Where Does Prepaid Rent Go On A Balance Sheet - In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. What it does simply trades one asset. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of.

Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. What it does simply trades one asset. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company.

Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. What it does simply trades one asset. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using.

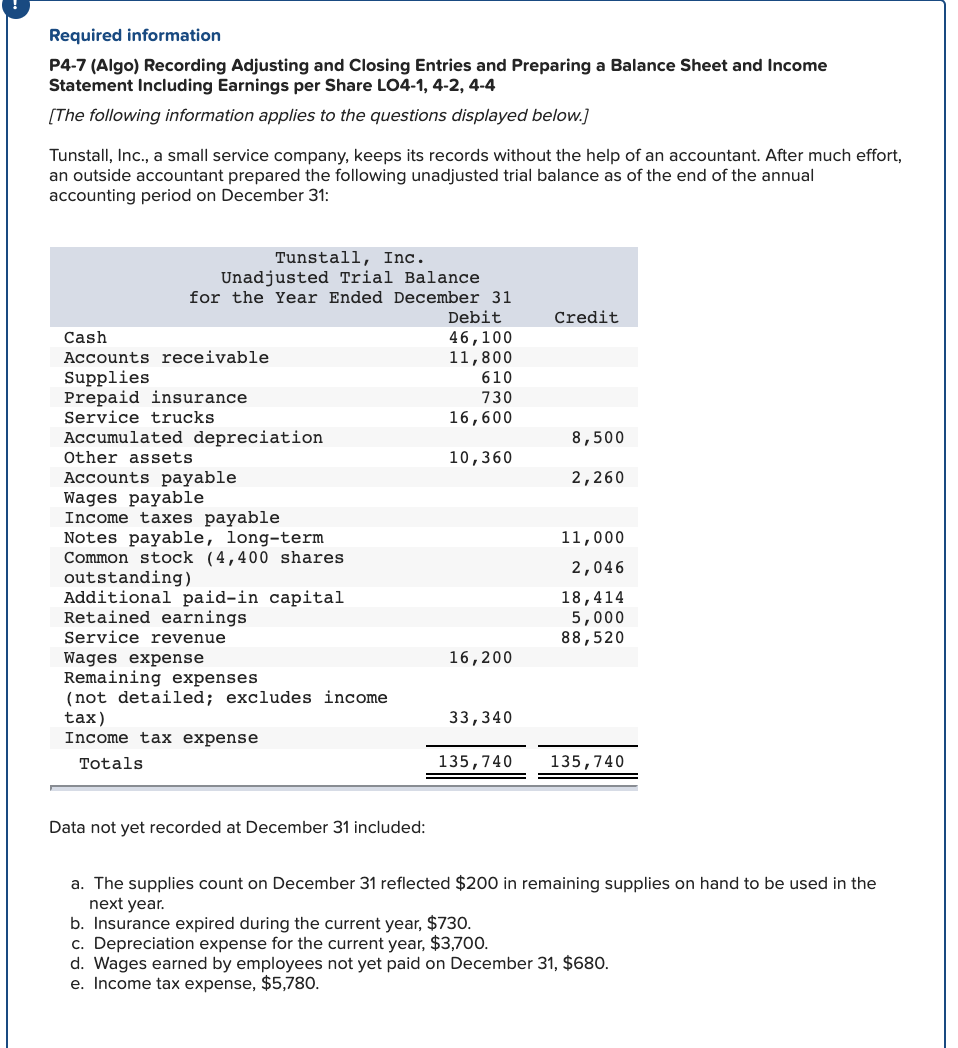

Solved Please help complete balance sheet. Prepaid insurance

In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. What it does simply trades one asset. Likewise, as an advance payment, prepaid rent doesn’t affect the.

