Where Does Prepaid Rent Go On The Balance Sheet - The proper way to account for prepaid rent is to record the initial payment in the. Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will receive in the. This type of asset shows that. Prepaid rent is listed as a current asset on the balance sheet if it will be used within a year or an operating cycle. Under asc 842, prepaid rent is now included in the rou asset. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Prepaid rent is governed by the asc 842 rules of lease accounting. What it does simply trades one asset. Example of prepaid rent accounting.

Prepaid rent is governed by the asc 842 rules of lease accounting. Under asc 842, prepaid rent is now included in the rou asset. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. What it does simply trades one asset. The proper way to account for prepaid rent is to record the initial payment in the. Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will receive in the. Prepaid rent is listed as a current asset on the balance sheet if it will be used within a year or an operating cycle. Example of prepaid rent accounting. This type of asset shows that.

Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will receive in the. Example of prepaid rent accounting. The proper way to account for prepaid rent is to record the initial payment in the. What it does simply trades one asset. Prepaid rent is listed as a current asset on the balance sheet if it will be used within a year or an operating cycle. This type of asset shows that. Under asc 842, prepaid rent is now included in the rou asset. Prepaid rent is governed by the asc 842 rules of lease accounting.

What type of account is prepaid rent? Financial

Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Under asc 842, prepaid rent is now included in the rou asset. Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will receive in the. Prepaid rent is governed by the asc 842.

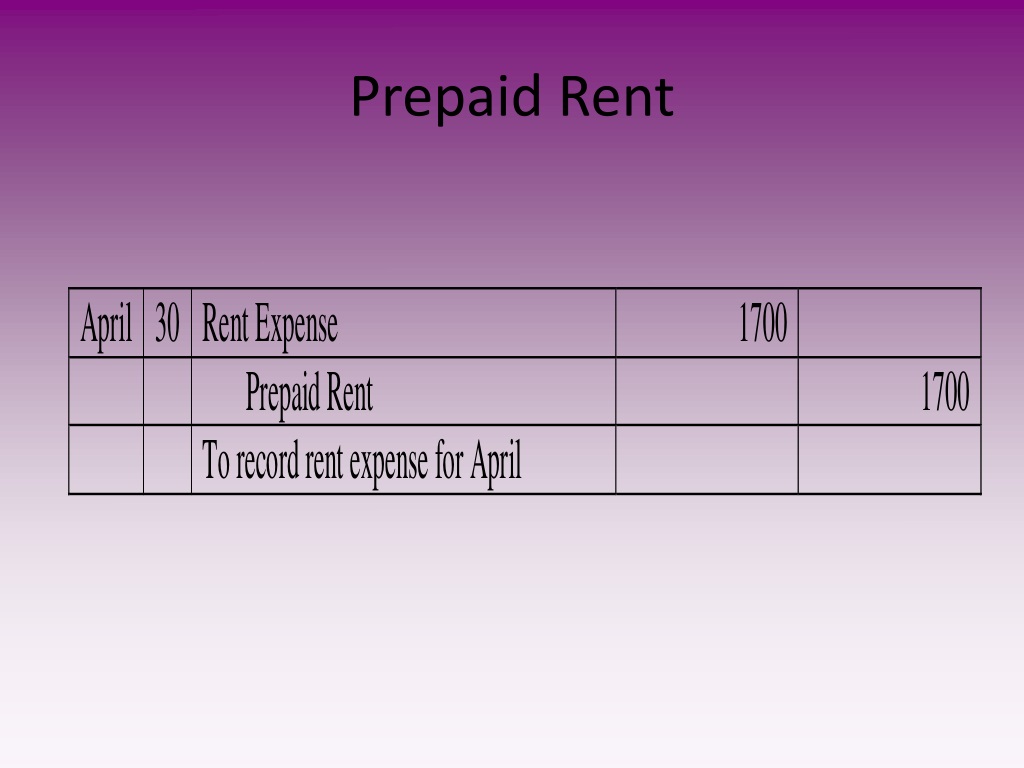

PPT Understanding Adjustments and Prepaid Expenses in Accounting

Example of prepaid rent accounting. Prepaid rent is governed by the asc 842 rules of lease accounting. Under asc 842, prepaid rent is now included in the rou asset. Prepaid rent is listed as a current asset on the balance sheet if it will be used within a year or an operating cycle. What it does simply trades one asset.

Favorite Info About Acc Depreciation On Balance Sheet Profit And Loss

The proper way to account for prepaid rent is to record the initial payment in the. Prepaid rent is governed by the asc 842 rules of lease accounting. Prepaid rent is listed as a current asset on the balance sheet if it will be used within a year or an operating cycle. What it does simply trades one asset. Instead,.

bucketsery Blog

Prepaid rent is governed by the asc 842 rules of lease accounting. Under asc 842, prepaid rent is now included in the rou asset. Prepaid rent is listed as a current asset on the balance sheet if it will be used within a year or an operating cycle. Example of prepaid rent accounting. What it does simply trades one asset.

