Where Do Accounts Receivable Go On A Balance Sheet - Classified as a current asset on the company's balance sheet, or statement of financial position, accounts receivable is highly important since it. Since the unmet payment obligation represents a future economic benefit to the company, the accounts receivables line. Accounts receivable are reported as current assets on the balance sheet because they are expected to be converted into cash within a.

Accounts receivable are reported as current assets on the balance sheet because they are expected to be converted into cash within a. Classified as a current asset on the company's balance sheet, or statement of financial position, accounts receivable is highly important since it. Since the unmet payment obligation represents a future economic benefit to the company, the accounts receivables line.

Classified as a current asset on the company's balance sheet, or statement of financial position, accounts receivable is highly important since it. Since the unmet payment obligation represents a future economic benefit to the company, the accounts receivables line. Accounts receivable are reported as current assets on the balance sheet because they are expected to be converted into cash within a.

Reporting Receivables on Classified Balance Sheet Accounting video

Accounts receivable are reported as current assets on the balance sheet because they are expected to be converted into cash within a. Classified as a current asset on the company's balance sheet, or statement of financial position, accounts receivable is highly important since it. Since the unmet payment obligation represents a future economic benefit to the company, the accounts receivables.

What is accounts receivable? Definition and examples

Accounts receivable are reported as current assets on the balance sheet because they are expected to be converted into cash within a. Since the unmet payment obligation represents a future economic benefit to the company, the accounts receivables line. Classified as a current asset on the company's balance sheet, or statement of financial position, accounts receivable is highly important since.

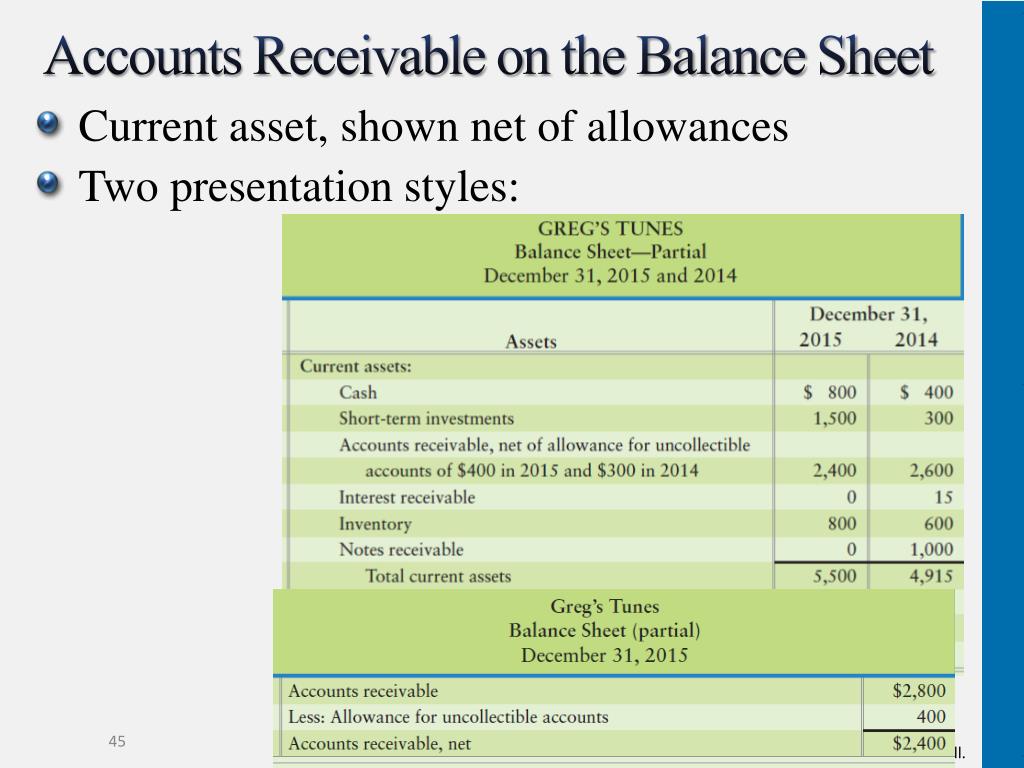

Accounts Receivable on the Balance Sheet

Accounts receivable are reported as current assets on the balance sheet because they are expected to be converted into cash within a. Classified as a current asset on the company's balance sheet, or statement of financial position, accounts receivable is highly important since it. Since the unmet payment obligation represents a future economic benefit to the company, the accounts receivables.

PPT Receivables PowerPoint Presentation, free download ID1657894

Accounts receivable are reported as current assets on the balance sheet because they are expected to be converted into cash within a. Since the unmet payment obligation represents a future economic benefit to the company, the accounts receivables line. Classified as a current asset on the company's balance sheet, or statement of financial position, accounts receivable is highly important since.

