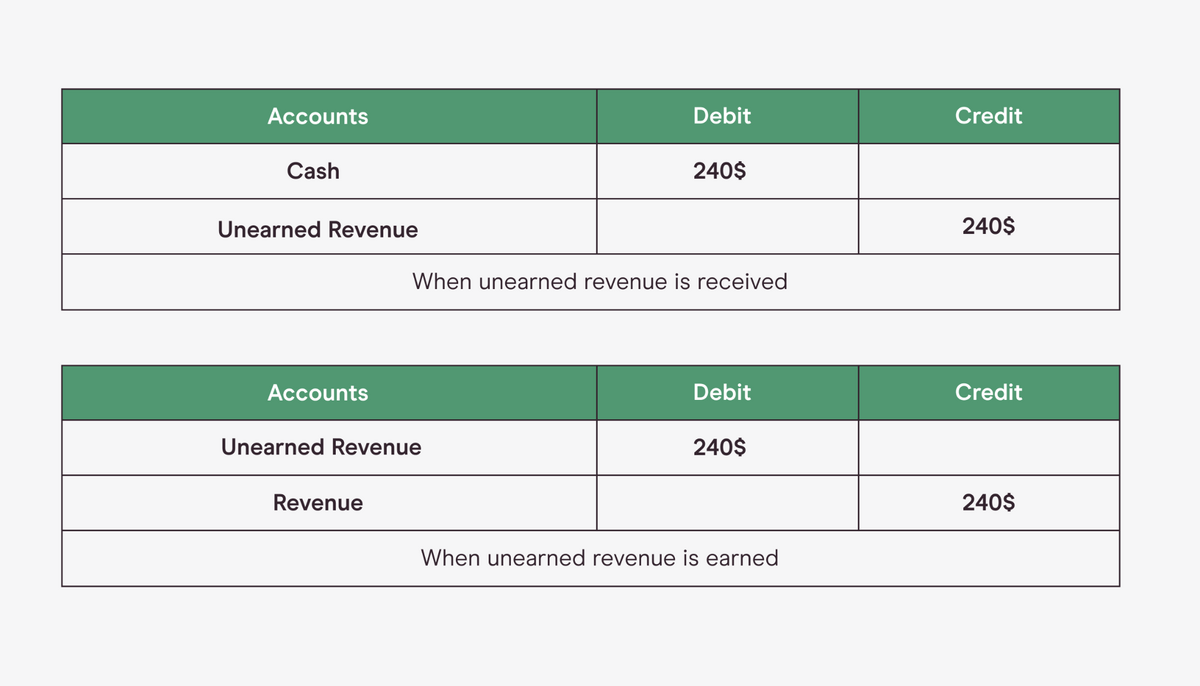

Unearned revenue examples and journal entries Financial

Unearned revenue, sometimes referred to as deferred revenue, is payment received by a company from a. Unearned revenue or deferred revenue appears as a liability on the balance sheet. It does not initially appear on the income. It’s considered a liability, or an amount a business owes. Unearned revenue is the number of advance payments which the company has received.

What Is Unearned Revenue? QuickBooks Global

Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Unearned revenue is an account in financial accounting. Unearned revenue, sometimes referred to as deferred revenue, is payment received by a company from a. It does not initially appear on the income. Unearned revenue is the number of advance.

Is unearned revenue a revenue? Leia aqui What is unearned revenue

Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Unearned revenue is the number of advance payments which the company has received for the goods or services which are still pending for the. Unearned revenue or deferred revenue appears as a liability on the balance sheet. It’s considered.

What Is Unearned Revenue? A Definition and Examples for Small Businesses

Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. It’s considered a liability, or an amount a business owes. It does not initially appear on the income. Unearned revenue is an account in financial accounting. Unearned revenue or deferred revenue appears as a liability on the balance sheet.

Unearned Revenue Balance Sheet Ppt Powerpoint Presentation Professional

It’s considered a liability, or an amount a business owes. Unearned revenue is an account in financial accounting. Unearned revenue is the number of advance payments which the company has received for the goods or services which are still pending for the. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed.

Unearned Revenue Accounting Corner

Unearned revenue is an account in financial accounting. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. It does not initially appear on the income. Unearned revenue or deferred revenue appears as a liability on the balance sheet. Unearned revenue, sometimes referred to as deferred revenue, is payment.

Unearned Revenue Accounting Corner

Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Unearned revenue, sometimes referred to as deferred revenue, is payment received by a company from a. Unearned revenue is an account in financial accounting. Unearned revenue is the number of advance payments which the company has received for the.

What is Unearned Revenue? QuickBooks Australia

Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Unearned revenue, sometimes referred to as deferred revenue, is payment received by a company from a. It’s considered a liability, or an amount a business owes. Unearned revenue is an account in financial accounting. Unearned revenue or deferred revenue.