Prepaid Expenses In Balance Sheet Analysis Template Ipsas 20 Financial

Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will receive in the. Example of prepaid rent accounting. The proper way to account for prepaid rent is to record the initial payment in the. This type of asset shows that. Likewise, as an advance payment, prepaid rent doesn’t affect.

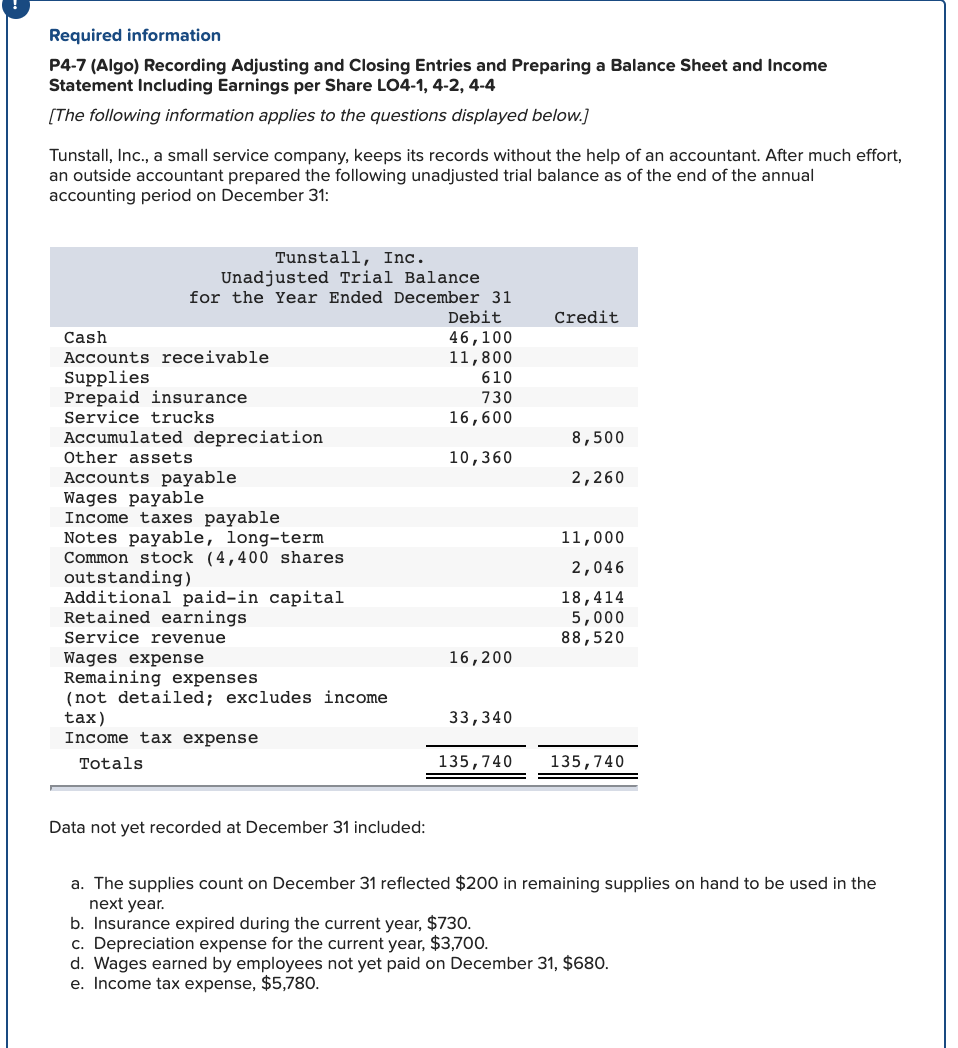

Solved Please help complete balance sheet. Prepaid insurance

Under asc 842, prepaid rent is now included in the rou asset. Prepaid rent is listed as a current asset on the balance sheet if it will be used within a year or an operating cycle. This type of asset shows that. Prepaid rent is governed by the asc 842 rules of lease accounting. Instead, prepaid rent is recorded on.

ASC 842 Balance Sheet Guide with Examples Visual Lease

Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Prepaid rent is governed by the asc 842 rules of lease accounting. This type of asset shows that. The proper way to account for prepaid rent is to record the initial payment in the. Prepaid rent is listed as a current asset on the.