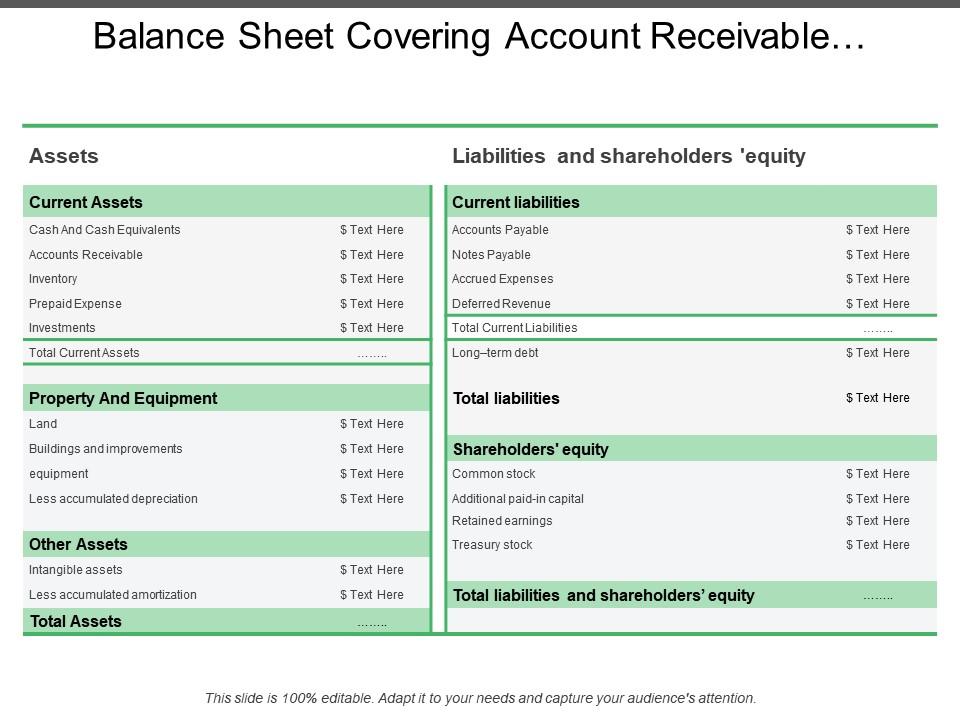

How to Read a Balance Sheet (Free Download) Poindexter Blog

Classified as a current asset on the company's balance sheet, or statement of financial position, accounts receivable is highly important since it. Since the unmet payment obligation represents a future economic benefit to the company, the accounts receivables line. Accounts receivable are reported as current assets on the balance sheet because they are expected to be converted into cash within.

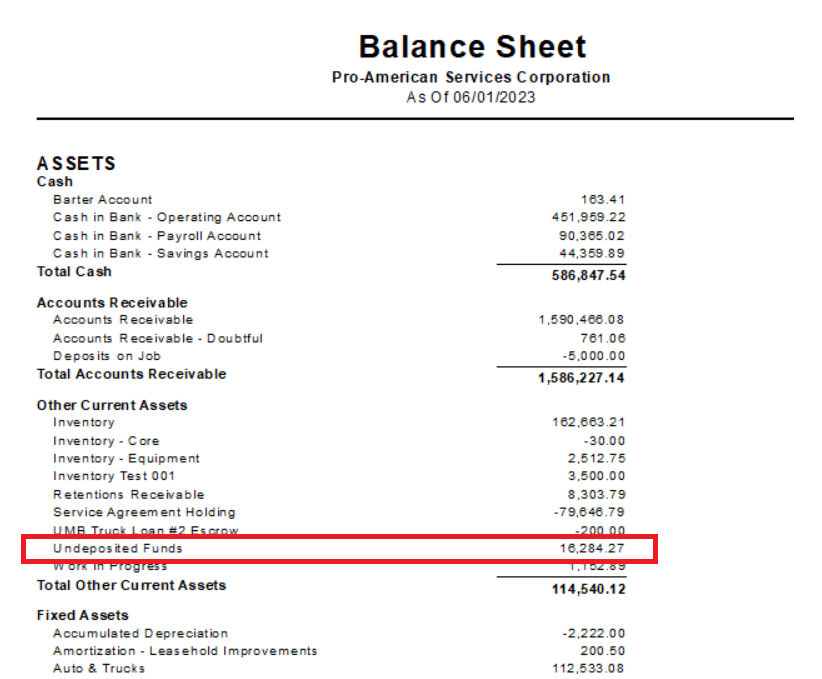

Accounts Receivable Balance Sheet

Classified as a current asset on the company's balance sheet, or statement of financial position, accounts receivable is highly important since it. Since the unmet payment obligation represents a future economic benefit to the company, the accounts receivables line. Accounts receivable are reported as current assets on the balance sheet because they are expected to be converted into cash within.