What is Unearned Revenue? A Complete Guide Pareto Labs

Unearned revenue is the number of advance payments which the company has received for the goods or services which are still pending for the. It does not initially appear on the income. Unearned revenue or deferred revenue appears as a liability on the balance sheet. Unearned revenue, sometimes referred to as deferred revenue, is payment received by a company from.

It Does Not Initially Appear On The Income.

Unearned revenue, sometimes referred to as deferred revenue, is payment received by a company from a. It’s considered a liability, or an amount a business owes. Unearned revenue is the number of advance payments which the company has received for the goods or services which are still pending for the. Unearned revenue or deferred revenue appears as a liability on the balance sheet.

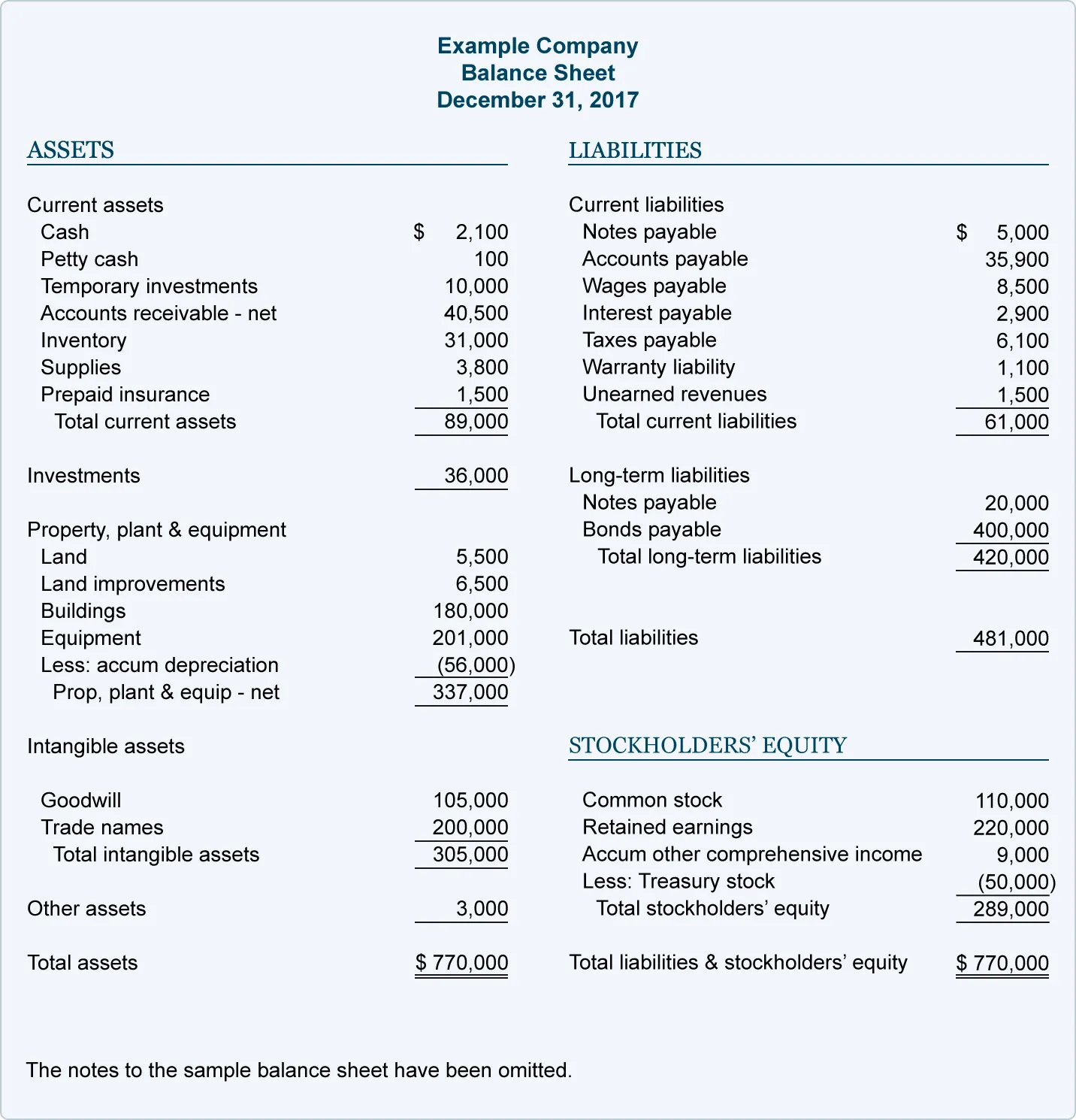

Unearned Revenue Is Recorded On A Company’s Balance Sheet As A Liability Because It Represents A Debt Owed To The Customer.

Unearned revenue is an account in financial accounting.