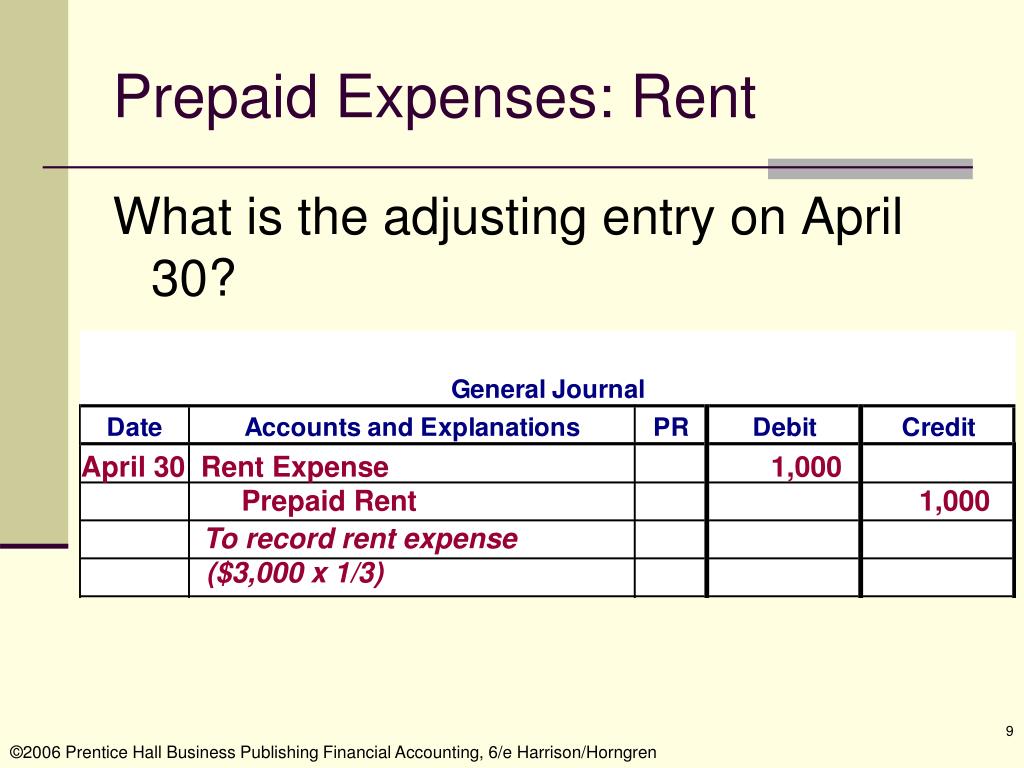

PPT Accrual Accounting and the Financial Statements Chapter 3

What it does simply trades one asset. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. In short, store a prepaid rent payment on the balance sheet as an.

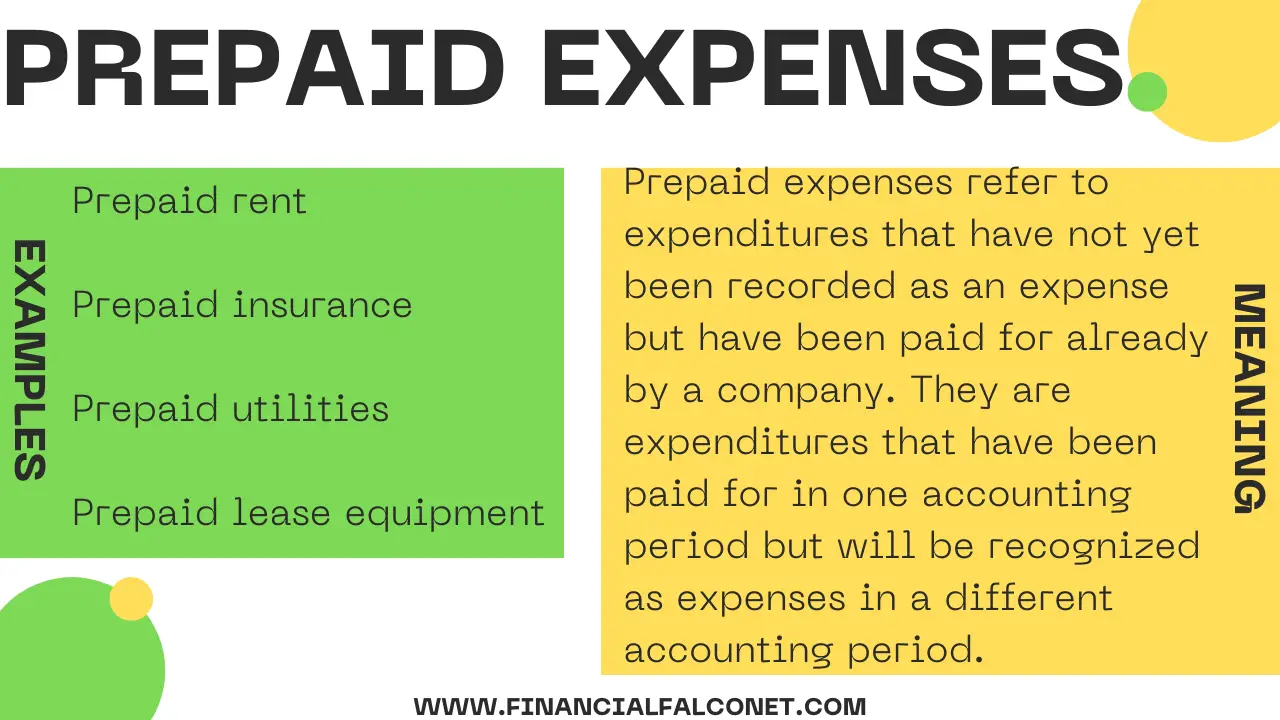

Prepaid Expenses In Balance Sheet Analysis Template Ipsas 20 Financial

What it does simply trades one asset. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Likewise, as an advance payment, prepaid rent doesn’t affect the.

Prepaid Expenses on Balance Sheet Quant RL

What it does simply trades one asset. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on.

ASC 842 Balance Sheet Guide with Examples Visual Lease

What it does simply trades one asset. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at.