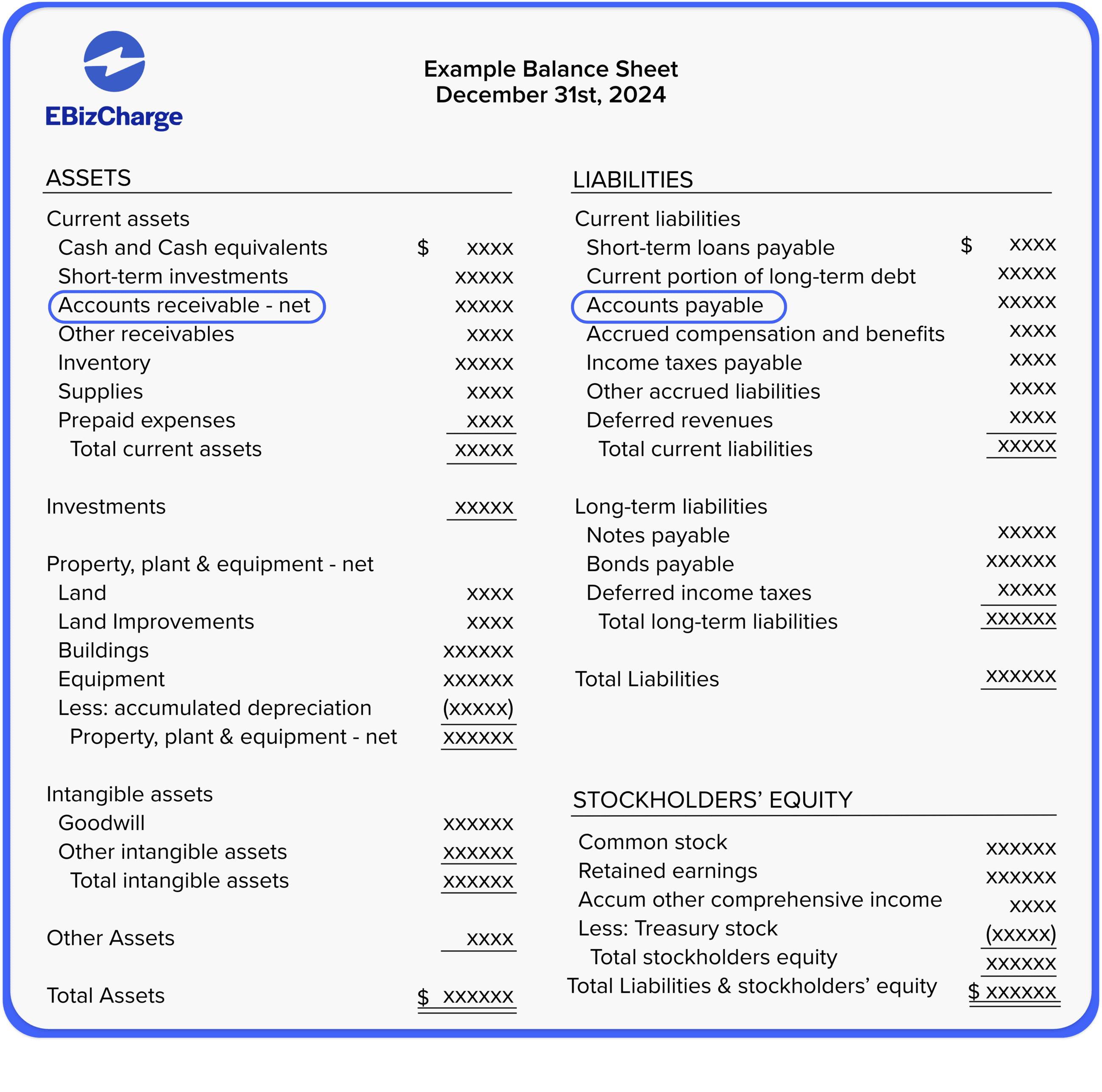

Accounts Receivable on the Balance Sheet Accounting Education

Since the unmet payment obligation represents a future economic benefit to the company, the accounts receivables line. Classified as a current asset on the company's balance sheet, or statement of financial position, accounts receivable is highly important since it. Accounts receivable are reported as current assets on the balance sheet because they are expected to be converted into cash within.

What are Accounts Receivable and Accounts Payable?

Accounts receivable are reported as current assets on the balance sheet because they are expected to be converted into cash within a. Since the unmet payment obligation represents a future economic benefit to the company, the accounts receivables line. Classified as a current asset on the company's balance sheet, or statement of financial position, accounts receivable is highly important since.

What is Accounts Receivables Examples, Process & Importance Tally

Accounts receivable are reported as current assets on the balance sheet because they are expected to be converted into cash within a. Classified as a current asset on the company's balance sheet, or statement of financial position, accounts receivable is highly important since it. Since the unmet payment obligation represents a future economic benefit to the company, the accounts receivables.

Accounts Receivable Balance Sheet

Accounts receivable are reported as current assets on the balance sheet because they are expected to be converted into cash within a. Classified as a current asset on the company's balance sheet, or statement of financial position, accounts receivable is highly important since it. Since the unmet payment obligation represents a future economic benefit to the company, the accounts receivables.

Since The Unmet Payment Obligation Represents A Future Economic Benefit To The Company, The Accounts Receivables Line.

Accounts receivable are reported as current assets on the balance sheet because they are expected to be converted into cash within a. Classified as a current asset on the company's balance sheet, or statement of financial position, accounts receivable is highly important since it.

/accounts-receivables-on-the-balance-sheet-357263-final-911167a5515b4facb2d39d25e4e5bf3d.jpg)