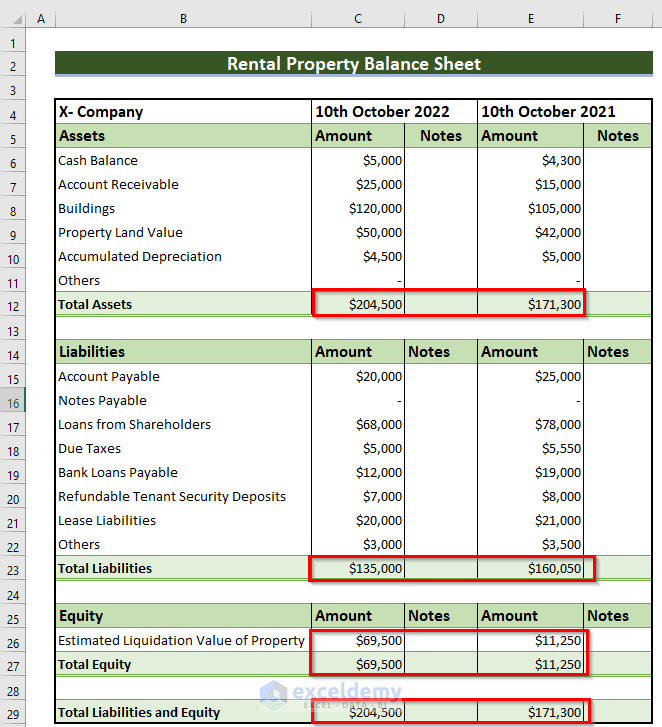

Rental Property Balance Sheet in Excel 2 Methods (Free Template)

What it does simply trades one asset. Prepaid rent is listed as a current asset on the balance sheet if it will be used within a year or an operating cycle. Example of prepaid rent accounting. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Instead, prepaid rent is recorded on the balance.

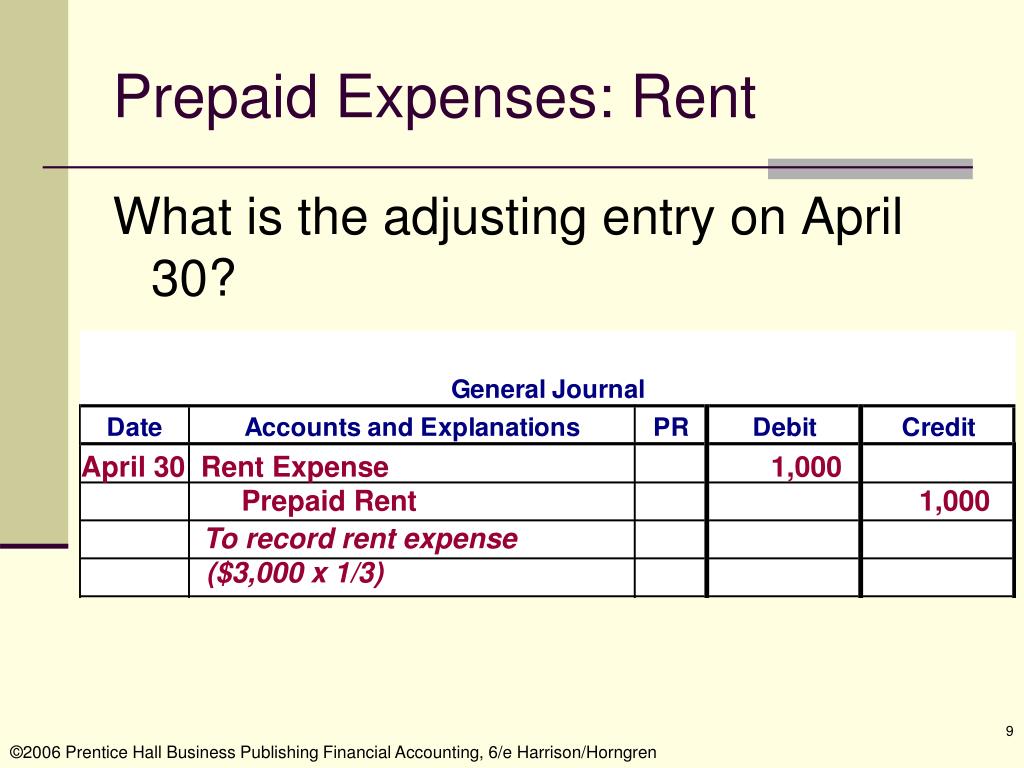

PPT Accrual Accounting and the Financial Statements Chapter 3

Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will receive in the. What it does simply trades one asset. Prepaid rent is governed by the asc 842 rules of lease accounting. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. This.

Where Are Expenses On The Balance Sheet LiveWell

Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will receive in the. What it does simply trades one asset. Example of prepaid rent accounting. Under asc 842, prepaid rent is now included in the rou asset. Prepaid rent is listed as a current asset on the balance sheet.

The Proper Way To Account For Prepaid Rent Is To Record The Initial Payment In The.

Example of prepaid rent accounting. Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will receive in the. Under asc 842, prepaid rent is now included in the rou asset. What it does simply trades one asset.

This Type Of Asset Shows That.

Prepaid rent is listed as a current asset on the balance sheet if it will be used within a year or an operating cycle. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Prepaid rent is governed by the asc 842 rules of lease accounting.