What Is The Basic Accounting Equation Explain With Suitable Example

Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. What.

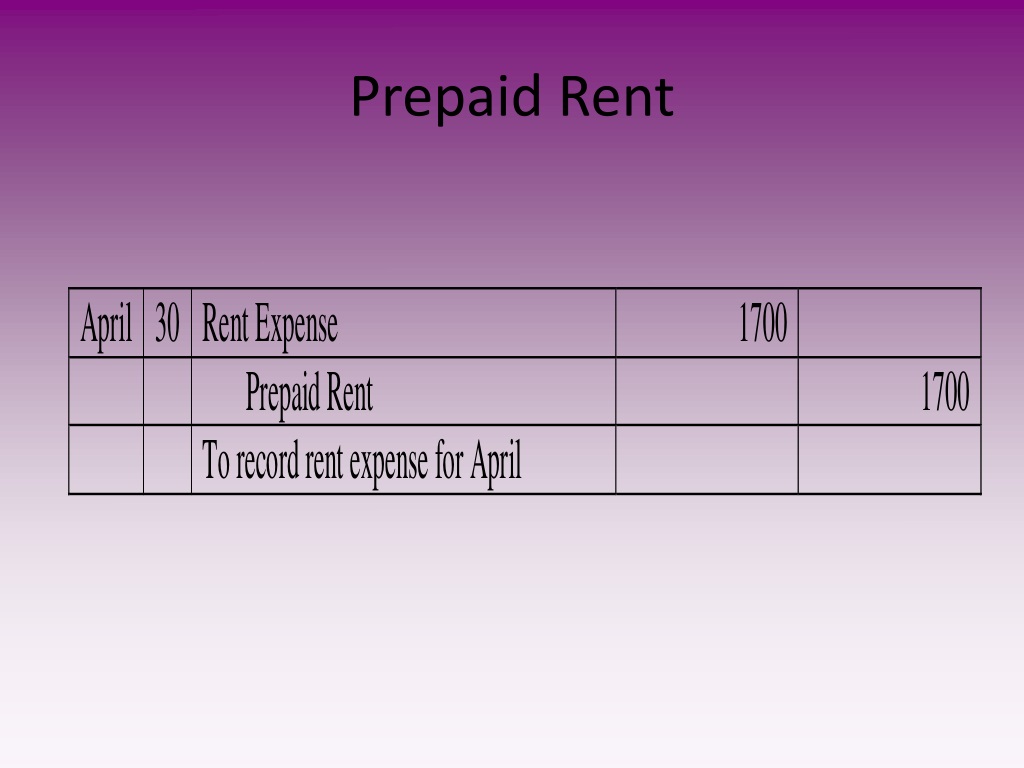

PPT Understanding Adjustments and Prepaid Expenses in Accounting

Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. What it does simply trades one asset. Likewise, as an advance payment, prepaid rent doesn’t affect the.

bucketsery Blog

What it does simply trades one asset. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Accurate accounting for prepaid assets begins with recognizing these payments.

Why Prepaid Expenses Appear in the Current Asset Section of the Balance

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at.

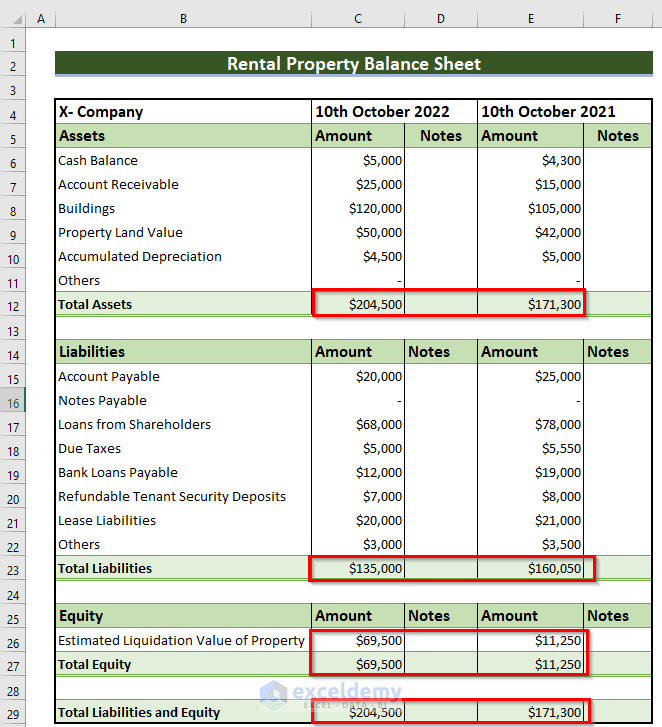

Rental Property Balance Sheet in Excel 2 Methods (Free Template)

In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. What.

Accurate Accounting For Prepaid Assets Begins With Recognizing These Payments As Assets On The Balance Sheet At The Time Of.

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. What it does simply trades one asset. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using.